Bitcoin

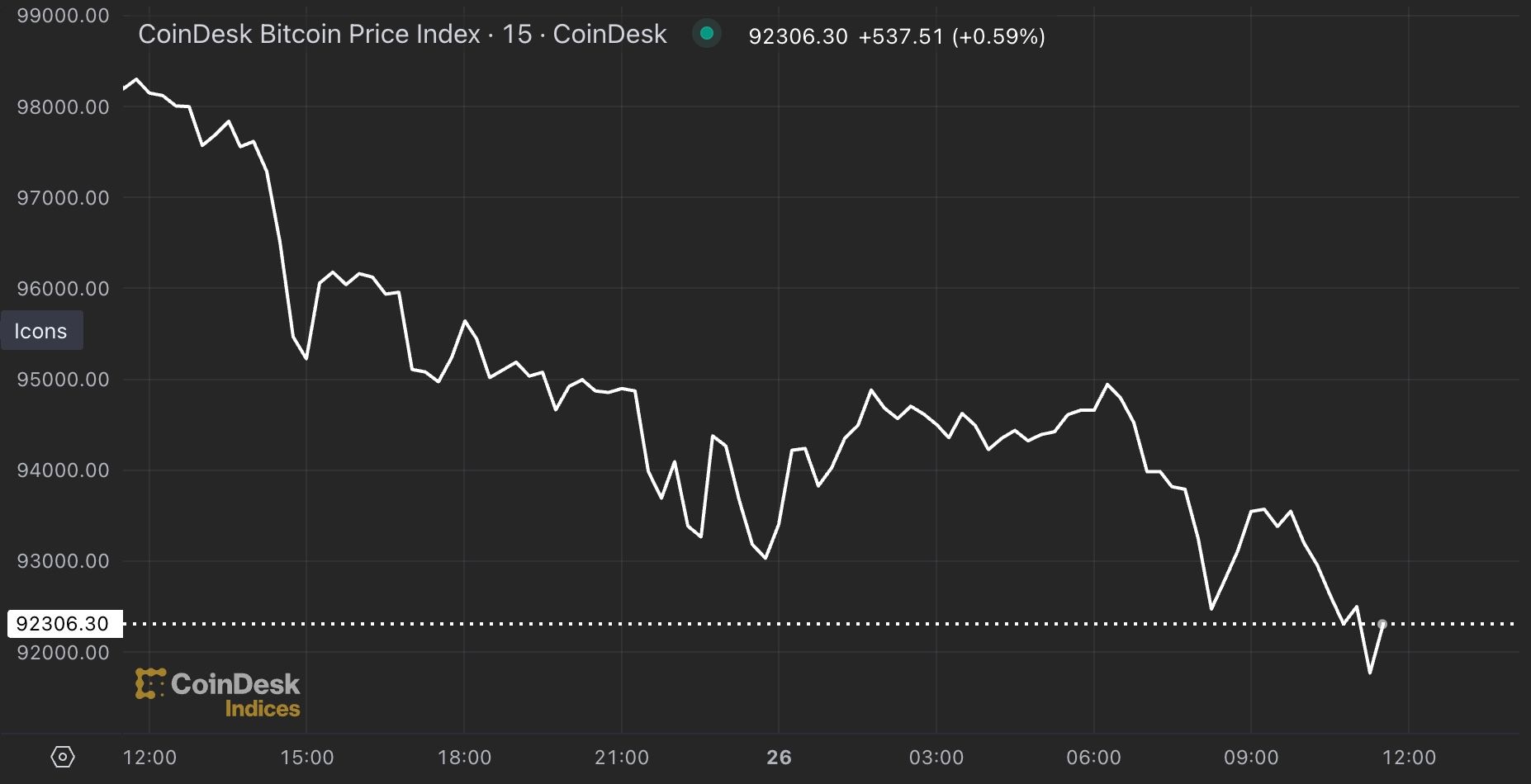

Bitcoin’s Correction Takes Price Below $93K

Credit : www.coindesk.com

Beginning subsequent Monday, First Mover Americas turns into Crypto Daybook Americas, your new morning briefing on what occurred within the crypto markets that night time and what’s anticipated within the day forward. Launched at 7am ET, it is going to kickstart your morning with in-depth insights. You do not need to begin your day with out it.

CoinDesk 20 index: 3,108.77 -9.55%

Bitcoin (BTC): $92,029.63 -6.72%

Ether (ETH): $3,319.02 -4.95%

S&P 500: 5,987.37 +0.3%

Gold: $2,632.36 +0.57%

Nikkei 225: 38,442.00 -0.87%

Prime Tales

A bitcoin-led crypto market correction entered a 3rd day because the asset misplaced one other 6% over the previous 24 hours, falling under $93,000. BTC has lower weekly positive aspects from over 10% to simply below 1%, amid profit-taking on the anticipated pullback. Main tokens have adopted the autumn, with Solana’s SOL, BNB, Cardano’s ADA and DOGE down as a lot as 7% over the previous 24 hours. The broad-based CoinDesk 20 (CD20), a liquid index that tracks the biggest tokens by market capitalization, minus stablecoins, is down practically 3%. Analysts view a correction of as a lot as 10% from the height as utterly pure, whereas sustaining a short-term goal of $100,000 per BTC.

Some indicators level to an ongoing correction within the worth of BTC, inflicting it to drop to a low of $90,000. One among these is the 25-delta danger reversal. This measures the volatility premium of out-of-the-money (OTM) calls, that are used to wager on worth rises, over OTM put choices, which give draw back safety. On Deribit, calls expiring this Friday at the moment are buying and selling at a decrease valuation than places, leading to unfavourable danger reversal, based on information supply Amberdata. The primary unfavourable worth in at the very least a month signifies a choice for protecting places. Maybe skilled merchants are making ready for an extension of Monday’s worth drop. On Monday, merchants offered name spreads and purchased put choices tied to BTC on over-the-counter liquidity community Paradigm.

After a chronic downtrend in opposition to bitcoin, ether is exhibiting indicators of a revival. ETH climbed to over $3,500 on Monday for the primary time since June, whereas BTC fell from its latest highs. Ether has since been hit by the broader market correction, buying and selling 5% decrease over the previous 24 hours whereas nonetheless outperforming the broader market, which has misplaced greater than 8% as measured by the CoinDesk 20 Index (CD20). Traders started rotating capital into smaller, riskier cryptocurrencies this weekend after bitcoin’s near-vertical rise since Donald Trump’s election victory stalled. The ETH/BTC ratio, which measures ether’s energy in opposition to bitcoin, plunged to a low of 0.0318 on Thursday, its weakest studying since March 2021, however the gauge has since risen 15% to 0.3660 on the second of writing.

Chart of the day

- Leverage is a double-edged sword, growing each income and losses…and the way.

- The Defiance Day by day Goal 2x Lengthy MSTR ETF, buying and selling below the ticker MSTX on Nasdaq, has fallen 41% in three days from $220 to $112.

- The ETF goals to ship twice the every day efficiency of shares in Bitcoin holder MicroStrategy. The MSTR is down 20% to $403.

- Supply: TradingView

-Omkar Godbole

In style posts

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now