Altcoin

Bitcoin’s bull run is far from over – THIS is a big reason why

Credit : ambcrypto.com

- The inflow of institutional demand has probably been one of many key elements explaining why Bitcoin hovered across the ATHs of the earlier cycle.

- Traders shouldn’t worry decrease volatility in the time-frame because the numbers help a buy-and-hold technique.

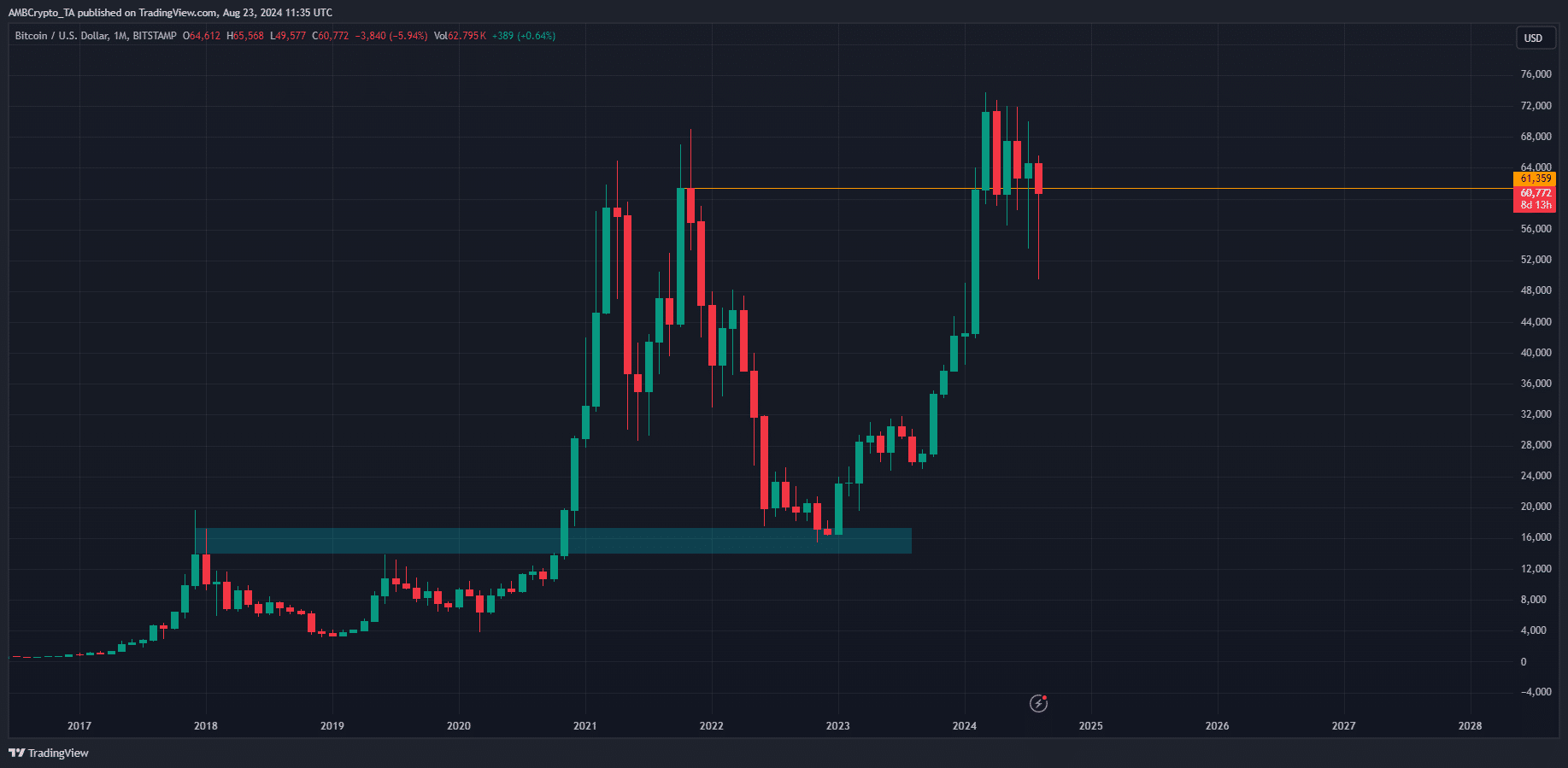

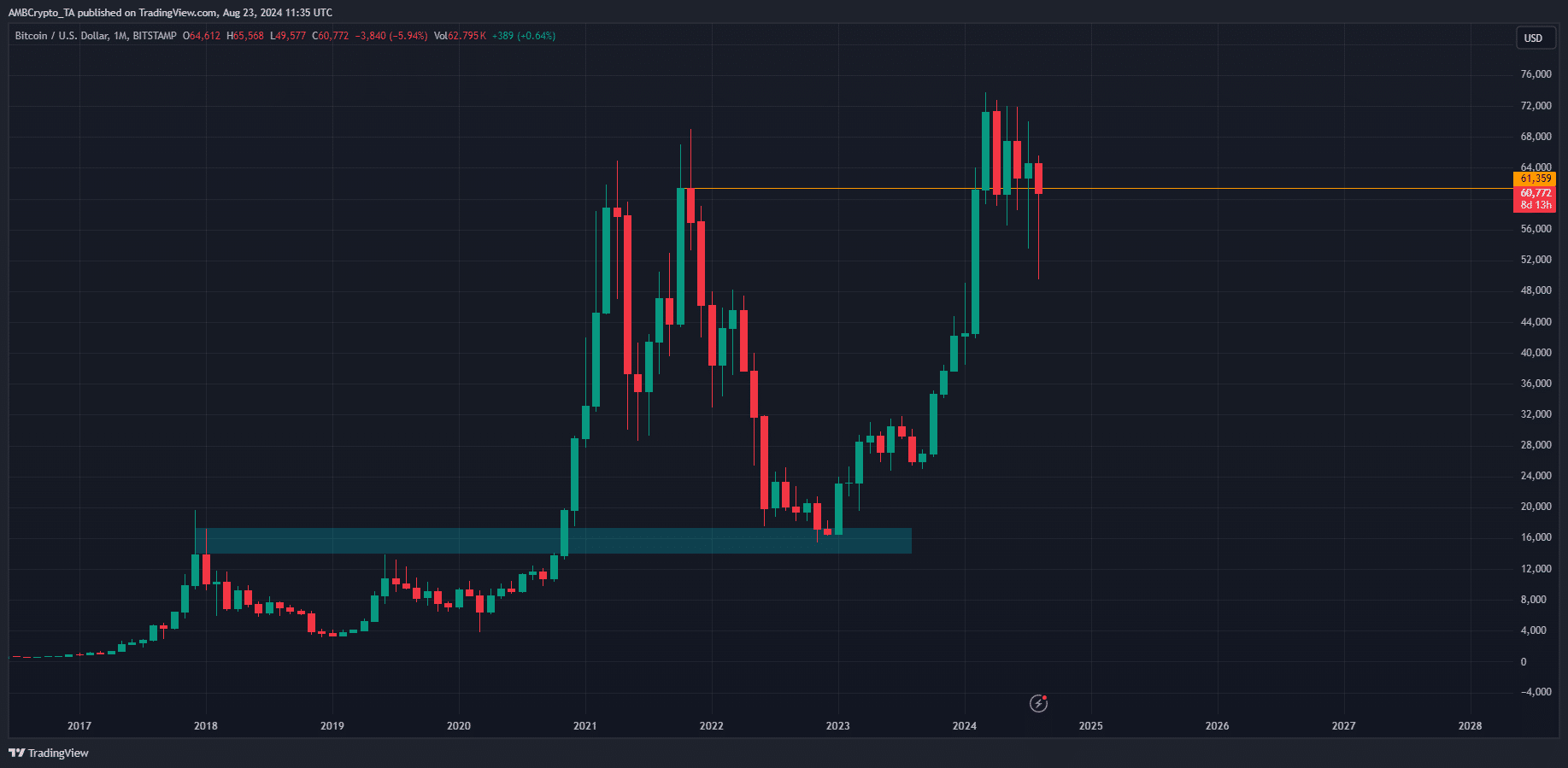

Bitcoin [BTC] was in a downtrend on the weekly chart, however in an uptrend on the month-to-month chart. Since March, it has consolidated inside the $50,000-$70,000 area.

Whereas merchants and buyers could also be pissed off by the shortage of motion, BTC remained extraordinarily bullish on the upper timeframes.

Like one popular crypto analyst famous, Bitcoin is closed six monthly trading sessions above the shut of the March 2021 month-to-month session.

Even the halving and quite a few FUD occasions out there weren’t sufficient to dethrone the king of cryptocurrency.

Unprecedented Bitcoin Value Efficiency

Supply: BTC/USDT on TradingView

By way of pure proportion good points, earlier Bitcoin cycles have been stronger. Nonetheless, this run has one thing that hasn’t occurred earlier than. Through the BTC halving in April 2024, the worth was above $61,000.

It has been buying and selling at or very near the earlier cycle’s ATH throughout and after the halving. Through the 2020 halving cycle, BTC costs had been virtually 60% decrease than ATH, in comparison with round 10% this cycle.

So, other than the decrease volatility, Bitcoin remained extraordinarily bullish for long-term buyers.

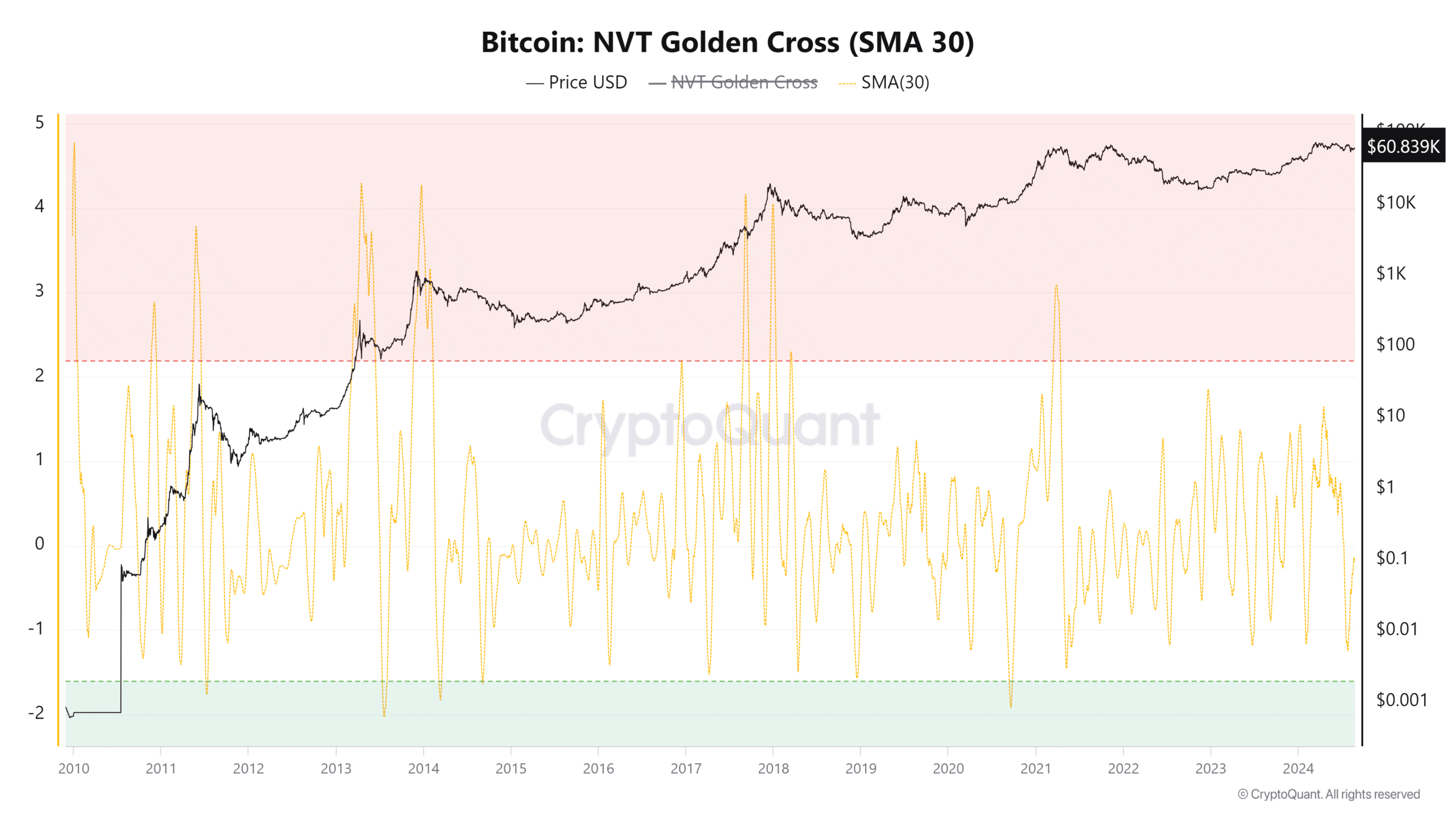

The NVT values inspired patrons

The 30-day easy shifting common of the NVT gold cross was -0.14. Typically, values above 2.2 point out a cycle high and beneath -1 point out a attainable backside. Due to this fact, the Bitcoin bull run nonetheless has a protracted strategy to go.

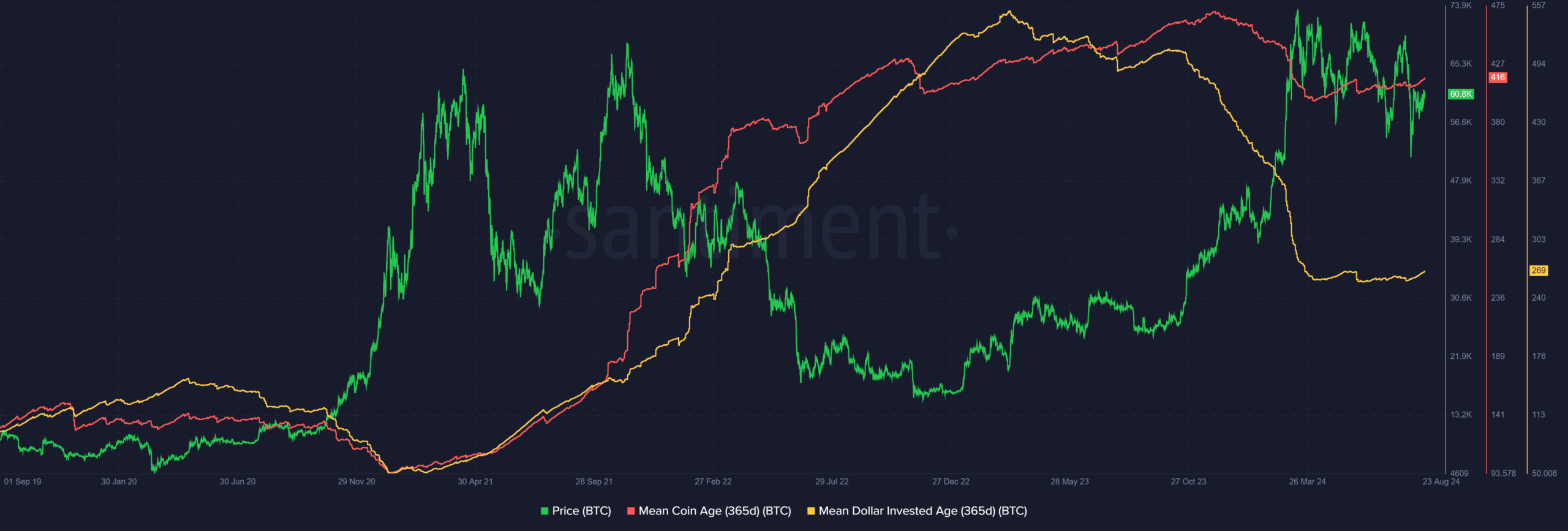

The typical greenback invested started to say no in November 2023 as costs rose quickly. It has been comparatively flat in latest months.

A declining MDIA is an indication that investments are coming again into circulation and newer investments are going down.

The MDIA might fall a lot farther from 269 to the earlier cycle low of 51 earlier than the continued uptrend would start to point community stagnation.

Learn Bitcoin’s [BTC] Value forecast 2024-25

The typical coin age slowly began to rise after the sharp decline in February and March, as fast worth will increase led to profit-taking and promoting strain.

A continuation of this upward development would point out network-wide accumulation.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024