Bitcoin

Bitcoin’s 47K outflows – A supply shock or just another move?

Credit : ambcrypto.com

- Bitcoin noticed 47k BTC outflows, however the value remained considerably secure on the charts

- Trade reserves have continued to fall available on the market

Bitcoin lately noticed an essential outflow of 47,000 BTC, a motion that led to a debate on whether or not it represents an actual provide shock or a routine inner transaction. Traditionally, nice circulation are related to lengthy -term accumulation, which reduces btc’s liquid provide and presumably has set the stage for Bullish Momentum.

Nonetheless, this final step requires an additional consideration of information on chains and value motion.

Analyze Bitcoin Trade Reserves – Is Accumulation within the recreation?

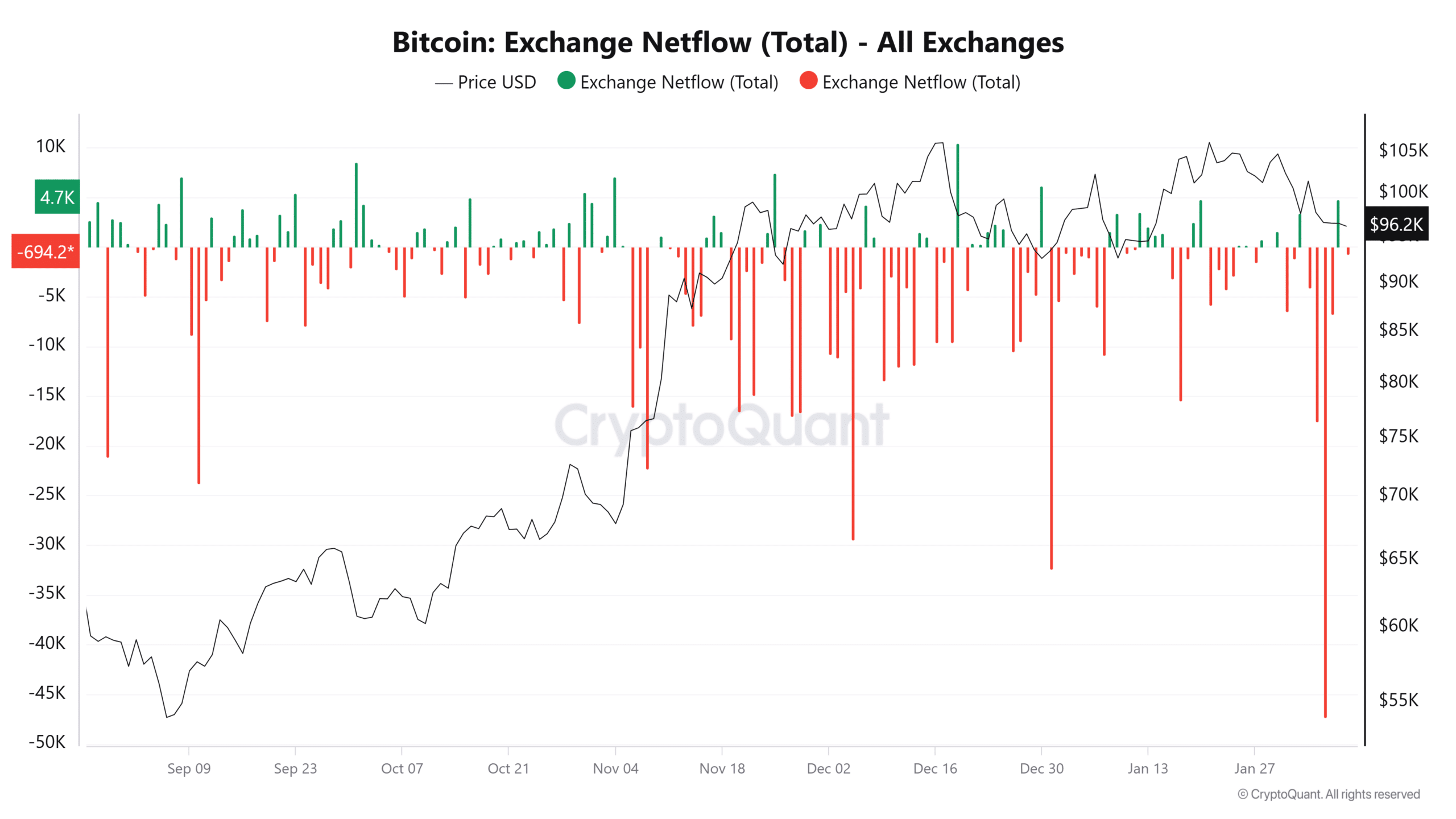

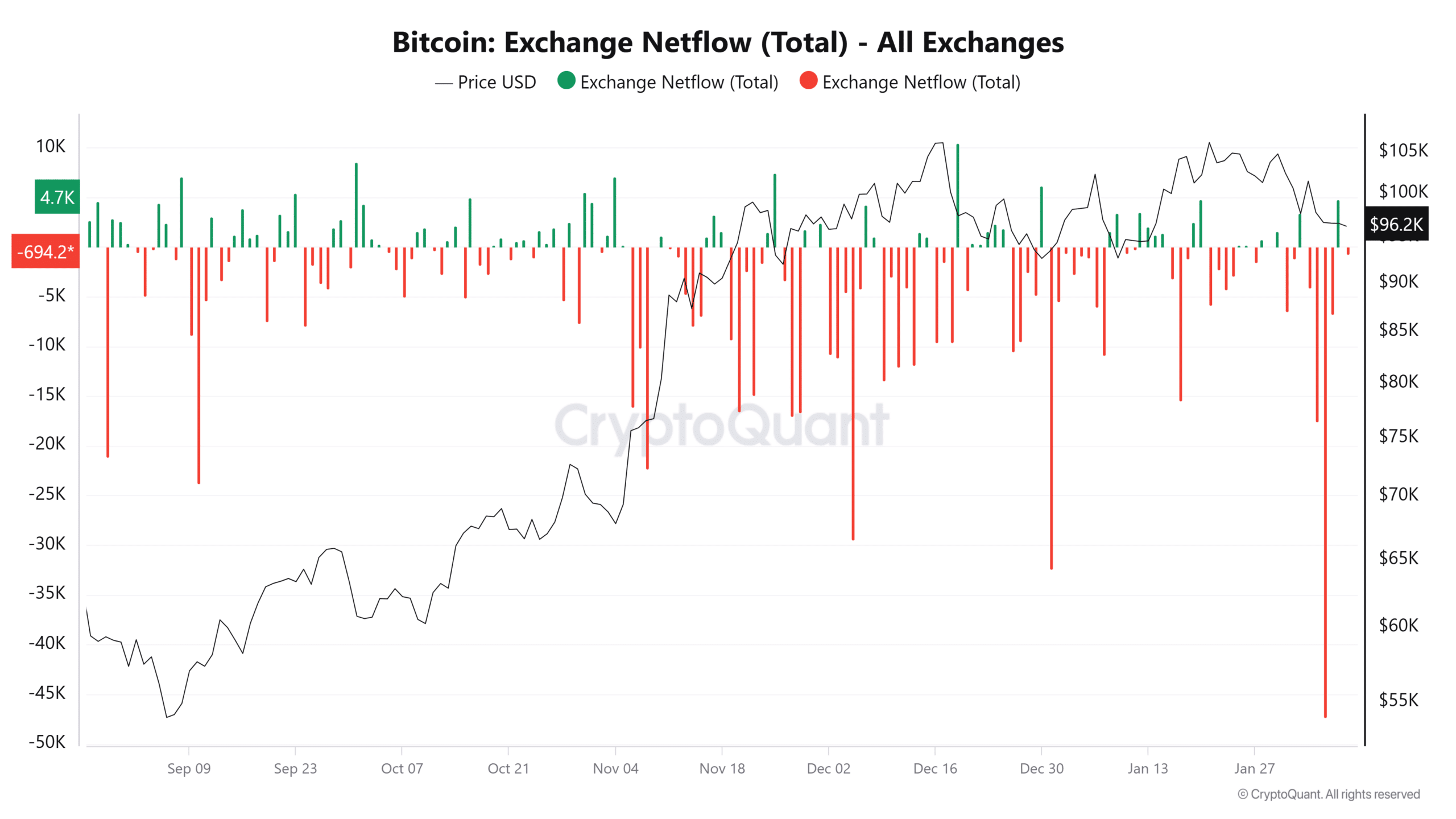

An evaluation of Bitcoin’s Netflows confirmed that it noticed essential outflows earlier than the height noticed it a couple of days in the past. BTC outflows are accelerated to greater than 47,000 BTC, making it the most important motion since 2022.

The that means of those shops led to conversations a couple of provide shock. Nonetheless, this alone didn’t absolutely verify a provide shock.

Supply: Cryptuquant

Additionally the Bitcoin Reserve -graphic Unveiled a seamless decline in BTC that was held over inventory exchanges, which fell within the mid -2024 from greater than 3 million BTC to round 2.45 million BTC in February 2025.

A shrinking change calfs often signifies that buyers are shifting BTC to personal portfolios for lengthy -term place, which reduces the obtainable provide for fast sale.

How did the value of Bitcoin react?

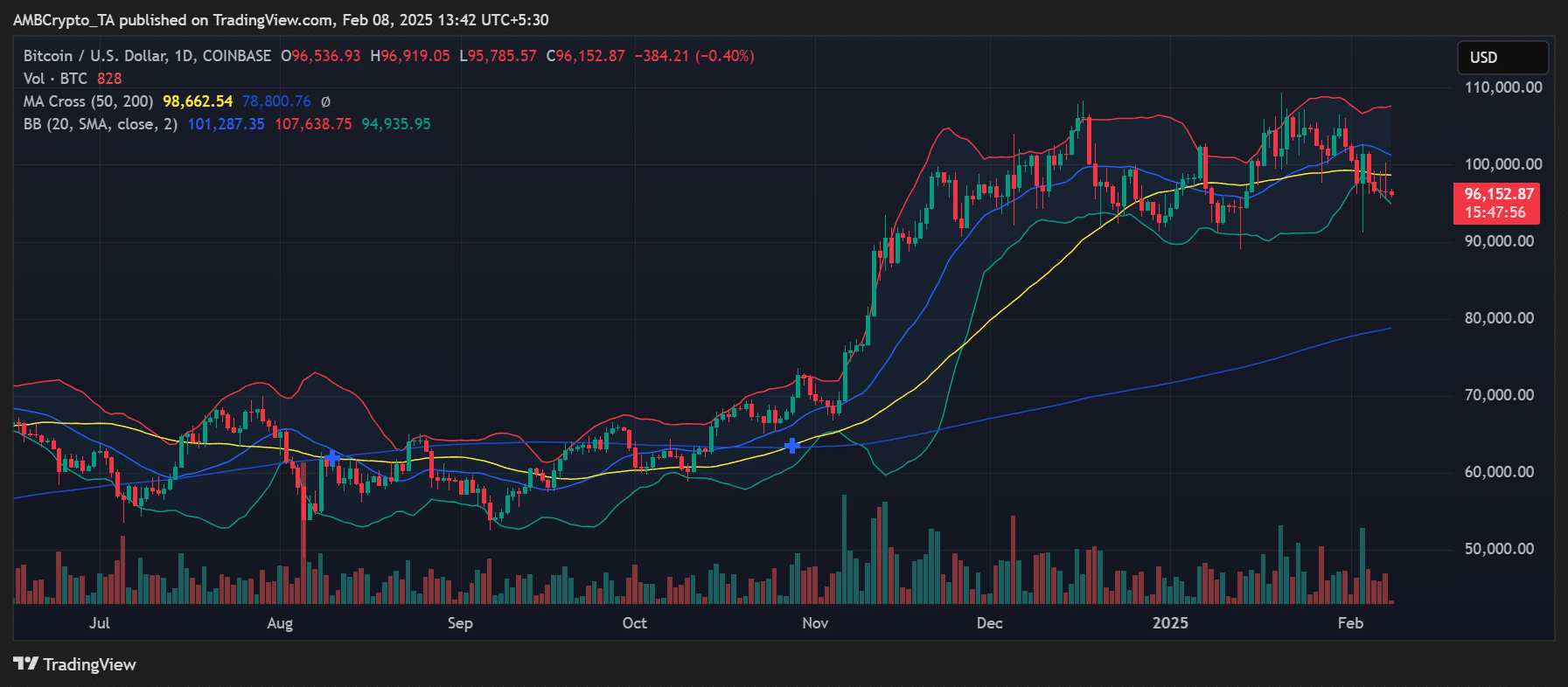

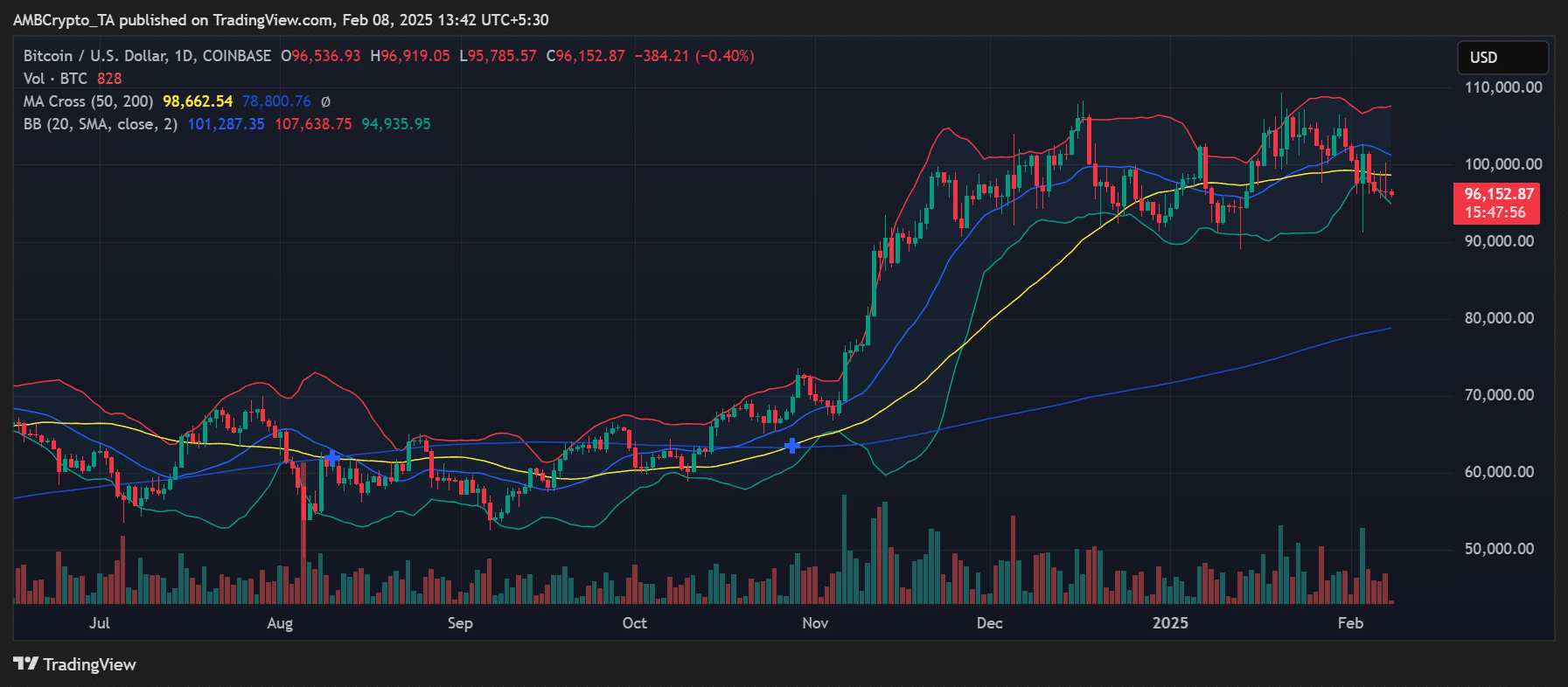

After the outflow, the value of Bitcoin remained secure round $ 96,152 – an indication that the fast market affect was minimal.

The Bollinger tires indicated reasonable volatility, with the value between $ 94,935 and $ 107,638 consolidated. The 50-day progressive common was $ 98,662 and acted as a short-term resistance degree.

Supply: TradingView

Though main outflows might point out accumulation, an absence of sturdy value response signifies that this motion was not seen as a market -changing occasion. At the very least within the brief time period.

Futures Market underlines hypothesis

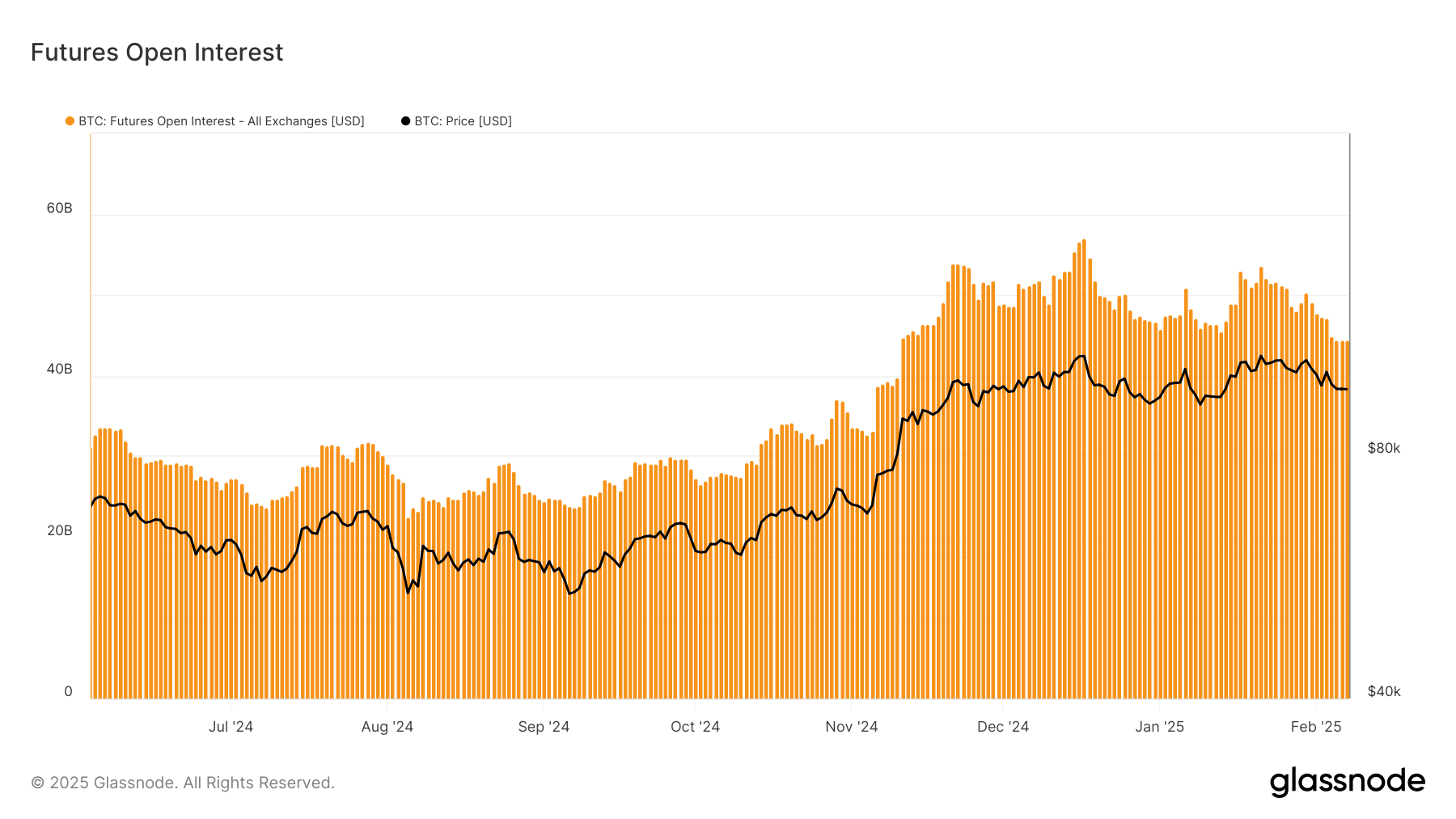

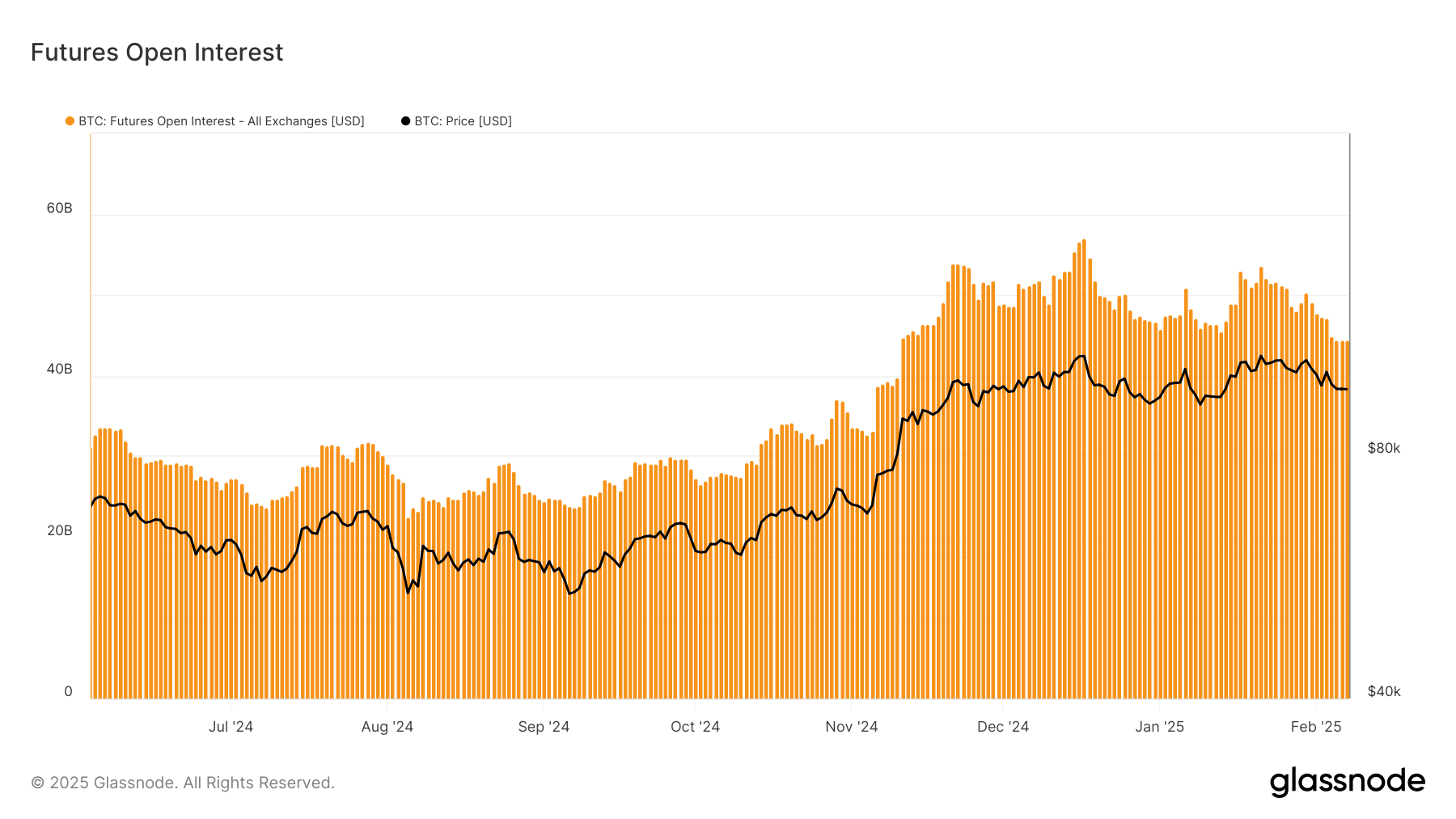

The Futures Open Curiosity Chart of Glassnode revealed a gradual improve in speculative positioning in January, with open curiosity that’s approaching $ 60 billion.

Rising open curiosity and essential change outflows typically imply that merchants guess on an upcoming Squeeze vary. On the time of writing, the OI had a lecture of round $ 44 billion.

Supply: Glassnode

Nonetheless, if the financing percentages develop into overly constructive, this may increasingly point out that the market is used an excessive amount of. Bitcoin could make this vulnerable to pullbacks powered by liquidation.

Delete a shock or routine motion?

Whereas the 47k BTC outflows appeared to regulate to a wider development of falling change reserves, its fast market affect was damped.

Varied components, together with an absence of a aggressive value motion and the potential for inner pockets, counsel that this was not a direct shock. As an alternative, a part of a protracted -term accumulation development.

-Elet Bitcoin (BTC) Value forecast 2025-26

That stated, if Bitcoin enters and whale exercise proceed like this, a suggestion may come up within the coming months. The development will regularly exert upward stress on the value of Bitcoin.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024