Bitcoin

Bitcoin’s expanding triangle, explained: Looming breakout or trap?

Credit : ambcrypto.com

- Bitcoin’s increasing triangle sample signifies excessive volatility, paving the best way for a breakout or decline.

- The MVRV ratio means that holders are making a revenue, however there’s room earlier than crucial profit-taking ranges are reached.

Bitcoins [BTC] The worth continued to type an increasing triangle sample on the time of writing, which caught the eye of analysts.

This formation, characterised by broader value motion, signifies market indecision with growing volatility.

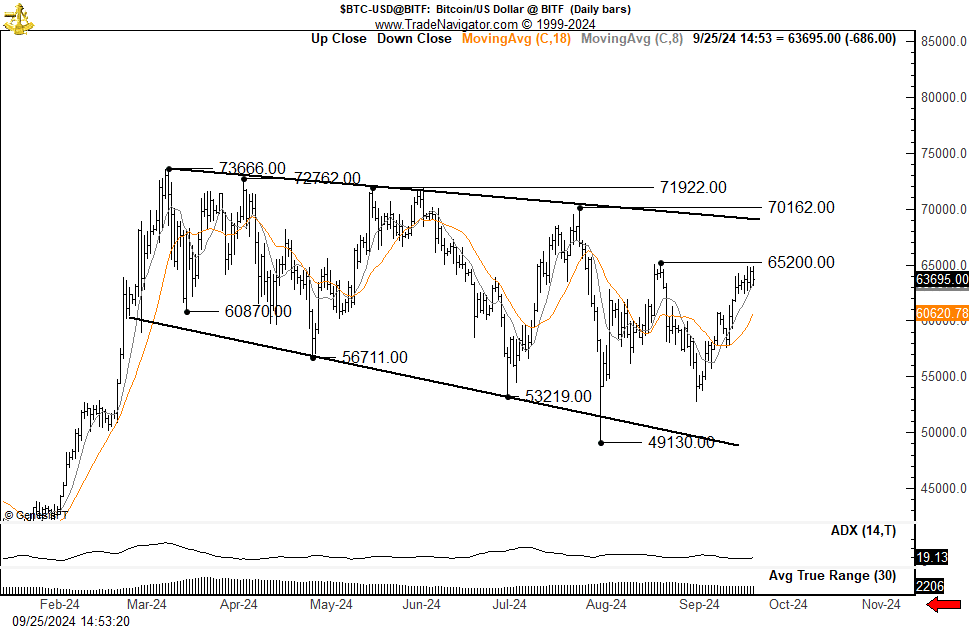

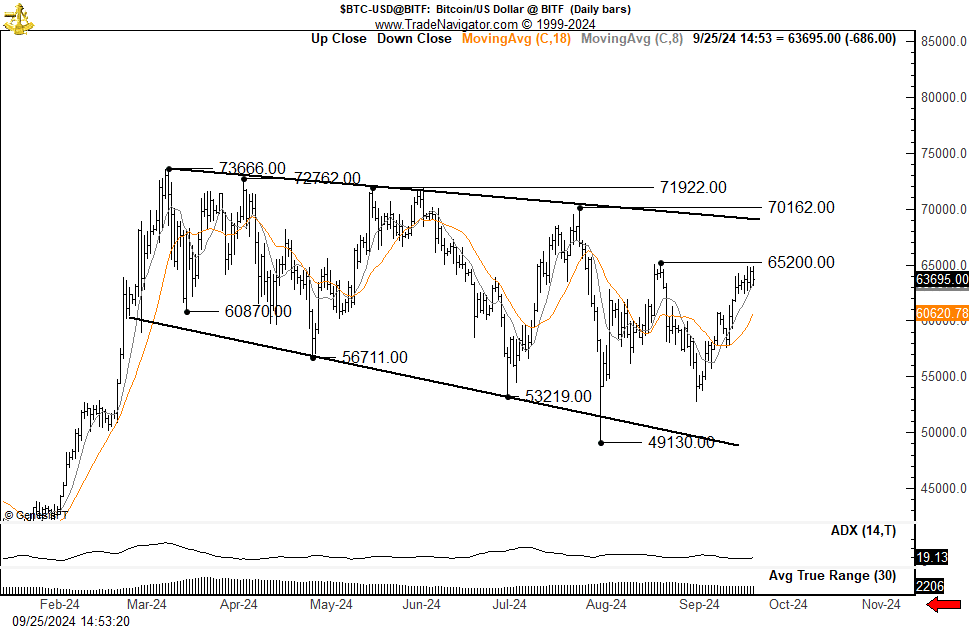

Crypto analyst Peter Brandt notes that Bitcoin is in a sequence of decrease highs and decrease lows, which might proceed until the worth closes meaningfully above the July highs.

The present technical state of affairs might set the stage for a significant breakout or additional draw back dangers.

Increasing triangle and assist ranges

Bitcoin’s rising triangle formation displays the uncertainty out there, with growing value swings indicating growing volatility. Traditionally, such patterns have usually preceded sharp strikes, both up or down.

Bitcoin’s decrease certain round $49,130 and former lows of $53,219 are essential assist ranges to keep watch over. A break under these factors might point out additional draw back dangers, probably main to greater losses.

Supply:

On the time of writing, Bitcoin was buying and selling round $63,838.14with a slight enhance of 0.01% within the final 24 hours and a rise of two.85% within the final week.

The market stays tense and ready for a decisive transfer as the worth hovers close to crucial resistance ranges.

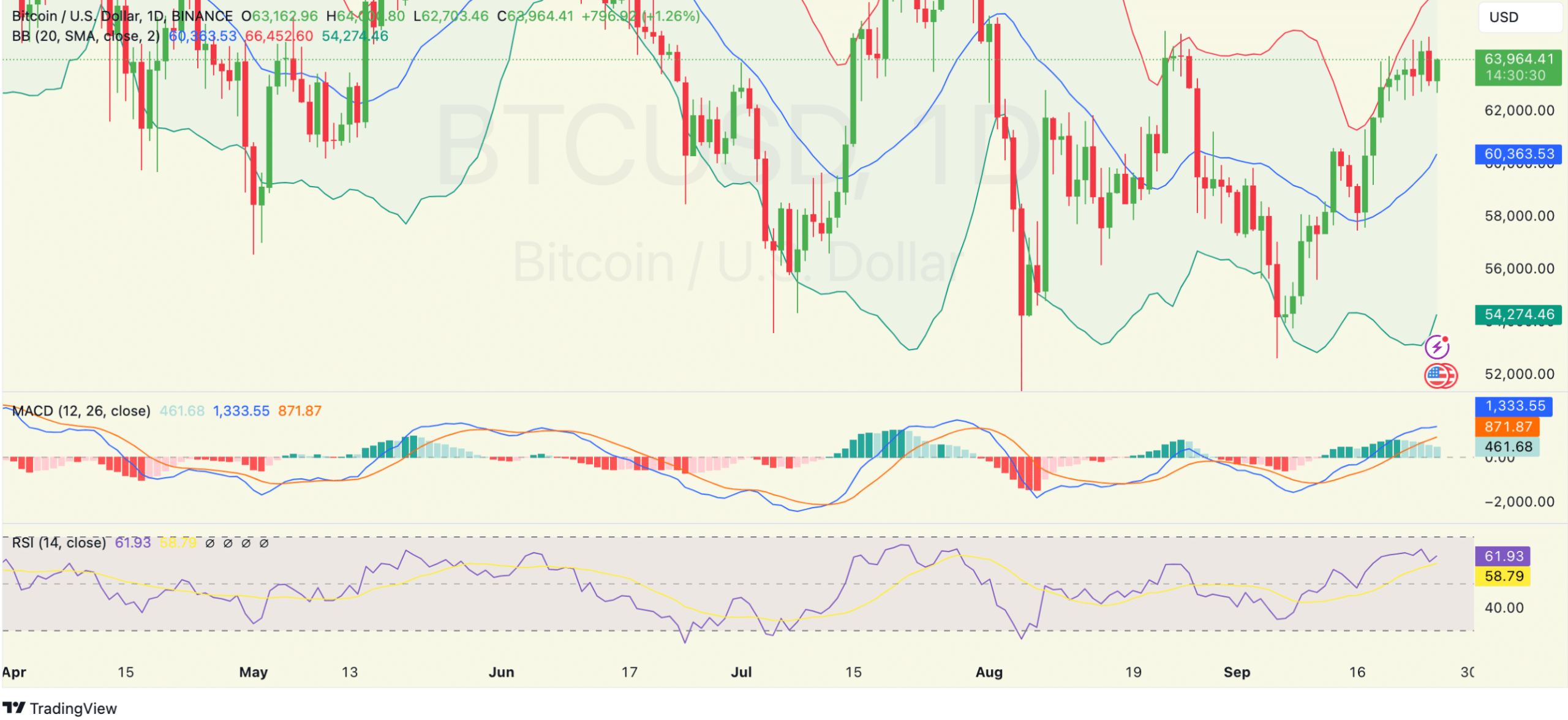

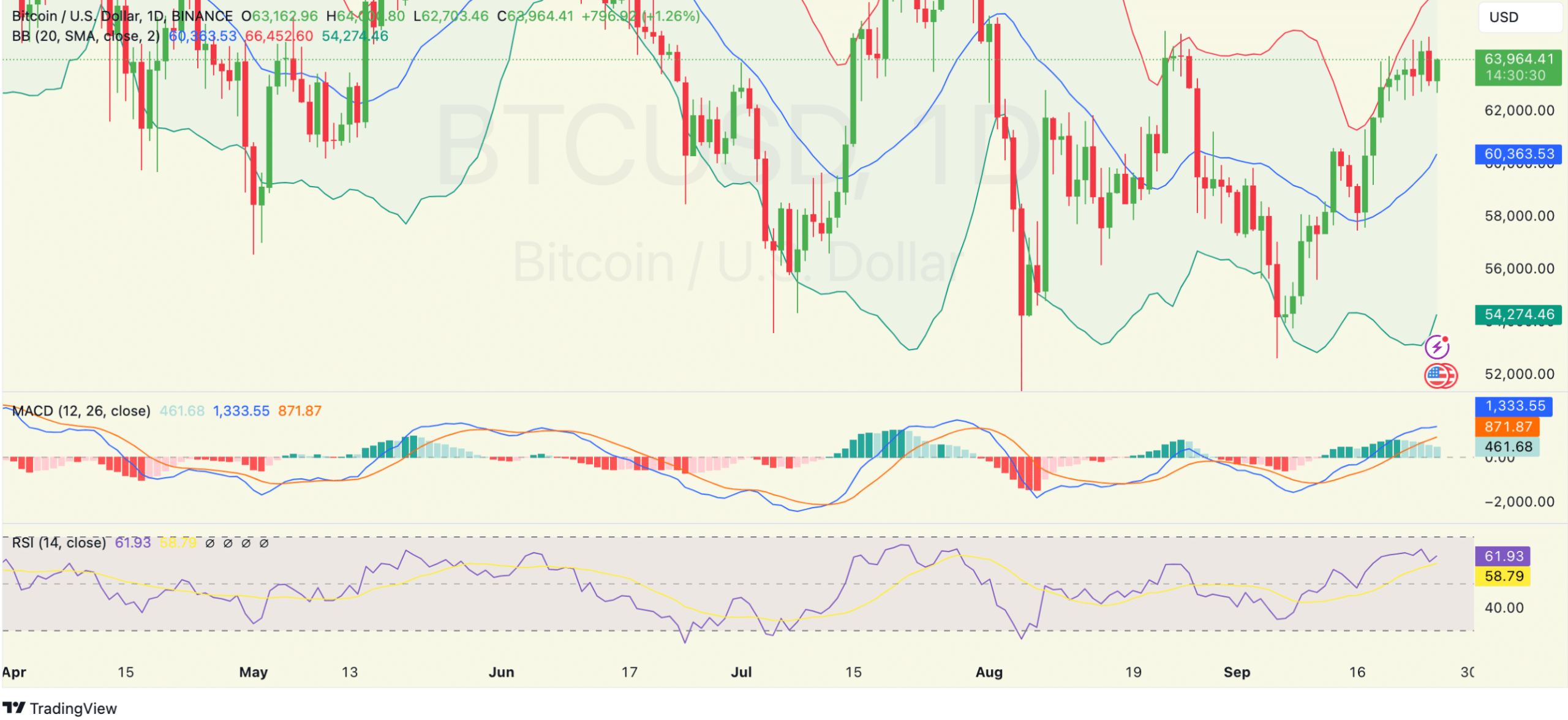

Bollinger bands and momentum indicators

The worth motion is consolidating close to the higher Bollinger Band, indicating Bitcoin testing resistance round $63,800.

The widening of the vary signifies a possible enhance in volatility, which is usually noticed earlier than a big market transfer. If Bitcoin manages to keep up momentum above this resistance, it might sign additional upside.

Conversely, the shortcoming to maintain this degree might end in a pullback to the mid-band close to $60,355.

Supply: TradingView

Momentum indicators, such because the MACD, present a bullish stance, with the MACD line above the sign line and in constructive territory.

Nevertheless, the declining histogram bars point out a slowdown in bullish momentum, growing warning amongst merchants.

A possible bearish crossover might function an early warning of a reversal, making these technical indicators price holding a detailed eye on.

The Relative Energy Index (RSI) is presently round 61, which signifies that Bitcoin is in bullish territory, however not but overbought.

This implies that there’s room for additional value appreciation earlier than an overbought state of affairs happens, which normally results in revenue taking.

Ought to the RSI rise above 70, merchants may even see elevated promoting strain, probably resulting in a value decline.

Bitcoin Earnings Close to Peak?

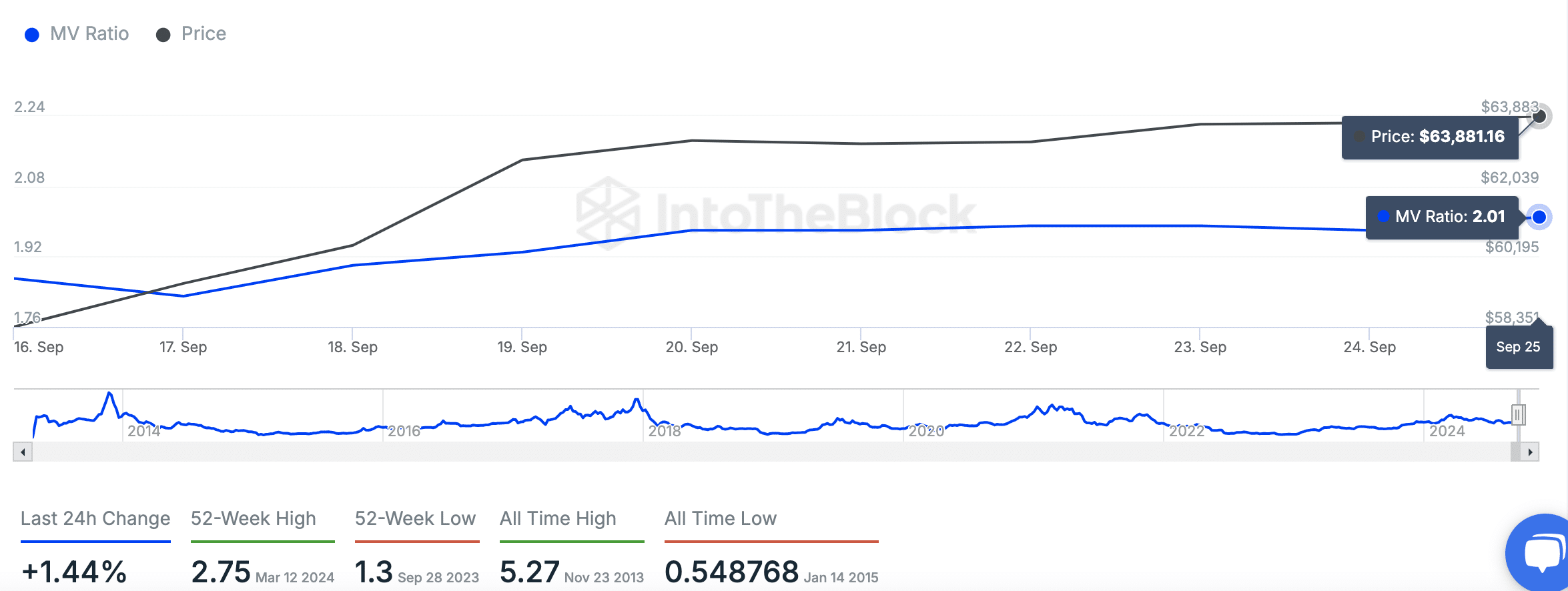

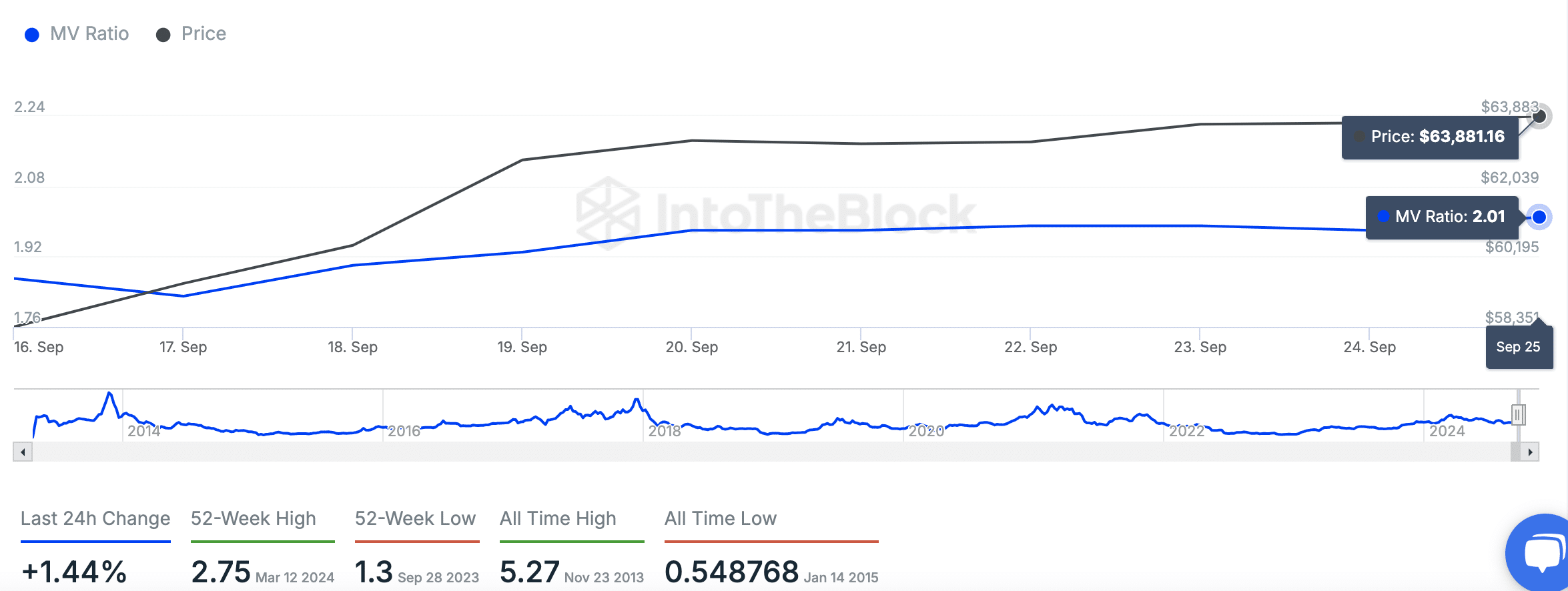

On-chain information reveals that Bitcoin’s MVRV ratio is 2.01, indicating that its market worth is double its realized worth.

Learn Bitcoin’s [BTC] Value forecast 2024–2025

This ratio is rising, indicating that holders are making growing income, which might result in promoting if the ratio continues to rise.

Supply: IntoTheBlock

Nevertheless, with the MVRV nonetheless under its 52-week excessive of two.75, there stays room earlier than a traditionally important degree of profit-taking is reached.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now