Altcoin

Bitcoin: This ratio points to a possible BTC range – how?

Credit : ambcrypto.com

- Binance quantity rose whereas the medium time period holders doubled, indicating the rising institutional accumulation.

- The curiosity and leverage of the general public fell, through which market selections and a weak second of demand had been emphasised.

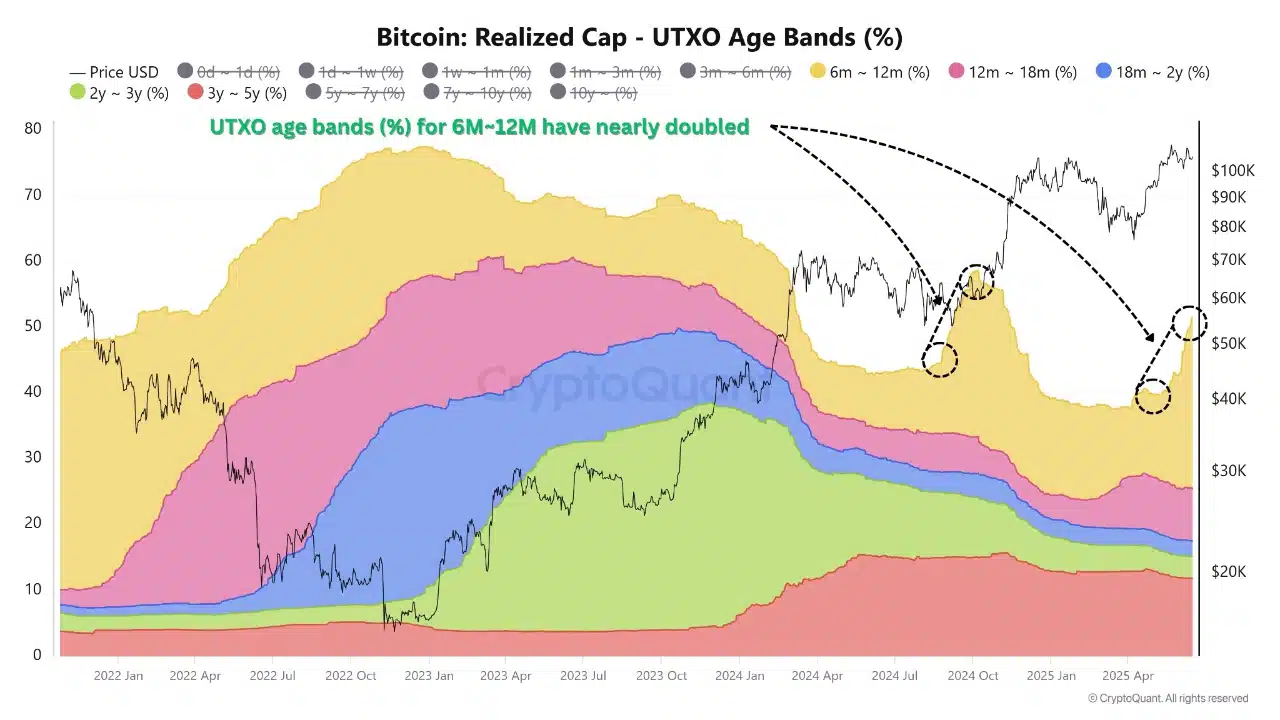

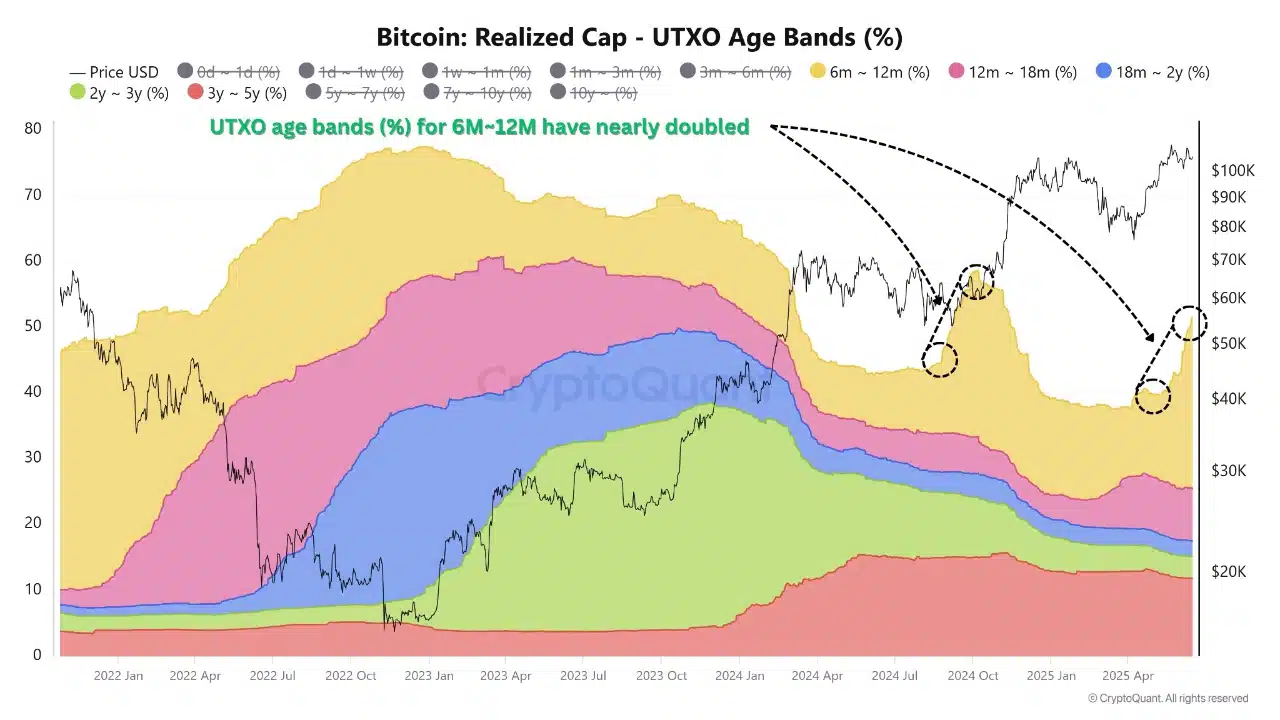

Bitcoin’s [BTC] Utxo Band doubled from 6 million to 12 million in June, indicating the conviction of rising holders, even though BTC fell 1.79% to $ 104,950 within the final 24 hours, a velocity time.

This peak reveals that extra buyers select to retain volatility as a substitute of taking a revenue, lowering the accessible supply.

From a historic perspective, such habits of medium-term holders is essential as good cash for robust rallies. If this development continues, Bitcoin may construct a bullish setup based mostly on accumulation.

The quick -term demand stays fragile and merchants should stay cautious till crucial mounting indicators return.

Supply: Cryptuquant

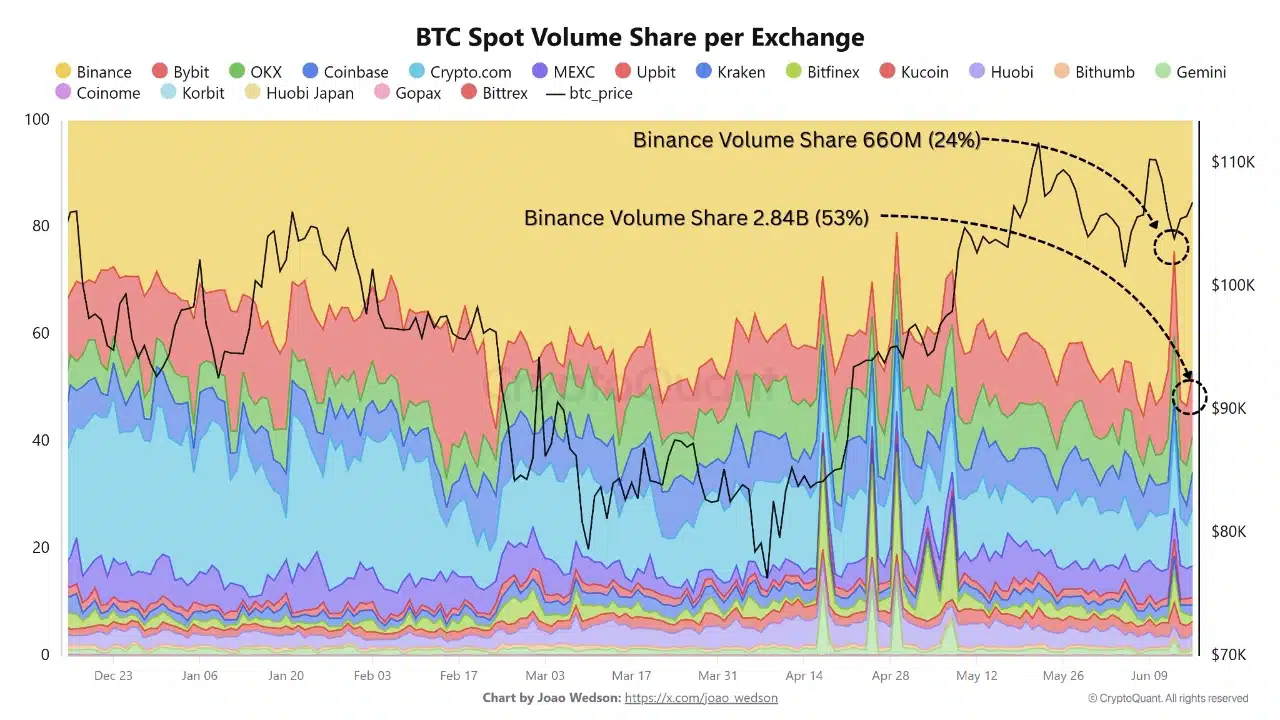

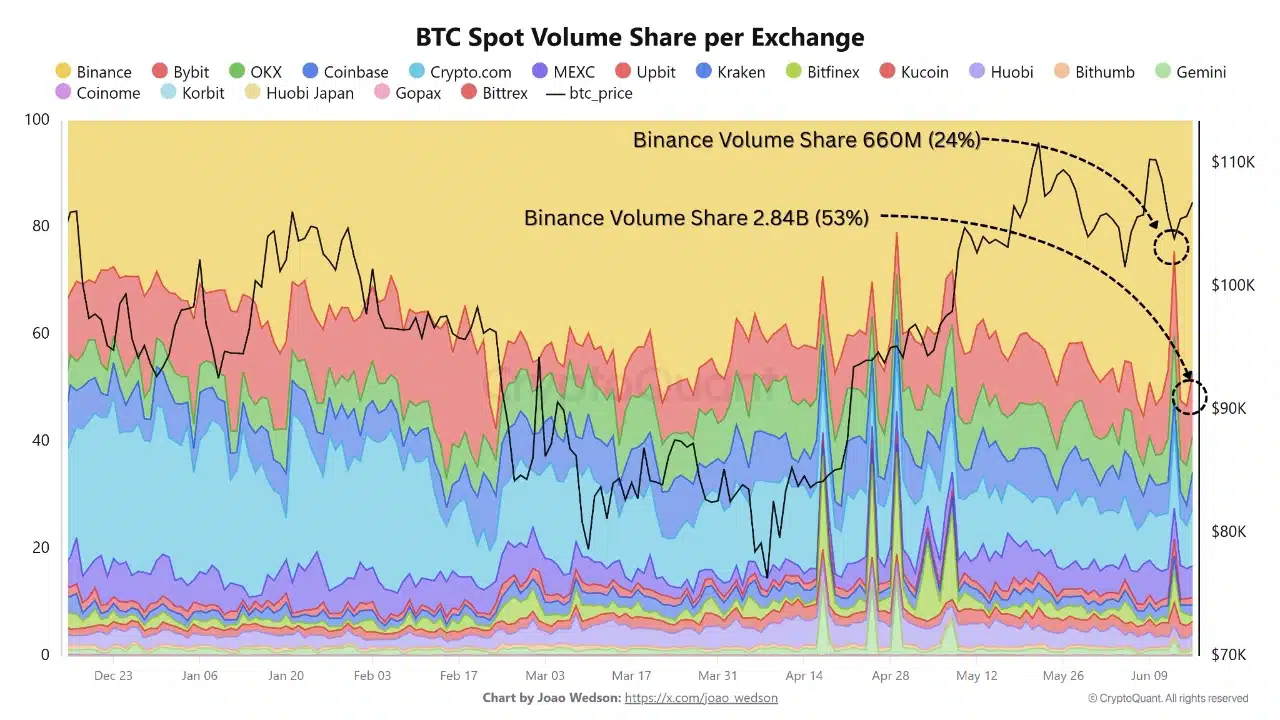

Why does Binance soak up the vast majority of the spot market exercise?

The share of Binance in Bitcoin Spot Buying and selling Quantity has risen in simply in the future from 24% to 53% – a dramatic shift, pointing to an enormous inflow of capital.

This peak might be powered by institutional gamers who once more grant their exercise, drawn by Binance’s deep liquidity and price -effective buying and selling construction.

Such a sudden rise within the change of dominance typically signifies an approaching section with excessive volatility, particularly whether it is fed by coordinated accumulation or strategic positioning previous to crucial value actions.

Furthermore, this speedy consolidation of quantity emphasizes the rising centralization in crypto -trading infrastructure.

Whether it is maintained, this may have everlasting penalties for value dialogue and market dynamics.

Supply: Cryptuquant

Verify a stock-flow ratio of 580 Excessive shortage for BTC?

On the time of writing, Bitcoin’s stock-to-flow (S/F) rose to 580-one degree nicely above historic averages.

This metric measures the connection between the circulating vary of Bitcoin and its annual challenge, and such a pointy improve normally factors to the tightening of supply and lengthy -term bullish potential.

Nevertheless, the elevated studying may be skewed by elements reminiscent of lowered miners’ gross sales or quick -term fluctuations throughout actions on the chain.

Though a excessive S/F ratio helps the story of an imminent provide shock, it’s not a standing sign for value valuation.

Persistent value development nonetheless relies on growing demand and broader market participation.

With out renewed investor’s pursuits and elevated actions, elevated S/F ranges can solely fail to trigger fast upward impulse.

Supply: Santiment

BTC Social and Derivators Statistics present indecision as conviction stalls

BTCs Social dominance fell to 19.88%, whereas the binance financing share floated on a impartial 0.001%, on account of fading crowd -engagement and dealer indecision.

This mixture suggests a low-judgment setting, through which neither bulls are neither assertively beneath management.

Traditionally, the falling of social curiosity together with flat financing preceded the nice volatility, for the reason that markets are ready for catalysts. The shortage of utmost sentiment or leverage reduces the quick -term momentum.

That’s the reason Bitcoin can stay accessible with out a peak in involvement or directive financing. If these statistics shift sharply, they’ll point out the beginning of the subsequent massive transfer of Bitcoin.

Supply: Santiment

Adverse DAA -Divergency continues to exist regardless of the current value stability

The divergence of the worth DAA remained damaging, which means that the deal with exercise didn’t maintain observe of current value actions.

This persistent divergence requires concern in regards to the energy of the present market construction.

The rising deal with exercise normally helps sustainable rallies, whereas divergence typically signifies speculative or hole value motion.

The fixed hole implies that fewer distinctive customers transact the community, regardless of the worth that hangs above $ 100k.

Supply: Santiment

What energy will prevail – processing or exhaustion?

The Bitcoin market is at the moment trapped between reverse forces: robust accumulation by holders in the long run and lowering curiosity within the wider crowd.

Central time period Utxo development and the rising market share of Binance level to growing institutional belief and long-term conviction.

Alternatively, damaging divergence in each day energetic addresses (DAA), mutilated social sentiment and impartial financing percentages expose weak retail involvement.

For BTC to arrange a sustainable outbreak, the coordination between institutional accumulation and enthusiasm of retail commerce is important.

Till that steadiness arises, Bitcoin stays at an important level – hanging between the potential for an outbreak and the danger of market fatigue.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024