Altcoin

Bitcoin up to $ 10 million? Experts predict explosive growth by 2035

Credit : www.newsbtc.com

Cause to belief

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Made by specialists from the business and punctiliously assessed

The best requirements in reporting and publishing

Strictly editorial coverage that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

In a brand new publication entitled The Mustard Seed, Joe Burnett – Director of Market Analysis at Unchained – makes a thesis that proposes Bitcoin by 2035 $ 10 million per coin. letter Takes the lengthy illustration, geared toward “time arbitration” whereas it’s investigating the place Bitcoin, know-how and human civilization can now be a decade.

The argument of Burnett revolves round two important transformations that, in accordance with him, type the scene for an unprecedented migration of worldwide capital to Bitcoin: (1) the “giant stream of capital” in an lively with absolute shortage, and (2) the “acceleration of deflationary know-how” resembling AI and Robotics reshape industries.

An extended -term perspective on Bitcoin

Most financial feedback zoom in on the following successful report or the quick value volatility. The mustard seed, alternatively, clearly broadcasts its mission: “In distinction to essentially the most monetary remark that’s established on the next quarter or subsequent yr, this letter takes the lengthy show – identifies deep shifts earlier than they turn out to be a consensus.”

The core of Burnett’s prospects is the remark that the worldwide monetary system – which comprises round $ 900 trillion in whole property – comprises the continual dangers of “dilution or devaluation”. Bonds, currencies, shares, gold and actual property have every expansive or inflatory parts that erode their store-or worth perform:

- Gold ($ 20 trillion): mined at about 2% per yr, will increase the availability and slowly thinning its shortage.

- Actual property ($ 300 trillion): about 2.4% grows per yr because of new growth.

- Equits ($ 110 trillion): Enterprise income are continuously eroded by competitors and market saturation, which contributes to devaluation dangers.

- Getting caught and Fiat ($ 230 trillion): structurally topic to inflation, which reduces buying energy over time.

Burnett describes this phenomenon as a capital “in search of a decrease potential power state”, wherein the method is in contrast with water that breaks down a waterfall. Based on him, all pre-bitcoin activa courses had been efficient “open premes” for dilution or devaluation. Wealth managers can unfold capital beneath actual property, bonds, gold or shares, however every class was carrying a mechanism with which its actual worth might extract.

Associated lecture

Enter Bitcoin, along with his arduous cap of 21 million. Burnett sees this digital lively as the primary financial instrument that’s unable to be diluted or devalued from inside. Supply is fastened; The query, if it grows, can instantly translate into value valuation. He quotes Michael Saylor’s “Waterfall Analogy”: “Capital is in fact in search of the bottom potential power standing – similar to water flows downwards. Earlier than Bitcoin, wealth had no actual escape of dilution or devaluation saved in any activa courses acted as a market program.”

As quickly as Bitcoin was usually acknowledged, Burnett says, the sport modified for capital allocation. Identical to discovering an untouched reservoir far under the present water basins, the International Wealth Provide discovered a brand new outlet – one that can’t be supplemented or diluted.

As an example Bitcoin’s distinctive provide dynamics, the mustard seeds appeal to a parallel with the half -time cycle. In 2009, miners acquired 50 BTC per block – Akin to Niagara Falls at full energy. From as we speak, the reward fell to three,125 BTC, which is harking back to repeatedly halving the present of the waterfalls till it’s significantly decreased. In 2065, the newly crushed vary of Bitcoin shall be negligible in comparison with the whole quantity, which displays a waterfall that’s decreased to a ray.

Though Burnett admits that makes an attempt to quantify the worldwide acceptance of Bitcoin, is determined by unsure assumptions, he refers to 2 fashions: the Energy Legislation mannequin that tasks $ 1.8 million per BTC per BTC by 2035 and the Bitcoin mannequin by Michael Saylor, that that’s that $ 2.1, that that that $ 2.

He resists that these projections might be ‘too conservative’ as a result of they typically settle for a reducing return. In a world of accelerating technological acceptance – and a rising realization of the properties of Bitcoin – Value goals can significantly exceed these fashions.

The acceleration of deflatoire know-how

A second necessary catalyst for the upward potential of Bitcoin, in accordance with the mustard seed, is the deflatory wave brought on by AI, automation and robotics. These improvements shortly enhance productiveness, decrease prices and make items and companies extra abundantly. By 2035, Burnett believes that the worldwide prices in numerous necessary sectors can bear dramatic reductions.

The “velocity factories” of Adidas lower the sneaker manufacturing from months to days. The scaling of 3D printing and AI-driven mounting strains can decrease the manufacturing prices by 10x. 3D-printed homes will rise 50 occasions sooner at a lot decrease prices. Superior Provide Chain automation, mixed with AI logistics, could make high quality housing 10x cheaper. Autonomous using hailing could decrease charges by 90% by eradicating labor prices and bettering effectivity.

Burnett underlines that, beneath a Fiat system, pure deflation is commonly ‘artificially suppressed’. Financial coverage – resembling persistent inflation and stimulus – has damaged the costs, the true influence of masking know-how on lowering prices, available on the market.

Bitcoin, alternatively, would let the deflation ‘his course’ run, which will increase buying energy for holders as items turn out to be extra reasonably priced. In his phrases: “An individual with 0.1 BTC as we speak (~ $ 10,000) might see the buying energy enhance 100 occasions or extra in 2035 as items and companies turn out to be exponentially cheaper.”

To be able to illustrate how supply progress of a worth of a Winkel erodes in the midst of time, Burnett repeats Gold’s efficiency since 1970. The nominal value of Gold from $ 36 per ounce to round $ 2,900 per ounce in 2025 appears vital, however that the worth win was continuously diluted by the annual 2% enhance of Gold. For 5 a long time, the worldwide inventory nearly tripled.

If Gold’s supply had been static, the worth would have reached $ 8,618 per ounce in accordance with 2025, in accordance with Burnett’s calculations. This provide limitation would have strengthened the shortage of Gold, which can make the demand and the worth even greater than $ 8,618.

Associated lecture

Bitcoin, alternatively, comprises exactly the everlasting provide situation that gold has by no means had. Each new query won’t stimulate additional forex challenge and should subsequently ship the worth instantly up.

Burnett’s prediction for a $ 10 million bitcoin towards 2035 would suggest a complete market capitalization of $ 200 trillion. Though that determine sounds colossal, he factors out that it solely represents about 11% of worldwide wealth – the belief of worldwide wealth continues to broaden by an annual proportion of ~ 7%. From this viewpoint it is probably not far -fetched to allocate about 11% of the property of the world to what the mustard seed ‘calls the very best lengthy -term storage’ of worth property’. “Each worth of the previous is continually intensive within the provide to fulfill demand. Bitcoin is the primary to try this. “

An necessary piece of the puzzle is the safety price range for Bitcoin: Miner Income. By 2035 Bitcoin’s Block subsidy shall be fallen to 0.78125 BTC per block. With $ 10 million per coin, miners might earn $ 411 billion in whole turnover yearly. As a result of miners promote the bitcoin they earn to cowl the prices, the market ought to soak up $ 411 billion in newly mined BTC yearly.

Burnett attracts a parallel with the worldwide wine market, which was valued at $ 385 billion in 2023 and is predicted to succeed in $ 528 billion in 2030. If an “on a regular basis” sector resembling wine can help that stage of shopper demand, an business might be discovered that the main digital digital retailer that bones the digital worth.

Regardless of the general public notion that Bitcoin Mainstream turns into, Burnett emphasizes a sub -reported metric: “The variety of individuals worldwide with $ 100,000 or extra in Bitcoin is just 400,000 … That’s 0.005% of the world’s inhabitants – solely 5 out of 100,000 individuals.”

Within the meantime, research can display that round 39% of Individuals have a sure stage of “direct or oblique” Bitcoin publicity, however this determine contains any fractional ownership-such as shares of Bitcoin-related shares or ETFs by way of funding funds and pension plans. Actual, substantial adoption stays area of interest. “If Bitcoin is the very best lengthy -term saving know-how, we might anticipate everybody with substantial financial savings to have a substantial quantity of bitcoin. But as we speak, hardly anybody does that. “

Burnett emphasizes that the highway to $ 10 million doesn’t require that Bitcoin will substitute all the cash worldwide – simply to ‘soak up a helpful proportion of worldwide wealth’. The technique for future-oriented traders, he argues, is straightforward however non-trivial: ignore short-term noise, give attention to the multi-year horizon and acts earlier than the worldwide consciousness of Bitcoin’s properties turns into common. “Those that have the ability to see the bigger complete past the quick -term volatility and focus will acknowledge Bitcoin as essentially the most asymmetrical and overlooking bets on world markets.”

In different phrases, it’s about “on the entrance of capital migration”, whereas the Bitcoin consumer base continues to be comparatively tiny and the overwhelming majority of conventional wealth stays in outdated property.

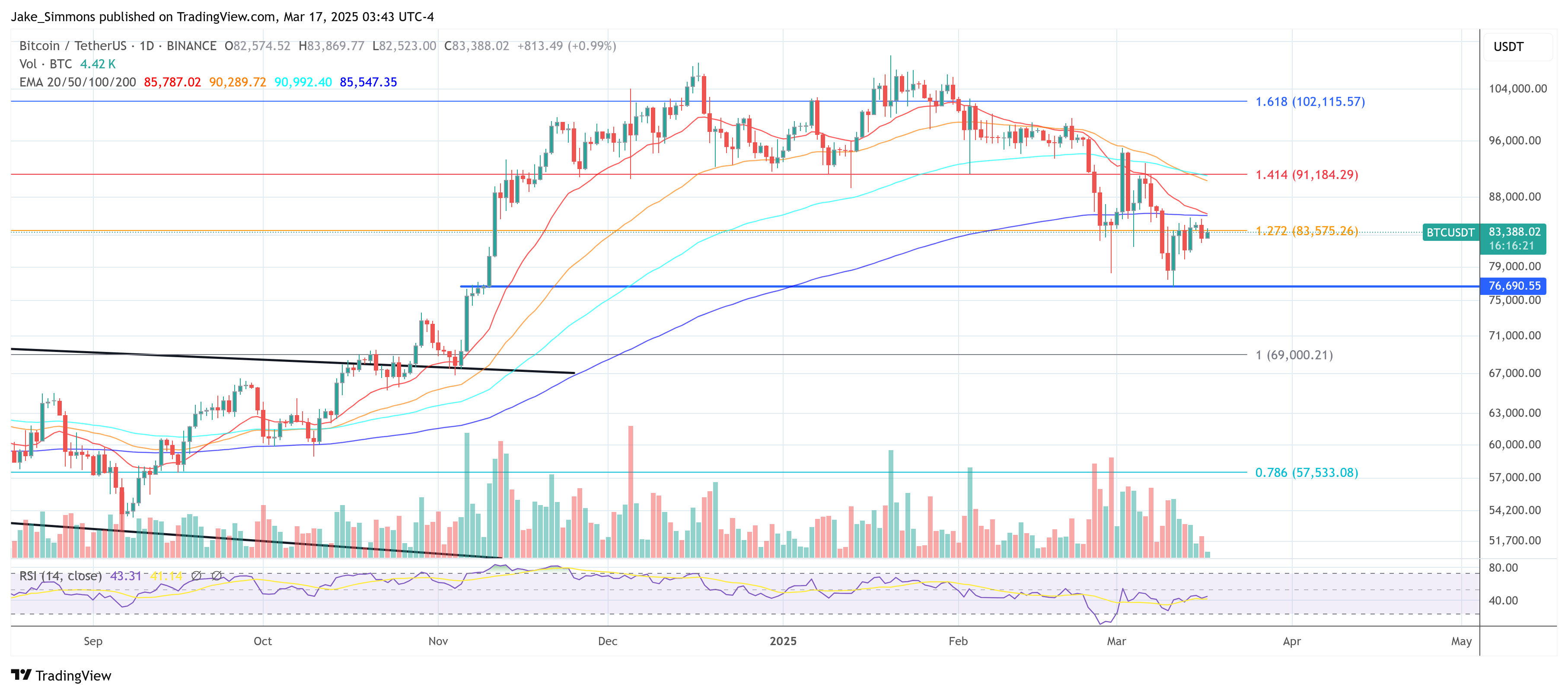

On the time of the press, BTC traded at $ 83,388.

Featured picture made with dall.e, graph of tradingview.com

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now