Altcoin

Bitcoin Short -term floor rises to $ 100,000, strengthening bullish sentiment

Credit : www.newsbtc.com

Motive to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by specialists from the trade and thoroughly assessed

The best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

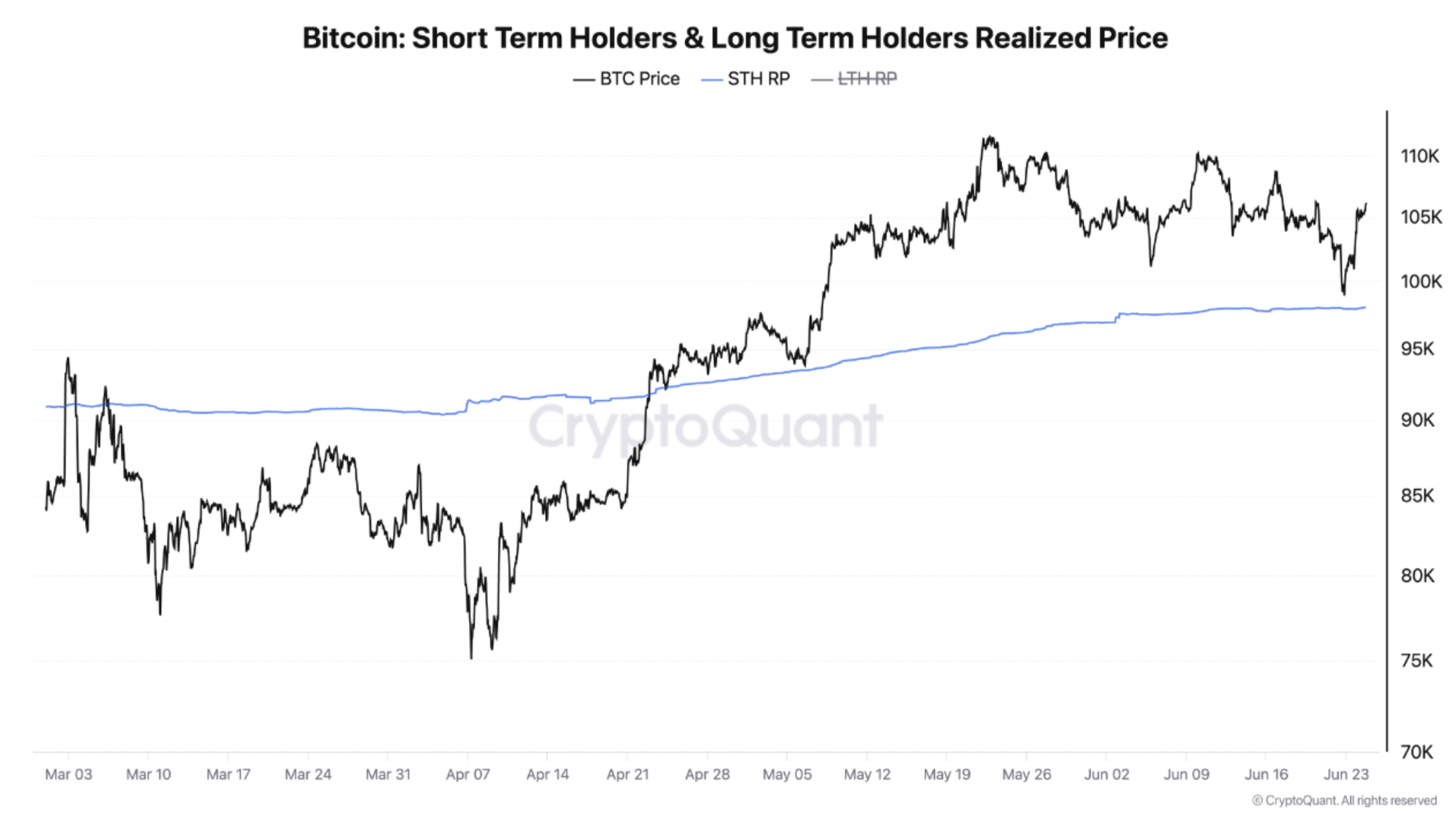

After a speedy lower to nearly $ 98,000 within the weekend, Bitcoin (BTC) has recovered Most of his current losses and now act above $ 107,000 on the time of writing. Recent on-chain information means that the short-term (STH) flooring for BTC has steadily risen to the extent of $ 100,000.

Bitcoin STH flooring is approaching $ 100,000

Based on a current cryptoquant Quicktake publish from worker Unchained, Bitcoin’s STH has slowly closed realized value to the psychologically vital degree of $ 100,000. Particularly, the analyst had beforehand talked about this statistics because the “fault line” to look.

Associated lecture

For the non -ingwrden, the STH realized value represents the common value with which all Bitcoin was obtained for lower than 155 days. It acts as an vital psychological and technical assist degree.

If the market value stays above it, StH is in revenue and extra assured, whereas if it falls, the concern and gross sales strain typically rise. The STH at present realized round $ 98,000.

The analyst notes that each $ 500 improve within the STH successfully reset the ‘new consumers consolation flooring’. As a result of this metric is approaching six digits, the psychological stop-loss for newer traders can also be transferring up.

The subsequent graph illustrates two current authorities through which BTC bounced sharply after touching the blue STH realized value line. This value promotion suggests a bullish construction, whereby the gross sales strain decreases as quickly as BTC visits the common value foundation once more.

Within the meantime, the premium – the distinction between the spot value of BTC and STH realized value – is at present round 7.2%. A shrinking premium, often lower than 10%, has traditionally indicated a diminished market foam and sometimes preceded the subsequent leg as soon as open curiosity started to rebuild.

On the lengthy -term facet, the lengthy -term holder (LTH) realized that the value is basically unchanged at $ 32,000, a few third of the STH realized value. The analyst notes that these lengthy -term cash are most likely saved in chilly storage, which signifies “sturdy arms” with little incentive to promote. They concluded:

The blue line climbs relentlessly; So long as BTC lives above it, the prevailing tide continues to be increased, increased. Loss it day by day and we get our first actual intestinal management Since April-other, the bull-engine solely cools the cylinders.

Consultants predict new excessive for BTC

Since BTC’s StH realized value continues to rise – leading to the next flooring value for the digital energetic – completely different crypto specialists appear to agree that the cryptocurrency can quickly be attainable attain A brand new excessive of all time (ATH) within the coming months.

Associated lecture

Bitcoin is for instance forming A bullish reversed head and shoulder sample on the three-day graph, with a possible ATH of as excessive as $ 150,000. On the time of the press, BTC acts at $ 107,711, a rise of two.1% within the final 24 hours.

Featured picture of Unsplash, graphs of cryptoquant and tradingview.com

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now