Bitcoin

Bitcoin’s market uncertainty: Key factors driving BTC’s movements

Credit : ambcrypto.com

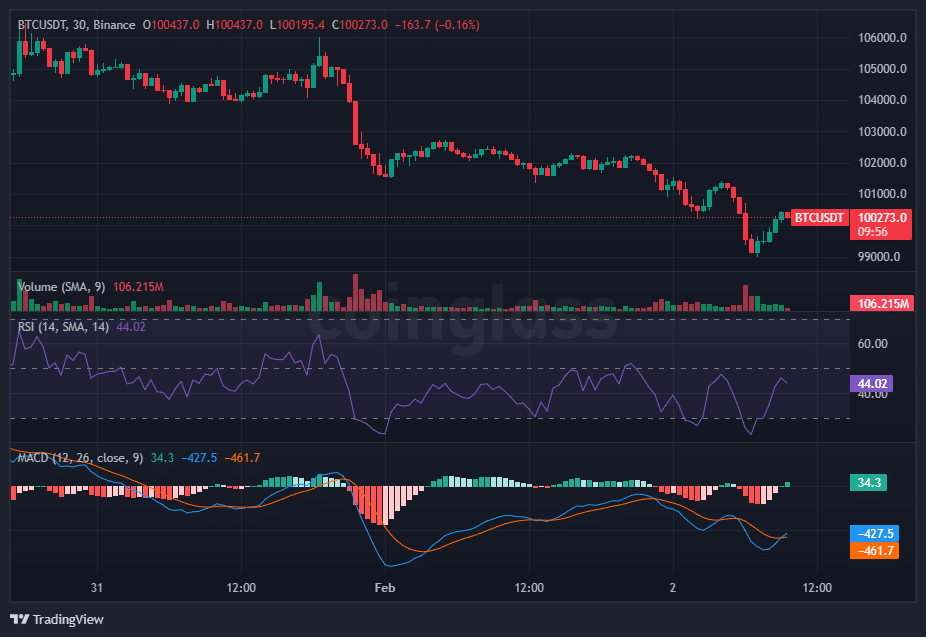

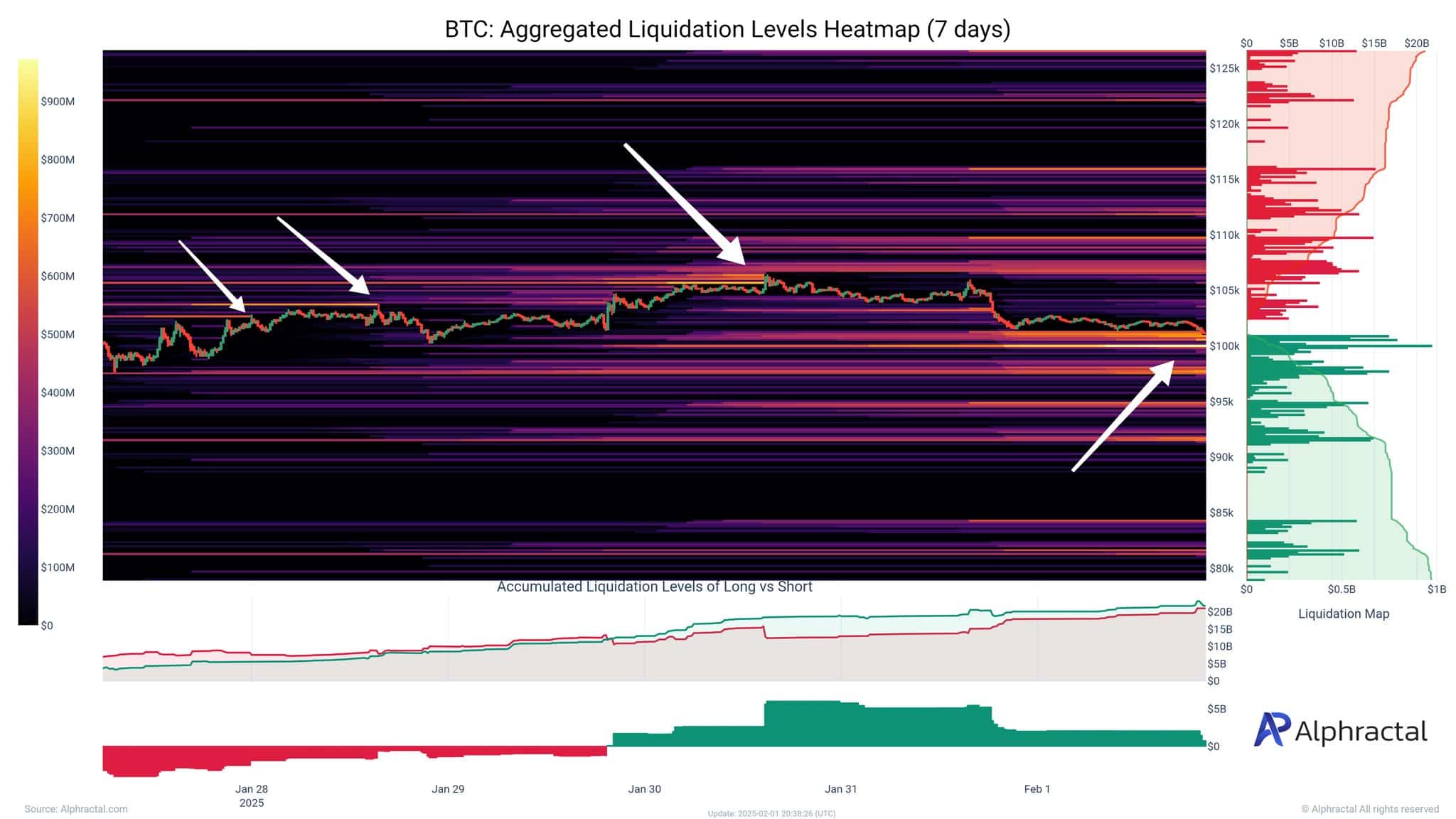

- The market has witnessed intense liquidation exercise, with the best focus between $ 101,500 and $ 99,800.

- The present distribution of Bitcoin holders gives perception into potential market developments.

Bitcoin’s [BTC] Current value fluctuations have caught the eye of merchants as volatility intensifies, which results in a rise in liquidations.

Whereas market members navigate by means of these fast value modifications, numerous vital elements type the Bitcoin course of.

Bitcoin’s value efficiency and key ranges

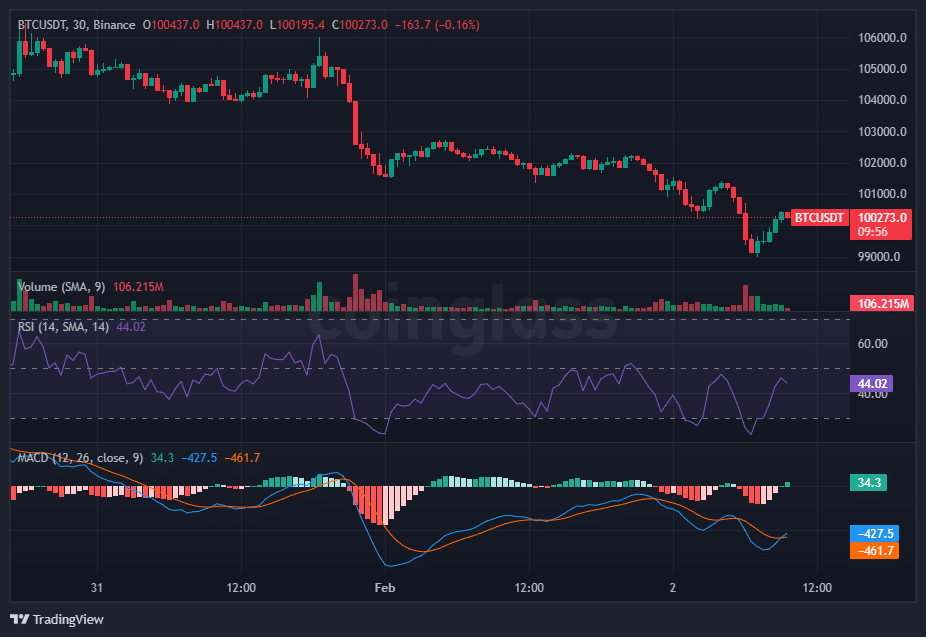

Ambcrypttos’s view of the worth of BTC confirmed a latest downtrend adopted by a small restoration. The worth has fallen significantly, however tried a strout of the extent of $ 99,000 and traded at $ 100.273 on the press.

Supply: Coinglass

The RSI was additionally at 44.02, which signifies impartial momentum however approached over -selling ranges.

The MACD histogram, then again, turned much less destructive, suggesting a possible bullish crossover, however the sign line remained underneath the zero line, which signifies that the downward development had not but been utterly reversed.

The quantity is enriched through the sale however stays comparatively decrease on the bounce. Usually, though there’s a small restoration, the development continues to be bearish

Tradent Intiment and Market Response

The market has witnessed intense liquidation exercise, with the best focus between $ 101,500 and $ 99,800.

This zone represents the utmost ache, the place each lengthy and brief positions with an accelerated velocity are liquidated.

Supply: Exhaustal

The fast settlement of positions has strengthened value instability, in order that merchants can re -assess their methods.

Because the liquidity is absorbed throughout these liquidation occasions, surprising value fluctuations develop into extra frequent, which strengthens the significance of threat administration in such risky circumstances.

Positioning of buyers and market affect

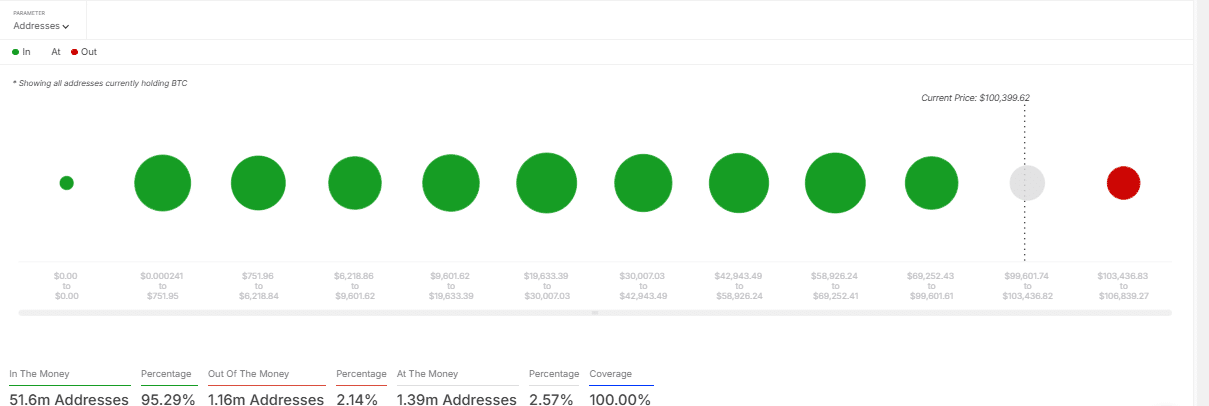

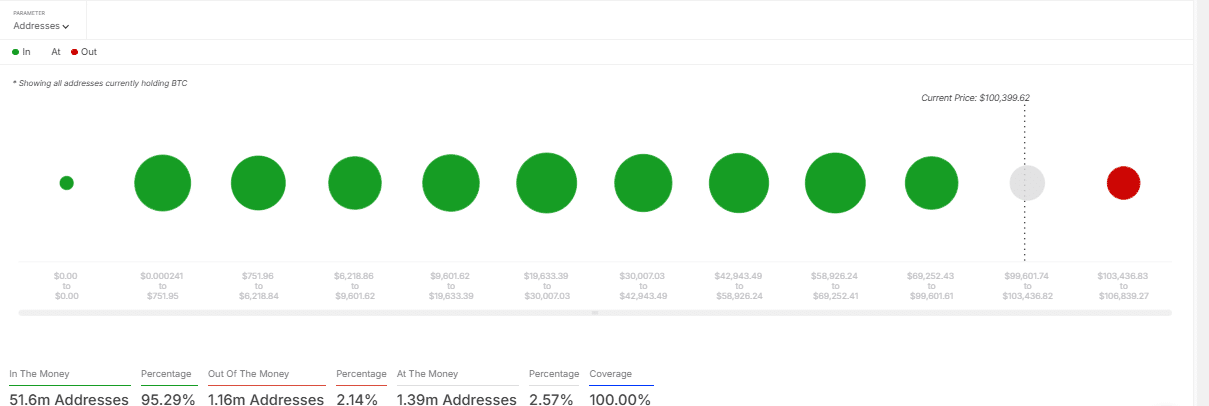

Bitcoin’s present distribution of holders offered perception into potential market developments. On the time of the press, 95.29% of the Bitcoin addresses, or 51.6 million, remained revenue.

Within the meantime, 1.16 million addresses have been “out of cash”, whereas 1.39 million have been “with the cash”.

Supply: Intotheblock

With most buyers who sat on non-realized revenue, the market sentiment remained secure, however taking a revenue may introduce the gross sales strain.

Learn Bitcoin’s [BTC] Value forecast 2025–2026

If a major a part of the worthwhile holders decides to go away their positions, Bitcoin could be confronted with further downward motion, making help ranges much more vital within the upcoming classes.

The worth actions of Bitcoin stay very reactive to market situations, with liquidation patterns, volatility ranges and buyers positioning that play an important function.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now