Bitcoin

Bitcoin’s historic correlation reveals why BTC can rally beyond $100K

Credit : ambcrypto.com

- Analysts consider that BTC could also be on the cusp of a significant rally, citing historic on-chain indicators.

- Nevertheless, revenue taking continues to exert downward strain, limiting rapid good points.

Bitcoin [BTC] has delivered a powerful efficiency, posting a month-to-month achieve of 46.59% and growing its market cap to $1.94 trillion.

But momentum has waned and there’s no clear market route but. Over the previous 24 hours, the BTC value has risen by 0.80%, placing it in a consolidation part.

AMBCrypto’s evaluation means that whereas BTC has a range-bound value, historical past reveals that it tends to interrupt larger as soon as market sentiment improves.

BTC nonetheless has room for a rally

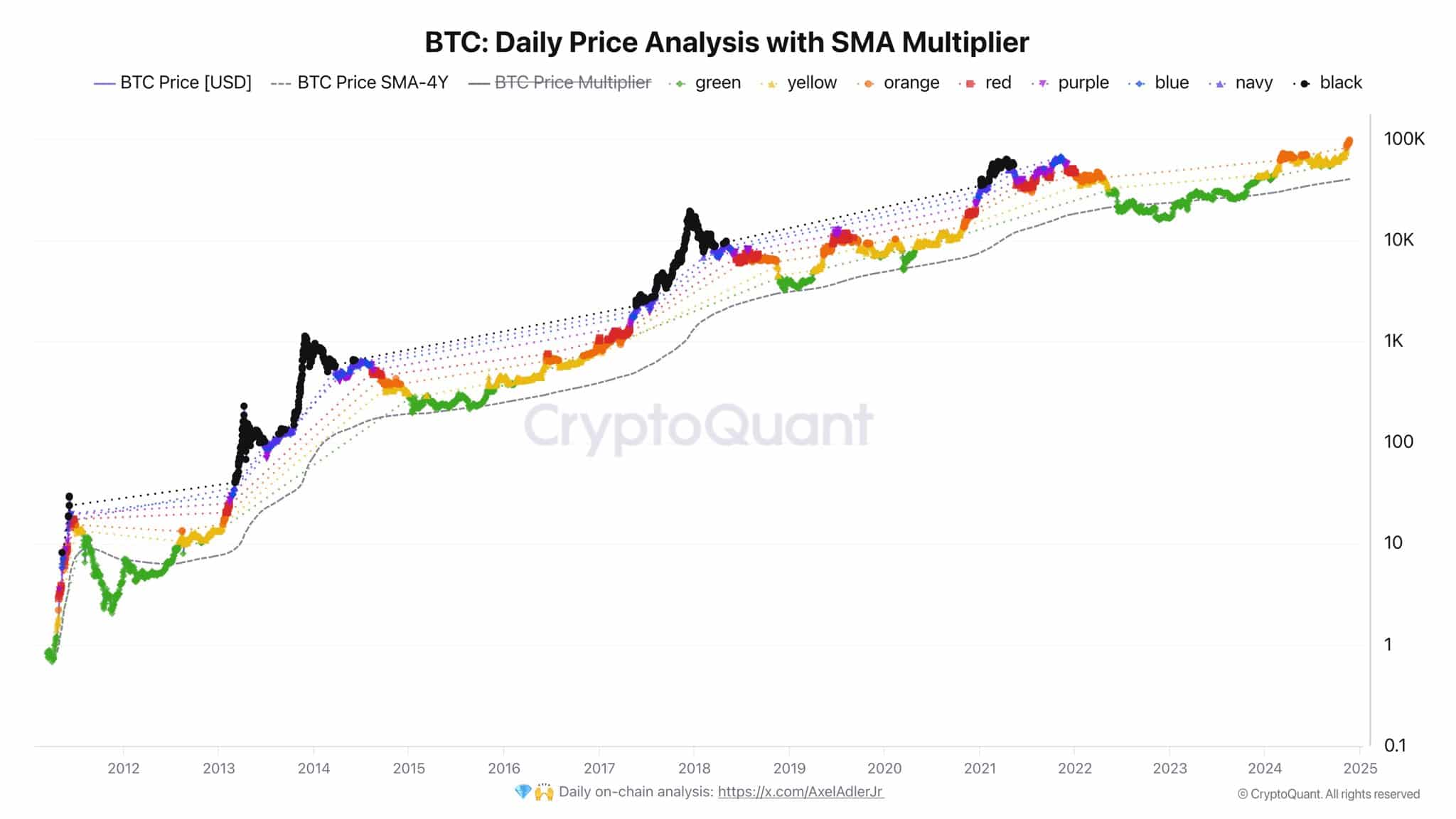

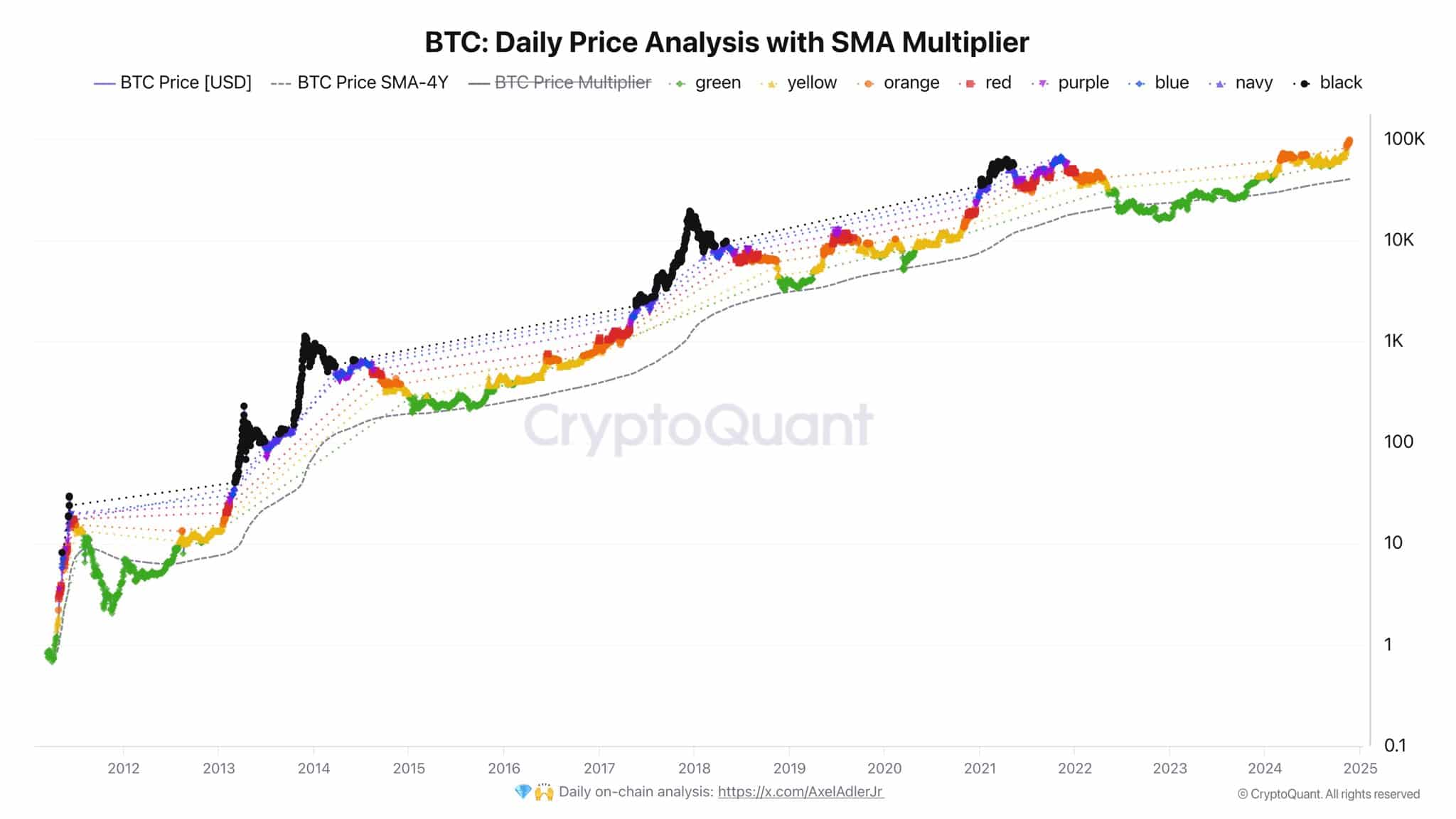

In keeping with one chart shared by Alex Adler Jr. Bitcoin has but to achieve its cyclical peak.

The chart examines BTC’s efficiency utilizing the Easy Shifting Common (SMA) Multiplier, a device designed to trace value traits throughout market cycles.

The evaluation makes use of color-coded zones – starting from inexperienced (starting of the cycle) to black (high of the cycle) – to depict Bitcoin market sentiment throughout completely different phases, from accumulation to peak hypothesis.

In his message, Adler acknowledged:

“The orange dot has arrived. Purple, purple, blue, navy and black are coming.”

Supply:

Which means BTC continues to be removed from the height of its cycle, with 5 extra phases forward. Traditionally, these phases observe a predictable sample, with the ultimate “black” part marking the start of a decline.

If this sample holds, BTC might surpass the long-awaited $100,000 goal that has captured the market’s consideration.

AMBCrypto explored further insights into why, regardless of these promising numbers, Bitcoin has but to completely notice its rally.

Revenue-taking slows BTC’s rally

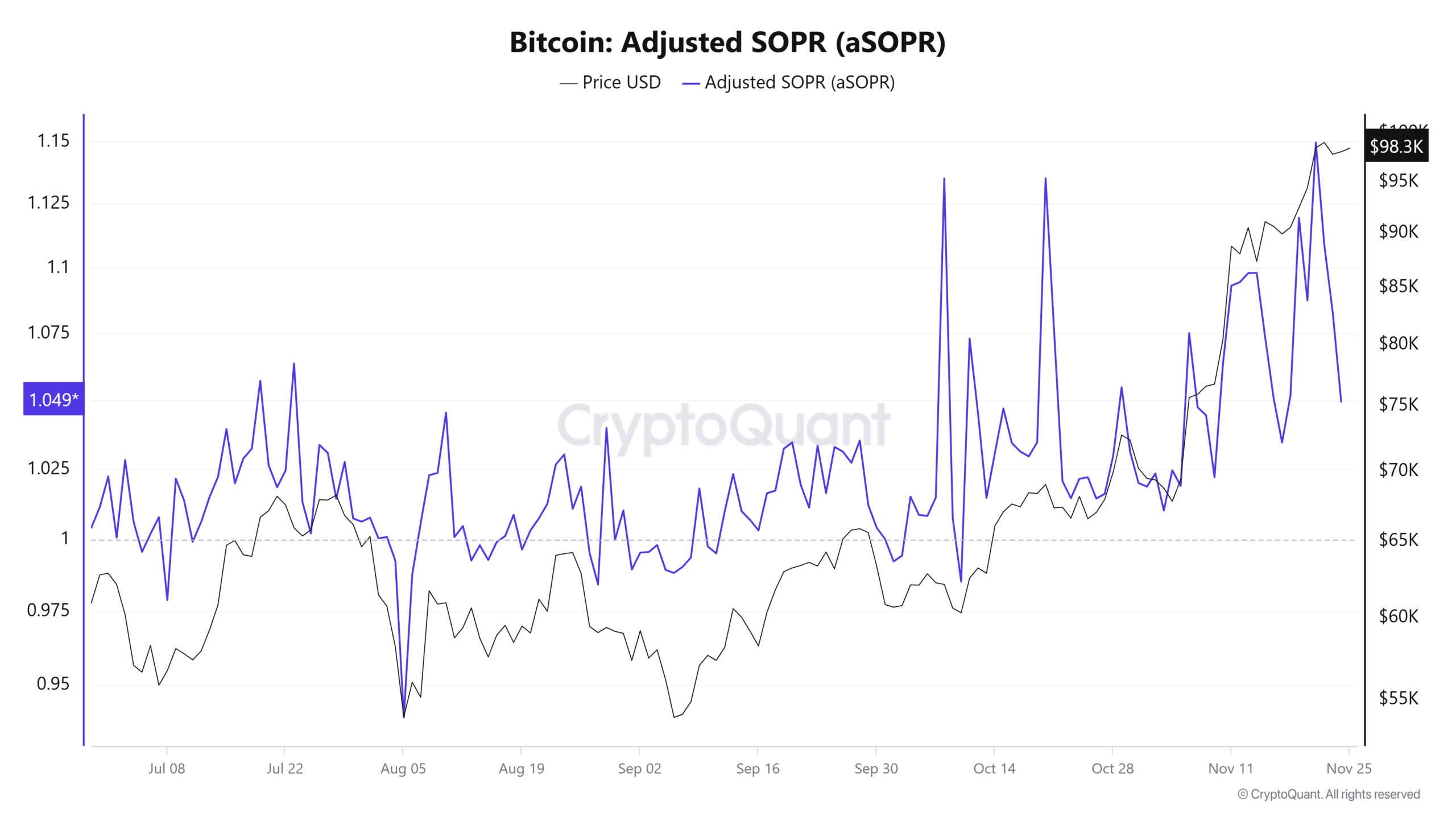

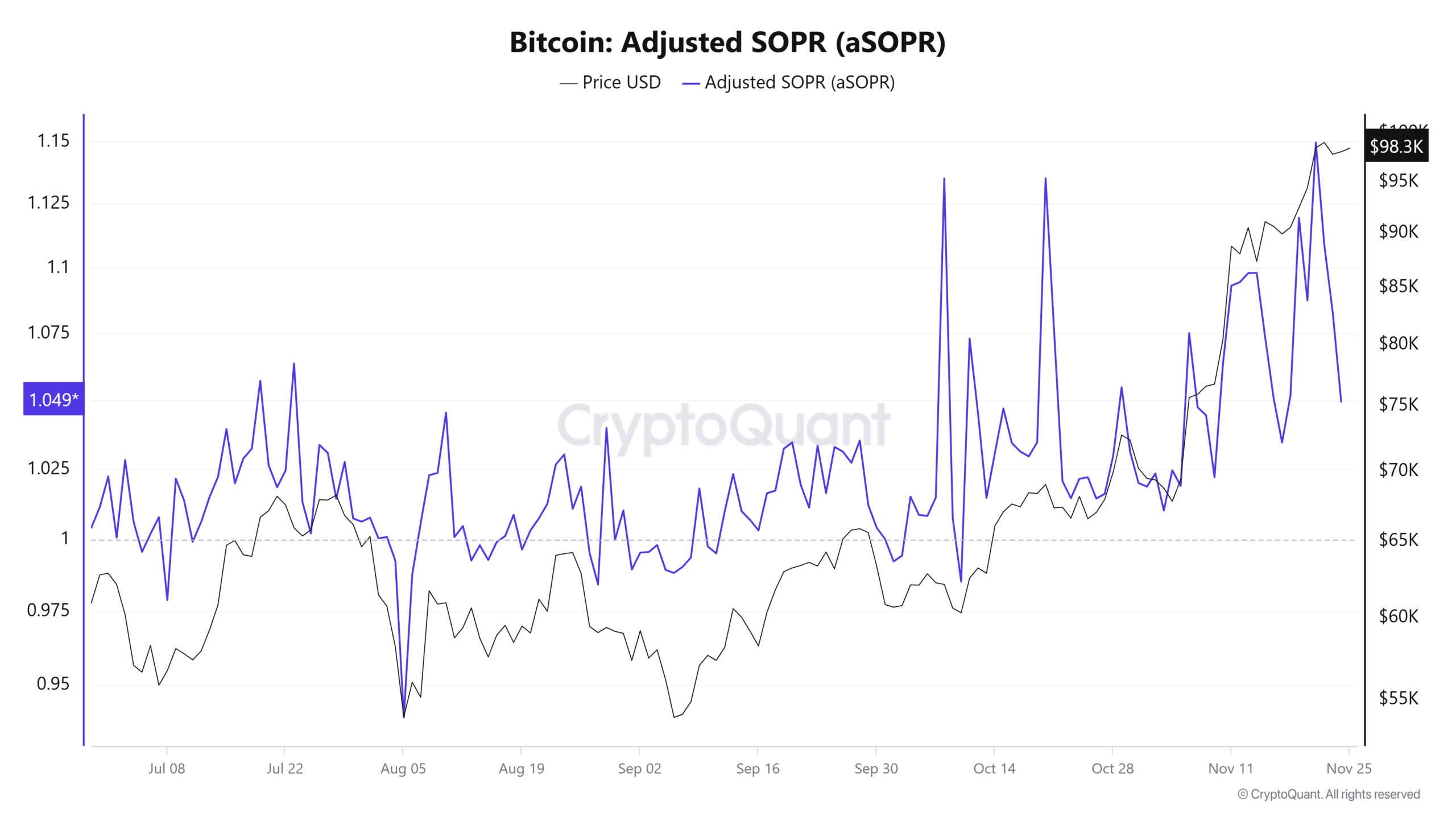

CryptoQuant’s final insight reveals that elevated profit-taking exercise is weighing on Bitcoin’s (BTC) value momentum, stopping it from making vital upward strikes.

The Adjusted Spent Output Revenue Ratio (aSOPR), which measures whether or not buyers promote their BTC shares at a revenue or loss, stood at 1.049 on the time of writing.

A worth above 1 signifies that buyers offered at a revenue, and this has put strain on the value of BTC, slowing the rally.

Supply: Coinglass

Moreover, the Take Purchase/Promote Ratio, an indicator of whether or not consumers or sellers dominate the market, stood at 0.963 on the time of writing.

This means that the promoting quantity is bigger than the shopping for quantity, additional slowing BTC’s upward motion.

Traders be sure that BTC doesn’t fall

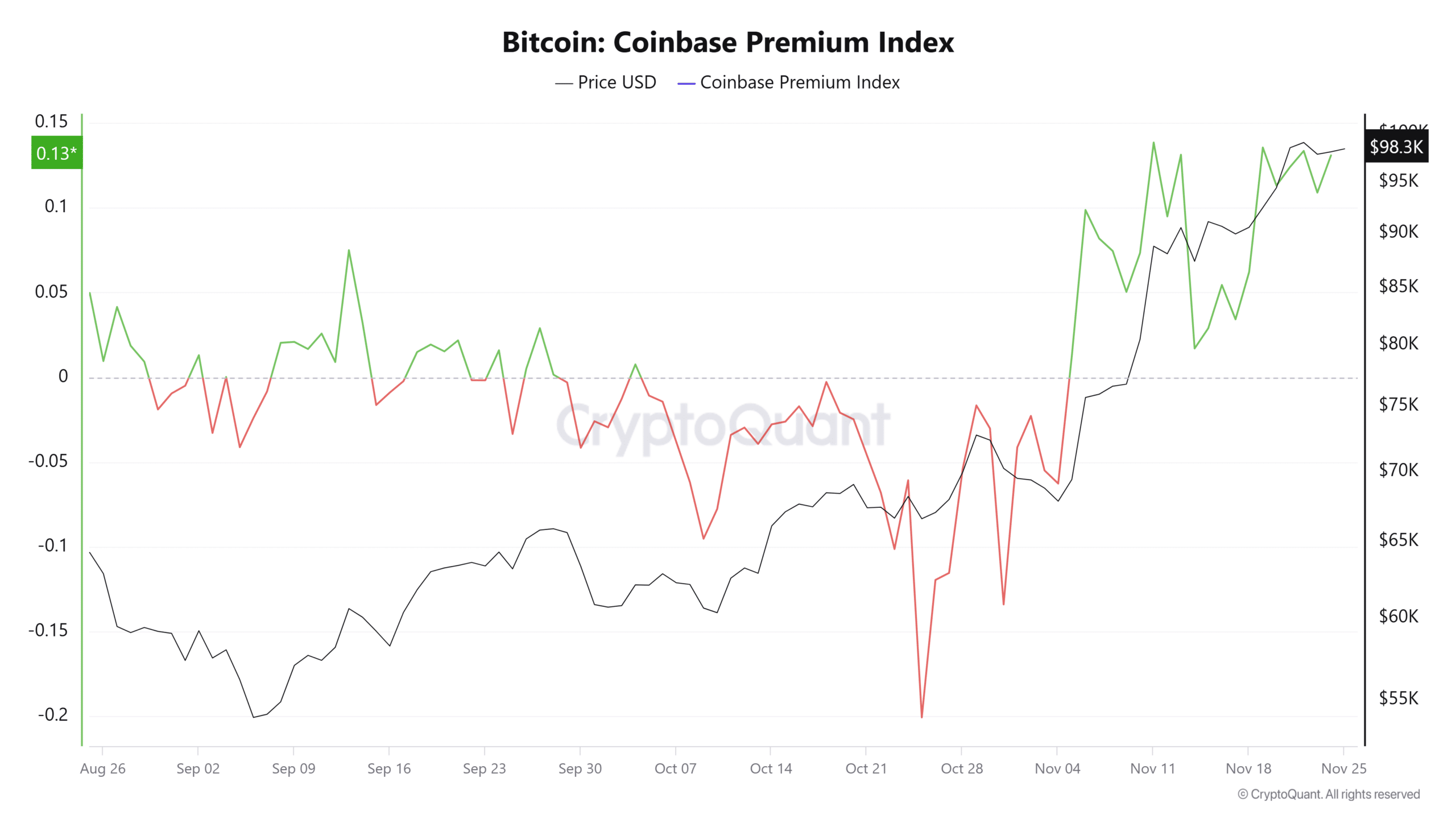

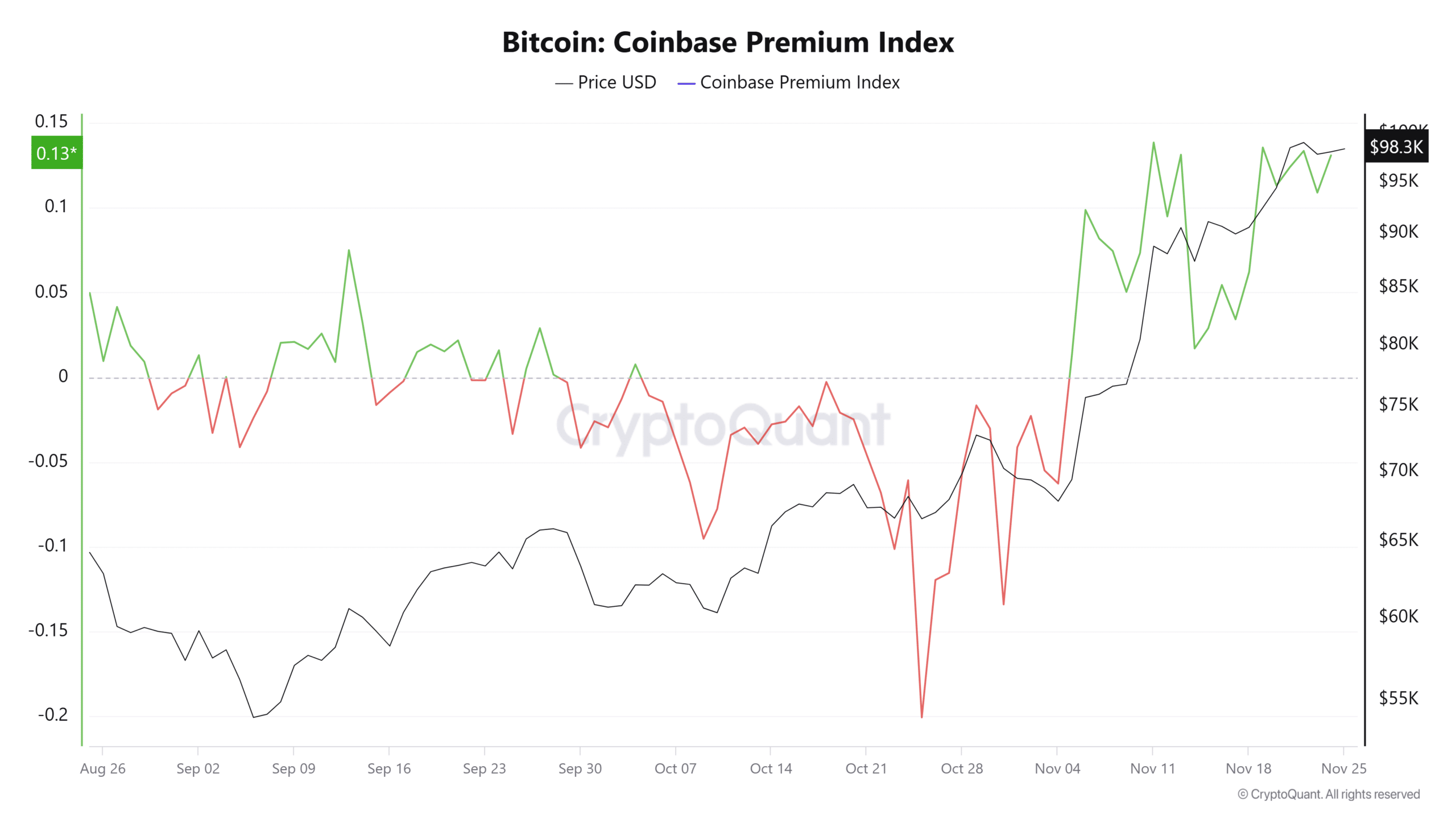

CryptoQuant reviews that US buyers have been actively shopping for Bitcoin (BTC) in current days.

The Coinbase Premium Index, which measures the value distinction between BTC on Coinbase and Binance, has moved larger to 0.1308. That is near the November excessive of 0.1384.

Supply: Coinglass

Learn Bitcoin’s [BTC] Worth forecast 2024–2025

A constructive studying of this index – above zero – signifies stronger shopping for exercise from US buyers in comparison with different markets.

This elevated demand has helped stabilize the value of BTC and stop additional declines.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024