Bitcoin

Bitcoin Treasury Bubble About To Burst, Say 10x Research

Credit : coinpedia.org

For months, buyers believed that purchasing shares in Bitcoin treasury firms like MicroStrategy and Metaplanet was the smarter and safer solution to acquire publicity to the world’s largest cryptocurrency. It felt like a shortcut to Bitcoin earnings till the Bitcoin bubble burst.

In response to a brand new one report from 10x Researchretail buyers have misplaced greater than $17 billion chasing these so-called “Bitcoin Treasury” shares. And the crash wasn’t because of a drop within the value of Bitcoin, however one thing way more painful.

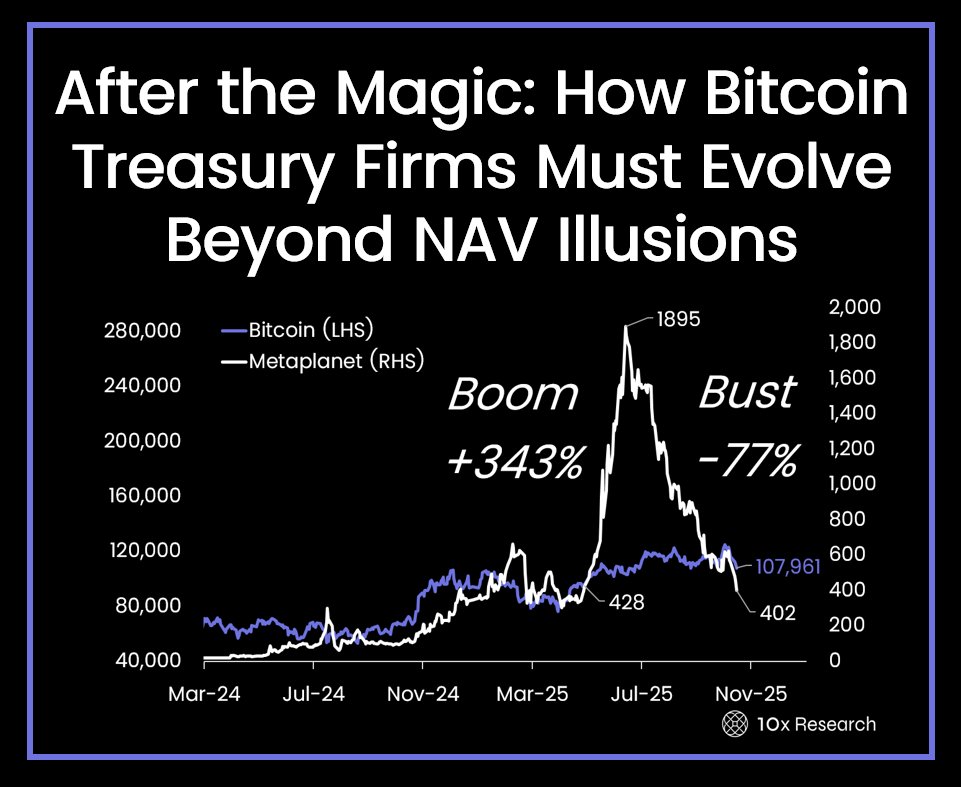

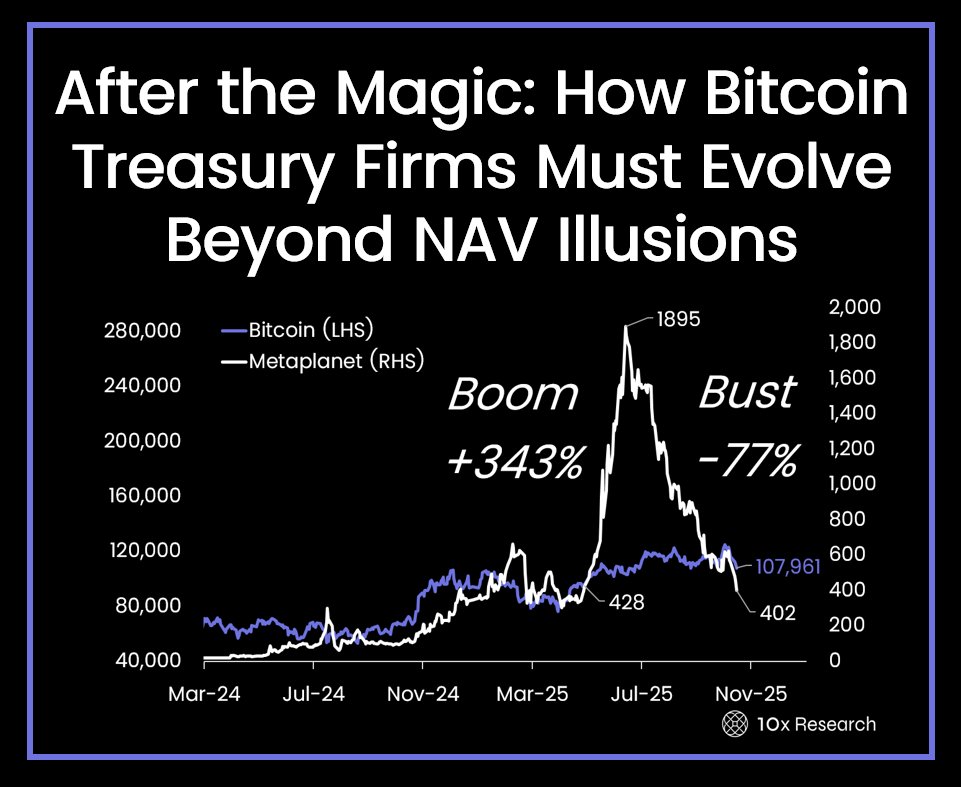

Sky-high premiums are collapsing

In 2024 and early 2025, the joy surrounding Bitcoin’s institutional adoption reached its peak. Buyers began paying 3 to 4x their web asset worth (NAV) simply to personal shares in Bitcoin holdings, treating them as bets on the way forward for crypto.

However as world markets cooled and Trump’s commerce tensions with China elevated uncertainty, these inflated valuations didn’t maintain up.

Multiples collapsed approximately 1.0–1.4× NAVerasing billions in shareholder worth at the same time as Bitcoin’s value remained close to file highs. In complete, 10x Analysis estimates that about $20 billion was overpaid, demonstrating the prices of chasing hype about actual property.

Metaplanet and MicroStrategy are additionally competing

Metaplanet, as soon as referred to as “Asia’s MicroStrategy,” stopped shopping for Bitcoin in early October after its share value fell practically 47% in simply three weeks, pushing its firm worth beneath the worth of its BTC holdings. The corporate alone misplaced $4.9 billion from its peak.

MicroStrategy was not spared both; the premium fell sharply from 4x to 1.4x NAV, exhibiting how even established gamers had been feeling the strain.

- Additionally learn:

- Why does the Wealthy Dad Poor Dad creator imagine that authorities cash is “pretend”?

- ,

How Buyers Suffered Huge Losses

10x Analysis calls this the tip of ‘monetary magic’. These treasury firms, as soon as celebrated for his or her daring Bitcoin methods, at the moment are below strain to show actual worth by way of lending, custody or arbitrage.

The crash was simple arithmetic: firms purchased Bitcoin with fairness or debt at excessive costs. As valuations cooled, buyers who purchased on the peak misplaced about 67% in comparison with holding Bitcoin immediately.

Because of this, many are shifting to Bitcoin ETFs or direct investments, the place transparency is healthier and premiums don’t erode returns.

10X Analysis additional warns that the collapse in premiums might wipe out $25 billion to $30 billion in worth by the tip of the 12 months, additional hitting speculative Bitcoin capital. To outlive, firms now want to realize 15 to twenty% returns by way of actual return methods – or threat collapse.

By no means miss a beat within the Crypto world!

Keep knowledgeable with breaking information, knowledgeable evaluation, and real-time updates on the newest traits in Bitcoin, altcoins, DeFi, NFTs, and extra.

Regularly requested questions

These are firm shares, like MicroStrategy, that gained worth by holding massive Bitcoin reserves, however buyers typically paid a big premium over the precise Bitcoin worth.

Retail buyers misplaced greater than $17 billion chasing these shares, with an estimated $20 billion overpaid in premiums that then evaporated.

In response to Coinpedia’s BTC value forecast, Bitcoin value might peak at $168,000 this 12 months if bullish sentiment continues.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict editorial tips based mostly on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our assessment coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We attempt to offer well timed updates on every part crypto and blockchain, from startups to trade majors.

Funding disclaimer:

All opinions and insights shared signify the creator’s personal views on present market situations. Please do your personal analysis earlier than making any funding choices. Neither the author nor the publication accepts accountability on your monetary selections.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks might seem on our web site. Adverts are clearly marked and our editorial content material stays utterly impartial from our promoting companions.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024