Analysis

Bitcoin trades at discount in Korea destroying historical ‘Kimchi Premium’

Credit : cryptoslate.com

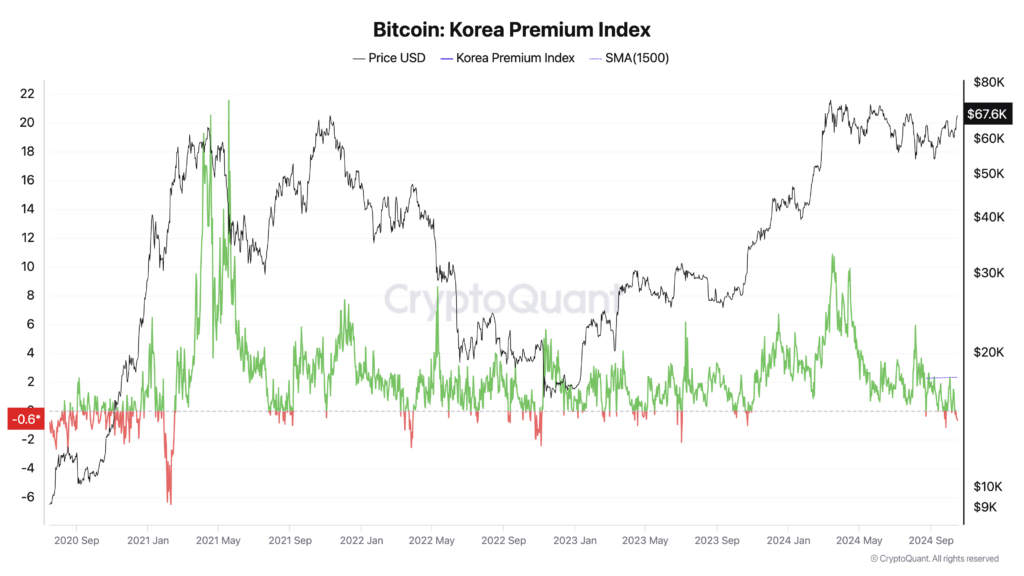

Bitcoin is buying and selling at a reduction on South Korean exchanges, reversing the standard “kimchi premium” that has traditionally signaled bullish market sentiment.

Per The Korea Times, the cryptocurrency is priced about 700,000 received ($511.73) decrease domestically than on international exchanges, leading to a damaging premium (low cost) of -0.74% as of Thursday afternoon.

This shift appears to point a bearish view amongst South Korean buyers. Sometimes, the next kimchi premium signifies sturdy native demand and constructive sentiment, which regularly results in Bitcoin costs exceeding international charges. In distinction, a decrease or damaging premium displays weakened enthusiasm and lowered shopping for strain, doubtlessly signaling a market correction or alignment with international valuations.

Analysts attribute this uncommon discrepancy to subdued investor sentiment in South Korea and better demand for digital belongings on international platforms. KP Jang, head of Xangle Analysis, informed the Korea Instances that restrictions are stopping international and institutional buyers from accessing home inventory exchanges, amplifying the impression of declining demand from retail buyers.

A shift in merchants’ preferences in direction of altcoins can be affecting the market. As Bitcoin boomed globally, Korean merchants started accumulating undervalued various cryptocurrencies in anticipation of a stable rally within the fourth quarter. reported By means of Enterprise insider. These altcoins, together with Tao, Sei Community, Aptos, Sui, NEAR Protocol and The Graph, are seen as having greater returns, doubtlessly diverting consideration from Bitcoin.

Declan Kim, a analysis analyst at DeSpread, additionally informed the Korea Instances that the altcoin market, which includes a good portion of home buying and selling, continues to wrestle amid transitional phases of latest laws. The implementation of the Digital Asset Consumer Safety Act impacts market forces. Many altcoins are nonetheless unlisted on home exchanges in comparison with international ones, and the ban on market making makes securing liquidity a problem.

The Kimchi bounty has historically been a trademark of the South Korean crypto market. When Bitcoin crossed the 100 million received mark domestically in March, the premium briefly spiked to as a lot as 10%. The next premium typically signifies sturdy native demand and bullish sentiment, usually coinciding with or previous Bitcoin worth will increase. Conversely, a decrease or damaging premium signifies bearish sentiment and lowered shopping for strain.

Information signifies a notable decline in buying and selling quantity between Bitcoin and Korean Received (BTC/KRW) over the previous 40 days, reflecting a shift in investor focus.

Analysts anticipate the reverse kimchi premium to be momentary. Jang expects the discrepancy to vanish quickly, as such premiums have not often held up for lengthy intervals. He mentioned ongoing discussions on laws permitting company funding in digital belongings might enhance liquidity on home exchanges and step by step slender the worth hole with international markets.

Present buying and selling situations mirror a fancy interaction of home laws, investor conduct and international market tendencies, indicating important shifts inside South Korea’s crypto panorama. The damaging kimchi premium, whereas uncommon, might in the end result in a extra balanced and mature market because it higher aligns with international digital asset valuations.

The final time Kimchi Premium turned damaging was in October 2023, proper earlier than Bitcoin’s ETF-driven bull run.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now