Bitcoin

Bitcoin’s long % rises, despite price correction — What else to watch for a bounce?

Credit : ambcrypto.com

- Bitcoin’s lengthy proportion started to rise as the worth fell, leaving longs trapped

- Demand for Bitcoin soared as funding charges remained constructive regardless of the dip

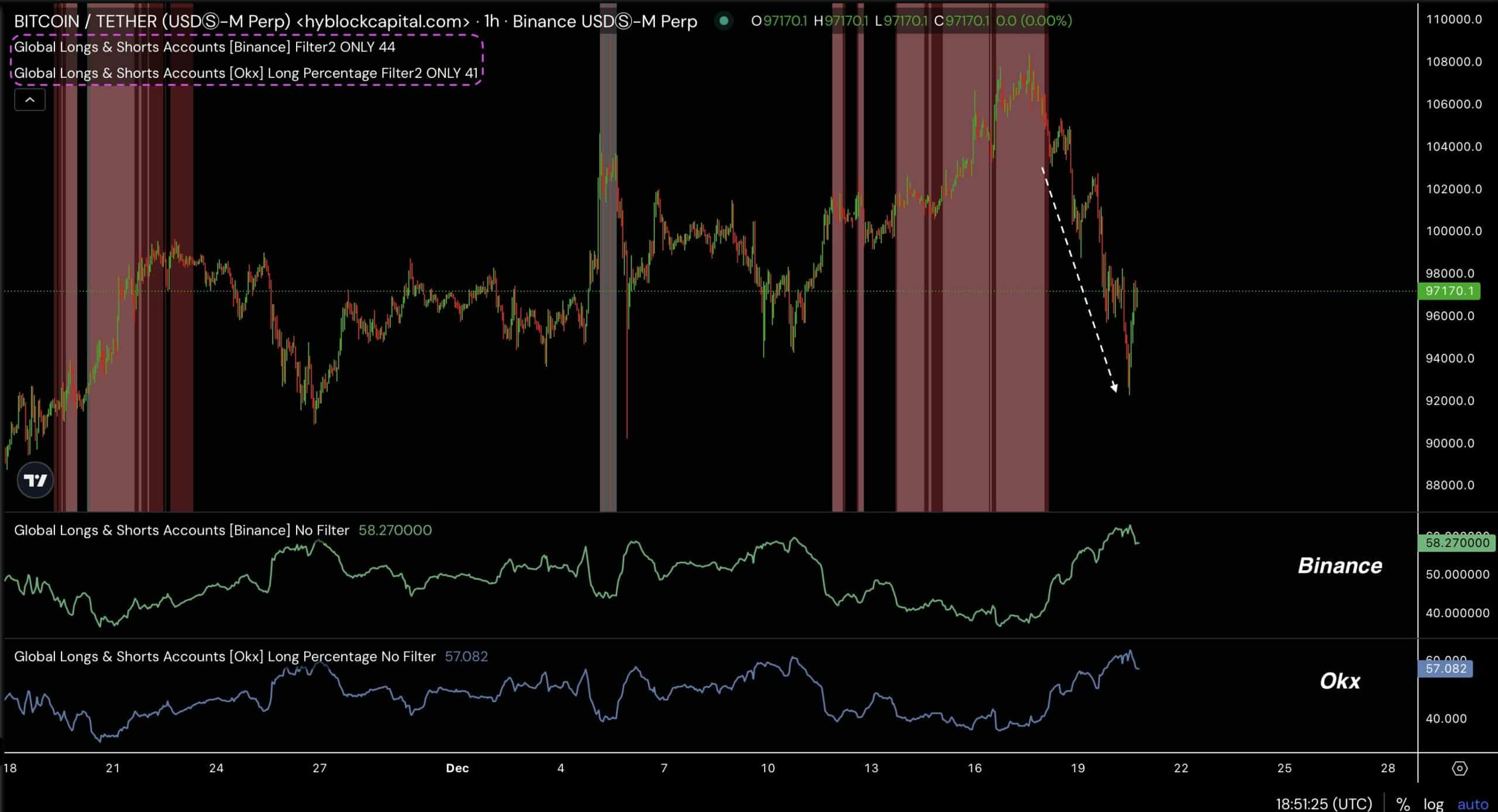

Bitcoin (BTC) noticed a surge in lengthy positions at the same time as its worth fell sharply, suggesting its merchants had been in an extended entice. The truth is, the share of longs on Binance and OKX escalated considerably as the worth of BTC fell to a low of virtually $92,000.

This development signaled an impending reversal, one the place the extreme bullish sentiment might reverse itself, resulting in a potential worth restoration as shorts are available in and longs exit.

Supply: Hyblock Capital

These cycles usually precede important market reversals. The downturn would place BTC for some restoration as lengthy charges peak and start to say no.

This could point out a shift in sentiment, doubtlessly trapping quick positions. Right here it’s price noting that other than the lengthy proportion improve, BTC additionally confirmed different indicators of restoration on the charts.

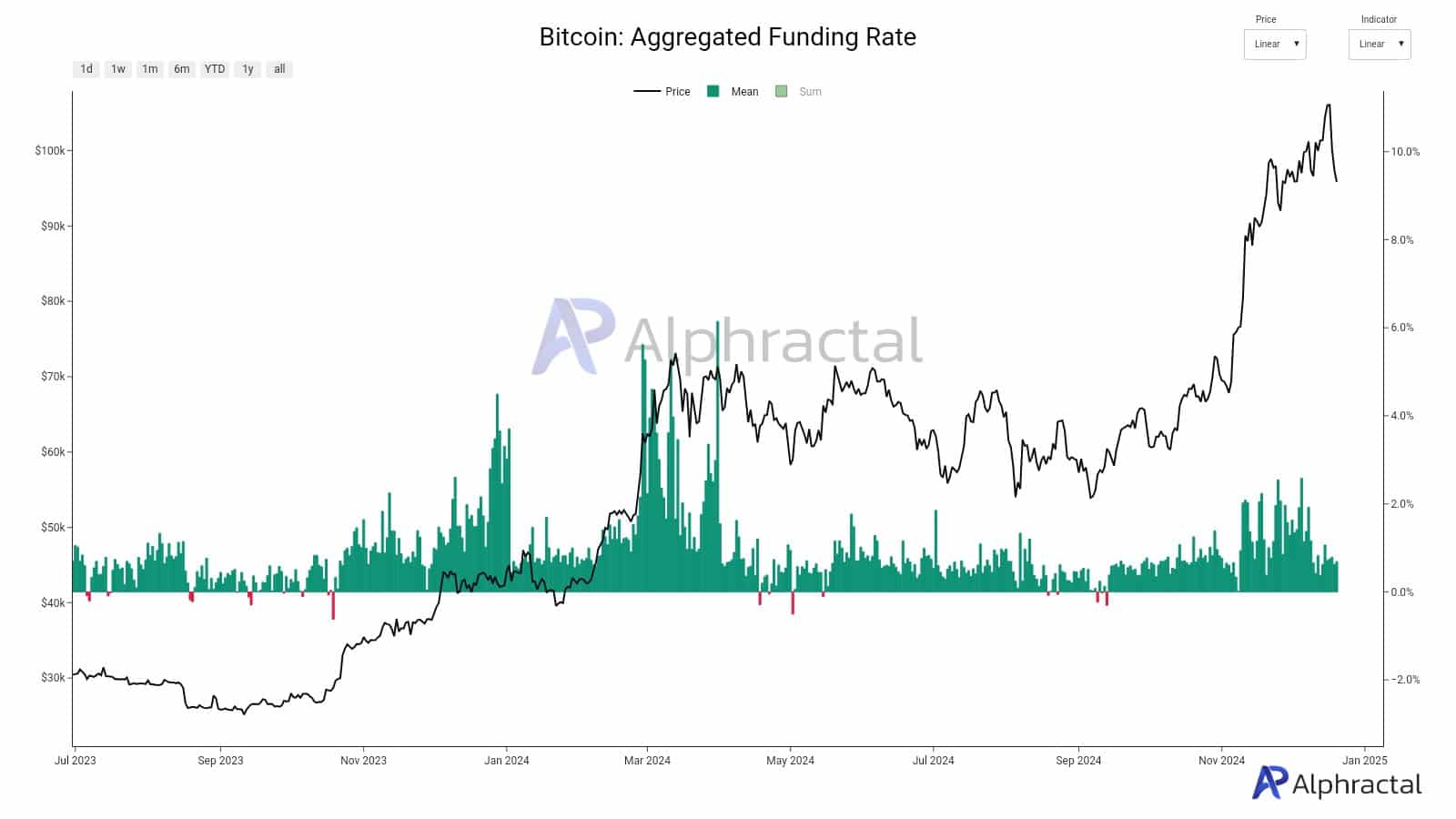

Bitcoin’s funding charge

The general funding charge noticed a pointy improve as the worth escalated – an indication of robust bullish sentiment. Subsequently, the funding charge remained excessive whereas the worth of Bitcoin started to say no – indicating an overloaded market.

Merchants seemingly entered lengthy positions throughout the charge hike, and the market’s lack of ability to maintain larger shopping for strain resulted in a correction.

Supply: Alpharactal

The pullback might have spurred profit-taking or pushed shorts to benefit from the excessive funding ratio, creating promoting strain.

However, the continued constructive funding charge indicated underlying market confidence, though warning could also be warranted. If the financing charge maintains or reverses itself, it could sign potential market actions. Stabilization or a reversal within the funding charge might decide Bitcoin’s trajectory within the close to time period.

Demand meets brick wall

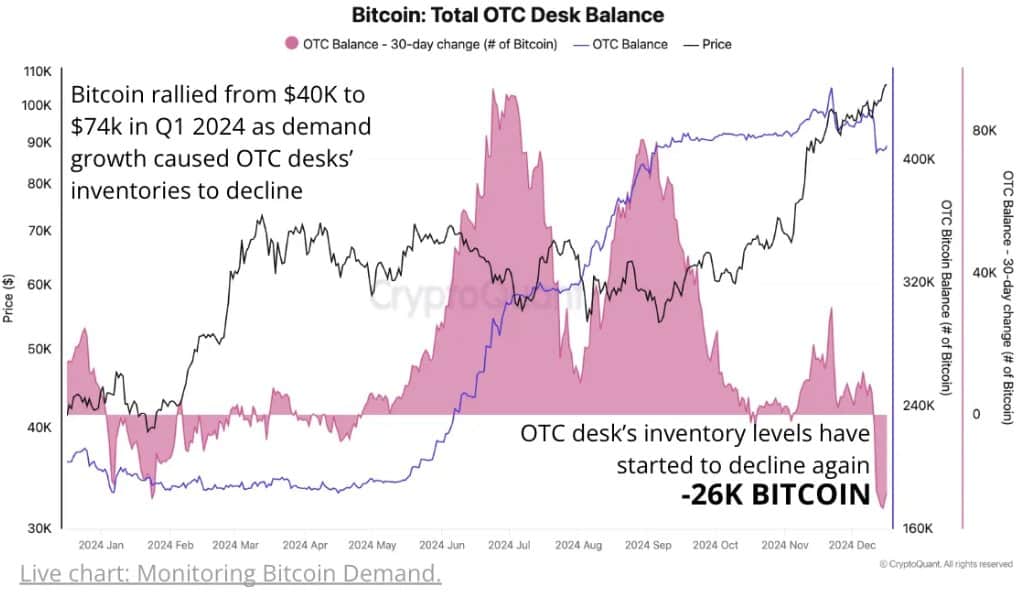

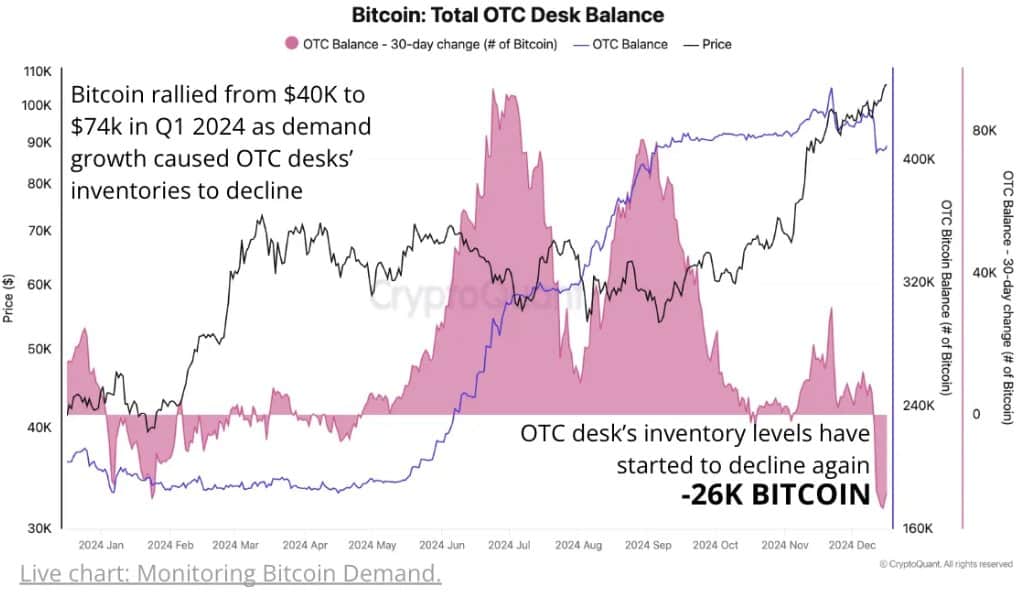

Bitcoin rallied considerably, rising from $40,000 to $74,000 by the tip of the primary quarter of 2024.

This improve was pushed by growing demand, as evidenced by important stock declines at over-the-counter (OTC) buying and selling desks. Throughout this era, OTC desks reported their greatest month-to-month stock decline of the 12 months, with a drop of 26,000 BTC – an indication of tighter provide.

Supply: CryptoQuant

The entire stability at OTC counters additionally decreased by 40,000 BTC as of November 2020, additional indicating declining provide amid rising demand.

The drop in OTC balances alongside the worth improve may be seen as a robust signal of robust momentum. The connection additionally indicated that if OTC stock ranges proceed to say no, Bitcoin’s worth might escalate additional. Particularly if demand continues.

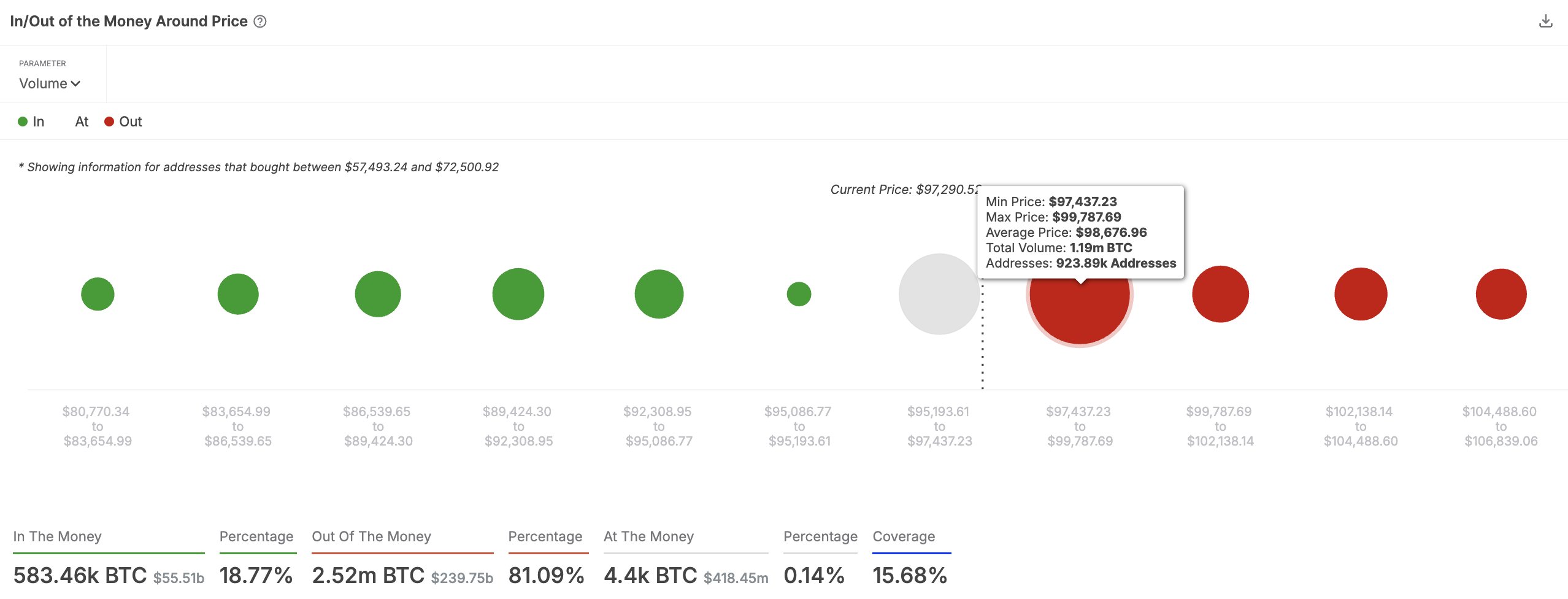

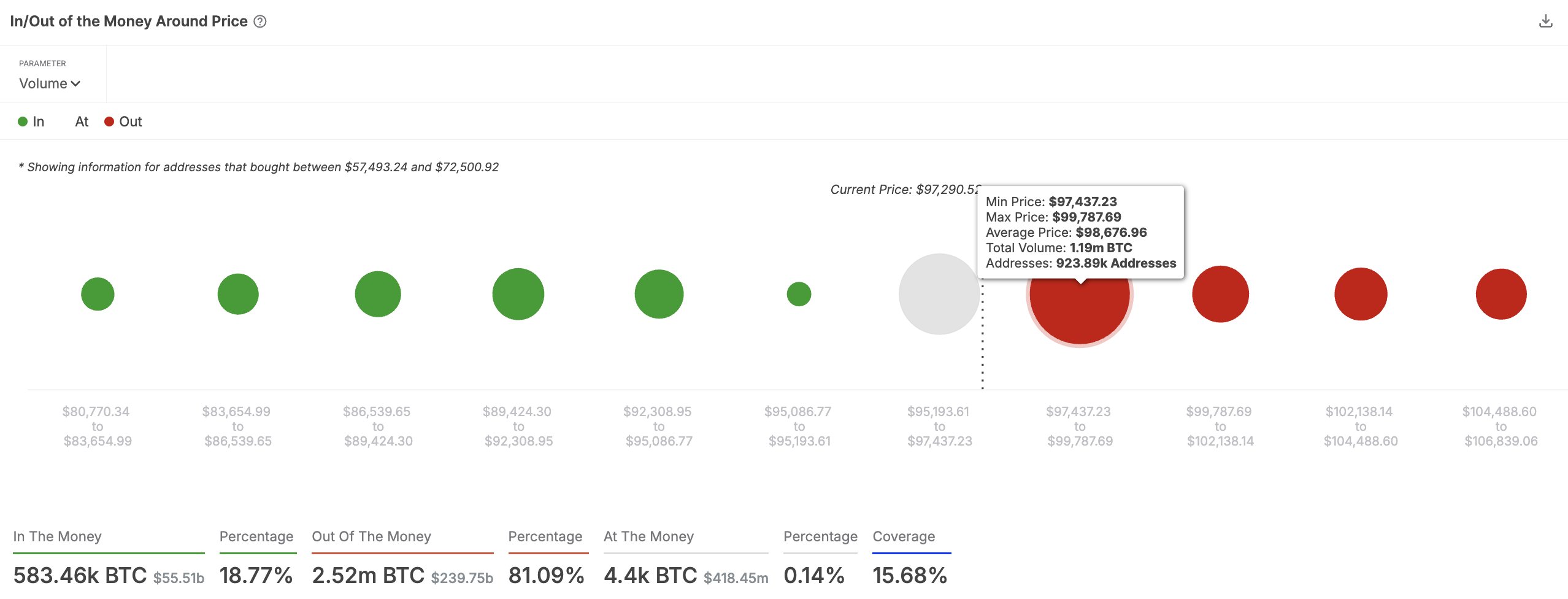

Nevertheless, demand would face key resistance between $97,500 and $99,800, with 924,000 wallets holding over 1.19 million BTC.

Supply: IntoTheBlock

If Bitcoin breaks above this resistance, there could also be potential for reaching new ATHs. Crossing the barrier would imply robust shopping for momentum, doubtlessly shifting the stability from bearish to bullish sentiment.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September