Altcoin

Bitcoin Trading Activity is falling – is there a big price shift?

Credit : ambcrypto.com

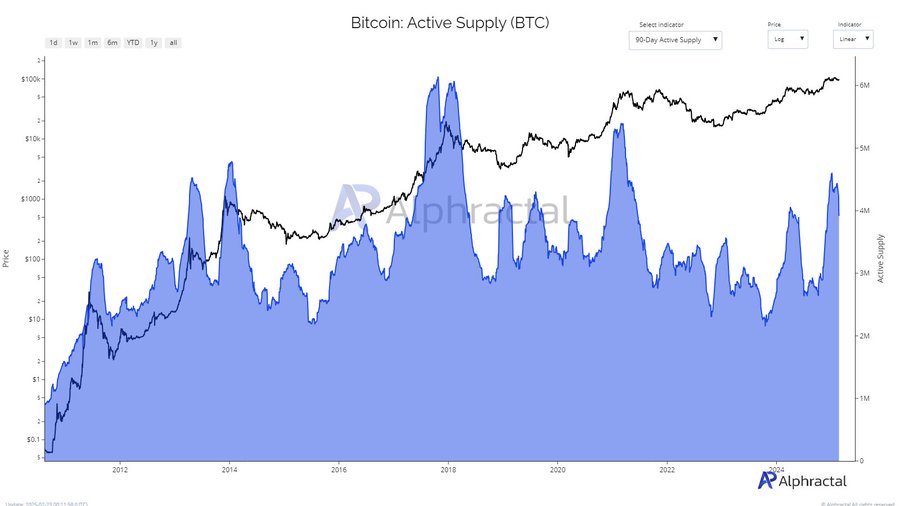

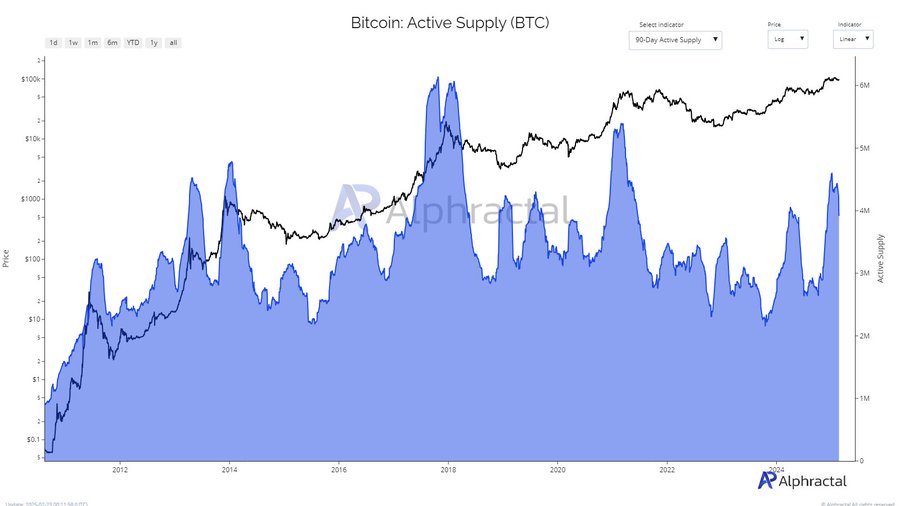

- Bitcoin’s 90-day energetic provide drops and signifies a decrease buying and selling exercise and demand within the quick time period.

- The lower in energetic supply could point out a possible value consolidation or additional dip.

In current weeks, Bitcoin’s [BTC] Energetic vary of 90 days has been a noticeable decline and raises questions in regards to the present state of market demand and investor sentiment.

This has lengthy been used to evaluate each the extent of latest market pursuits and the final temper of merchants.

Because the statistics proceed to fall, it’s essential to grasp what this shift might imply for the worth motion of Bitcoin and which traits traders ought to take note of within the coming months.

Energetic provide, market demand and sentiment

The 90-day energetic provide helps to learn each the market demand and sentiment by following the Bitcoin that was dealt with a minimum of as soon as inside a interval of 90 days.

A excessive energetic provide normally signifies elevated market participation, which is commonly a mirrored image of the rising demand from new or quick -term merchants.

Conversely, a lower in energetic supply could point out decreased curiosity or a shift in sentiment, as a result of in the long run holders are much less more likely to promote in periods of decrease market exercise.

Traditionally, appreciable shifts in energetic supply are correlated with modifications in market temper, in order that potential value fluctuations and traits are sometimes indicated.

Elements behind the shift in market habits

The current lower within the 90-day energetic inventory of Bitcoin identified A reduction in commercial activity in the short termSign much less curiosity from new market individuals.

If this development continues, this implies that the worth of Bitcoin can consolidate sideways for an extended interval or expertise a slight dip.

Numerous elements contribute to this shift.

After the rise of Bitcoin past $ 100,000 after President Donald Trump’s election, the market needed to cope with elevated volatility, pushed by coverage safety and inflation issues.

This has led to extra cautious buying and selling habits.

Furthermore, the choice of the SEC to drop his case towards Coinbase has created a extra favorable regulatory surroundings, inflicting the lengthy -term retaining to energetic commerce.

Because the institutional rate of interest grows, market individuals appear to make use of a wait -and -see method that may additional affect energetic supply statistics.

Historic traits and patterns within the energetic vary of Bitcoin

An evaluation of historic Bitcoin Cycli reveals that the energetic provide tends to rise in the course of the peaks of the bull market and to contract in early section rallies or post-recalcation consolidation intervals.

The graph signifies earlier peaks in energetic supply throughout a very powerful value will increase of Bitcoin in 2013, 2017 and 2021, adopted by steep decreases throughout corrective phases.

Supply: Alfractaal

Specifically, the current recession in energetic vary displays traits which might be noticed earlier than giant outbreak, which means that present market individuals maintain their belongings whereas awaiting the next value bone.

If this sample applies, Bitcoin may be in a consolidation section earlier than a brand new upward motion.

Has this influenced BTC’s value?

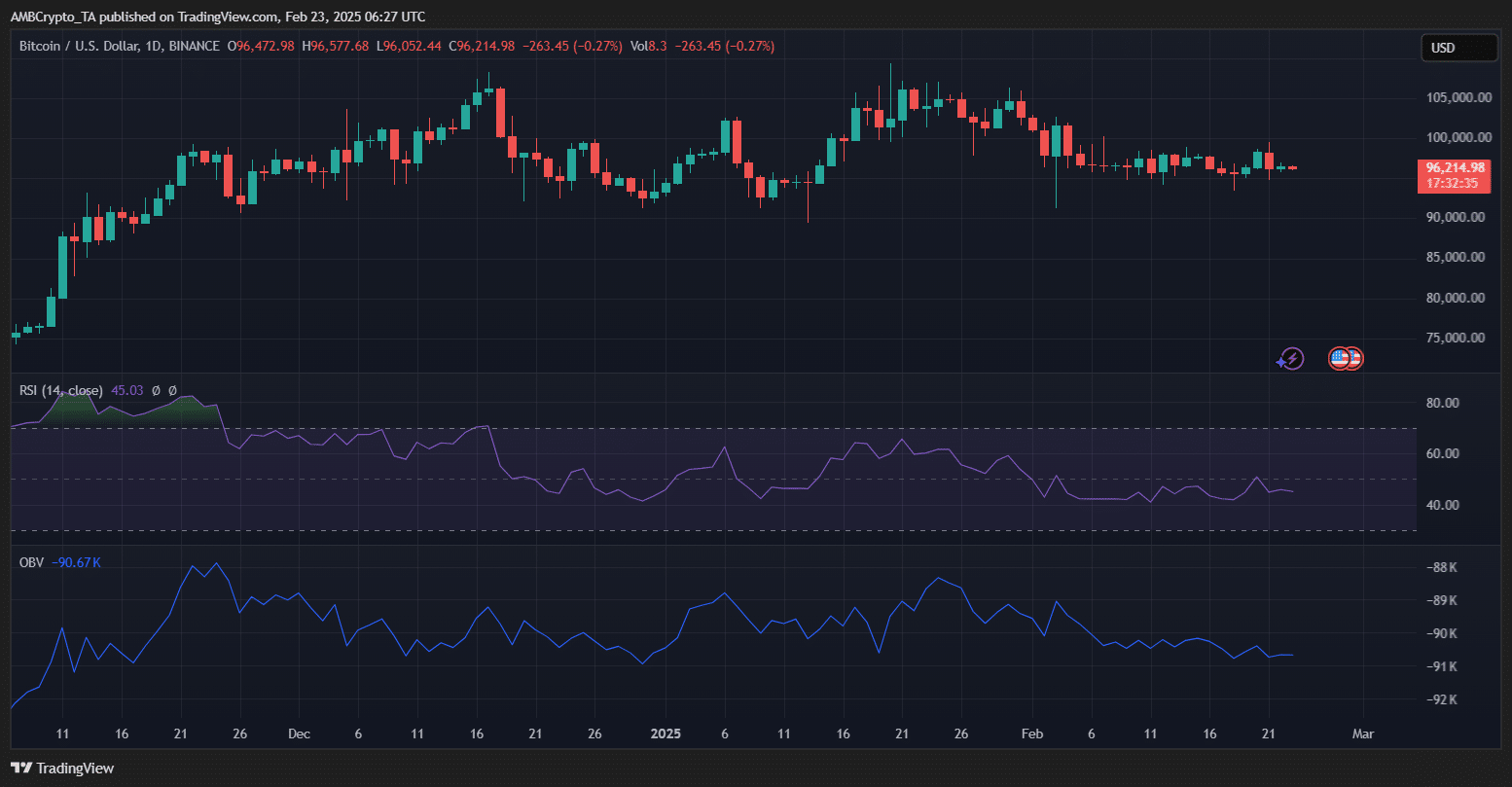

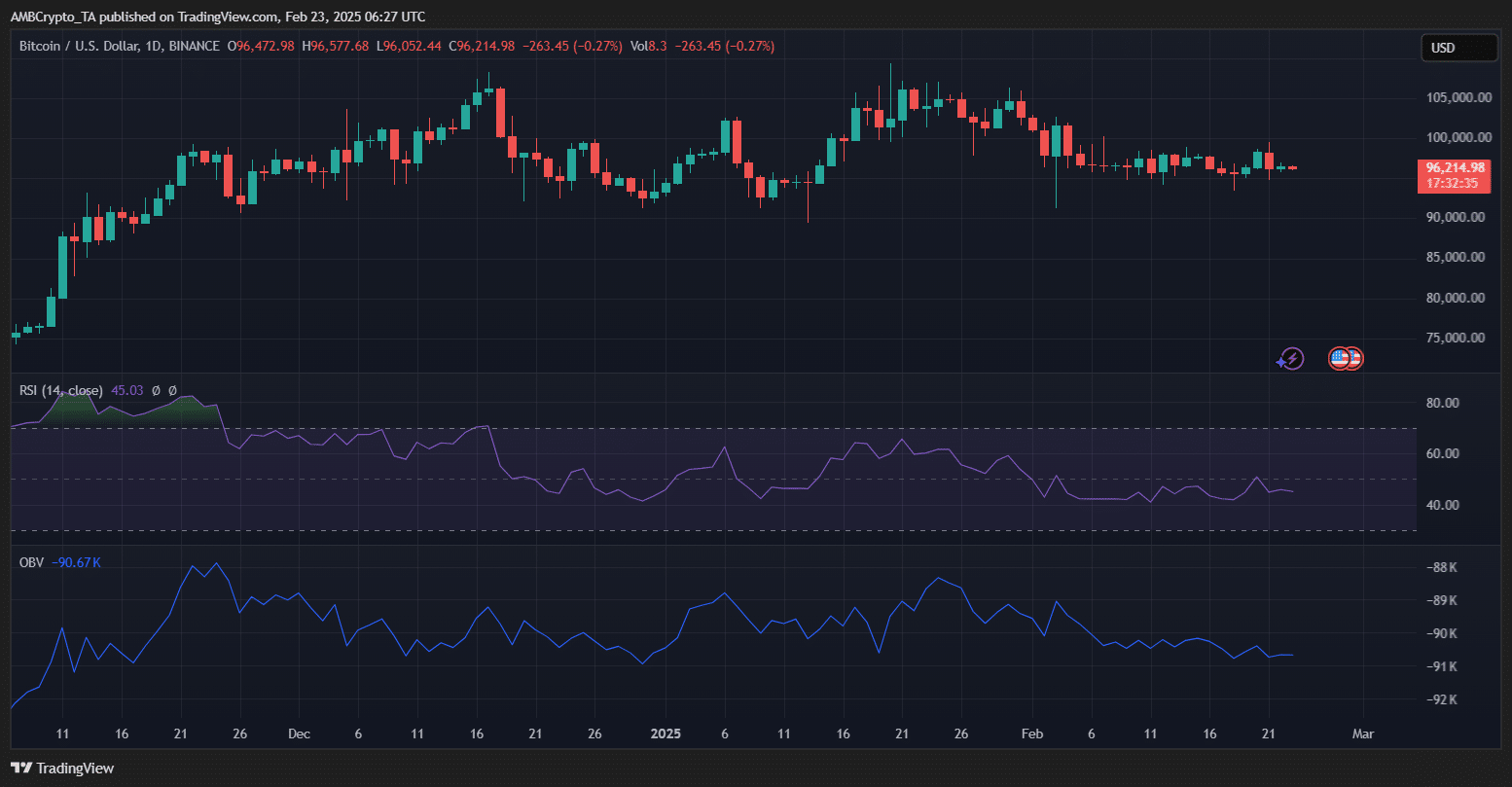

Bitcoin traded at $ 96.214 on the time of the press, which confirmed a lower of 0.27% within the final 24 hours. The RSI at 45.03 indicated that BTC is situated on impartial territory, neither bought nor overbough.

The OBV was trending down, which factors to weakening buying strain, which labored according to the decline in energetic weight loss plan of 90 days.

Supply: TradingView

BTC marked $ 100,000 after not figuring out a transparent outbreak.

The lowering buying and selling exercise within the quick time period signifies that traders are cautious and doubtless look ahead to stronger catalysts. If BTC fails to win again Momentum, a withdrawal to $ 90,000 stays attainable.

Nonetheless, if the query arises, BTC might attempt a brand new push to psychological resistance at $ 100,000.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024