Altcoin

Bitcoin Whale Adds $267 Million to BTC, Ideal Buying Opportunity?

Credit : ambcrypto.com

- CryptoQuant CEO Ki Younger Ju additionally famous that whales are accumulating Bitcoin and that we’re in the course of the bull cycle.

- BTC’s Lengthy/Quick ratio presently stands at 1.1048 (a worth of the ratio above 1 signifies bullish market sentiment amongst merchants).

Regardless of vital volatility within the cryptocurrency market, Bitcoin stays [BTC] whales and establishments appear to be taking benefit of the present sentiment by amassing cash.

In latest days, general market sentiment for cryptocurrency has been difficult, with main cryptocurrencies equivalent to Ethereum, Solana and XRP struggling to achieve momentum.

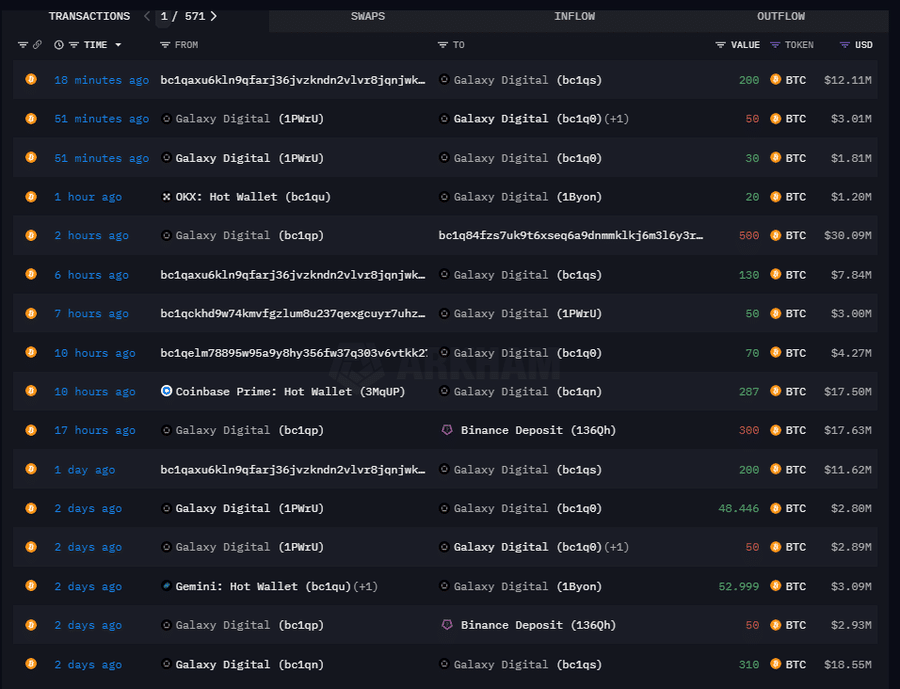

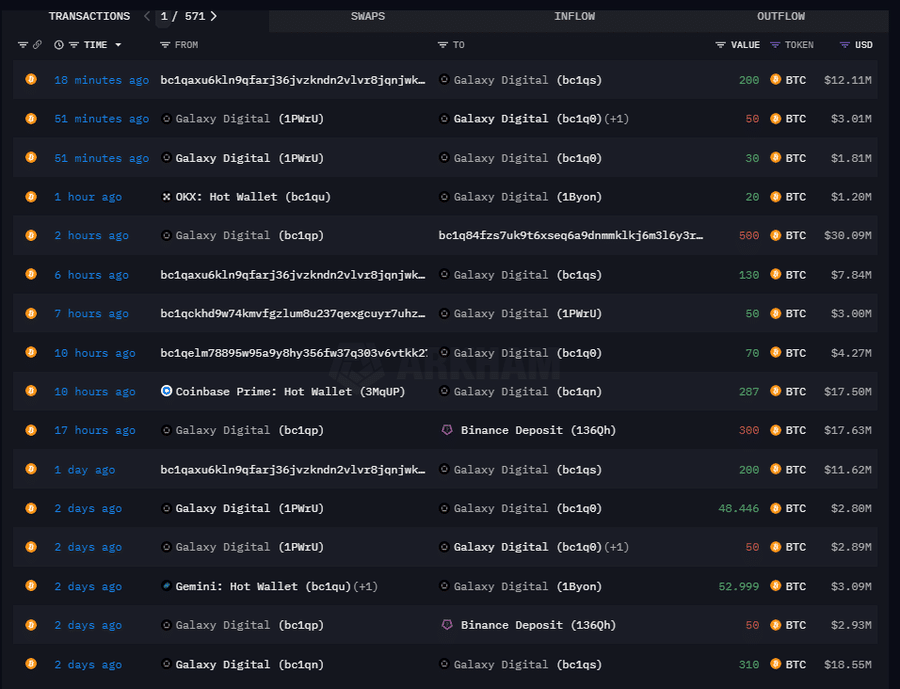

Whales and institutional accumulation

On a series analysis company posted on Gemini.

With this latest accumulation, the corporate now owns an enormous 8,790 BTC, value $532.38 million.

Along with this put up on X, CEO of CryptoQuant Ki Young Ju additionally shared knowledge supporting the identical perspective on Bitcoin whales. In a put up on X, Ki Younger famous that whales are amassing Bitcoin.

He added: “Six days of accumulation warnings in a row, primarily as a result of influx of custody portfolios. Nothing has modified for Bitcoin; we’re in the course of the bull cycle.”

Ideally suited shopping for second?

Bitcoin’s accumulation in these difficult situations is a constructive signal and will point out a super shopping for alternative.

Regardless of the numerous accumulation and bullish outlook from whales, Bitcoin stays secure and consolidates between $58,000 and $60,000.

On the time of writing, BTC is buying and selling close to the $60,550 degree and has skilled a worth enhance of over 3.35% previously 24 hours. Throughout the identical interval, buying and selling quantity elevated by 40%, indicating higher participation amongst merchants.

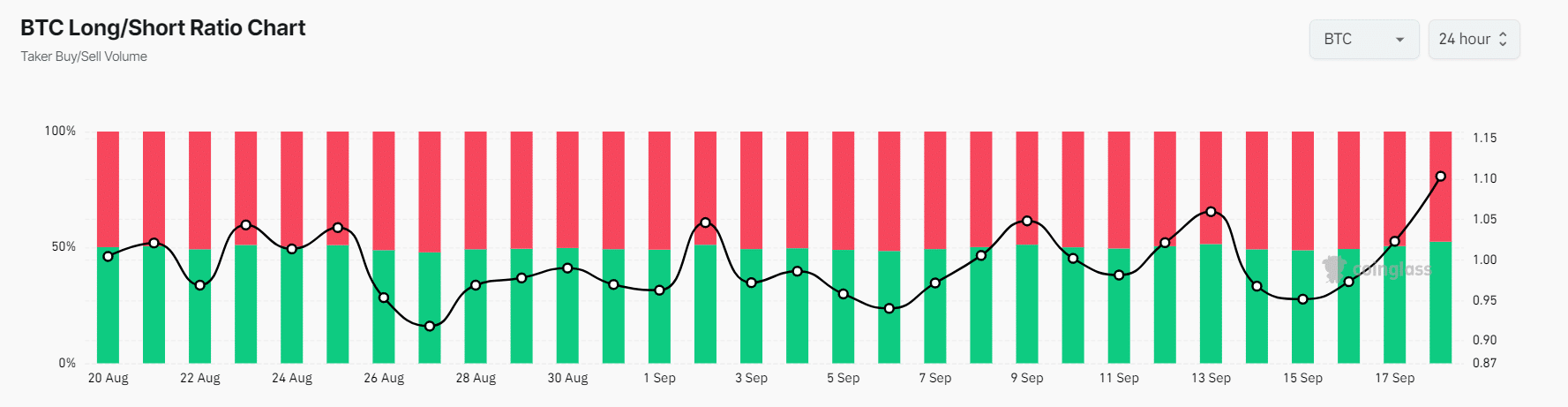

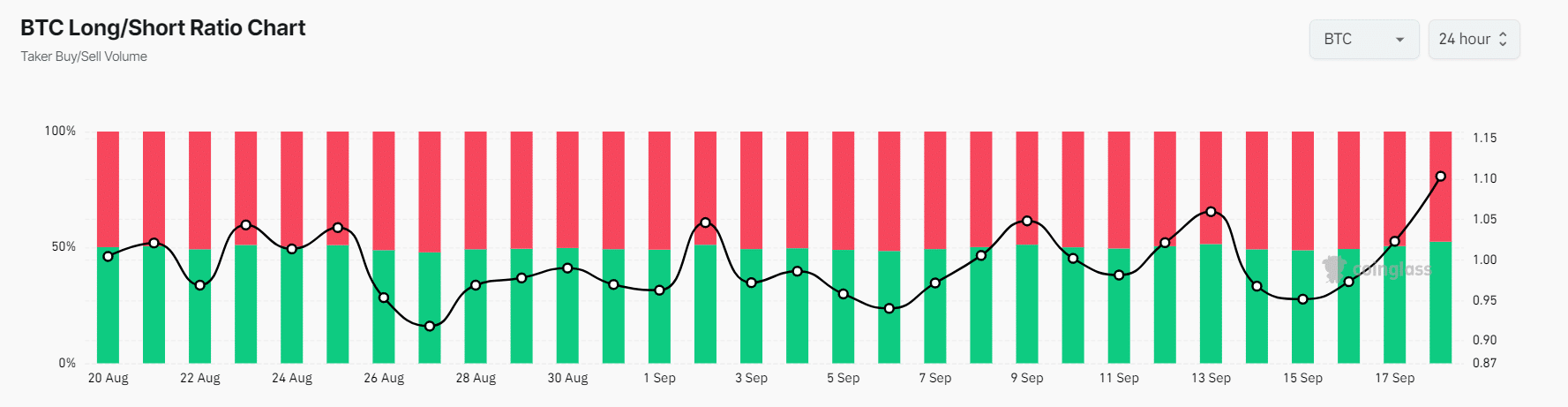

BTC’s bullish on-chain metrics

At the moment, Bitcoin’s on-chain metrics are sending bullish alerts. In keeping with on-chain analytics agency Coinglass, BTC’s Lengthy/Quick ratio presently stands at 1.1048 (a worth above 1 signifies bullish market sentiment amongst merchants), the best since August 2024.

Supply: Coinglass

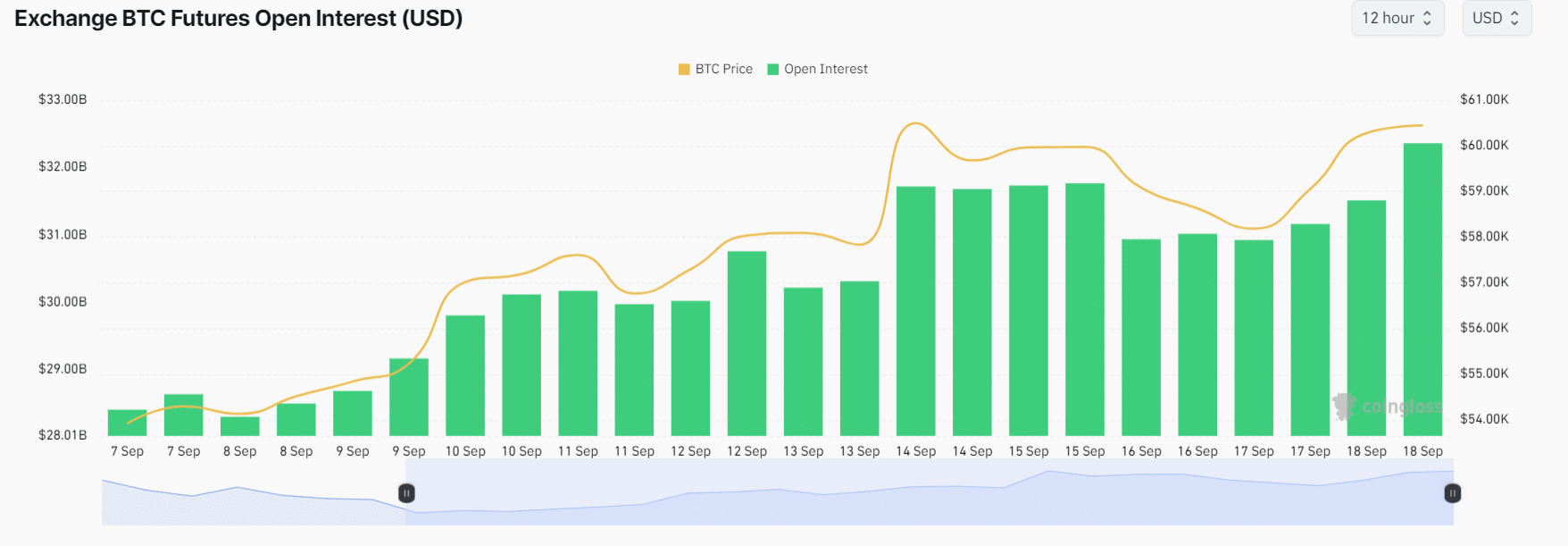

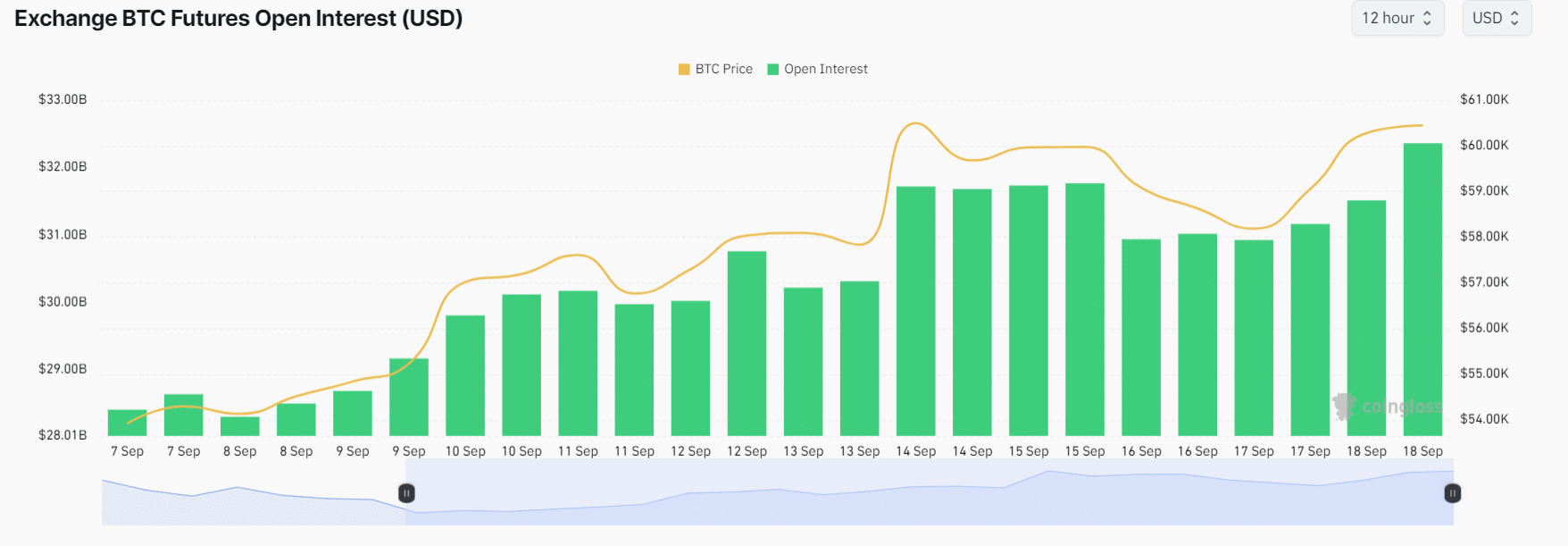

Moreover, BTC future open curiosity has risen 6% over the previous 24 hours and continues to develop, indicating growing curiosity from merchants and traders.

Supply: Coinglass

Learn Bitcoin’s [BTC] Worth forecast 2024-25

At the moment, 52.5% of the highest Bitcoin merchants have lengthy positions, whereas 47.5% have quick positions, indicating that the bulls are again and dominating the asset.

In the meantime, BTC’s OI-weighted funding charge stands at +0.0053% and is within the inexperienced, reflecting bullish sentiment amongst merchants and traders.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024