Bitcoin

Bitcoin will ‘explode’ when the Fed pivots, says Robert Kiyosaki

Credit : ambcrypto.com

- Based on Kiyosaki, BTC will explode after the Fed price reduce.

- The creator believed that cash would flee bonds and different property into BTC, gold and silver.

The extremely anticipated Fed pivot occasion will happen this week, and market specialists have been bullish these days. The US FOMC (Federal Open Cash Committee) is anticipated to start out its easing cycle on September 18.

Based on Robert Kiyosaki, the creator of “Wealthy Dad Poor Dad,” the Fed will profit Bitcoin [BTC] and gold. He said,

“Bitcoin, Gold and Silver Costs Are About to Explode… When the Fed PIVOTS and Actual Belongings Surge in Worth Whereas Faux Cash Leaves Faux Belongings Like US Bonds and Flees to Actual Belongings Like Actual Property, Gold, Silver and Bitcoin.”

Inflation to make BTC rise?

Kiyosaki additional urged his followers to purchase extra BTC earlier than the Fed begins its easing cycle.

“Purchase some (extra) gold, silver or Bitcoin… earlier than the Fed modifications and cuts rates of interest.”

This would be the first price reduce in 4 years, and market observers can have primed dangerous property for potential positive factors. Nevertheless, Kiyosaki has beforehand said that BTC and different actual property will profit much more from unsustainable US debt.

On On September 13, Kiyosaki warned that unsustainable US debt can’t be solved regardless of who wins the US election. He declared that the greenback was rubbish and that folks have been higher off with Bitcoin and gold than the greenback.

“The greenback is trash. Cease saving {dollars}, pretend cash… and begin saving gold, silver and Bitcoin… actual cash.”

Galaxy’s Mike Novogratz echoed an analogous sentiment in March. Based on Novogratz, BTC would enhance in worth as US debt continues to develop by $1 trillion each 100 days.

Briefly, financial inflation will erode the worth of the greenback, forcing customers to search for alternate options akin to gold, BTC or silver. This large inflation might shortly push BTC to $10 million per coin, noted the creator in a July worth projection.

Within the meantime, BTC was again to $60,000 after two weeks of struggling beneath the psychological degree.

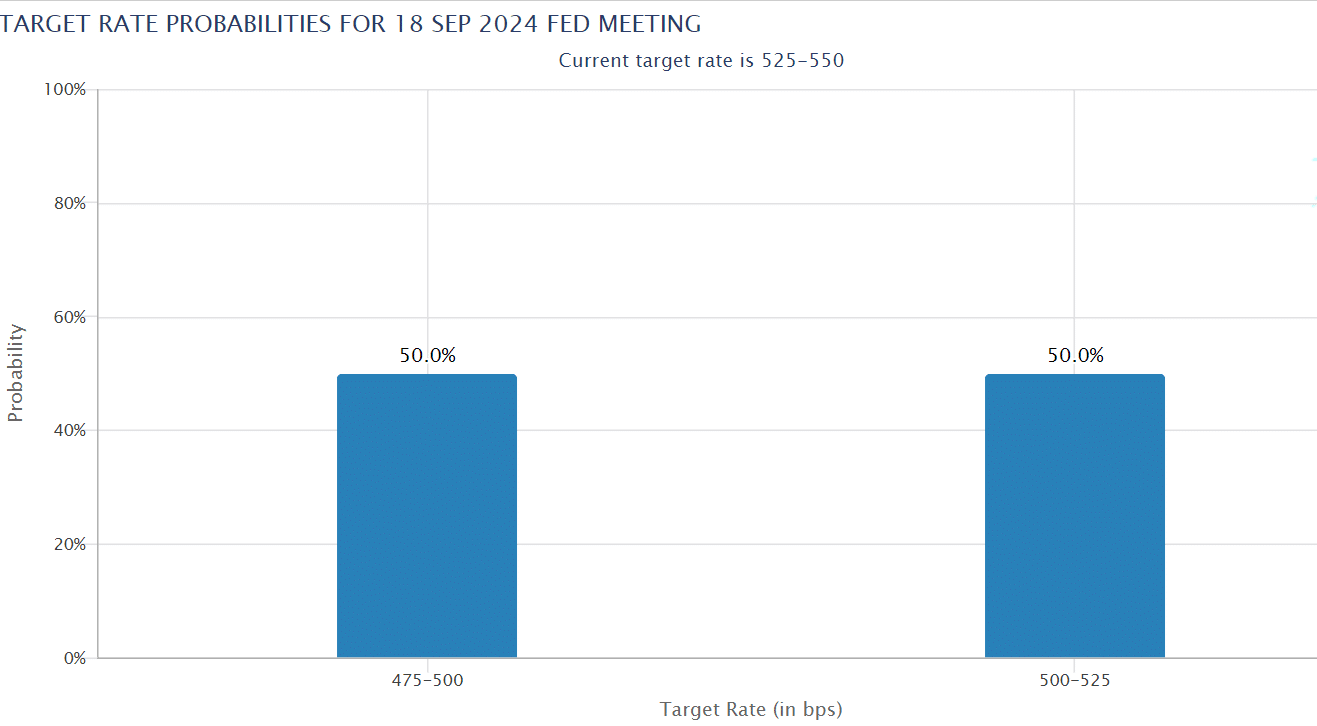

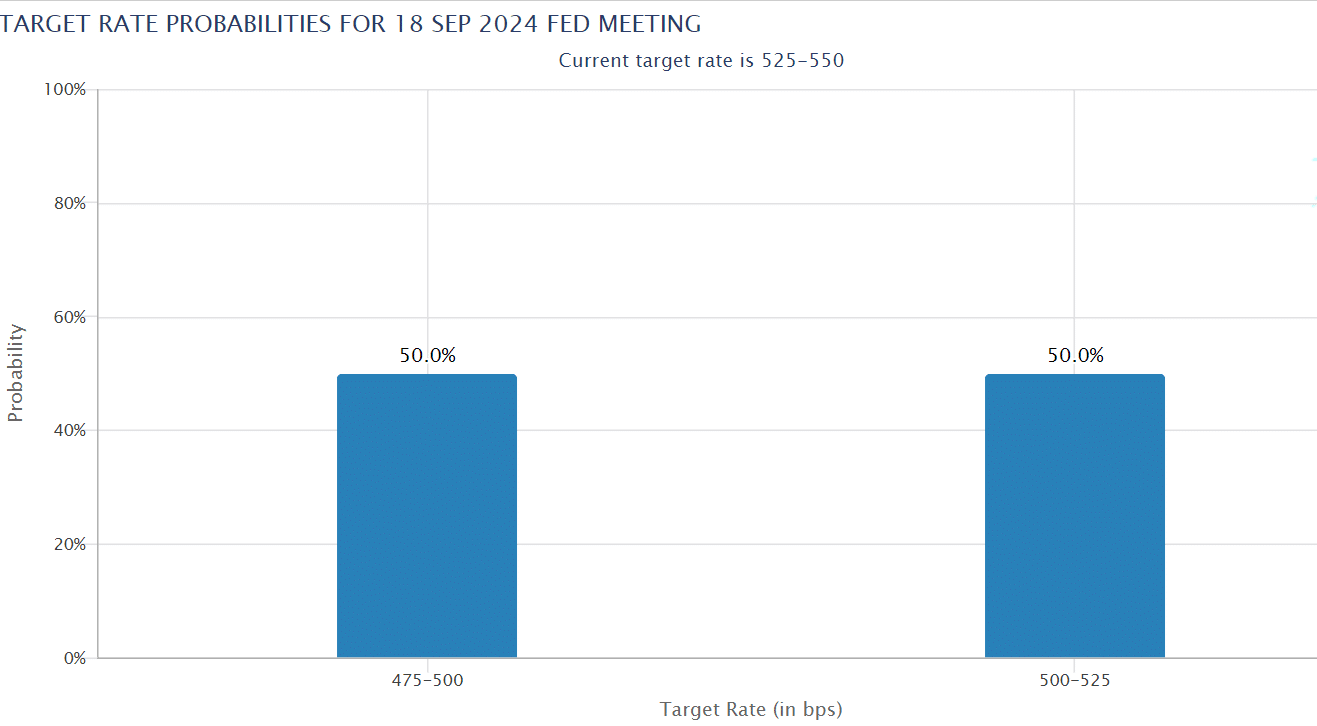

Following final week’s US financial information, markets are estimating a 50/50 likelihood of a 25/50 Fed price reduce (foundation factors). It stays to be seen how the market will react to the Fed’s turnaround within the quick time period.

Supply: CME FedWatch

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now