Altcoin

Bitcoin Spot ETF Exodus continues: the $ 900 million outlines expand the loss streak

Credit : www.newsbtc.com

After the final buying and selling window, the US Bitcoin spot ETFs have registered for an additional week of overwhelming internet outflows with traders who get greater than $ 900 million from the market. This growth marks the fifth consecutive week of repayments that point out weak market confidence at institutional traders of the primary cryptocurrency.

Bitcoin Institutional Buyers withdraws for the fifth consecutive week

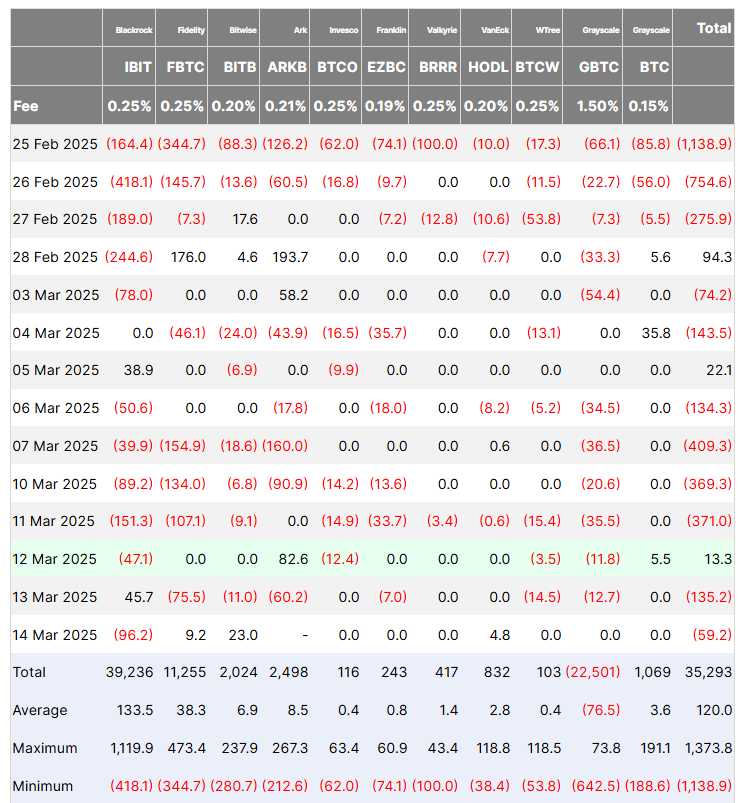

After a powerful begin of the 12 months by which the Bitcoin ETFs entice greater than $ 5 billion in investments, institutional traders have proven lots of warning in current weeks by mass recording. In response to Data from FINES -INVESTERDERSThe Bitcoin Spot ETFs recorded $ 921.4 million in internet outflows in an estimated complete of $ 5.4 billion within the final 5 weeks final week.

The vast majority of final week’s recordings have been taken from the IBIT of BlackRock, which registered $ 338.1 million in internet outflows. The FBTC from Constancy carefully adopted with traders with fund repayments that surpass deposits with $ 307.4 million. Different Bitcoin ETFs akin to Ark’s Arkb, Invesco’s BTCO, Franklin Templeton’s EZBC, BTCW from Wisdomtree, and GBTC from Grayscale all noticed average internet outflow between $ 33 million and $ 81 million.

Within the meantime, Bitwise’s Bitb, Valkyrie’s Brrr and Vaneck’s Hodl all recorded small internet outflows, no higher than $ 4 million. The BTC from Grayscale emerged as the one fund that has a constructive present with a internet consumption of $ 5.5 million.

The constant excessive ranges of recordings of the Bitcoin ETFs will be related to the current BTC market value correction. Previously month, the Maiden Cryptocurrency skilled a value lower of 11.95% that reaches ranges, as little as $ 77,000. Throughout this era, institutional traders have proven lots of warning, with the overall internet property of the Bitcoin spot ETFs that, in keeping with 21.70%, fall to $ 89.89 billion in keeping with Data from Sosovalue.

Ethereum ETFs lose $ 190 million in recordings

Within the midst of the struggles of the Bitcoin ETFs, the Ethereum Spot ETFS market experiences the same investor sentiment after internet outflows of $ 189.9 million prior to now week. This growth marks the third consecutive week of recordings, in order that the overall internet outflows are $ 645.08 million inside this era. Identical to along with his Bitcoin reverse, BlackRock’s Etha skilled the most important recordings of the previous week price $ 63.3 million. On the time of writing, the overall cumulative influx into the ETHEEM ETF market is appreciated at $ 2.52 billion with a complete internet activa at $ 6.72 billion ie 2.90% of ETH market capitalization. Within the meantime, Ethereum continues to behave at $ 1,924 on account of a revenue of 0.73% within the final 24 hours. Then again, Bitcoin is appreciated at $ 84.009 with out important value change in his every day graph.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024