Bitcoin

Bitcoin to hit new ATH? Look out for these new metrics!

Credit : ambcrypto.com

- The amount of enormous trades by whales and traders rose 7.85%, indicating a bullish outlook

- On the time of writing, 55% of the highest BTC merchants had lengthy positions, whereas 45% had quick positions

Bitcoin (BTC), the world’s largest cryptocurrency by market capitalization, is poised for an upward rally after an 8% worth drop in current days.

After breaking out of the descending channel sample on October 28, BTC rose by greater than 8%. Nevertheless, the most recent decline seems to be a worth correction – a optimistic signal for the upcoming rally.

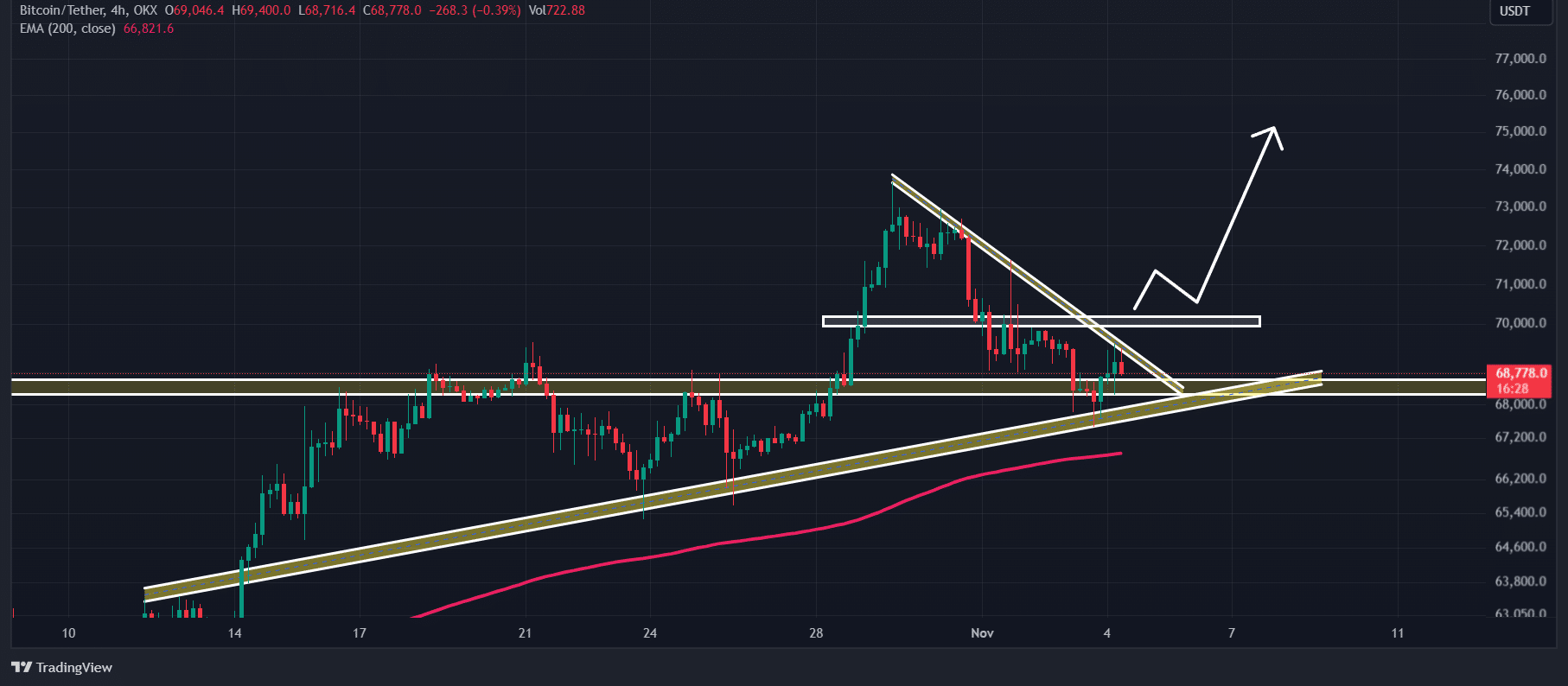

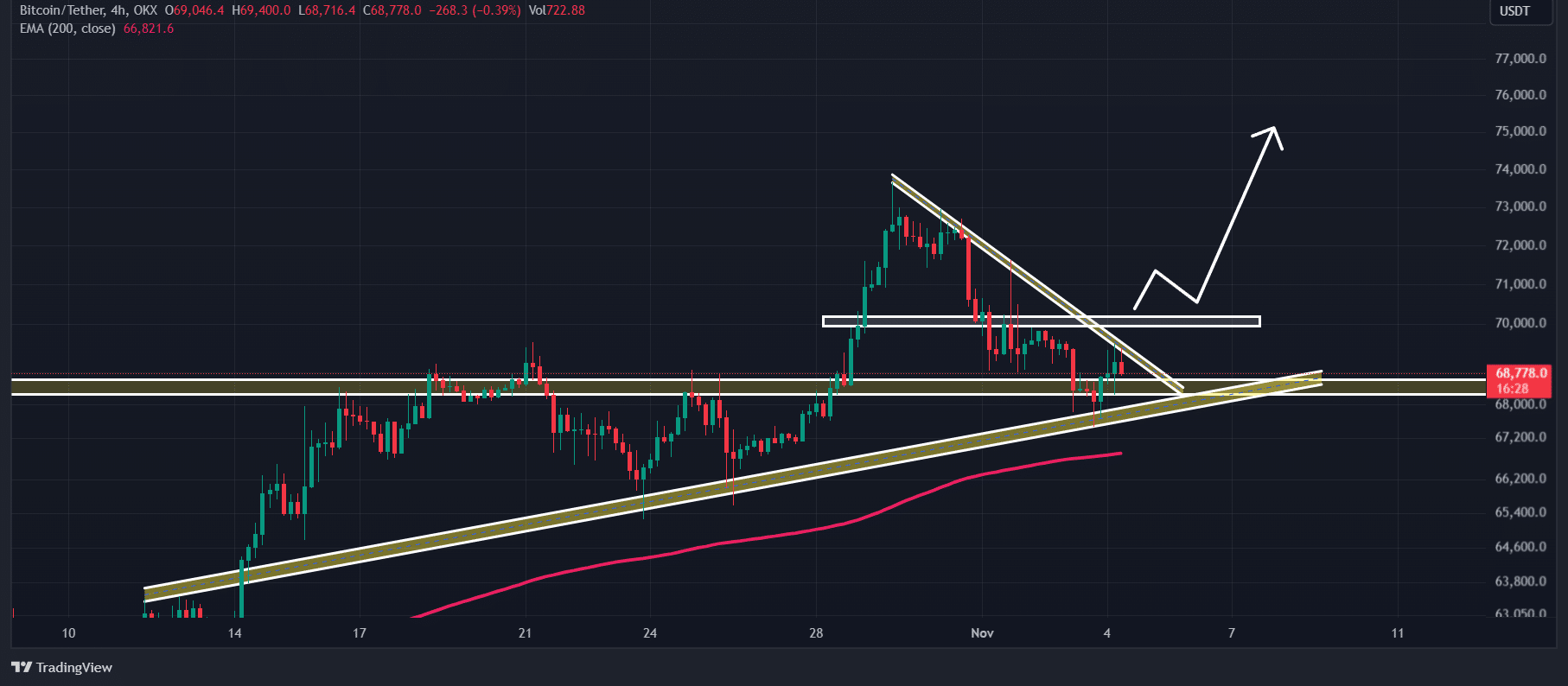

Bitcoin Worth Evaluation and Key Ranges

In keeping with AMBCrypto’s technical evaluation, the cryptocurrency appeared to come across resistance from a descending trendline inside a four-hour timeframe. If Bitcoin registers an upward rally, there’s a good probability that the asset might break this aforementioned hurdle.

Supply: TradingView

If BTC breaks this trendline and closes a four-hour candle above $70,000, there’s a good probability the asset might rise considerably. Potential to succeed in a brand new all-time excessive within the coming days.

Nevertheless, this bullish thesis will solely work if Bitcoin maintains assist above the $67,500 stage. In any other case it might fail.

On the time of writing, BTC seemed to be buying and selling above its 200 Exponential Transferring Common (EMA) on each the four-hour and each day time frames, indicating an uptrend.

BTC’s bullish on-chain metrics

Taking a look at this bullish outlook, it appeared that whales and traders have elevated their participation. In keeping with the on-chain analytics firm InHetBlokBTC’s excessive transaction quantity has elevated by 7.85% prior to now 24 hours. This might assist enhance the value of the asset.

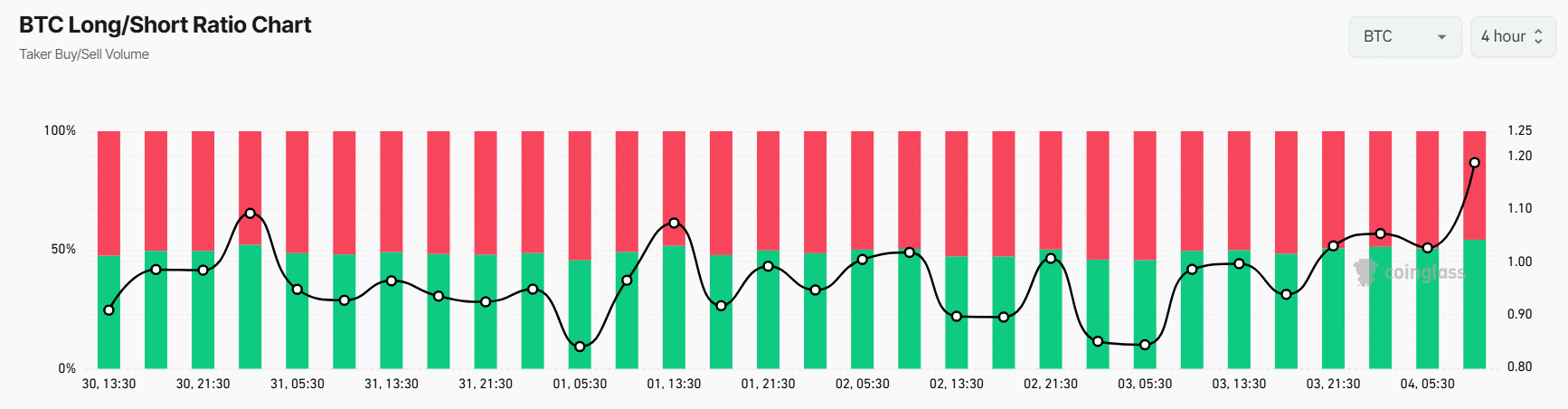

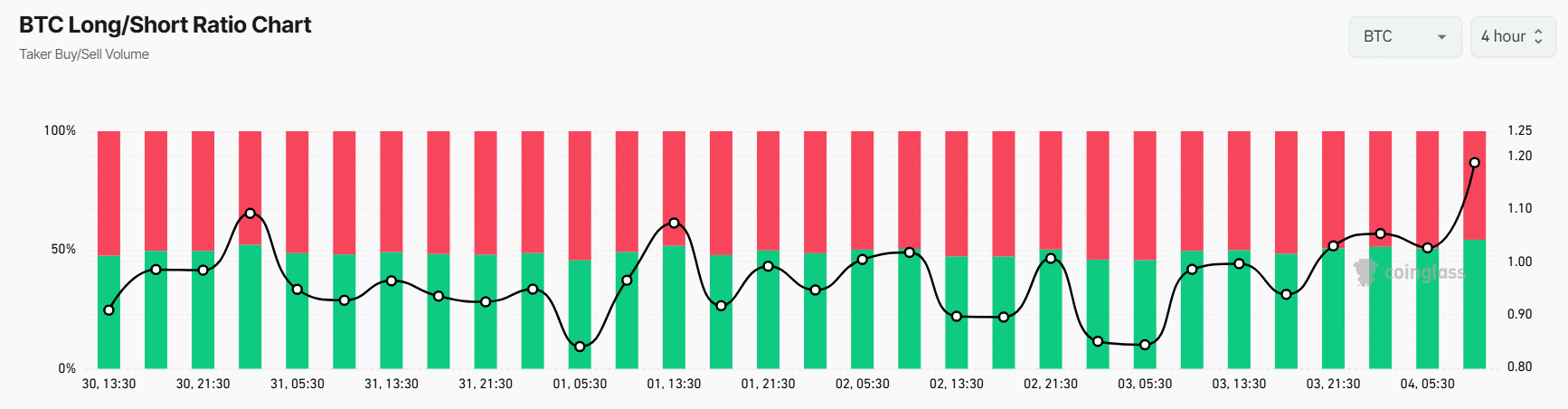

Moreover, BTC’s Lengthy/Brief ratio stood at 1.20, underscoring the sturdy bullish sentiment amongst merchants. In the meantime, Open Curiosity rose 2.9% over the previous 24 hours, indicating rising curiosity and the formation of latest positions from merchants.

Supply: Coinglass

Primarily based on an evaluation of Coinglass information, 55% of high merchants had lengthy positions, whereas 45% had quick positions.

Worth efficiency

On the time of writing, Bitcoin was valued at $69,100, having appreciated practically 1.1% prior to now 24 hours. Throughout the identical interval, buying and selling quantity shot up 45%, indicating better participation from merchants and traders.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024