Altcoin

Bitcoin: This indicator reflects 2024’s Bull Run – will history repeat?

Credit : ambcrypto.com

- Bitcoin’s open curiosity Delta mimics patterns that preceded the value will increase previously.

- A dip within the 180-day delta can point out a market base or new accumulation cycle.

Bitcoin’s [BTC] Open curiosity Delta confirmed indicators that could be identified to skilled merchants.

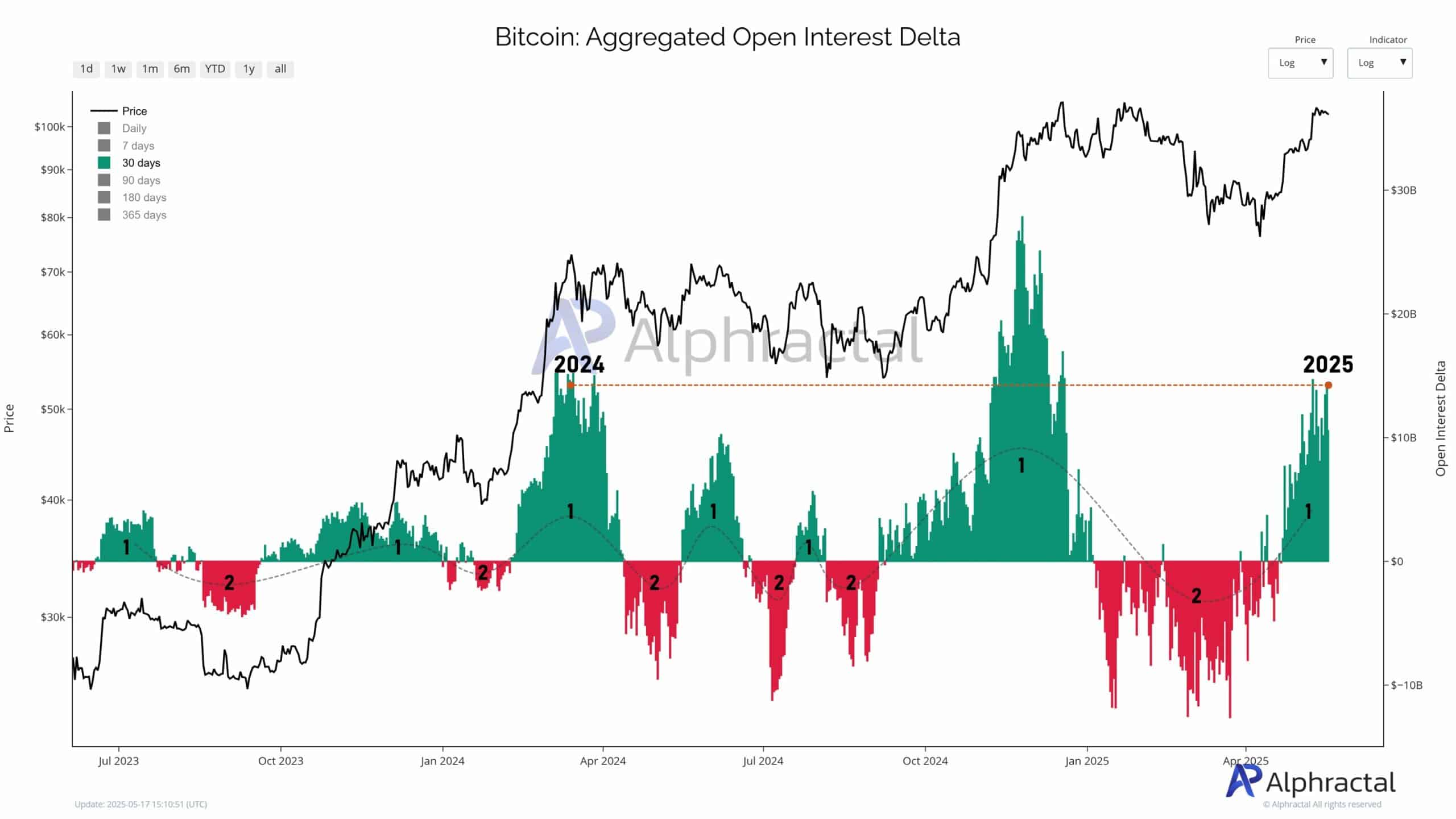

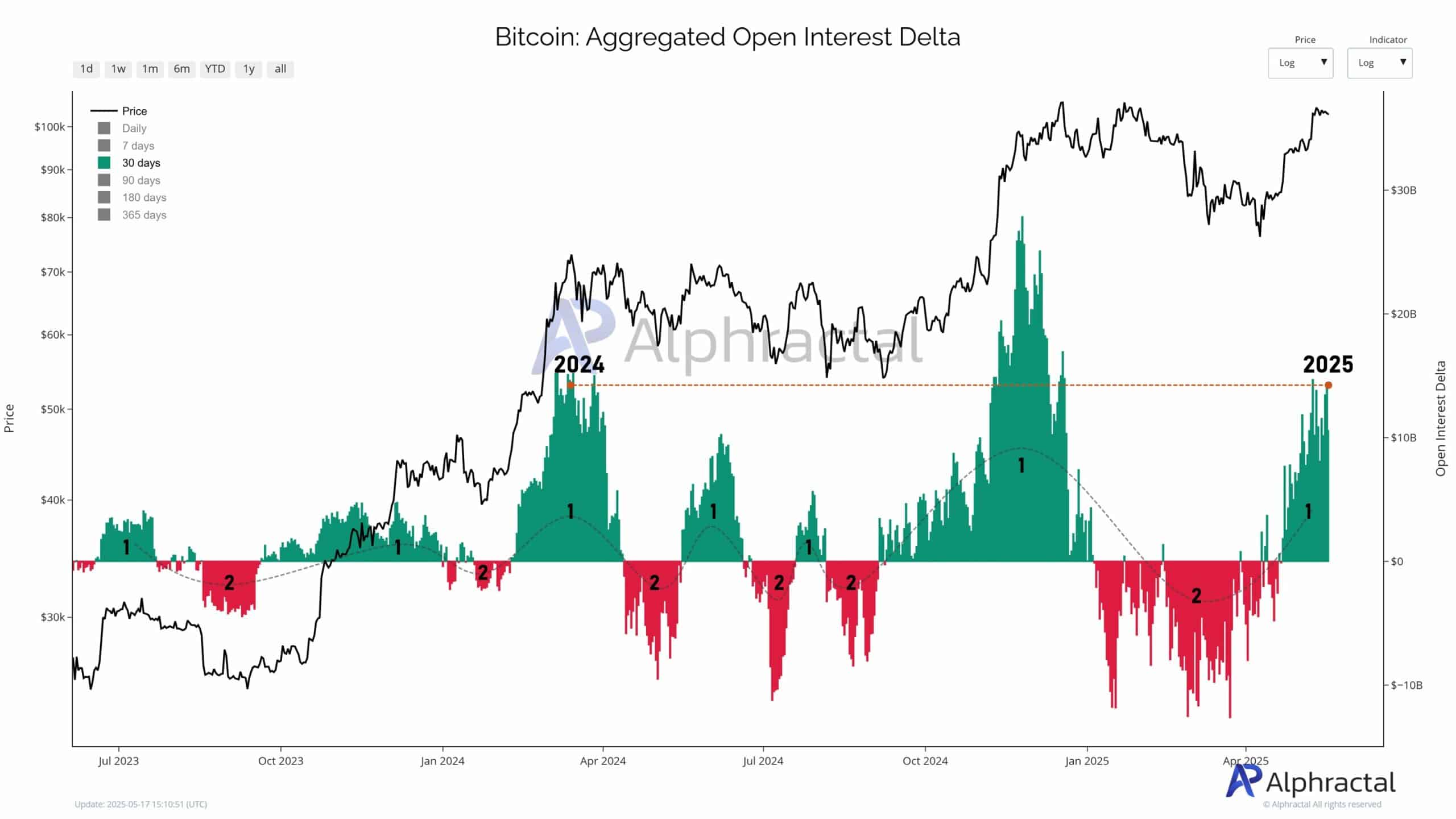

The 30-day consolidated delta reached ranges that haven’t been seen since 2024, when Bitcoin jumped above $ 73k to achieve its highest excessive.

That second in historical past now appears to be repeated, with the identical sample that comes up in regards to the statistics of derivatives.

Two clear phases are taking part in

The Open Curiosity (OI) cycle is mostly defined by analysts who’ve two phases. Section 1 is marked by a speedy accumulation of positions – this normally exhibits a optimistic delta.

After which section 2, the place the positions start to unravel, in order that the delta is negatively reversed. This forwards and backwards course of exhibits a rhythm of leverage and sentiment.

Supply: Alfractaal

On the time of writing, knowledge from Alphractal exhibits that we could introduce a special section 1. And as in earlier Bitcoin Bull -Runs, the tempo and form of this pattern are noticed.

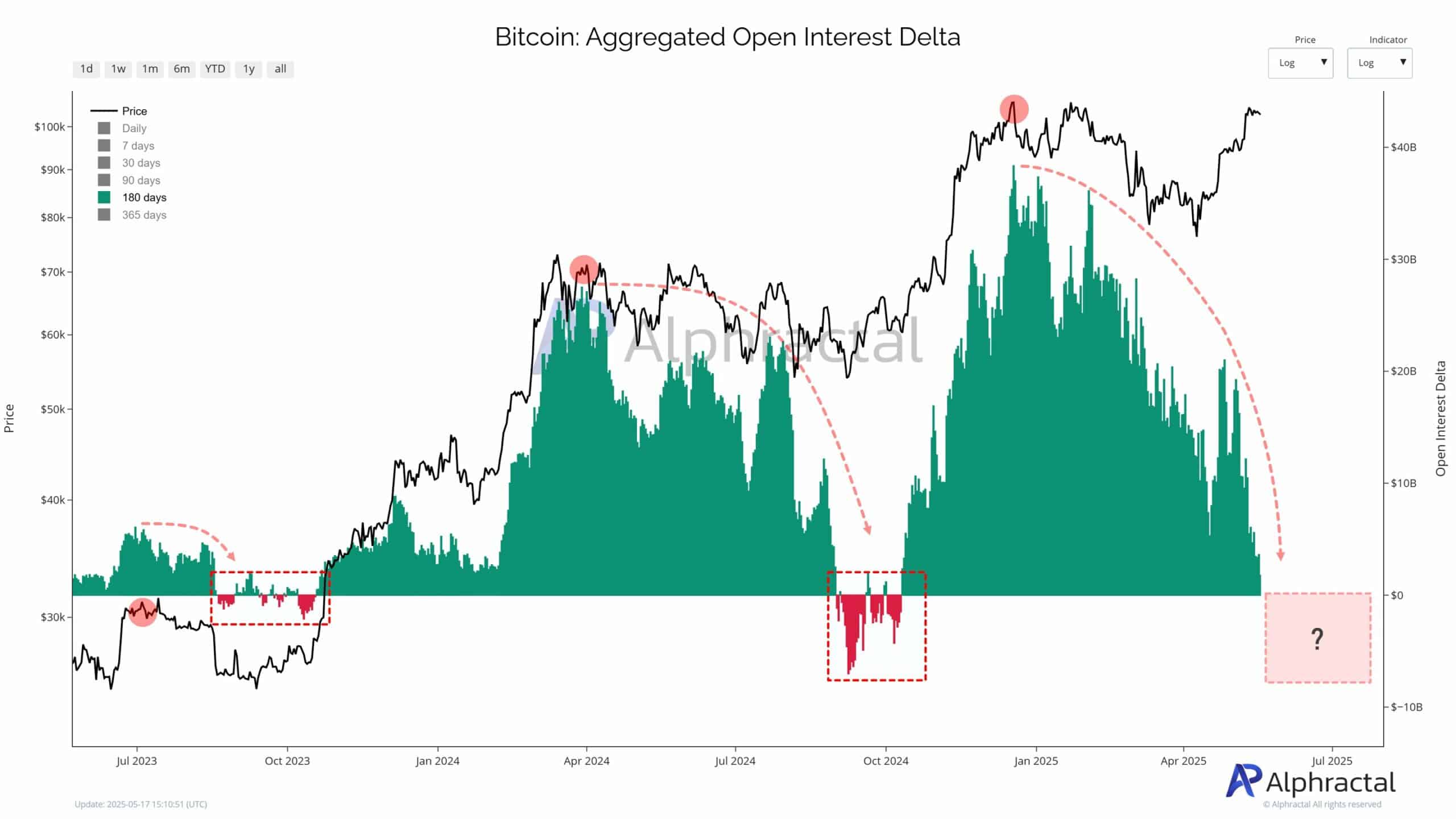

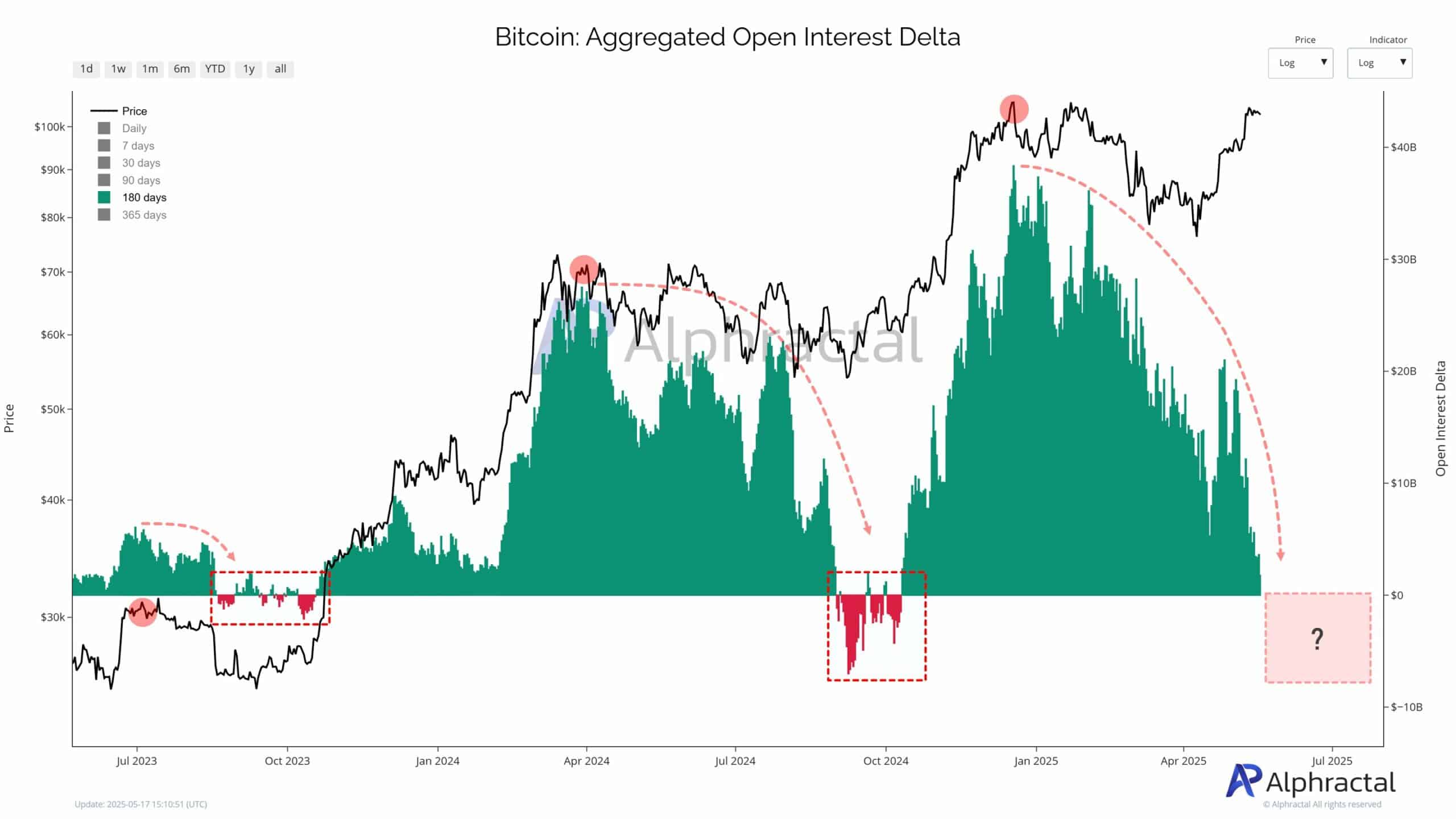

What reveals the 180-day Delta

After the quick time period, the 180-day OI Delta is extra informational.

Previously, sudden drops in Bitcoin Delta Delta huge liquidations. These occasions are inclined to get pleasure from lengthy positions via too out there. Fascinating is that they usually coincide with market bases.

On the time of the press, the 180-day delta floats simply above zero. If the crimson folds, this could mark the beginning of one other battery section.

This transition is commonly the place massive buyers quietly begin loading.

Supply: Alfractaal

Bitcoin -Walvissen comply with a nicely -known sample

Previously two years, comparable Delta shifts have been preceded by massive Bitcoin conferences, particularly in October 2023 and early 2024. Throughout these intervals, aggressive OI -Spikes signaled a robust upward momentum.

Nevertheless, this time the sample has modified. OI has not risen so sharply, which suggests that enormous gamers use a extra cautious method.

This habits is in keeping with how whales normally work – they stimulate market momentum however withdraw strategically, making their actions necessary to take a look at.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now