Bitcoin

Bitcoin vs. altcoins: The holiday season winner might surprise you

Credit : ambcrypto.com

- Bitcoin versus altcoins – a battle ensues in quantity and worth.

- Whereas Bitcoin exhibits dominance in these areas, the altcoin index exhibits volatility.

As the vacation season progresses, the cryptocurrency market is buzzing with exercise, exhibiting a battle for dominance between Bitcoin. [BTC] and altcoins.

Traditionally, this era has been characterised by distinctive market dynamics, with Bitcoin typically seen as a steady alternative, whereas altcoins are geared toward risk-tolerant merchants in search of excessive returns.

Evaluation reveals the advanced interaction between these two segments and supplies insights into which segments might emerge because the winners of the vacation season.

Bitcoin: a steady performer amid the market fluctuations

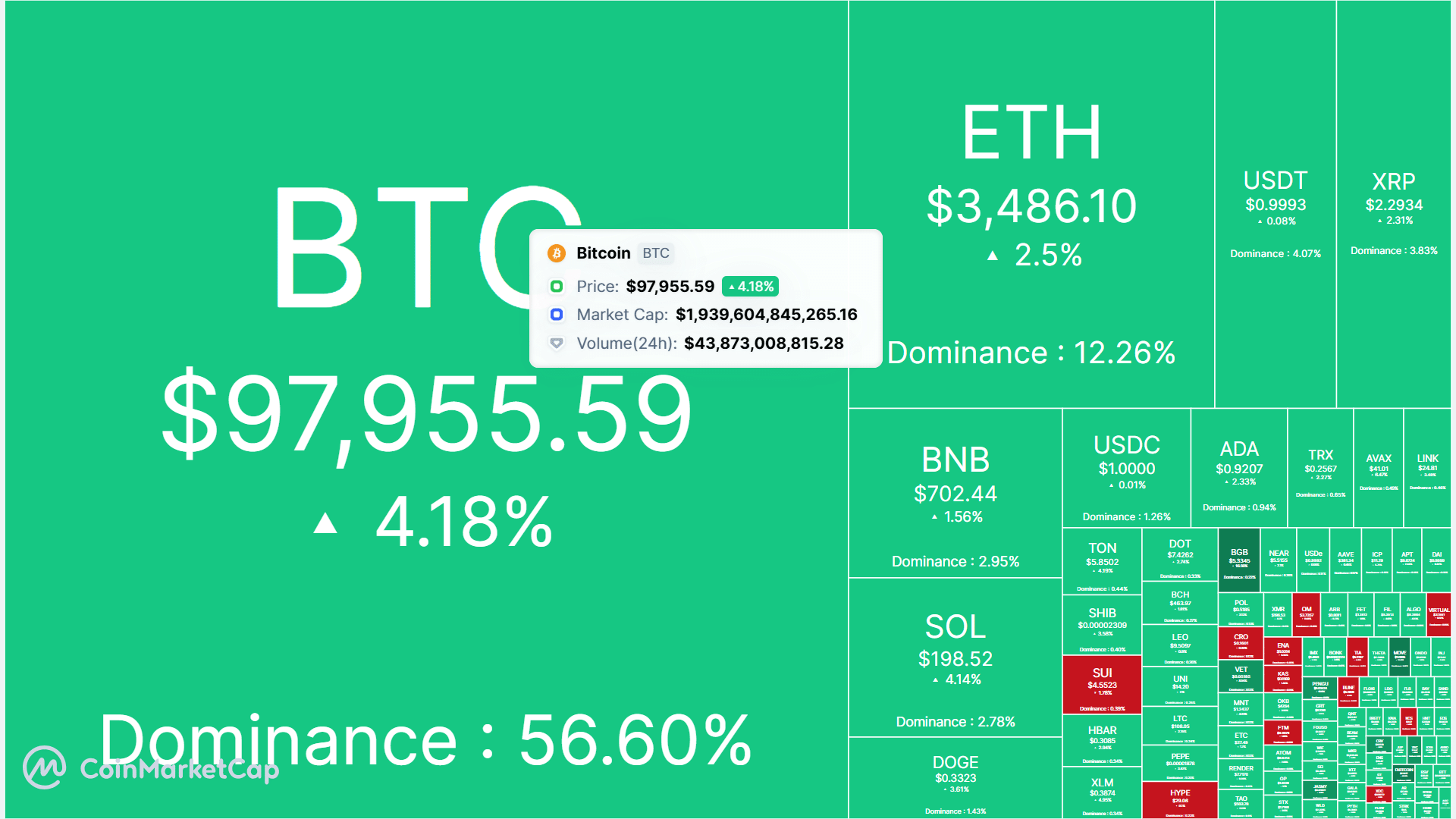

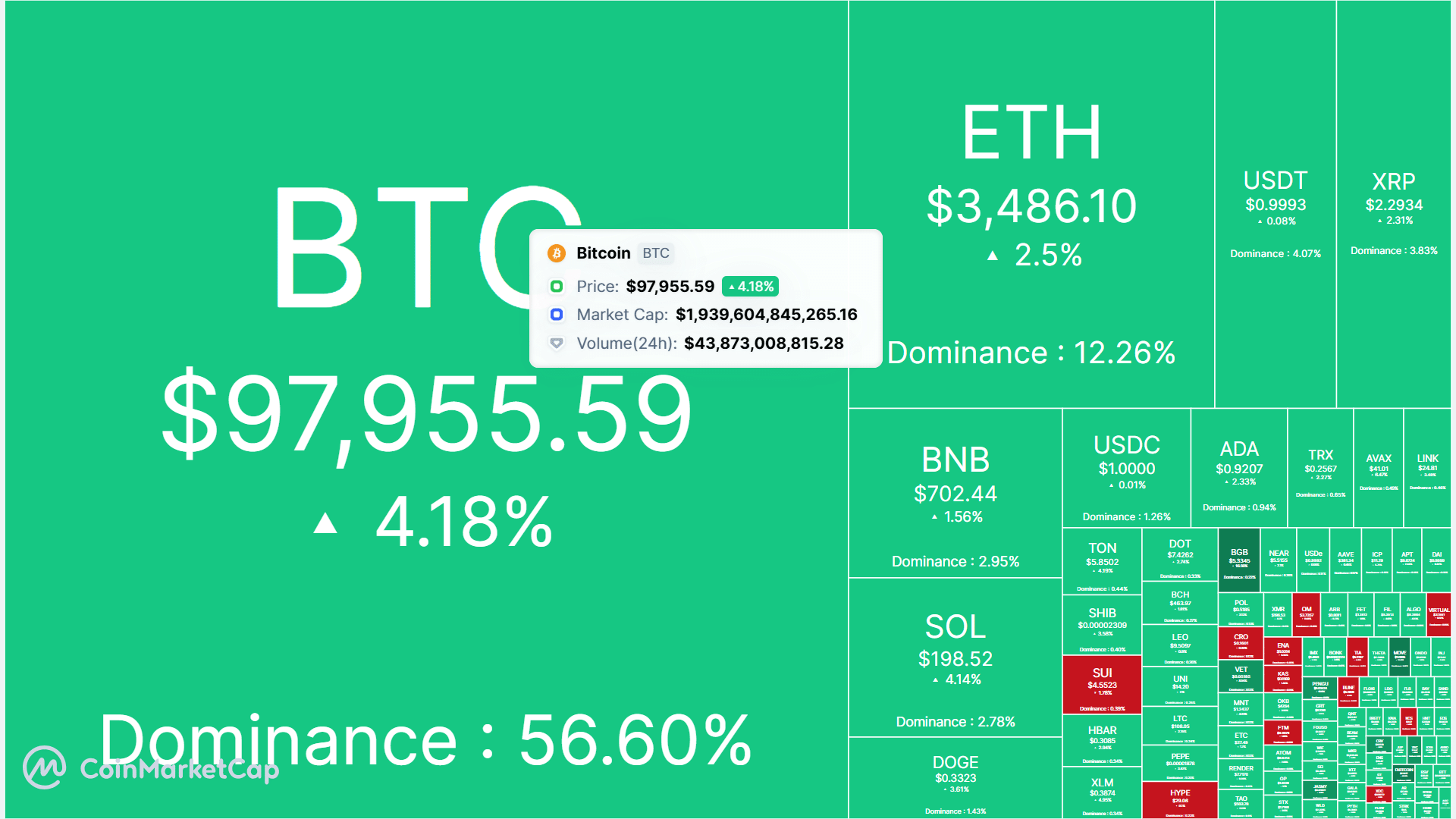

Bitcoin has proven resilience throughout this vacation season, holding its worth at $97,955 with a day by day achieve of 4.18%.

The market dominance chart exhibits Bitcoin’s sturdy level at 56.60%, indicating a transparent choice amongst buyers for the main cryptocurrency.

This dominance underlines Bitcoin’s means to face up to market turbulence whereas delivering steady returns.

Supply: CoinMarketCap

The market heatmap additional highlighted Bitcoin’s constant efficiency, with buying and selling quantity exceeding $43.87 billion up to now 24 hours.

Such strong exercise mirrored continued institutional curiosity and retail confidence in Bitcoin’s position as a “secure haven” in risky occasions.

Regardless of competitors from altcoins, Bitcoin’s regular upward pattern has strengthened its place as a dependable asset, particularly for long-term holders in search of decrease danger throughout a seasonally risky interval.

Altcoin seasonal index: a shift in momentum

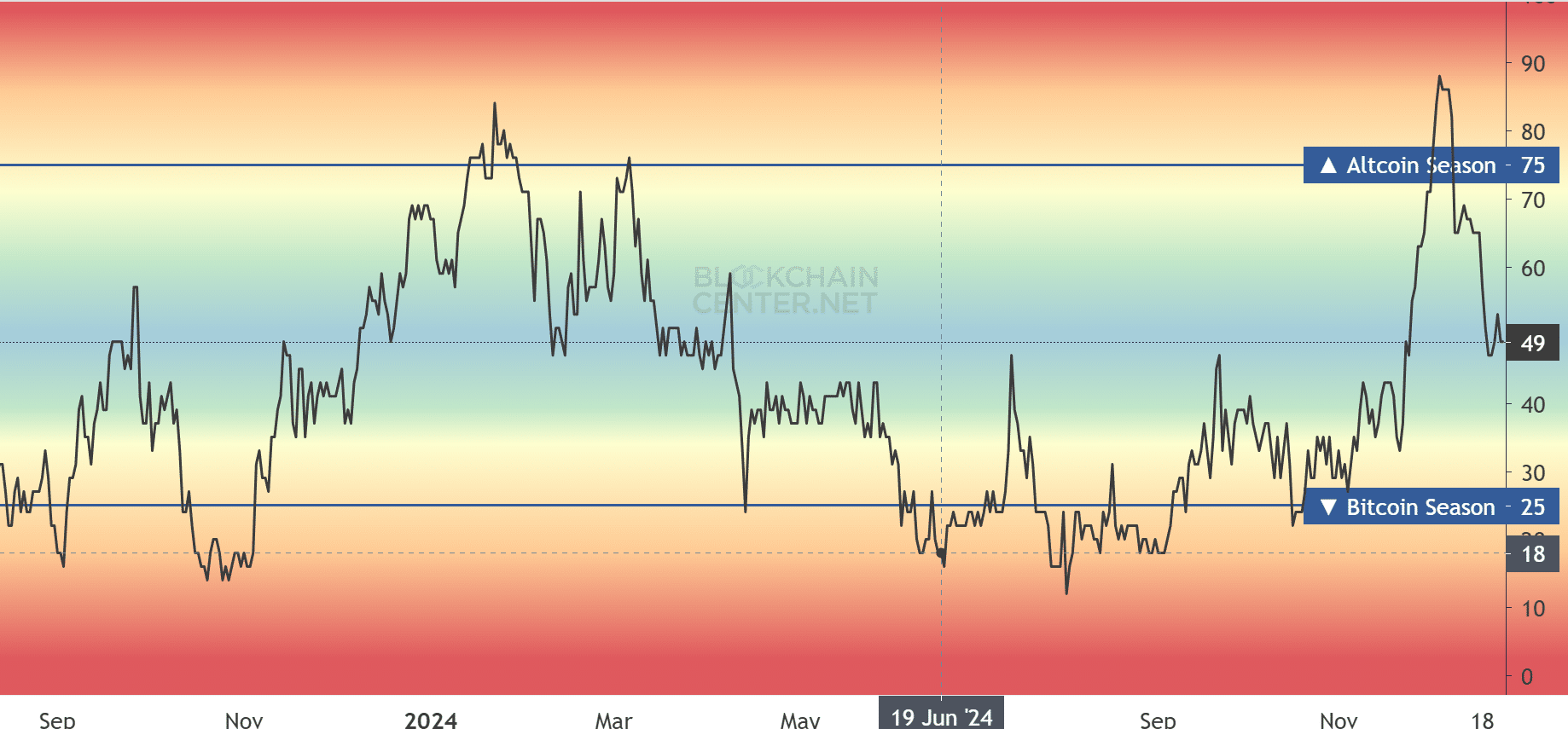

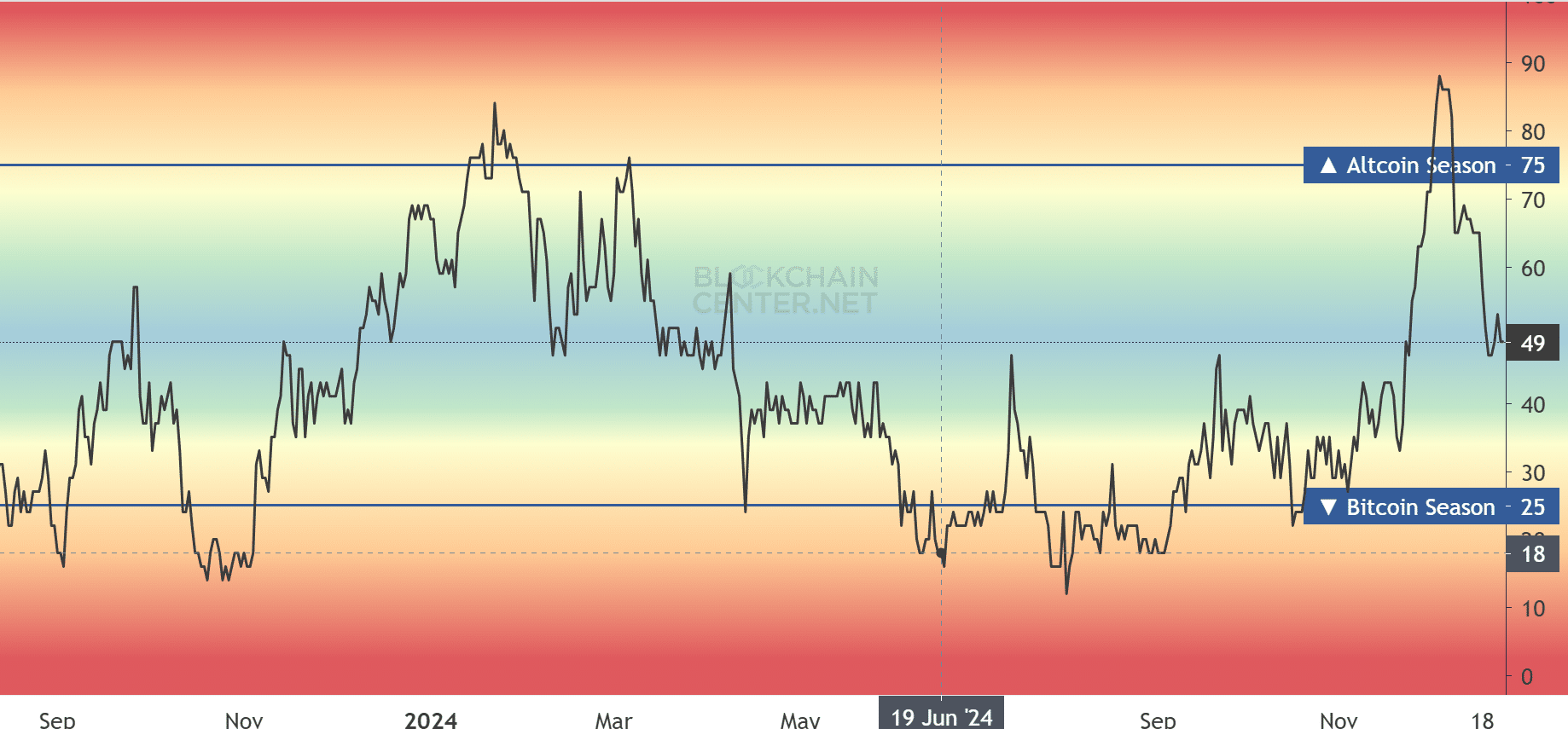

The Altcoin Season Index offered a complete overview of broader market dynamics. The index stood at 49 on the time of writing, indicating a impartial stance between Bitcoin and altcoins.

This follows a pointy decline from the earlier excessive of 75, which marked a dominant altcoin rally. This decline alerts a shift in market sentiment, with Bitcoin returning to favor.

Supply: Blockchaincenter

Blended efficiency inside the altcoin sector accompanies the index’s decline.

Notable property corresponding to Ethereum [ETH] (+2.5%) and Solana [SOL] (up 4.14%) have made beneficial properties, however the broader altcoin market stays fragmented.

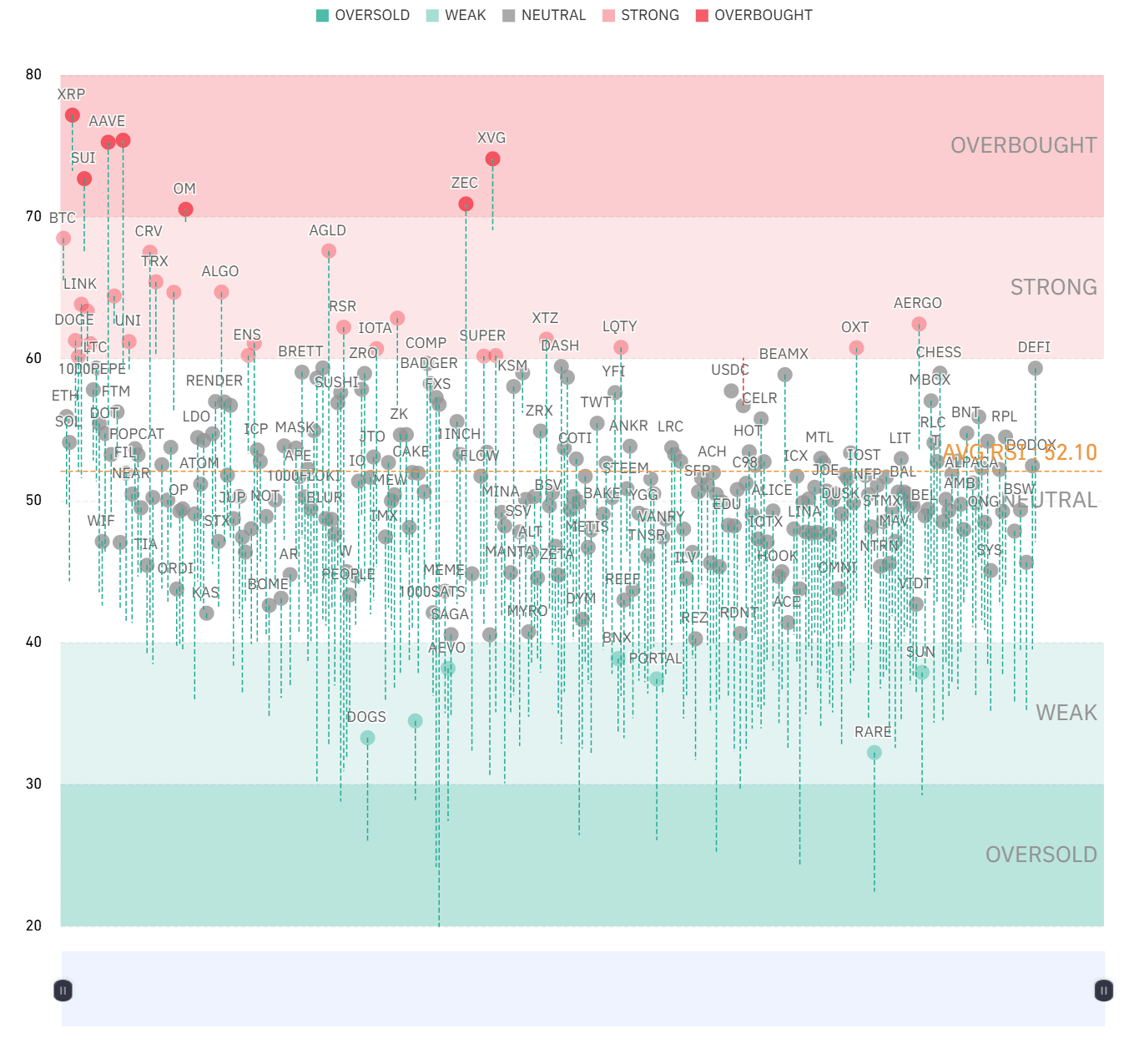

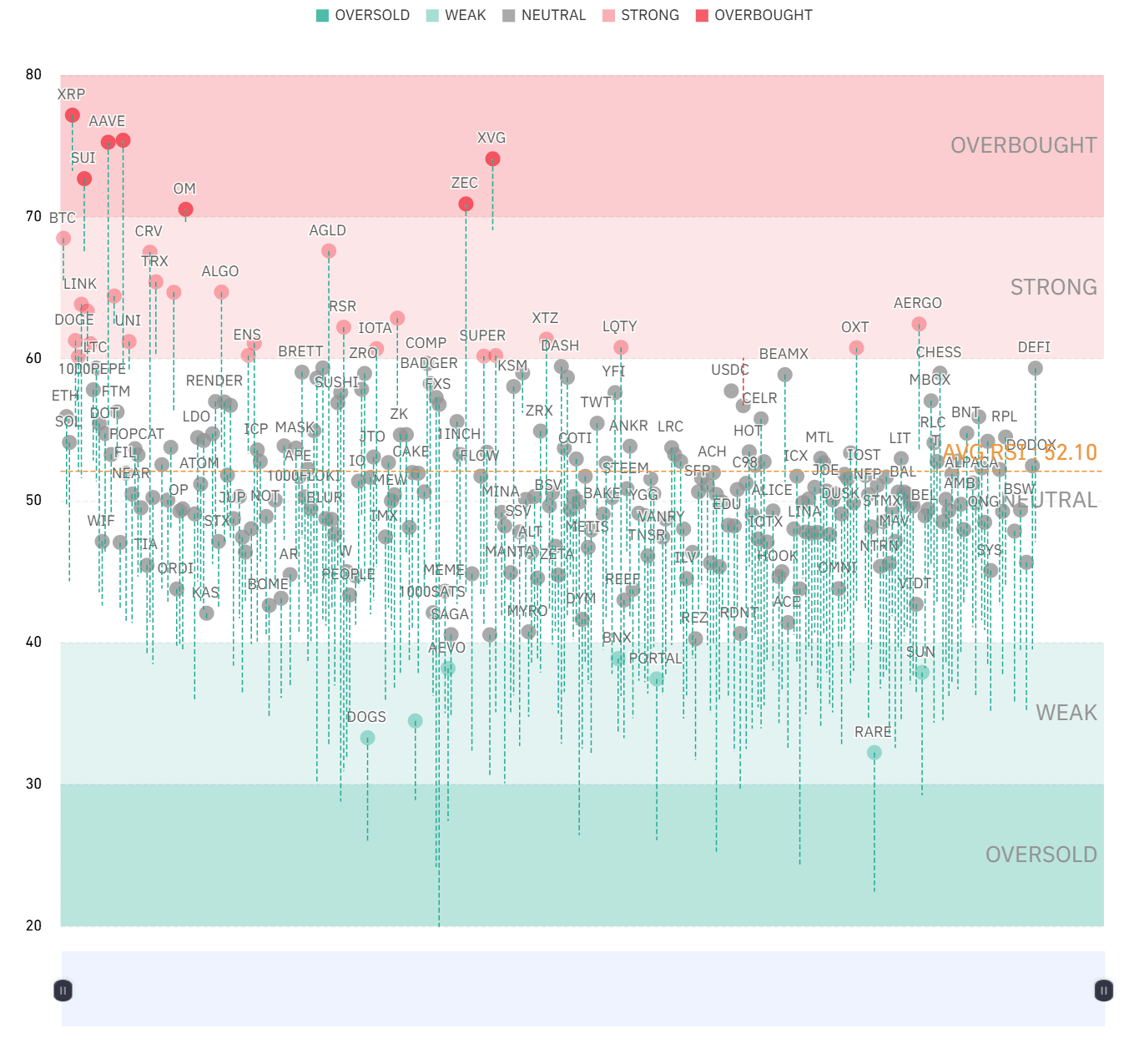

The oversold/overbought chart supplies extra perception and exhibits a distinction in efficiency.

XRP and Ave [AAVE] are in overbought territory, implying potential corrections, whereas oversold property spotlight shopping for alternatives for speculative merchants.

Overbought versus oversold: a narrative of divergence

AMBCrypto’s evaluation of the oversold/overbought chart revealed the stark distinction between Bitcoin and altcoins.

Whereas Bitcoin remained inside a impartial zone, indicating balanced sentiment, many altcoins had been unfold throughout overbought and oversold areas.

Property like Zcash [ZEC] and XRP appeared overbought, indicating restricted upside and potential profit-taking.

However, oversold altcoins offered alternatives for buyers in search of undervalued property to revenue from through the vacation season.

Supply: Coinglass

This distinction highlights the speculative nature of altcoins, which regularly have larger volatility in comparison with Bitcoin.

Whereas this supplies alternatives for short-term beneficial properties, it additionally will increase the dangers of investing in altcoins throughout unsure market situations.

Bitcoin vs Altcoin: Stability vs Volatility

The market heatmap underlined Bitcoin’s dominance by way of buying and selling exercise and market capitalization, reflecting its position as a stabilizing drive.

Whereas altcoins delivered increased proportion beneficial properties in some circumstances, they remained prone to sharp worth swings as a consequence of decrease liquidity and speculative curiosity.

Bitcoin’s constant buying and selling quantity and dominance indicated a extra steady sentiment than the fragmented and speculative nature of altcoins.

The impartial stance on the Altcoin Season Index means that whereas altcoins have seen particular person success, the broader market remains to be leaning towards Bitcoin because the asset of alternative.

The winner of the vacation season

Based mostly on the evaluation, Bitcoin seems to have an edge through the vacation season.

Its stability, rising dominance and robust buying and selling volumes make it the favourite asset of long-term buyers and risk-averse merchants.

Nonetheless, the altcoin market provides alternatives for these prepared to navigate the volatility, with property in oversold territory providing potential entry factors.

The last word winner is determined by the investor’s targets. For many who prioritize stability and sustainable progress, Bitcoin stays the champion.

Selective altcoins can ship surprises for these in search of increased dangers and probably increased rewards. As the vacation season progresses, protecting a detailed eye on these metrics will illuminate the evolving dynamics of Bitcoin versus altcoins.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024