Bitcoin

Bitcoin – Widespread capitulation signals likely bottom, BUT risks remain

Credit : ambcrypto.com

- Bitcoin’s big +$ 800 million a day realized losses can mark a possible soil

- The general query has remained unfavourable, with BTC ETFs that bleed greater than $ 5 billion

Bitcoin [BTC] Has remained under $ 85k within the charts after a brief dip as much as $ 76k – a motion Bitfinex Trade analysts imagine that stabilization may most likely sign.

Of their weekly market reportThe analysts famous that merchants noticed a realized lack of $ 818 million a day, a market rinse that all the time precedes a possible soil.

“Such widespread capitulation typically precedes market stabilization, though geopolitical and macro -economic care stays an necessary overhang.”

Will BTC restore?

Quick -term holders (STH) have bought BTC with a loss since October 2024.

Supply: Bitfinex

They quoted the Bitcoin Output Revenue Ratio (Sopr), who follows the profitability of merchants, as a result of it dropped below 1. It indicated that holders bought with a loss.

“Quick -term holder SOPR registered his second largest unfavourable print of this cycle at 0.95, indicating that new market leaders capitulate.”

For the restoration shift, Bitfinex analysts claimed that Soprr should rise once more above 1, which might recommend that ‘herncumulation’ and ‘bullish continuation’ can be.

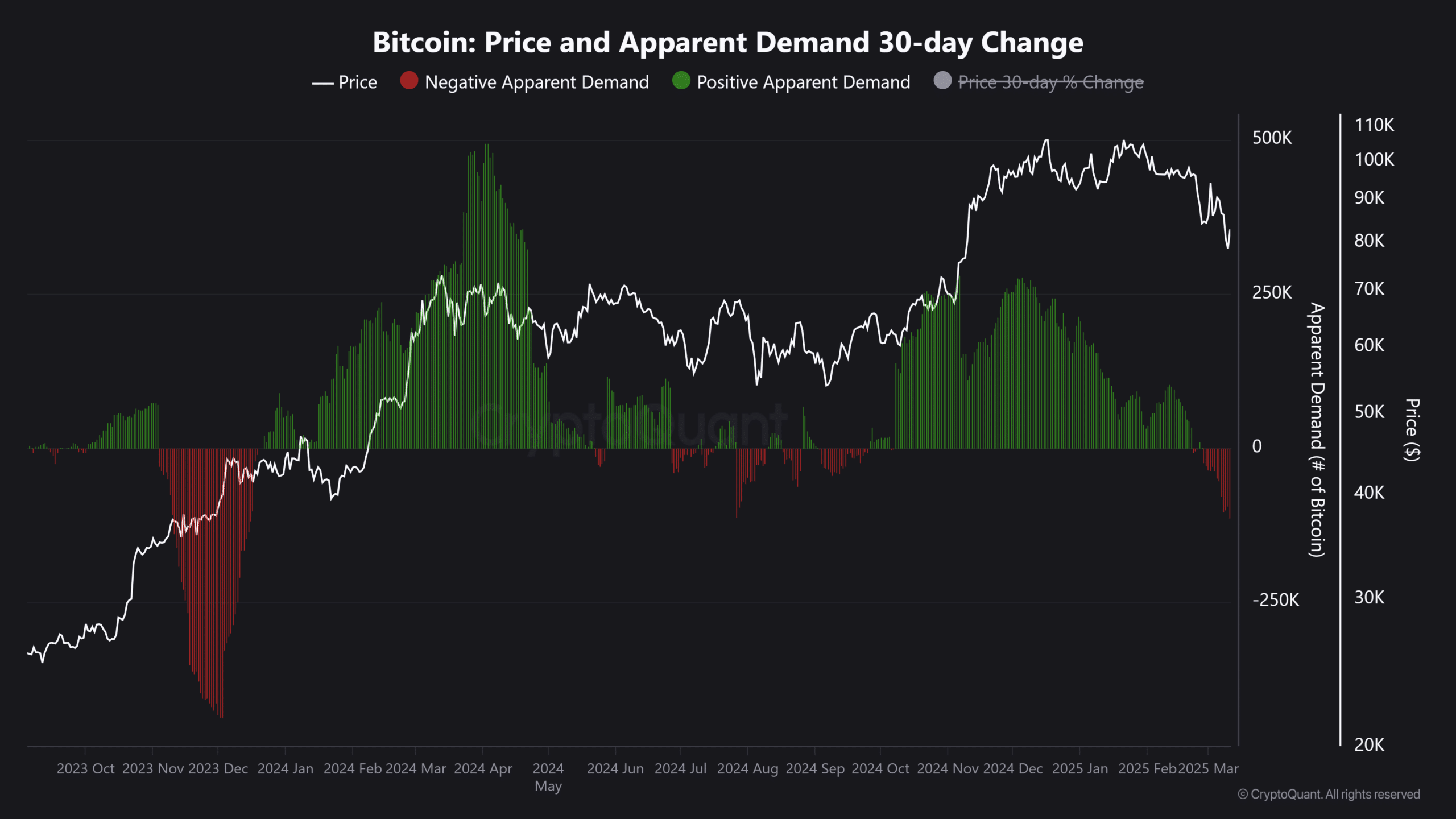

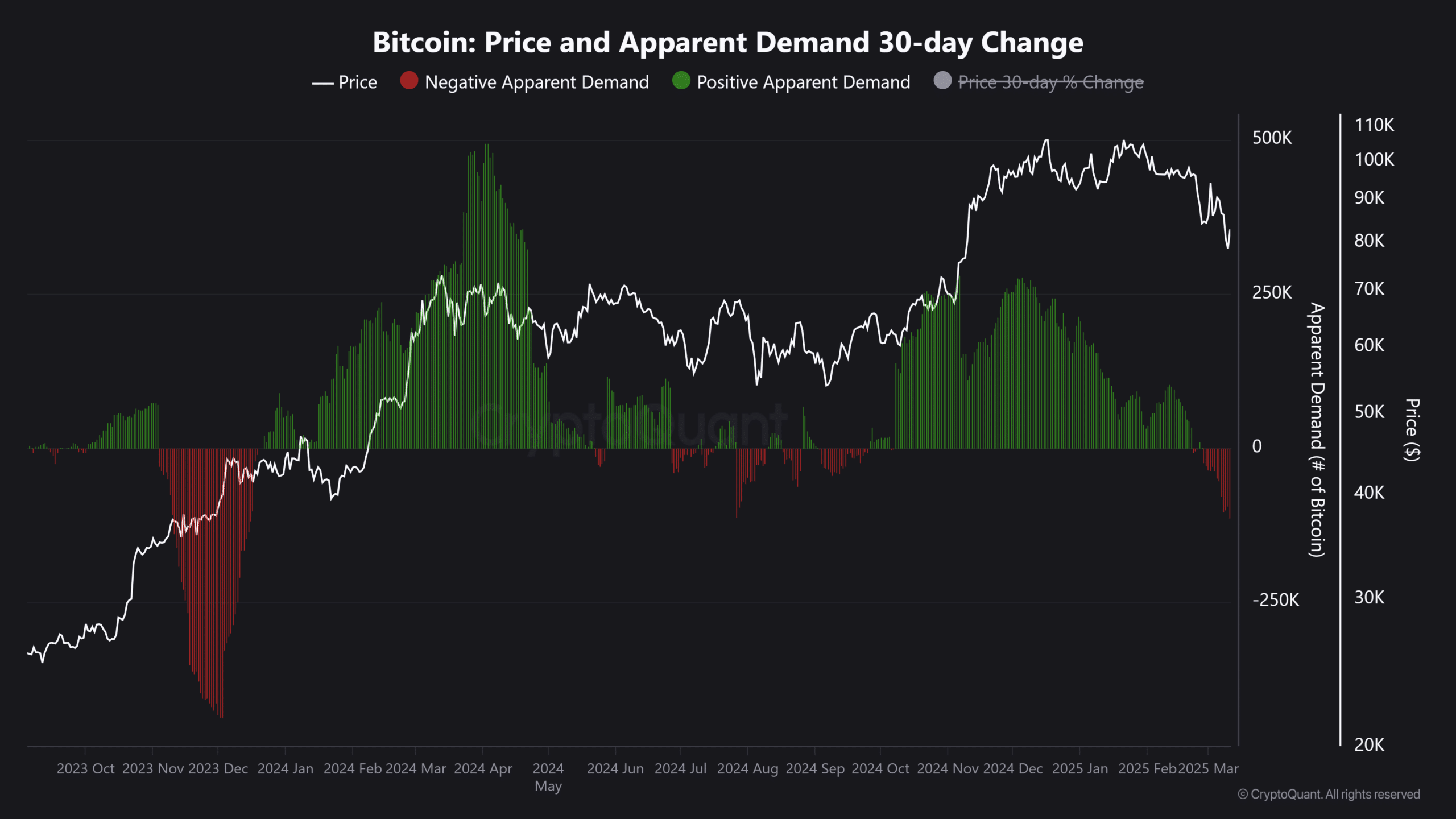

The weak BTC query confirmed the BitFinex warning. Based on Cryptoquant knowledge, the demand for the cryptocurrency has even remained unfavourable because the finish of February.

Supply: Cryptuquant

US Spot BTC ETFs bled $ 1.5 billion within the first half of March. In February alone, the product noticed $ 3.56 billion out per SOSO worth. They’ve seen greater than $ 5 billion out of bleeding within the final 6 weeks.

Bitfinex analysts additionally warned that the blended lecture on American macro -economic elements may nonetheless lower crypto -markets. Regardless of Trump’s tariff wars, the American CPI inflation knowledge got here in cooler than anticipated for February.

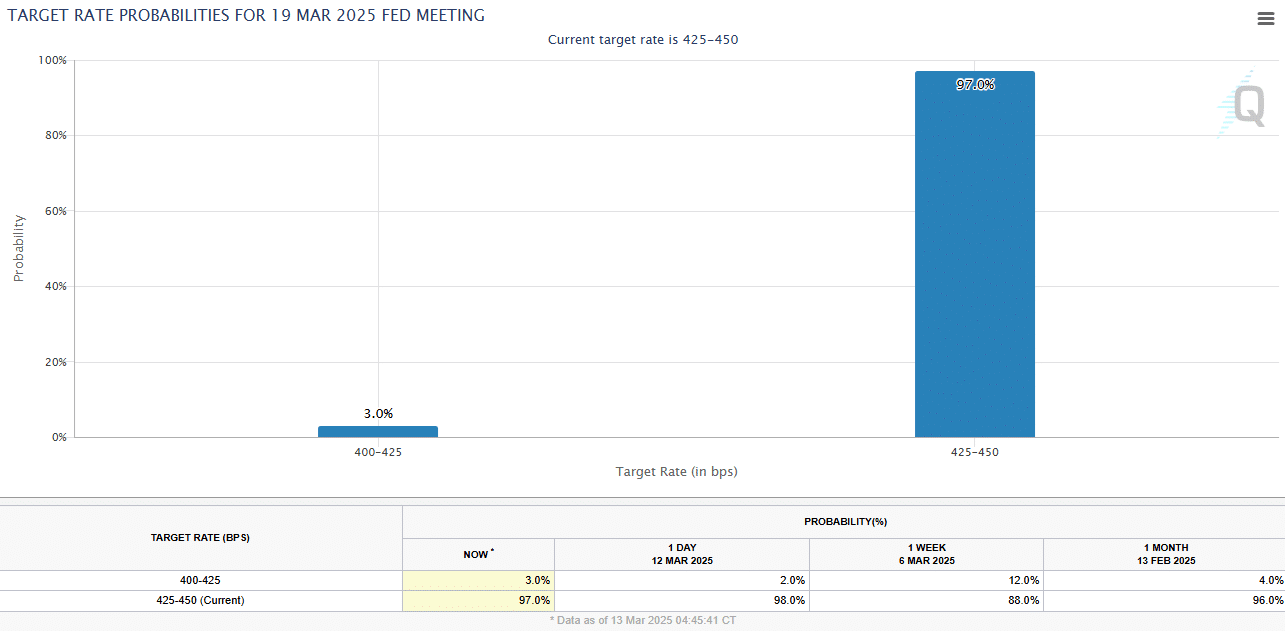

Sadly, the market doesn’t count on a decreased FED charge within the subsequent FOMC assembly deliberate for 19 March. Rentraders have priced a 97percentchance that the FED would maintain the charges unchanged on the present objective of 4.25%-4.50%.

There’s solely a 3% probability of a 25bps acceleration through the FOMC assembly subsequent week. As such, BTC can nonetheless be caught Turbulent waters within the quick time period.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now