Bitcoin

Bitcoin – What do Global M2 patterns say about BTC’s next bull cycle?

Credit : ambcrypto.com

- The worldwide m2 cash provide has turned optimistic.

- Historic patterns point out that BTC might now soar on the charts

Bitcoin [BTC]The world’s main cryptocurrency, continues to trigger uncertainty amongst merchants, whales and establishments. Particularly because the market is ready for higher circumstances within the final quarter of the 12 months.

Traditionally, Bitcoin has soared when the worldwide M2 cash provide has elevated. With the worldwide M2 turning optimistic, merchants are anticipating a possible bull run. The same one to that of late October 2023 and early January 2024, after which BTC reached new all-time highs.

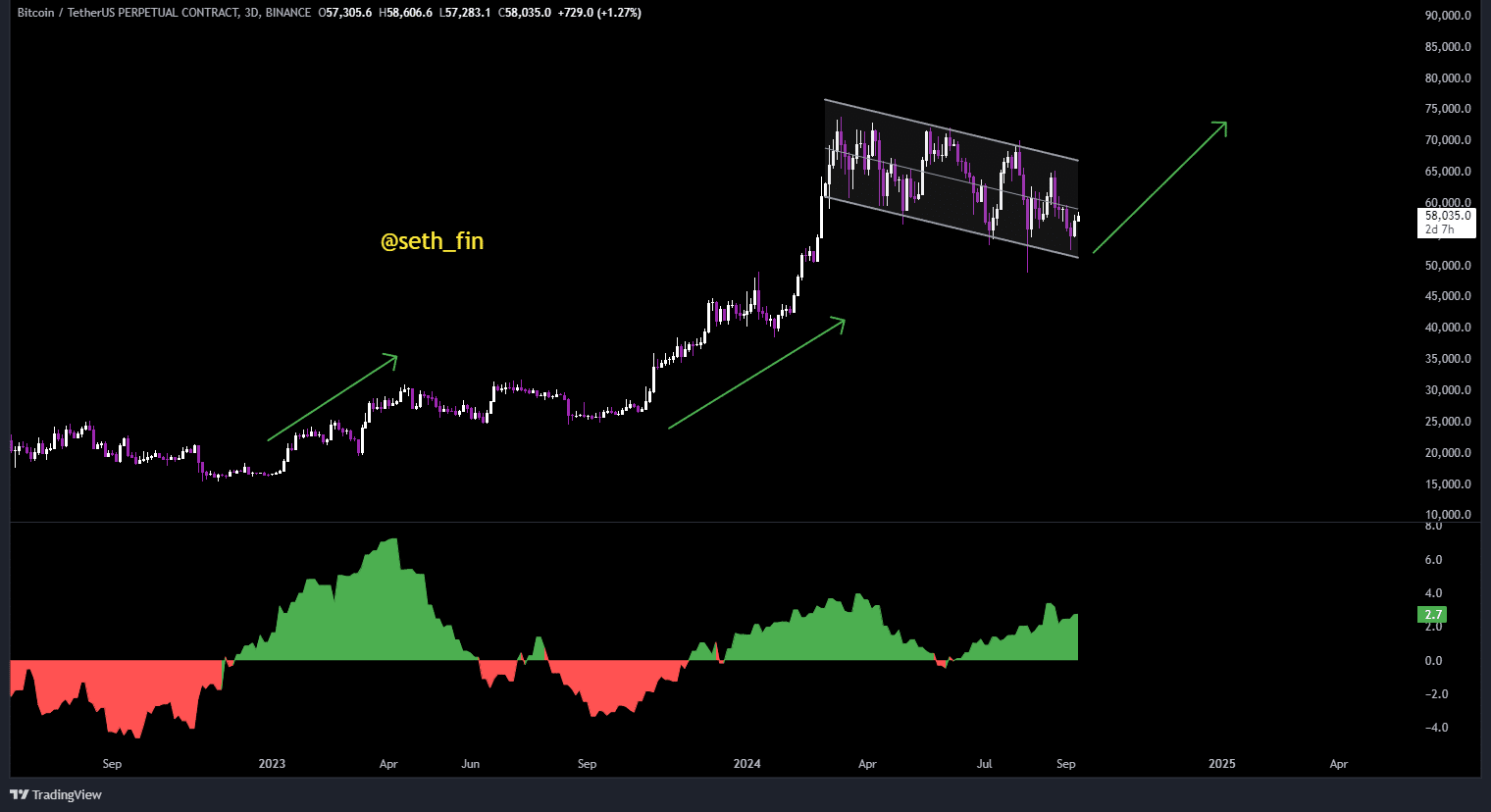

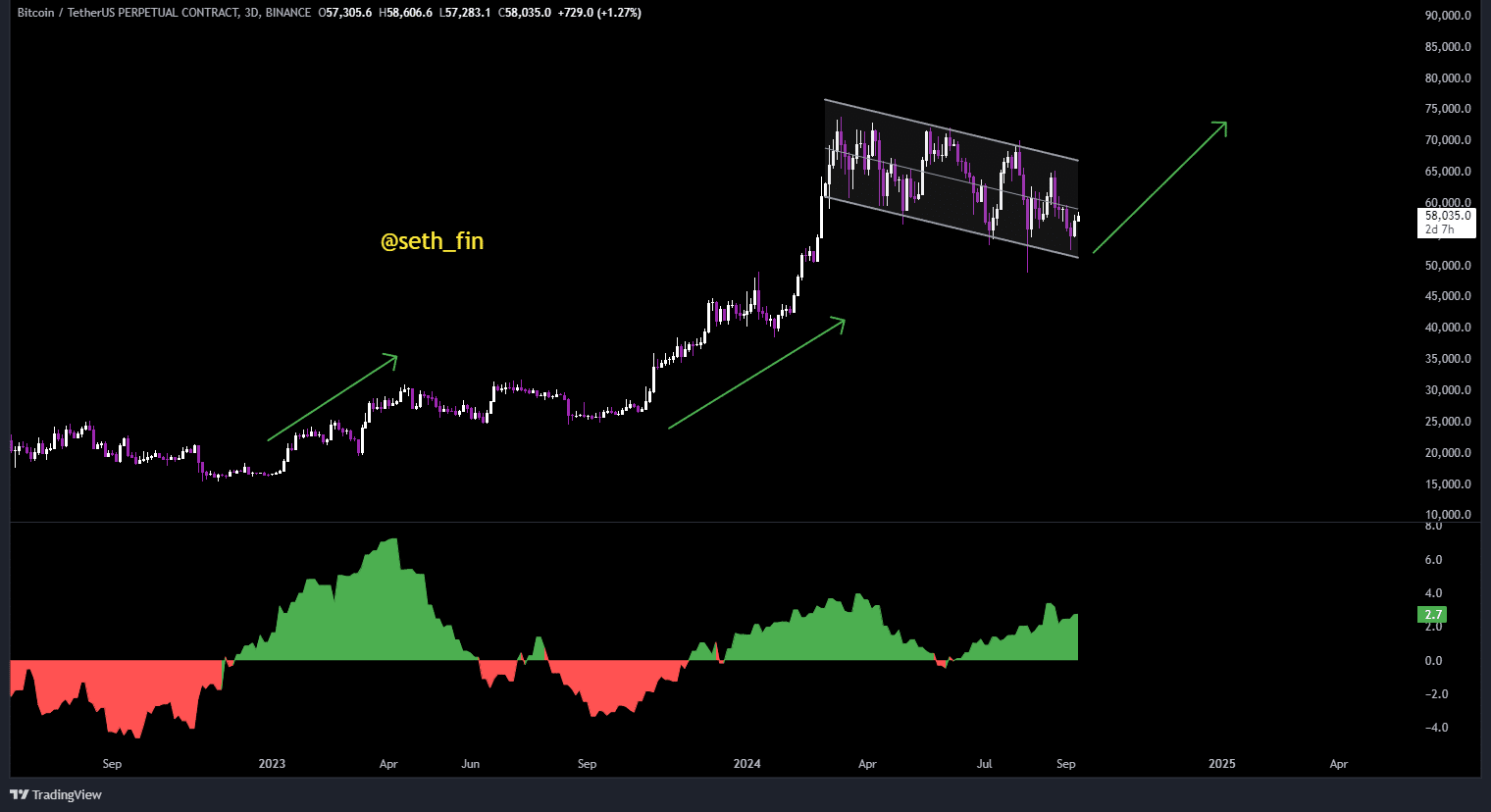

On the time of writing, BTC/USDT gave the impression to be correcting right into a bullish flag sample. One other BTC surge might be within the offing, with the Federal Reserve’s anticipated charge reduce being key.

Supply: Seth Fin/X

A reduce of 25 foundation factors appears probably. Nevertheless, within the monetary markets, giant actions should first relax earlier than they change into seen.

Bitcoin is buying and selling again on the mid-range

On the time of writing, BTC was buying and selling in the midst of its worth vary inside a downtrend channel.

A breakout to the upside might result in a push to the highest of the channel and a doable breakout. The decrease restrict was at $51,000, whereas the higher resistance was $66,000.

Though BTC appeared to consolidate, its energy stays evident. Primarily as a result of bears have failed to interrupt the decrease development line.

Supply: TradingView

If Bitcoin breaks the higher trendline and stays above it, the worth of BTC might see a major rally, probably taking it to new highs. This may be supported by the worldwide M2 vs Bitcoin worth chart.

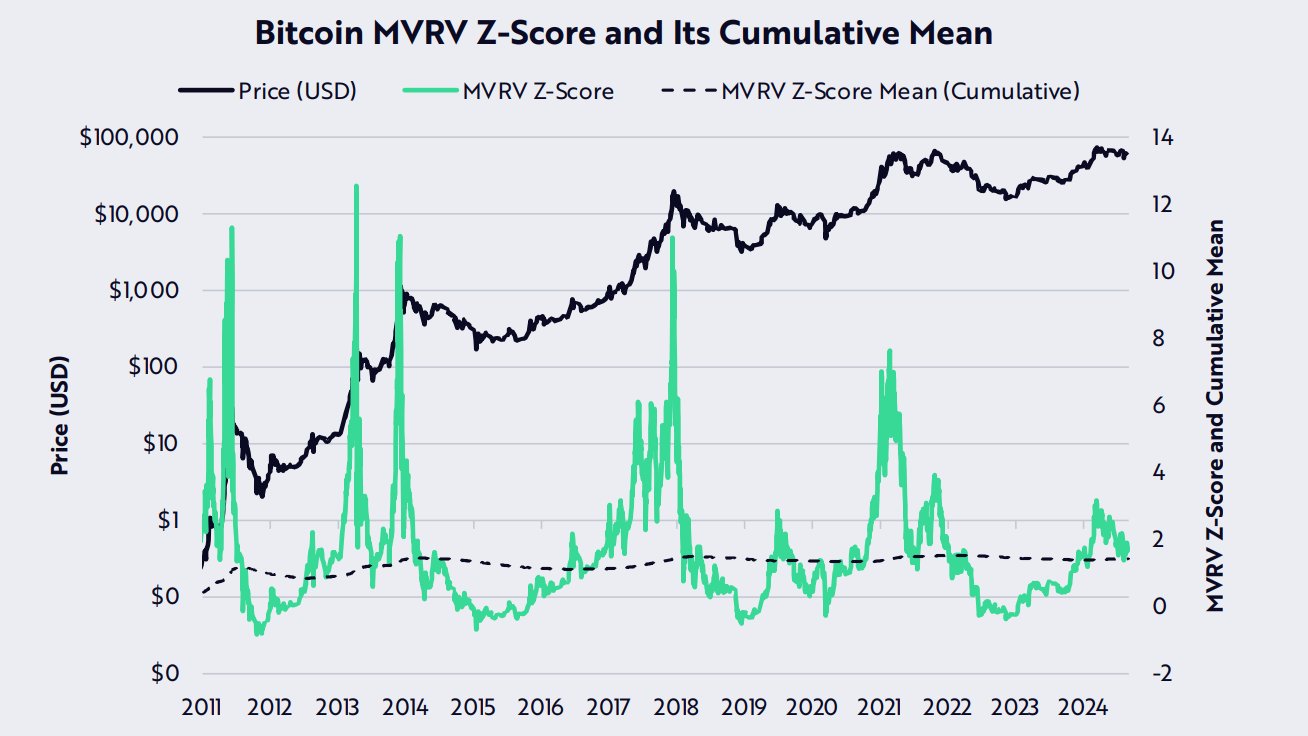

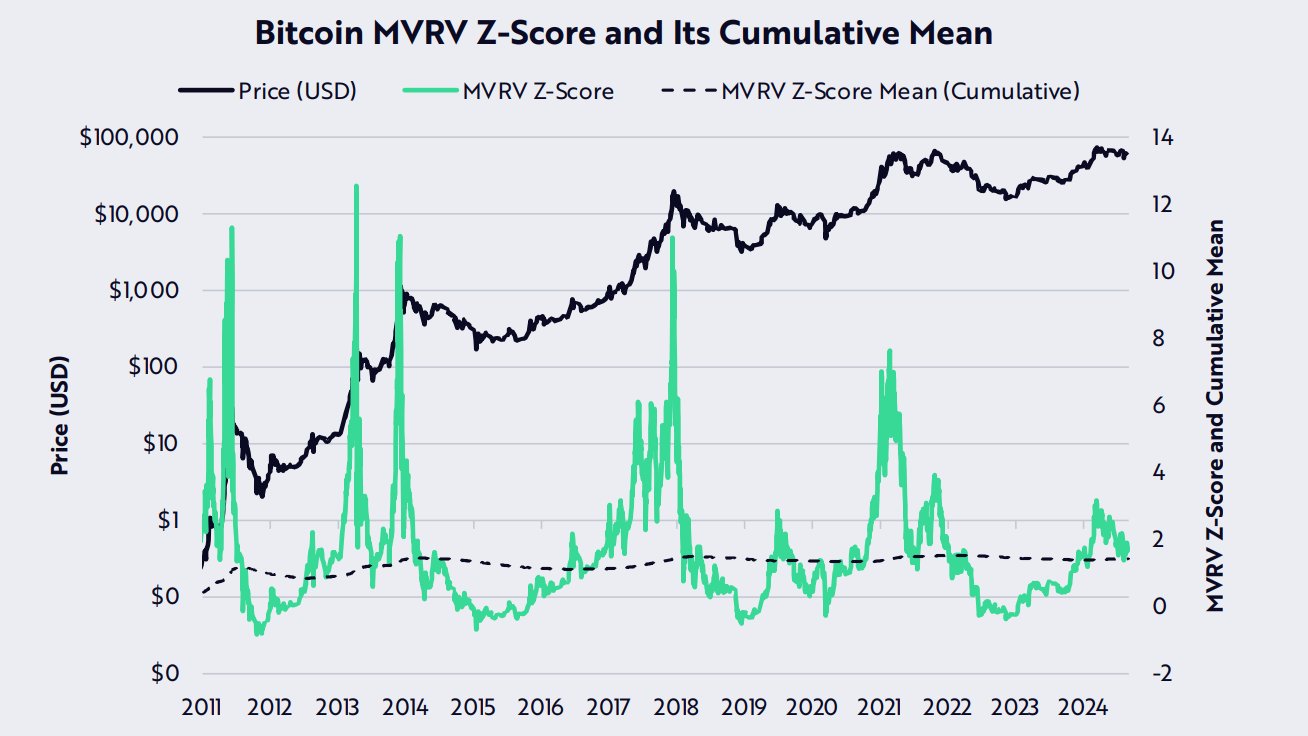

The MVRV z-score emphasizes low unrealized positive aspects

The MVRV z-score, a key indicator of market sentiment, stood at round 1.9 on the time of writing. This instructed that BTC has regularly declined whereas the community’s common value base has elevated.

By extension, which means that there are low unrealized positive aspects available in the market, leaving extra room for upward motion.

Traditionally, when the MVRV z-score has been at these ranges, Bitcoin has seen vital upward tendencies. The case research of 2012, 2020 and 2023 are good examples.

Supply:

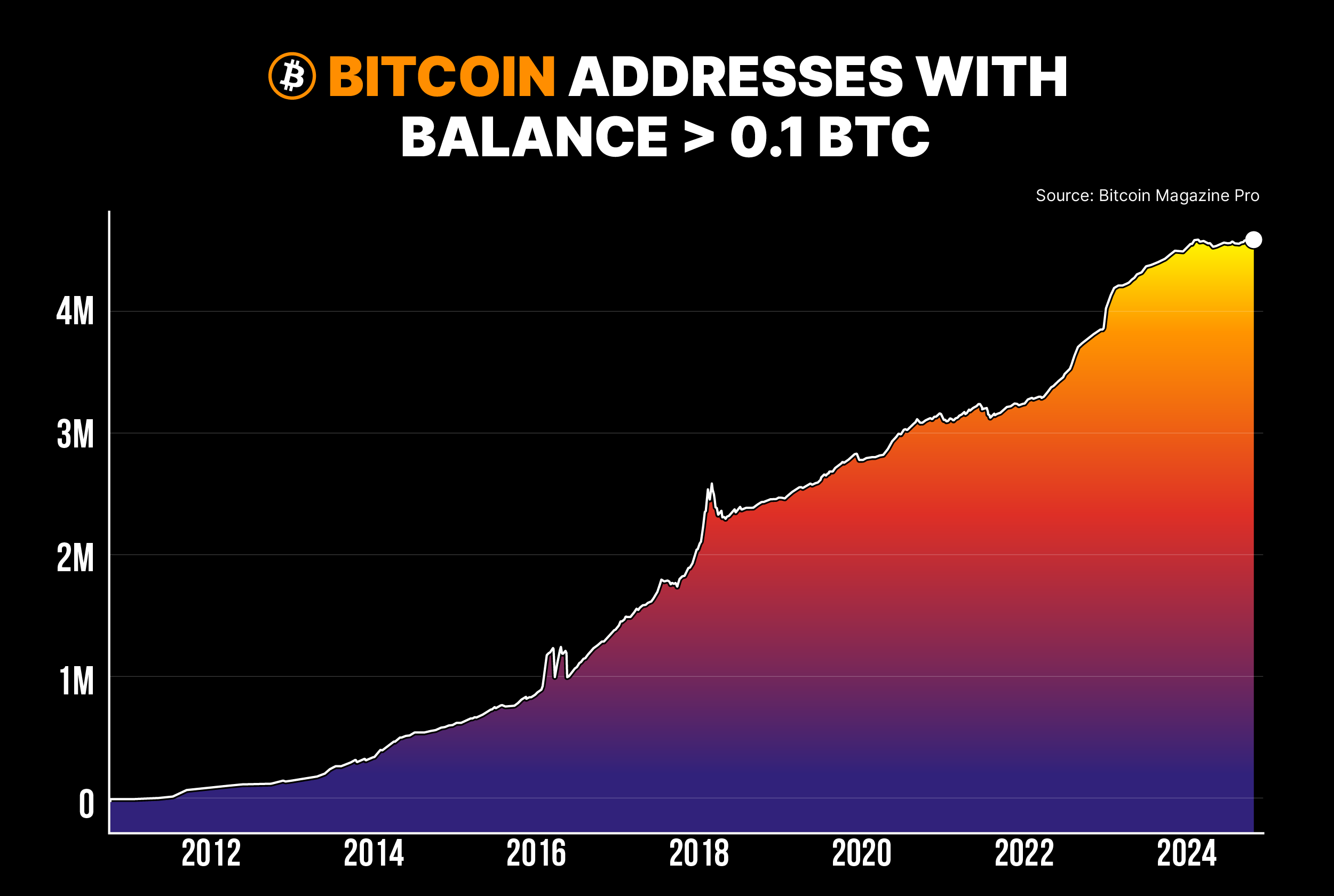

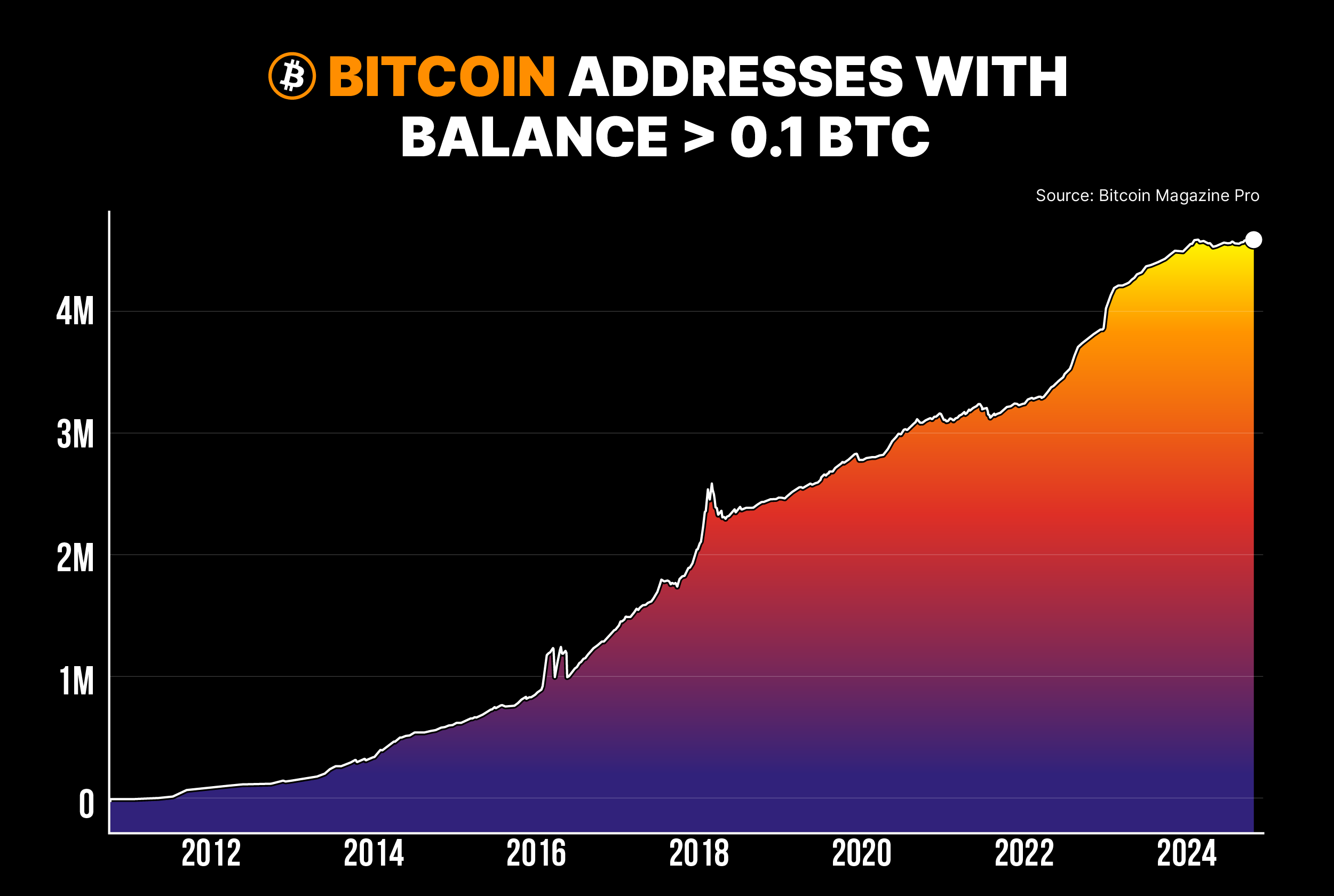

Addresses with greater than 0.1 Bitcoin close to ATH

Moreover, the variety of Bitcoin addresses holding a minimum of 0.1 BTC is approaching a brand new all-time excessive.

Because of this long-term holders, sometimes called “robust fingers,” are accumulating Bitcoin, which helps the case for larger BTC costs.

As extra robust fingers purchase BTC, this strengthens the market. This will increase the possibility of a rising development within the charts.

Supply; Bitcoin Journal PRO

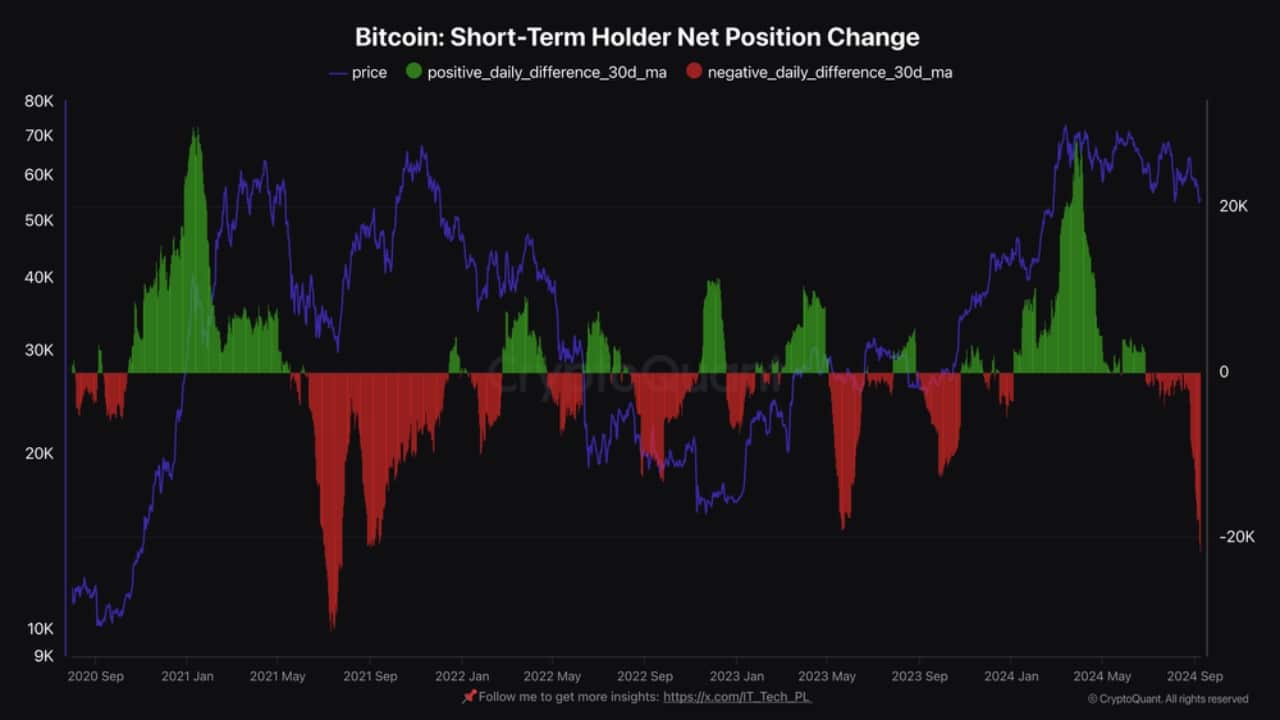

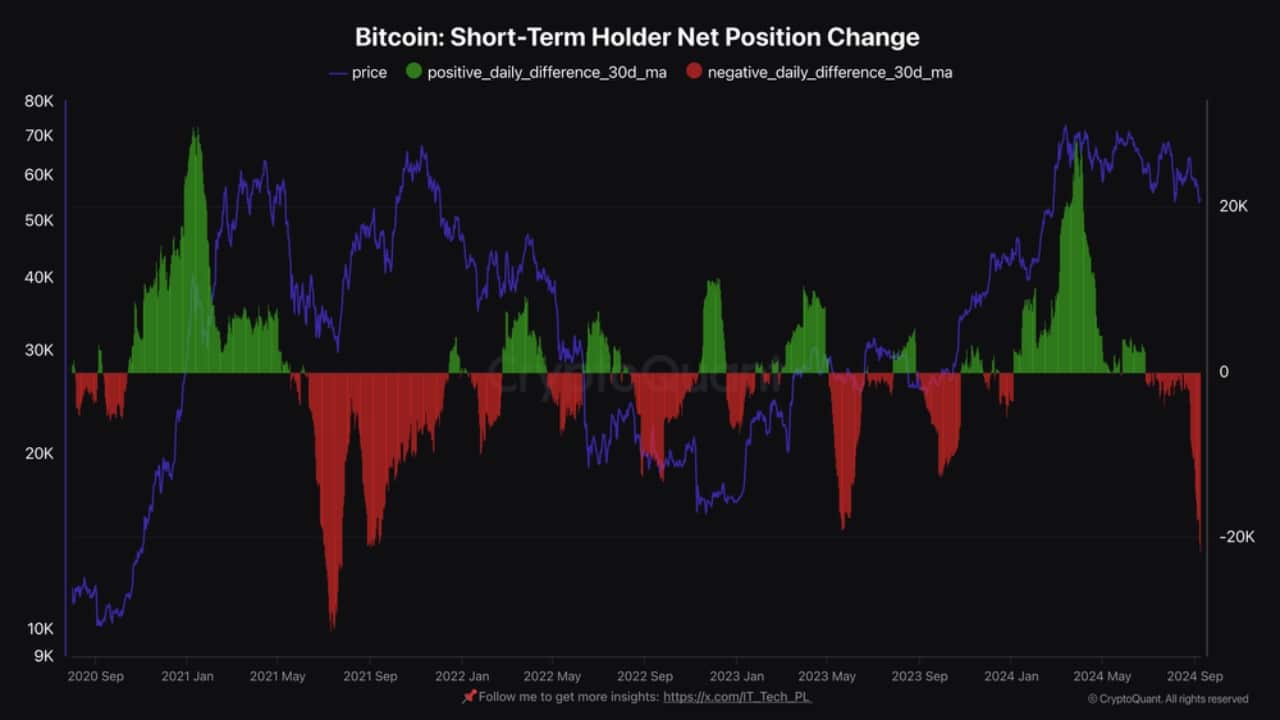

Bitcoin’s internet place change within the quick time period

Lastly, the short-term Bitcoin holder internet place change revealed that many current consumers, who got here in over the past worry of lacking out (FOMO) peak, at the moment are exiting.

That is usually an indication of market capitulation, indicating a possible backside. When short-term holders capitulate, this usually precedes an increase in BTC costs.

Supply: CryptoQuant

In conclusion, Bitcoin’s worth is primed for potential development. With robust on-chain metrics and historic tendencies favoring an uptrend, BTC might see a major rally if world market circumstances enhance and the Federal Reserve implements a charge reduce.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now