Bitcoin

Bitcoin’s ETFs Kill the Transaction Fees, Punishing the Miners More

Credit : www.coindesk.com

Good morning, Asia. That is what makes new within the markets:

Welcome to Asia Morning briefing, a every day abstract of high tales throughout American hours and an outline of market actions and evaluation. For an in depth overview of the American markets, see Coindesk’s Crypto Daybook Americas.

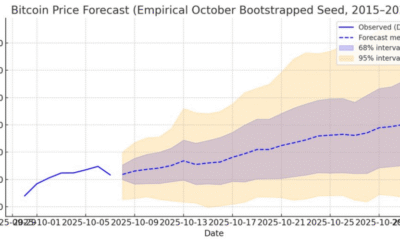

The value of Bitcoin holds data within the neighborhood, however the chain itself is quiet. Glassnode -Knowledge reveals that transaction prices have been folded again to 10 years of lows, whilst BTC Flirt with six digits.

In earlier cycles, the tariff peaks adopted the bull markets whereas merchants provide on blockspace. This yr the tariff curve is flat whereas the worth rises, a transparent signal that the demand for an onchain not sends the market.

A new report from Galaxy Research Present the median every day prices have fallen by greater than 80% since April 2024, with a minimum of 15% of the every day blocks that at the moment are just one Satoshi per VBYTE. Virtually half of the latest blocks usually are not full, which signifies a weak demand for blockspace and a sleeping mempool.

This can be a sharp distinction with earlier bull cycles, the place value rallies translate into congestion and value peaks.

The info confirms a structural shift: spot ETFs and managers now include greater than 1.3 million BTC and cash which can be parked in these wraps, the chain not often turns into once more.

On the similar time, retail exercise that when hides the Bitcoin -Blockchain is migrated to Solana, the place Memecoins and NFTs profit from cheaper and sooner model. The outcome, Galaxy notes, is that the Bitcoin value is decided by the consumption of the storage, whereas the onchain query from the community – as soon as a proxy for value motion – is delayed.

This dynamic is particular punishment for miners. With rewards halved to three,125 BTC and prices that contribute lower than 1% of the blocking earnings in July, the profitability is beneath strain. That stress pushes said miners to diversify in AI and HPC internet hosting.

Learn extra: Bitcoin -Mybouw is confronted with ‘extremely tough’ market when energy turns into the actual forex

A report from Rittenhouse Analysis earlier this yr argues that the relocation of Galaxy Digital from MijnBouw could possibly be the mannequin for the sector.

This step has been welcomed by the inventory markets. Though BTC has fallen greater than 3% within the yr, the Coinshares Bitcoin Mining ETF has received practically 22%. Buyers reward corporations which have launched themselves in diversification as an alternative of simply trusting block rewards.

Listing miners inform an identical story. Hive, Core Scientific and Terawulf reported all Q2 outcomes stuffed by HPC and AI -Internet hosting Revenue.

These with out diversification, reminiscent of Bitdeer and Bitfufu, stay deeply uncovered to electrical energy prices, depreciation of kit and a reimbursement market that warns Galaxy in his report is “something however strong”.

The juxtap place has been informed: Galaxy’s personal analysis warns that the settlement position of the Bitcoin -Blockchain is stagnating, whereas Galaxy’s stability is moved for development in AI knowledge brokers.

Onchain knowledge make the purpose: with out natural demand for blockspace, prices can not finance safety. And if the prices stay low, inventory markets paint a transparent image that the very best future returns of the mining sector of AI can not come from Bitcoin.

Market actions

BTC: Bitcoin traded at $ 113,286.95, a lower of 1.79%, after shortly depositing to a lowest level in six weeks close to $ 110,600, with the broader crypto market that was confronted with heavy liquidations and volatility.

ETH: Ether traded flat at $ 4,779 whereas Jerome Powell’s Dovish Jackson Gap feedback elevated the expectations of an rate of interest discount in September, whereby asset managers predicted new highlights for Bitcoin and an ETH outbreak above $ 5,000 regardless of the dangers of the TRASURY acceptance.

Gold: Gold was closed at $ 3,371 after Powell’s Dovish Jackson Gap feedback on the September rate-cut-modds have stimulated.

Nikkei 225: Asia-Pacific shares climbed on Monday, with the Japanese Nikkei 225 a rise of 1.08%, after Powell had indicated the potential meals pace throughout his speech by Jackson Hue in September.

Elsewhere in Crypto

- Financing: Why rising a Crypto VC Fund is now harder – even in a bull market (The block))

- Why Luca Netz will probably be ‘dissatisfied’ if Pudgy Penguins is not going to be IPO inside 2 years (Decrypt))

- KPMG says that investor curiosity in digital belongings will generate a robust second half for Canadian fintechs (Coindesk)

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024