Bitcoin

Bitcoin’s biggest institutional wave since 2024 – A macro-led rally soon?

Credit : ambcrypto.com

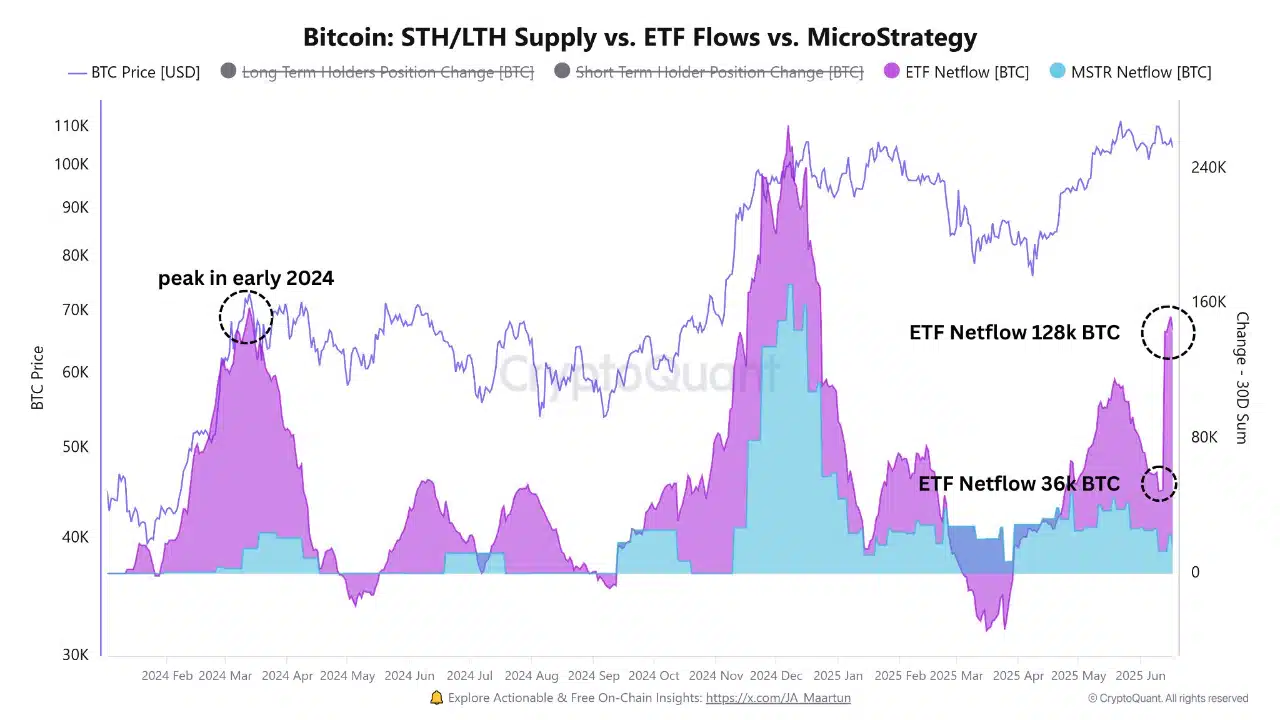

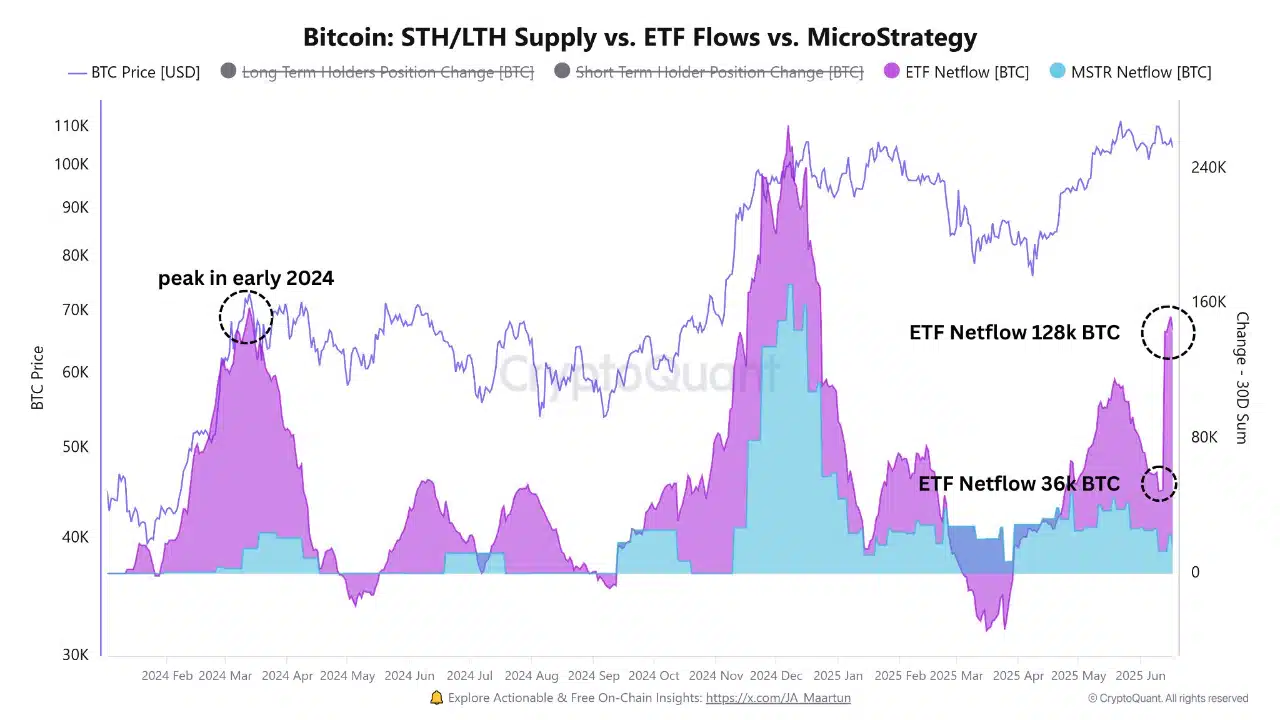

- ETF Netflows jumped in 30 days with 128k BTC and marked the strongest institutional consumption for the reason that starting of 2024.

- Falling short-term HODL exercise and transfers the scale of whales point out a structural bullish setup.

Bitcoin [BTC] ETF Netflows rose by 128,000 BTC in 30 days, which marks the biggest institutional wave of accumulation for the reason that starting of 2024.

As well as, Binance Whaling Leap from $ 2.3 billion to $ 4.59 billion in at some point.

This synchronized improve displays the rising belief amongst excessive -quality entities, which appear to place early for an excellent worth growth.

It’s clear that enormous holders should not ready to be uncovered to a macro-guided rally.

Supply: Cryptuquant

Bitcoin shortage is growing

The to-flow ratio of BTC rose to 2.12 million, which displays a rise of 133.34% and reinforces the shortage of the belongings.

New provide stays far behind the circulating inventory, which signifies robust accumulation habits. That’s the reason the shift is according to funding methods for long-horizon by institutional gamers on the lookout for asymmetrical advantages.

Traditionally, such drastic rises within the ratio are often preceded by giant bull runs powered by provide shocks.

Supply: Cryptuquant

Has the facility relationships shifted?

Counting of the transactions by measurement confirmed a steep lower over tires with a decrease worth, with the $ 1 – $ 10 tier down 38.26%.

Within the meantime, the $ 1 million tire – $ 10 million grew by 5.35%, which confirms that whales have taken over management over the market present. After all this shift suggests a structural pivot-minder noise, extra conviction of gamers with a deep bag.

Supply: Intotheblock

Overheating or speculative perception?

The Bitcoin NVT ratio rose to 824, a stage that’s hardly ever seen in earlier cycles. These alerts that market capitalization surpasses transaction transport, a possible signal of surplus worth within the quick time period.

Along with ETF entry and whale positioning, nevertheless, the height in all probability displays strategic retains, not speculative euphoria.

So though it’s elevated, this will point out delayed distribution, not a direct drawback.

Supply: Santiment

Do the quick -term holders quit as lengthy -term convictions?

The 0–1 day Cap Hodl Golf realized has fallen to 0.187%, the bottom studying in weeks.

This drop reveals that holders withdraw within the quick time period, with fewer individuals who do quick sale.

As an alternative, BTC more and more appears to be within the arms of long-term believers, in order that the dynamics of the shortage are already displayed in ETF and S/F knowledge. Whereas quick Flips disappear, the market tilts to structural energy.

Supply: Santiment

Backside Line

ETFs and whales appear to organize for launch.

The coordination of the deep incomes, shrinking presence within the retail commerce, growing shortage and lengthy -term holding habits displays strategic beliefs, not within the quick time period hypothesis.

Though metrics corresponding to NVT counsel short-term overheating, they’re compensated by clear indicators of tightening.

So long as this structural dynamics persist, the Bullish Momentum of Bitcoin stays well-supported and institutional capital could possibly be the catalyst that maintains the rally.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024