Bitcoin

Bitcoin short-term holders panic-sell – How will this affect BTC’s future?

Credit : ambcrypto.com

- BTC STHs could be panic-sold In response to the current information in regards to the Bybit -Hack.

- Evaluation of the energetic food regimen of 90 days mirrored a exceptional lower in current months.

Within the final 24 hours, Bitcoin [BTC] Skilled exceptional volatility. Quick -term holders (STHS) realized substantial losses, in all probability pushed by panic gross sales after the Bybit Hack Information.

BTC’s 4-hour graph additionally confirmed important bearish indicators previously 16 hours.

The exponential advancing common (EMA) Cross confirmed a bearish crossover, during which the EMA of 9 durations below the EMA of 26 durations fell round hour 14, which a downward momentum signifies within the quick time period.

This was tailor-made to the value fall from BTC to $ 96,259.9, which marked a lower in a -0.12% in comparison with the earlier interval.

Supply: Coinglass

The relative energy index (RSI) was 46.05 and mirrored a impartial however considerably bearish prospect.

This RSI stage recommended that BTC remained in a consolidation part, with out clear overbought or over -sold circumstances. If it returns above 50, Bullish sentiment can return, to help worth restore.

The cumulative quantity -delta (CVD) additionally confirmed a internet quantity delta of -94.67K, which displays a robust gross sales stress within the final 8 hours.

These alerts collectively intelligate capitulation, during which STH’s BTC discharged, which can shaped an area soil within the quick time period because the gross sales stress decreased.

Panic gross sales peaks: What’s the turning level?

The revenue and lack of the quick -term holder (P&L) to trade the Somgraphic for the previous 24 hours additionally emphasised appreciable losses in STHs.

The dominance of crimson bars, which peaked at -43.9k BTC, indicated that heavy panic was offered at round $ 90k to $ 95k after the Bybit Hack Information.

Supply: Cryptuquant

The STH revenue line remained minimal and strengthened the concept that few merchants noticed revenue within the quick time period. Related traits came about within the early 2022, the place extremely realized losses preceded the quick -term costs.

This knowledge recommended a possible native soil, as a result of a needy sale typically exhausts down momentum, making a attainable buy window for merchants.

BTC’s liquidity change

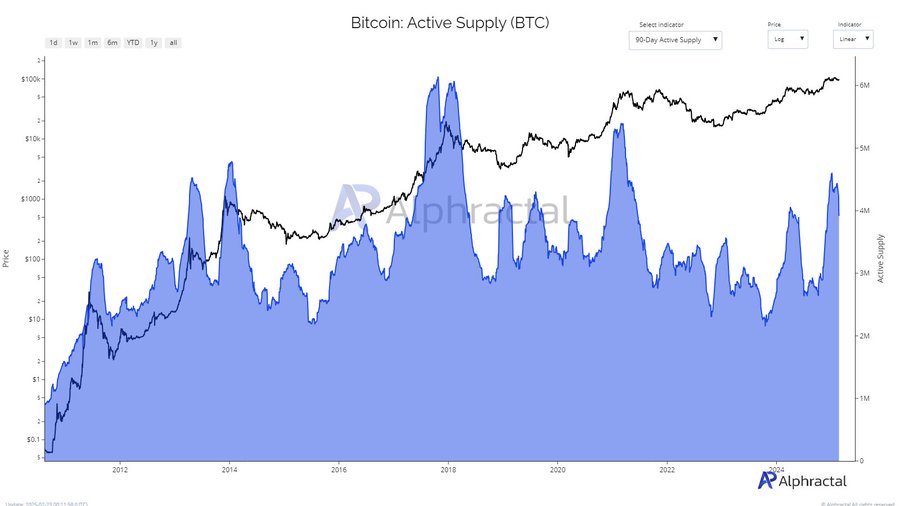

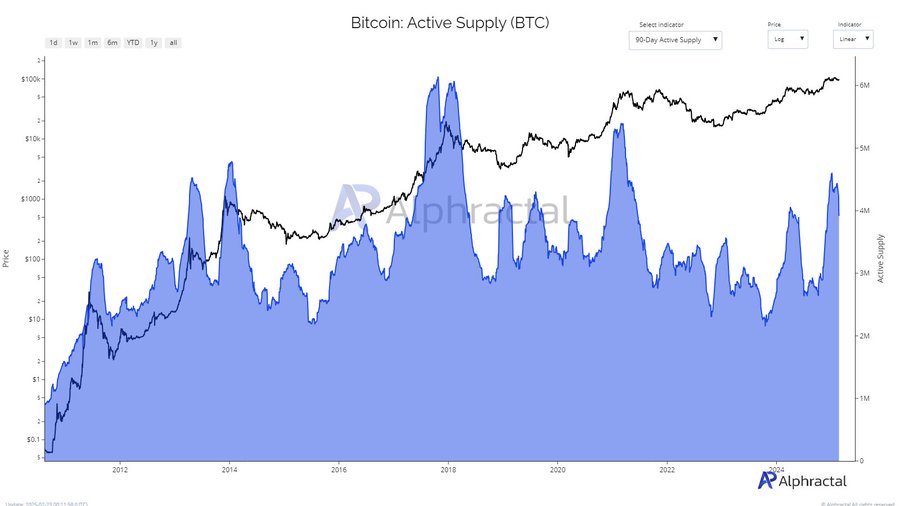

Evaluation of the 90-day energetic meals diagram for BTC, with 2012 to 2025, mirrored a exceptional lower in current months. From the start of 2025, the energetic meals floated round 4m BTC, by the tip of 2024 in opposition to 6m BTC.

Supply: Alfractaal

This metric indicated a lower in industrial exercise. Usually, growing energetic supply suggests a better demand and bullish sentiment, whereas the sign distribution and decreased rates of interest lower.

The present development implied StHs was largely deserted, which can cut back the gross sales stress.

This sample mirrored 2018, when the falling energetic food regimen preceded worth stabilization, to help the capitulation speculation and to strengthen soil formation within the quick time period.

An indication of energy or additional deterioration?

Deep evaluation confirmed that BTC Netflow -graph for aggregated gala’s dropped at mild previously 24 hours within the final 24 hours within the final three months previously three months previously three months previously three months.

This was a major reversal of the common influx of the +226.57 BTC final week and the common of 30 days of +1.29 Ok BTC influx.

Supply: Intotheblock

A sudden detrimental Netflow normally signifies that holders BTC withdraws to Off-Alternate portfolios, which suggests {that a} decreased gross sales stress.

This sample appeared like mid-2021, when giant BTC outflows preceded worth rebounds. As well as, the 24-hour Netflow change of +269.71 BTC renewed buy curiosity recommended.

Concluding, capitulation occasions, comparable to heavy lack of holders within the quick time period and falling trade fee community flows, previous to short-term restoration previous to short-term.

Though volatility stays within the quick time period, lengthy -term indicators recommend a attainable shift to restoration because the gross sales stress decreases.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now