Bitcoin

Bitcoin whales cash out $800M – What it means for BTC prices

Credit : ambcrypto.com

- Bitcoin whales money in $ 800 million, indicating a attainable shift in market sentiment.

- A very powerful help ranges and falling indicators point out attainable Bitcoin prize correction.

Bitcoin -Walvissen not too long ago invented practically $ 800 million revenue, which marks a considerable shift in market exercise.

On the time of the press, Bitcoin [BTC] was traded at $ 96,153.51, which mirrored a lower of two.07% within the final 24 hours.

This appreciable revenue realization coincides with a noticeable value improve, which results in hypothesis about market sentiment.

The rise in taking revenue by holders in the long run raises vital questions on the potential of a priceback or the beginning of a brand new market part.

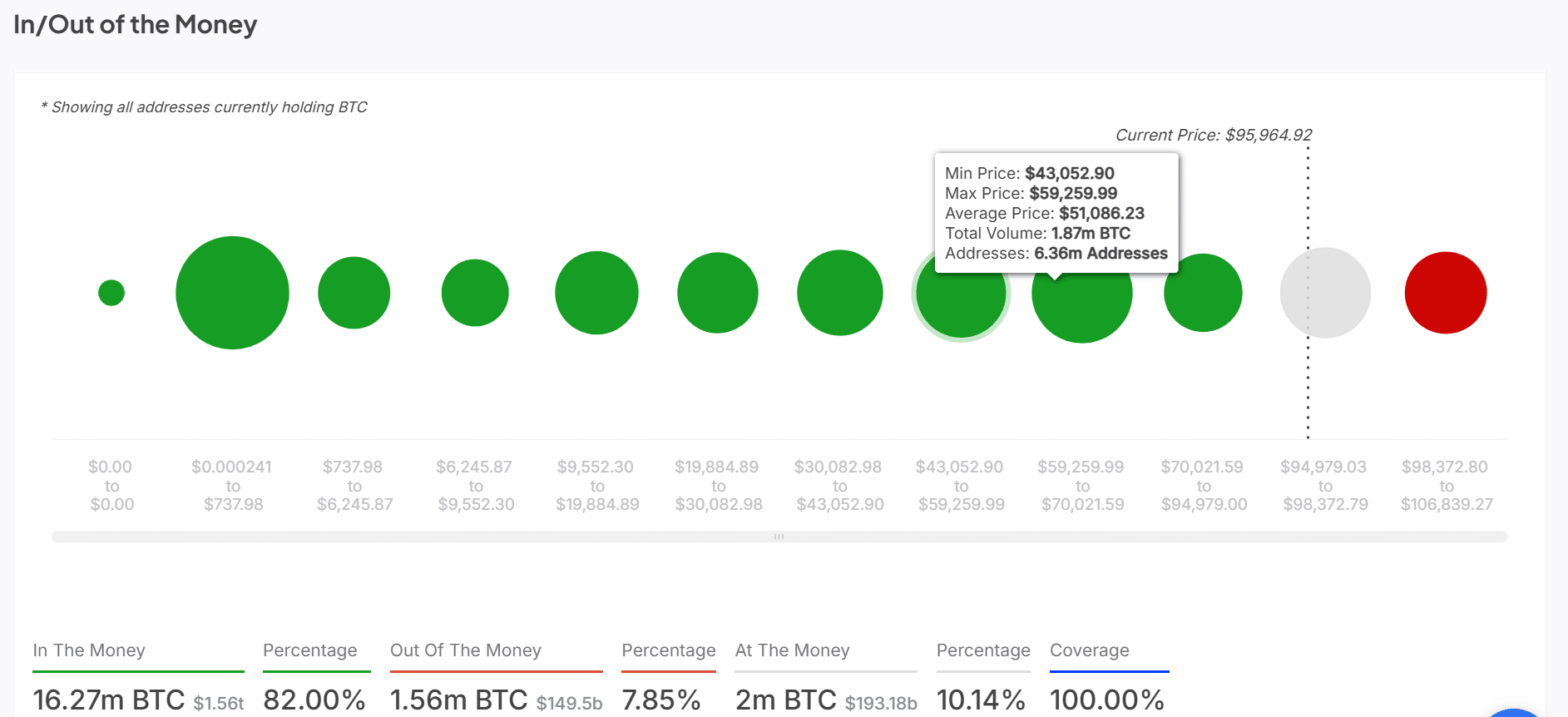

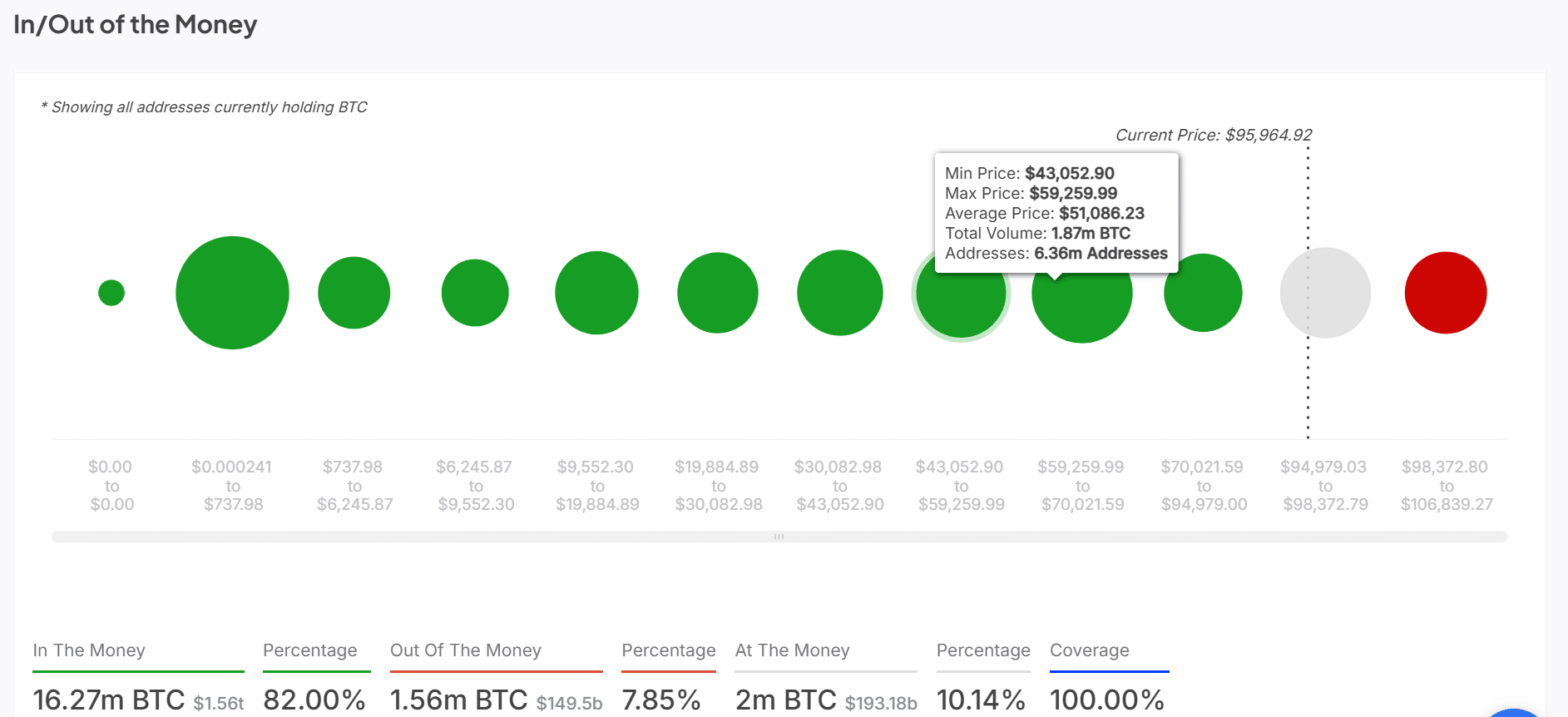

BTC in/out of cash: are most holders of revenue?

Bitcoin’s in/from the cash evaluation exhibits that 82% of Bitcoin addresses are at present worthwhile, with the typical value for these holders at $ 51,086.23. This massive proportion of worthwhile holders signifies widespread optimism in Bitcoin traders.

Nevertheless, there may be nonetheless 7.85% of the addresses from the cash, which signifies that a few of the holders can expertise losses if the value continues to fall.

As extra addresses turn out to be worthwhile, the prospect of elevated gross sales strain grows, which makes it attainable to affect the overall value pattern.

Supply: Intotheblock

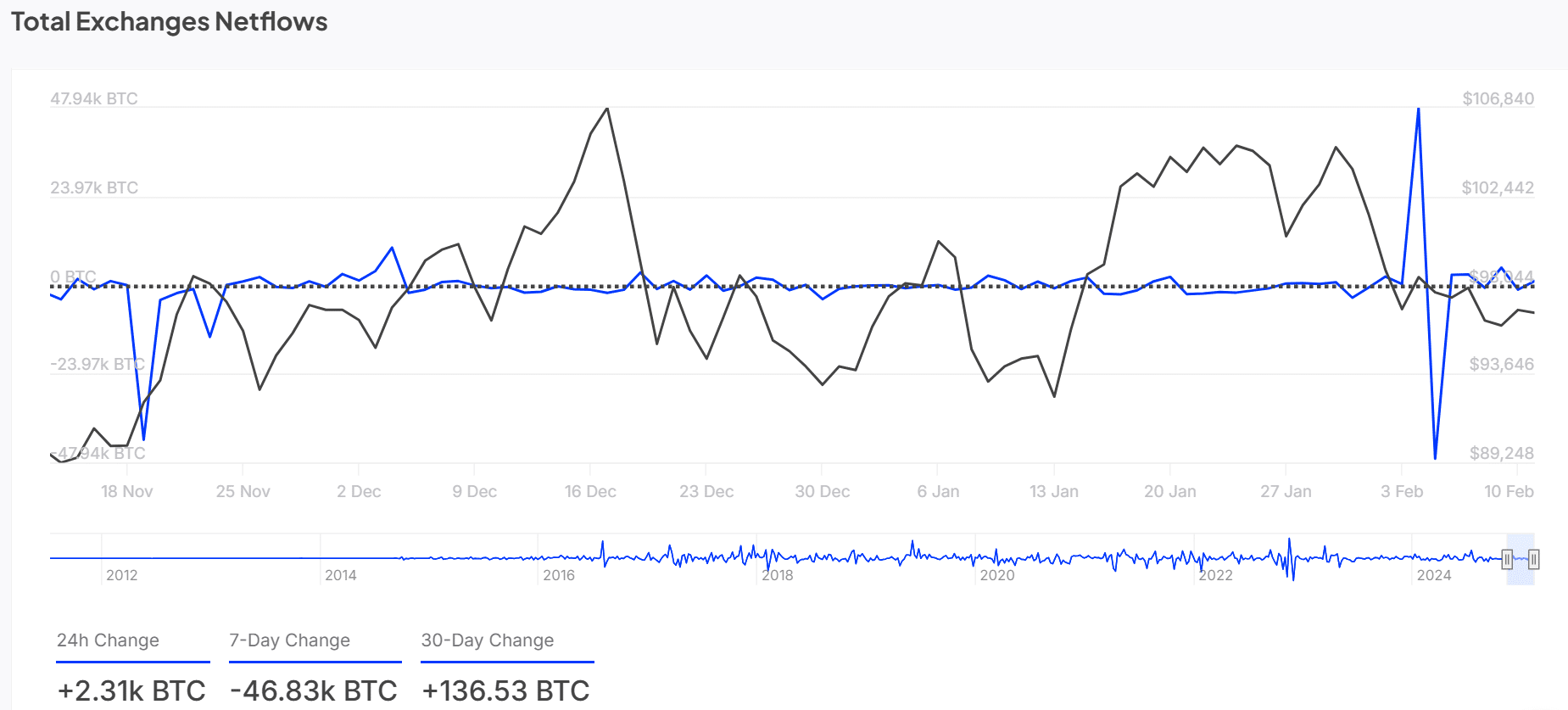

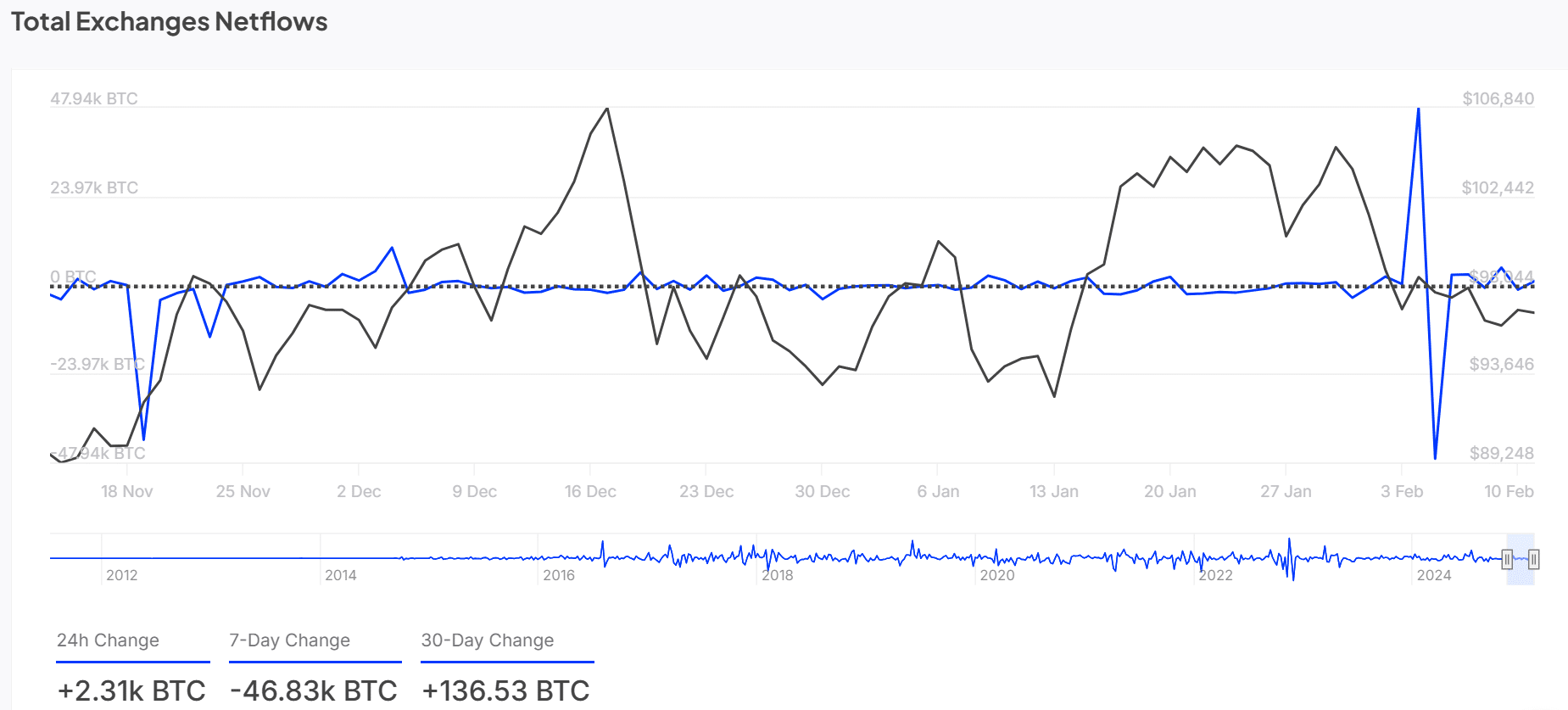

Complete change Netflows: do merchants put together for extra volatility?

Bitcoin has skilled a 24-hour Netflow-gain of +2.31K BTC, indicating that extra Bitcoin is introducing exchanges, presumably pending gross sales actions.

Previously thirty days, Netflows have risen with +136.53k BTC, which signifies appreciable liquidity in the marketplace. This influx can counsel that merchants are making ready for attainable volatility.

Nevertheless, it will possibly additionally point out a bullish prospect if costs break via a very powerful resistance ranges.

Supply: Intotheblock

Testing vital help and resistance ranges

The Bitcoin graph reveals that BTC consolidates inside a key value. Help is discovered at $ 92,450.82, whereas resistance ranges are seen at $ 101,441.81 and $ 109.260.07. These value zones are essential for figuring out the following step of Bitcoin.

If Bitcoin can break these resistance ranges, this may proceed its Bullish Momentum.

Nevertheless, failure to exceed these key ranges can result in a consolidation part or a possible value correction.

Supply: TradingView

Inventory-to-flow ratio and NVT Golden Cross: Bearish indicators?

Bitcoin’s stock-flow ratio was 1,2686 m, which displays a 20% lower within the final 24 hours, in accordance with Cryptoquant. This decline suggests a discount within the shortage of BTC, which might affect the lengthy -term worth.

Equally, the Golden Cross has taken by 29.22% for Golden Cross, which can point out a market prime or an approaching correction.

These components point out that Bitcoin might be below strain within the quick time period, as a result of the reducing shortage and the reducing transaction quantity counsel a delay in demand.

Supply: Cryptuquant

Conclusion: what’s the subsequent step for BTC?

Bitcoin’s market exercise exhibits combined indicators, whereby whales money in. In/out of the cash figures point out potential gross sales strain. Essential technical indicators point out each bullish and bearish prospects.

The evaluation means that Bitcoin might be confronted with challenges when breaking the resistance ranges, whereas diminished shortage and reducing NVT figures are involved in regards to the sustainability of the value.

That’s the reason a pullback within the value of Bitcoin in all probability appears shortly as quickly because the market dynamic shift.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024