Altcoin

Bitcoin set to rise? Analyst sees fresh $ 2 billion liquidity that activates the next leg

Credit : www.newsbtc.com

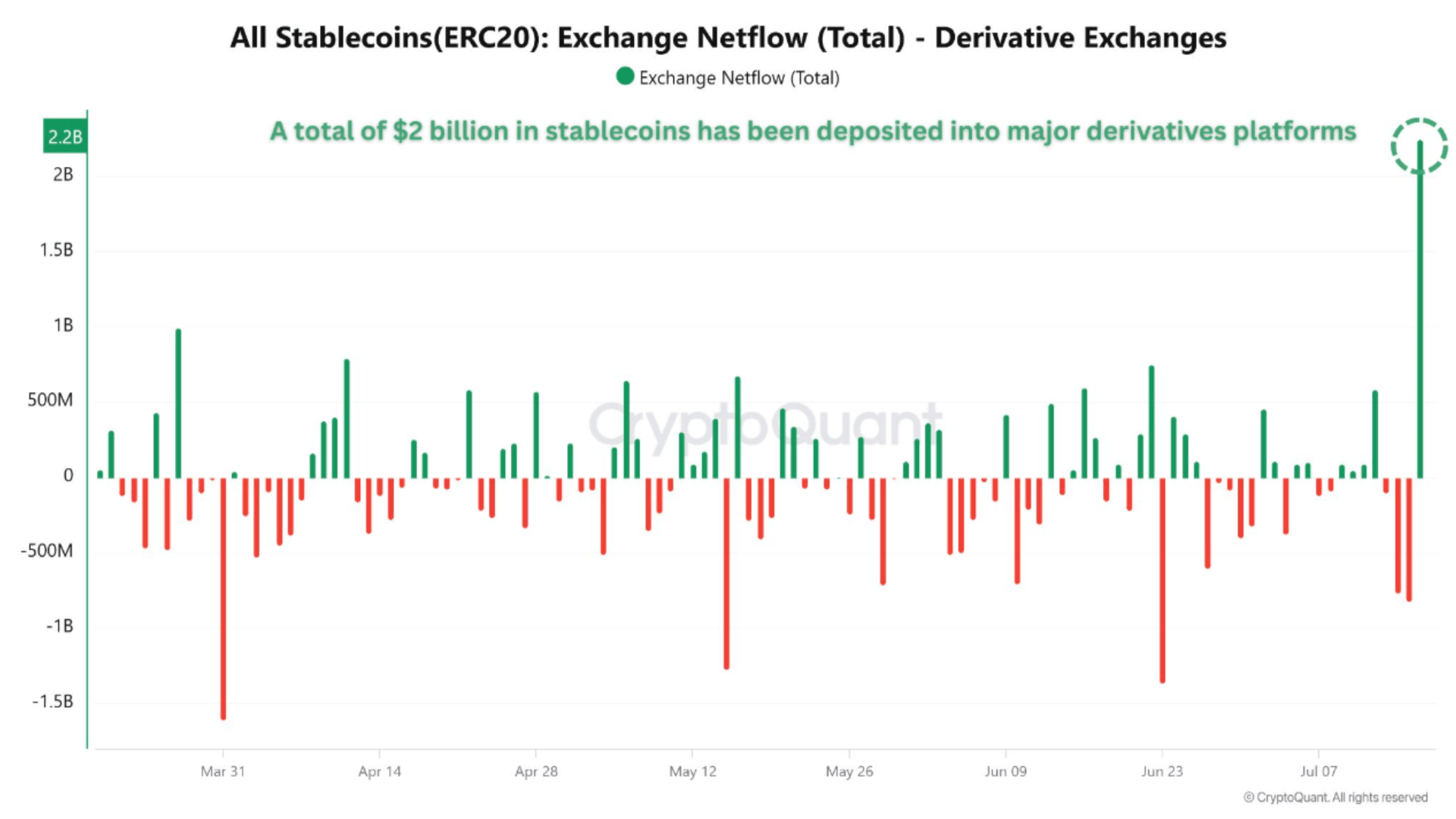

Bitcoin (BTC) is at the moment stabilizing inside the vary of $ 116,000 to $ 120,000. Recent liquidity of a complete of $ 2 billion in stablecoins may help, nevertheless, to push the flagship cryptocurrency to new all time (ATHS).

Bitcoin to benefit from new liquidity

In line with a cryptoquant Quicktake – submit from worker AMR Taha, earlier at the moment, greater than $ 2 billion in Stablecoins – primarily Tether (USDT) – was deposited in giant derivatives buying and selling platforms.

Associated lecture

Taha is of the opinion that this improve in influx alerts elevated urge for food for lifting tree positions in seasoned merchants, a lot of whom count on a possible outbreak within the worth of BTC. Particularly, this new get together USDT was crushed by Tether Treasury, which means that the institutional query stimulates the exercise.

Traditionally, large-scale Stablecoin influx preceded Bullish Marktmomentum, as a result of merchants typically use them to open lengthy positions on bitcoin and altcoin-futures and perpetual contracts. Quick Stablecoin deposits in spinoff modifications typically act as a number one indicator for giant worth collections.

Within the meantime, colleague -Cryptoquant worker traded on rising open curiosity, and famous that it’s rising along with BTC’s worth – a basic sign of robust bullish sentiment.

To clarify it, the rising open curiosity together with a rising Bitcoin worth normally implies that market participation and bullish sentiment improve as a result of extra merchants open positions which are anticipating additional the wrong way up. Nevertheless, it will possibly additionally point out a construction of leverage, which may result in elevated volatility or a pointy correction if sentiment shifts.

The analyst additionally emphasised the Coinbase Premium Index, which stays above zero-one signal that patrons established within the US pay a premium on international spot costs. They added that the indicator is at the moment inside a ‘breaker’ construction and sharing the subsequent graph for context.

Traderoasis famous that though the BTC worth rises, the Coinbase Premium index indicator has remained comparatively flat. The analyst defined:

This implies me that massive gamers take a win. If the falling development construction that I’ve marked with an arrow is damaged, the value will in all probability rise a lot stronger. However, if the indicator falls under the ‘0’ stage, I can contemplate it a purchase order sign, as a result of we’re nonetheless on a macro -bullish market.

Quick -term pullback for BTC?

Whereas the stablecoin injection of $ 2 billion is more likely to act as a bullish catalyst for BTC and the broader crypto market, some change knowledge are counsel A possible withdrawal within the quick time period for the subsequent leg up.

Associated lecture

BTC deposits for instance to change spiked After the digital actively grew to become a current excessive excessive round $ 123,000 – a sample that always precedes native tops and is normally adopted by a worth correction.

That stated, regardless of the current worthwhile, BTC did unstoppable A fantastic worth decline, pointing to a strong underlying query. On the time of the press, BTC acts at $ 119.171, a rise of two.4% within the final 24 hours.

Featured picture of Unsplash, graphs of cryptoquant and tradingview.com

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024