Bitcoin

Bitcoin short-term holders hold the key to $70K – Here’s why

Credit : ambcrypto.com

- Quick-term Bitcoin holders are making the very best features since August after BTC broke above $63,000.

- Widespread profitability has shifted market sentiment to optimistic, which may spark a protracted rally.

Bitcoin [BTC] was buying and selling at $63,790 on the time of writing, its highest value this month. Optimistic macro components have brought about BTC to defy the standard September decline, and with “ToIn sight, bulls seem like making their transfer.

Nonetheless, as this month’s optimistic macro tales seem to have run out, merchants who’ve held Bitcoin for lower than 155 days maintain the important thing to the following near-term value strikes.

Enhance in income of Bitcoin holders within the quick time period

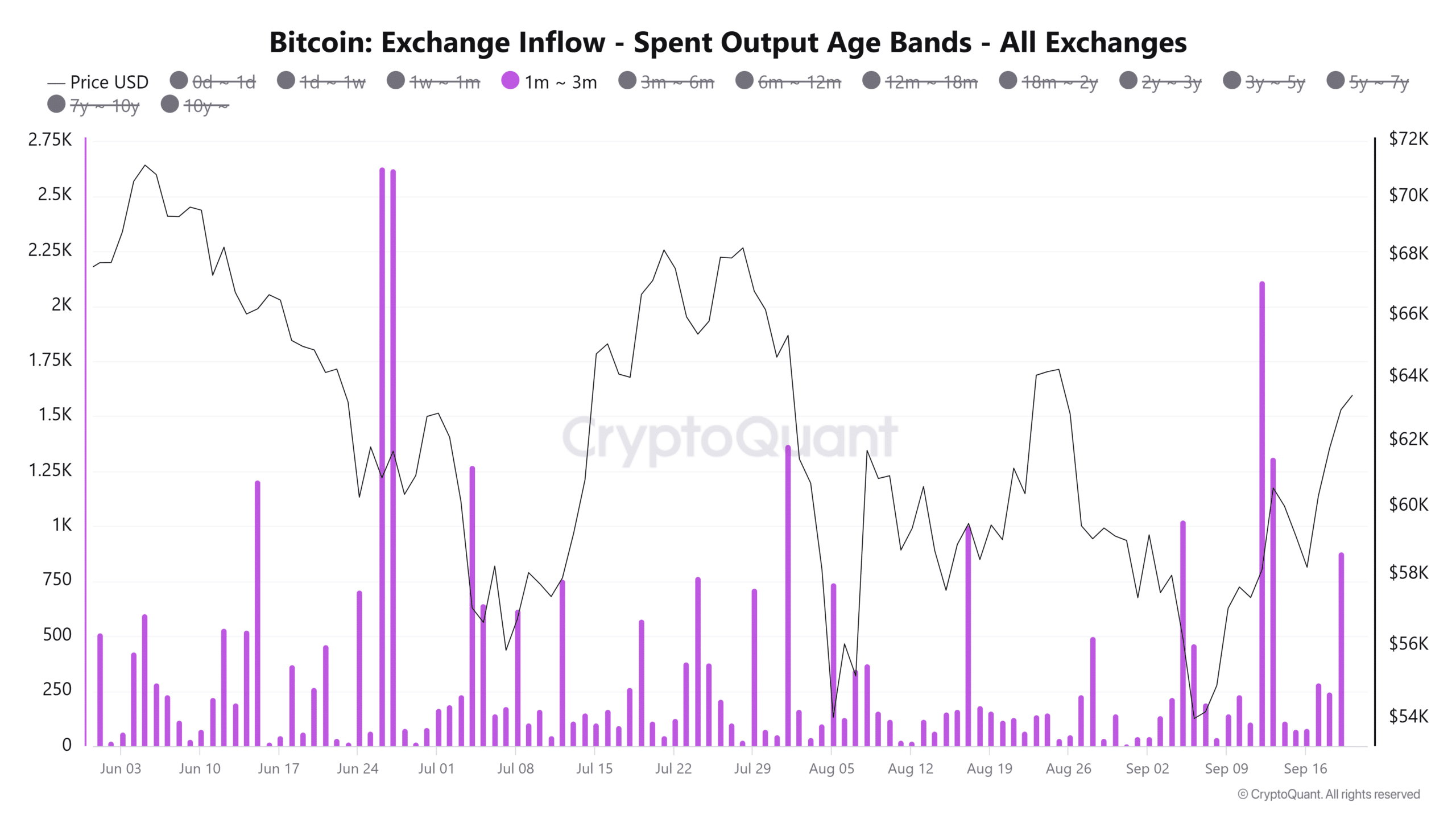

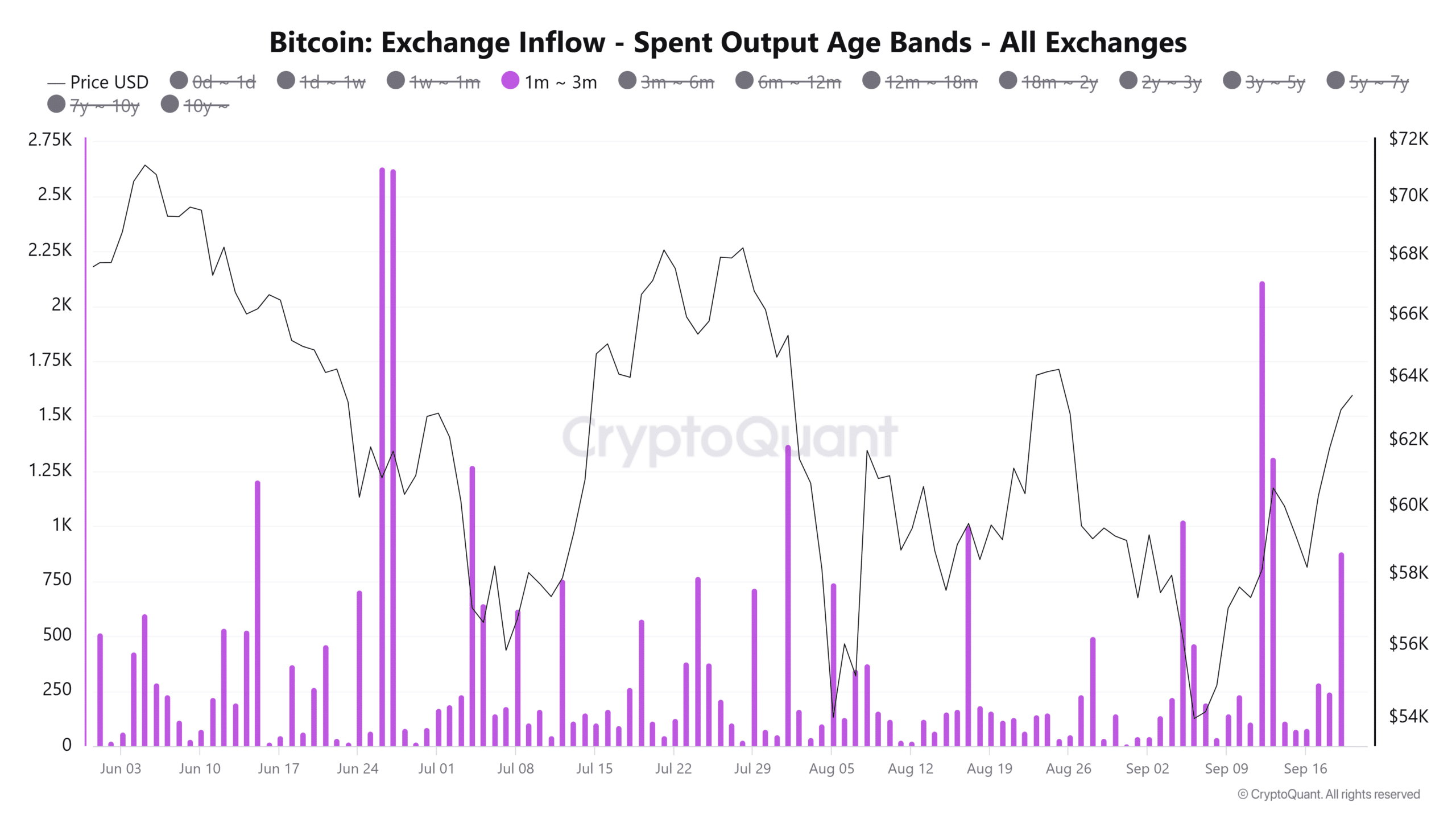

Information from CryptoQuant confirmed that after Bitcoin broke $60,000 earlier this week, short-term holders made income. This cohort was beforehand underwater.

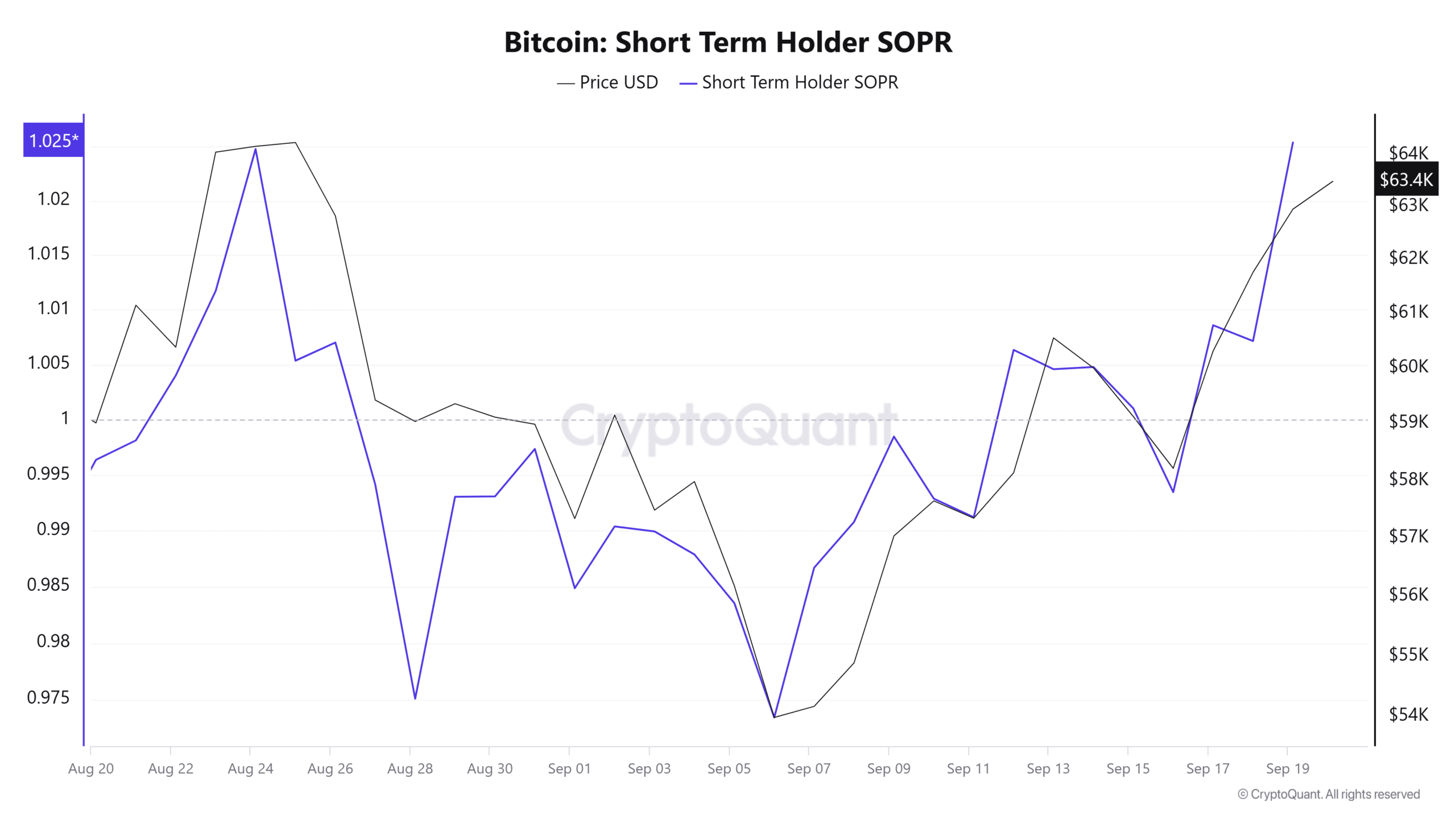

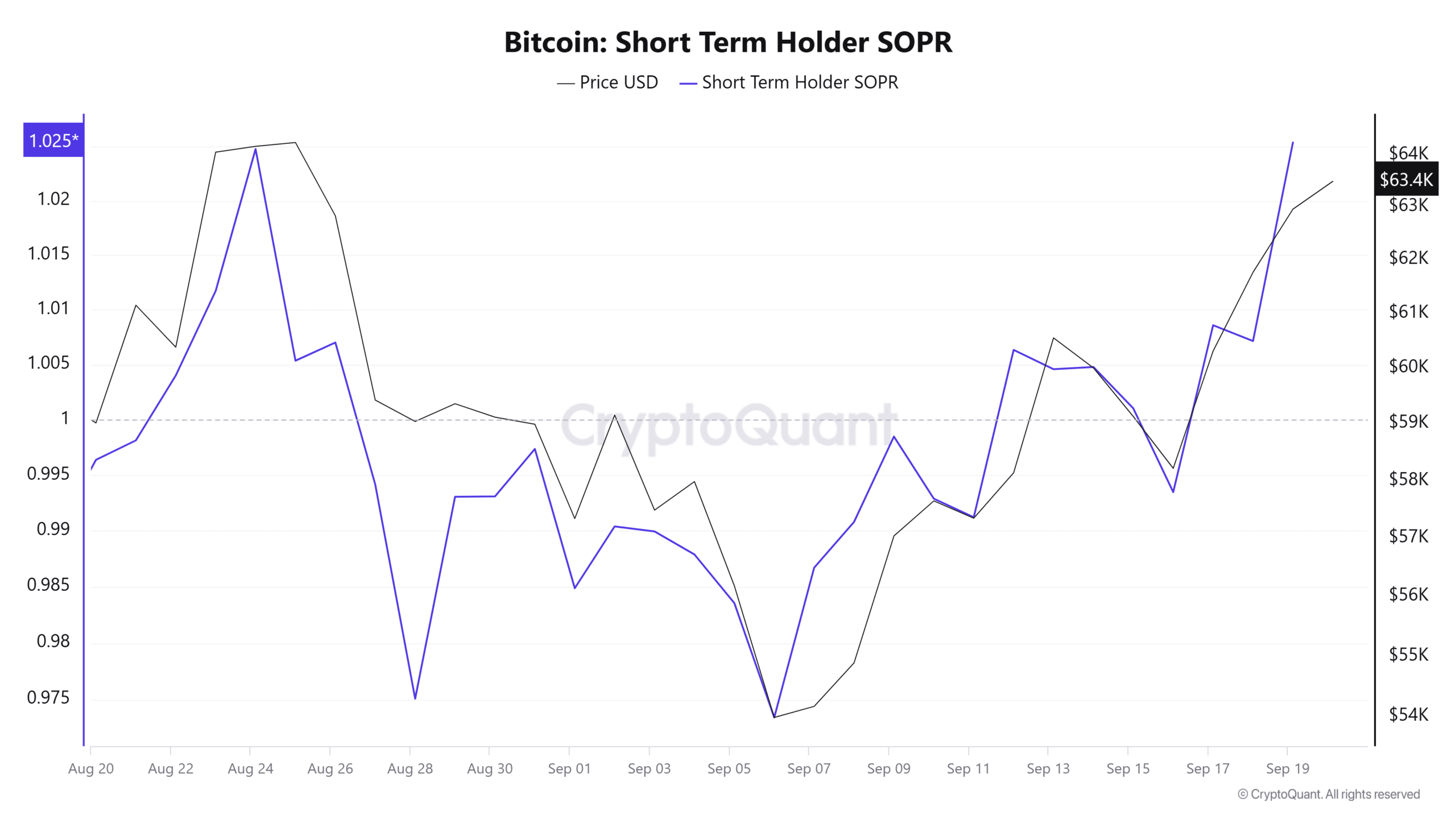

The shift in profitability may be seen within the short-term output revenue ratio (SOPR), which has risen sharply from beneath 1 to the very best stage since late August.

Supply: CryptoQuant

This measure indicated a shift in market sentiment from unfavourable to optimistic. The Bitcoin fear and greed index confirmed this when it rose to 54, the very best stage in additional than three weeks.

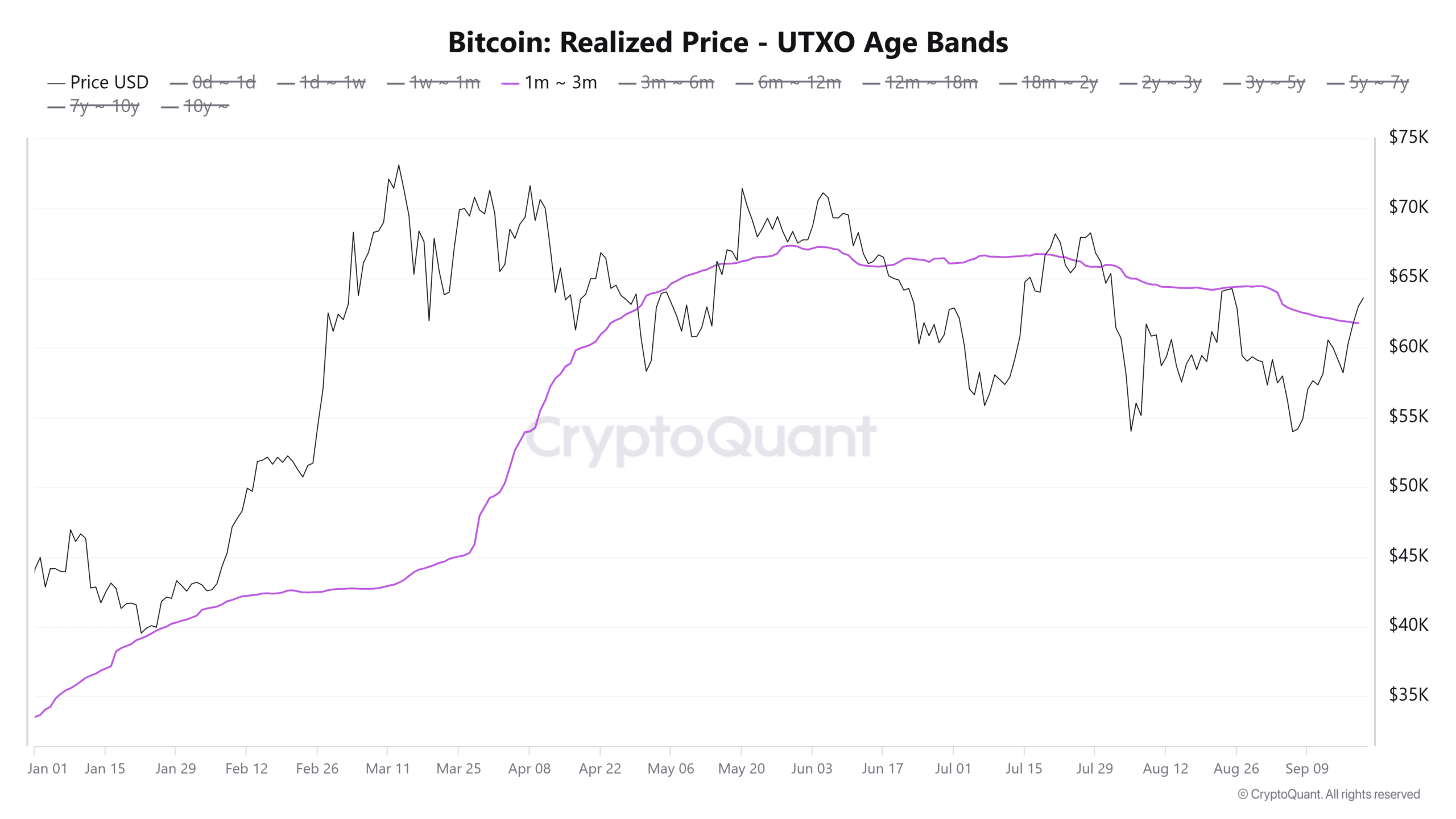

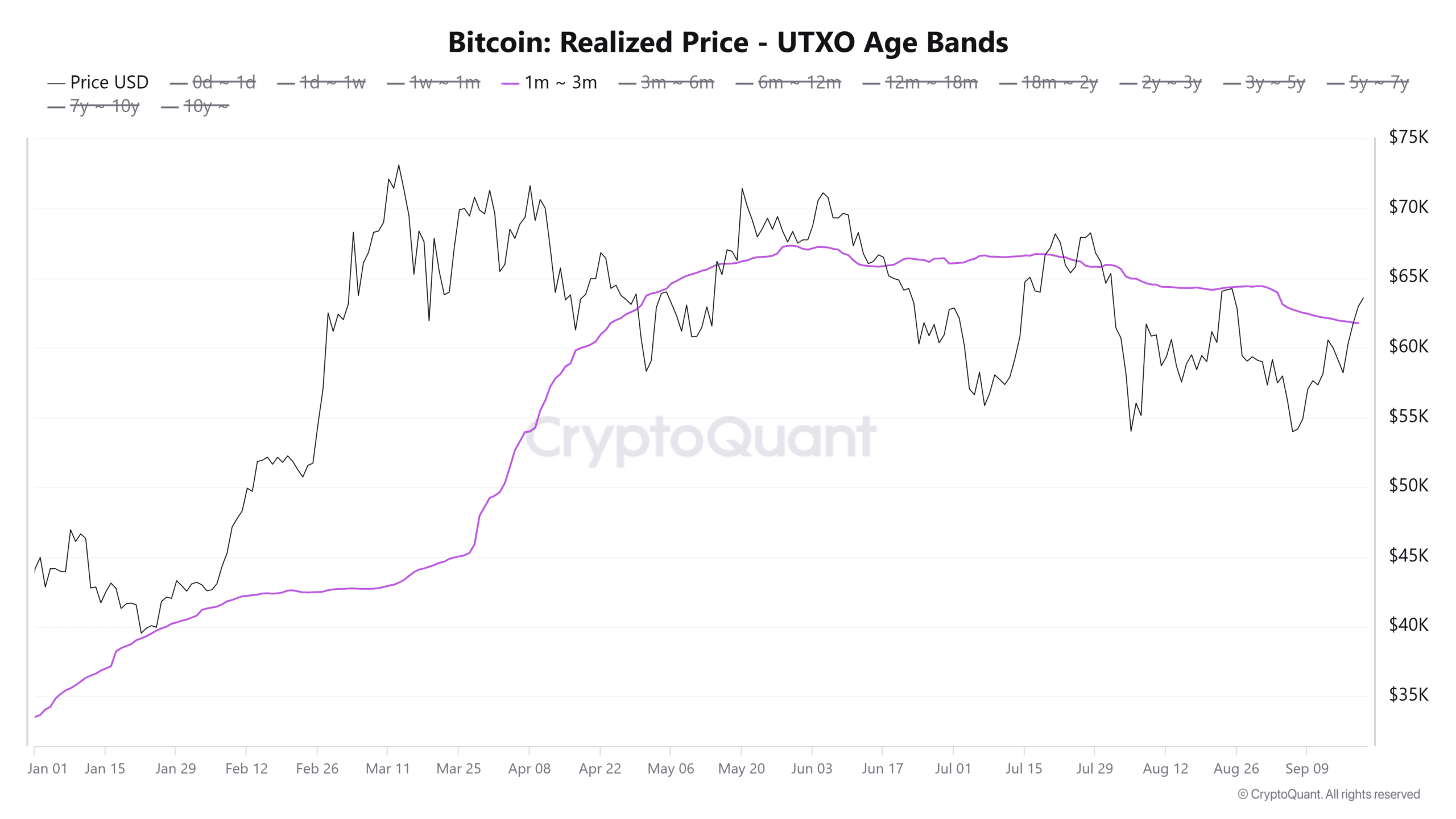

The short-term profitability of the holders can be mirrored within the realized value – UTXO age classes. Merchants who’ve held BTC for one to a few months have been beneath their common buy value since August.

These merchants returned to profitability on September 18, after BTC rose above $61,800.

Supply: CryptoQuant

In accordance with CryptoQuant analyst Avocado_onchainthe typical buy value of short-term holdings acts as a powerful resistance stage. With Bitcoin breaking above, it signifies a powerful bullish pattern.

Threat of revenue taking

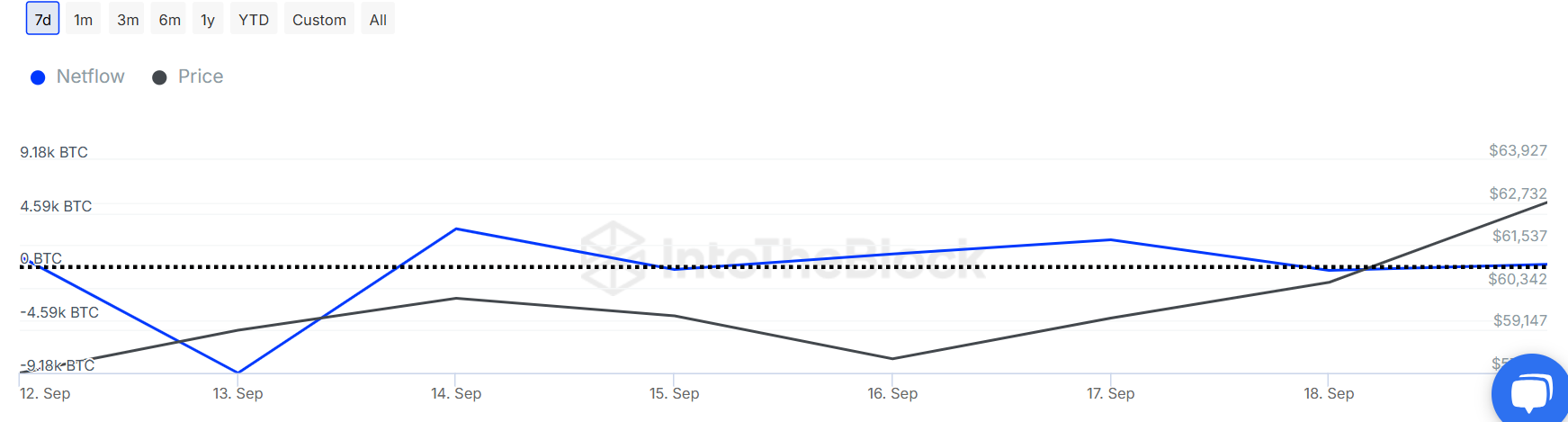

The widespread profitability amongst Bitcoin holders within the quick time period exhibits bullish sentiment, but additionally poses a threat to the short-term rally in the event that they resolve to promote.

The cash distributed by these holders have reached a weekly excessive, as evidenced by the Trade Influx – Spent Output Worth Bands, which coincided with the worth enhance.

Supply: CryptoQuant

This implies that short-term holders may take income after realizing features.

Nonetheless, as promoting exercise has not dampened the rally, numerous short-term merchants promoting at a revenue may pique the curiosity of recent patrons.

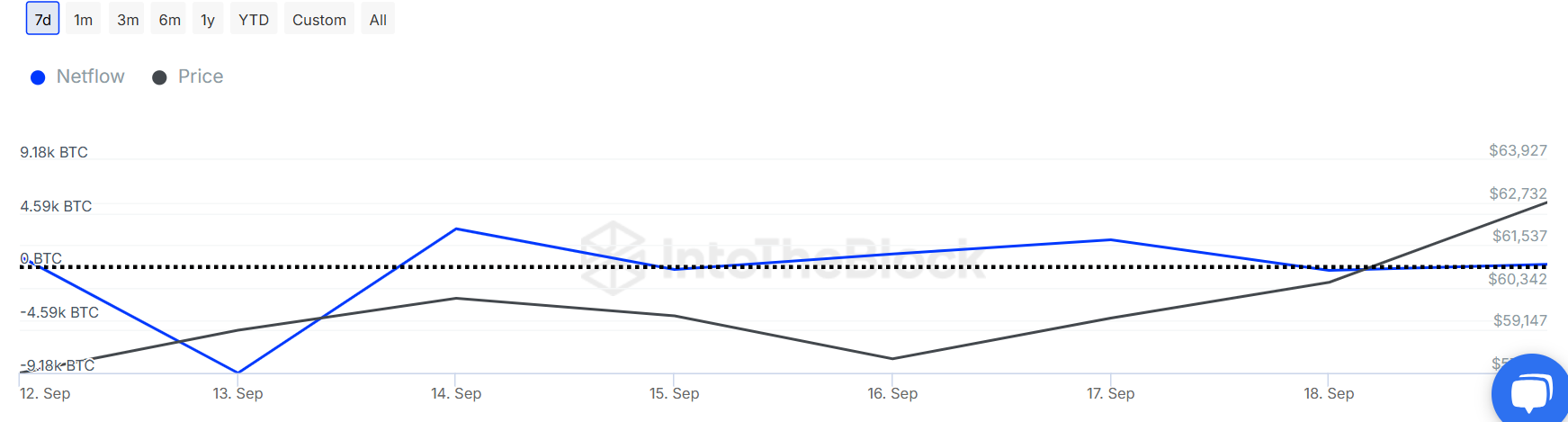

Merchants also needs to watch out for the $64,000-$70,000 ranges as 4.5 million Bitcoin addresses bought at these costs are nonetheless underwater in response to IntoTheBlock knowledge.

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

As such, Bitcoin will encounter resistance because it approaches this zone.

However, whales are but to work together with BTC, amid the latest features. Web stream from giant farmers has been principally flat over the previous two days, after a interval of accumulation. This reduces the danger of a serious sell-off.

Supply: IntoTheBlock

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024