Bitcoin

Bitcoin’s new rally in waiting? Unraveling 3 key signals

Credit : ambcrypto.com

- Bitcoin’s 1m 25 Delta Skew fell to -6.1%, with the next demand for calls on Putten within the Possibility Market.

- Whale -exchange steadiness change fell to -49.7k BTC for 30 days, which confirms a decrease gross sales strain.

Though Bitcoin [BTC] Had problem sustaining an up -like momentum and continued to behave underneath a straight consolidation channel, the sentiment stays Bullish.

The King Coin continues to see a powerful demand from all market individuals.

Name choices Surge

In keeping with Glass nodeBitcoin’s 1m 25 Delta Skew has fallen to -6.1%, with the decision choices that now have the next implicit volatility than wells.

Supply: Glassnode

At present, 205,447.56 BTC are assigned to on -call choices – 60% of the whole. Consider solely 131,697 BTC, or 39%.

This imbalance exhibits a transparent directional bias.

When calls dominate on this means, this often displays a powerful upward conviction amongst market individuals.

Coinglass knowledge verify this development. Merchants appear prepared to pay a premium for upward publicity, positioning for a rally as a substitute of a canopy danger.

This construction sends a risk-to-signal, to help Bullish continuation.

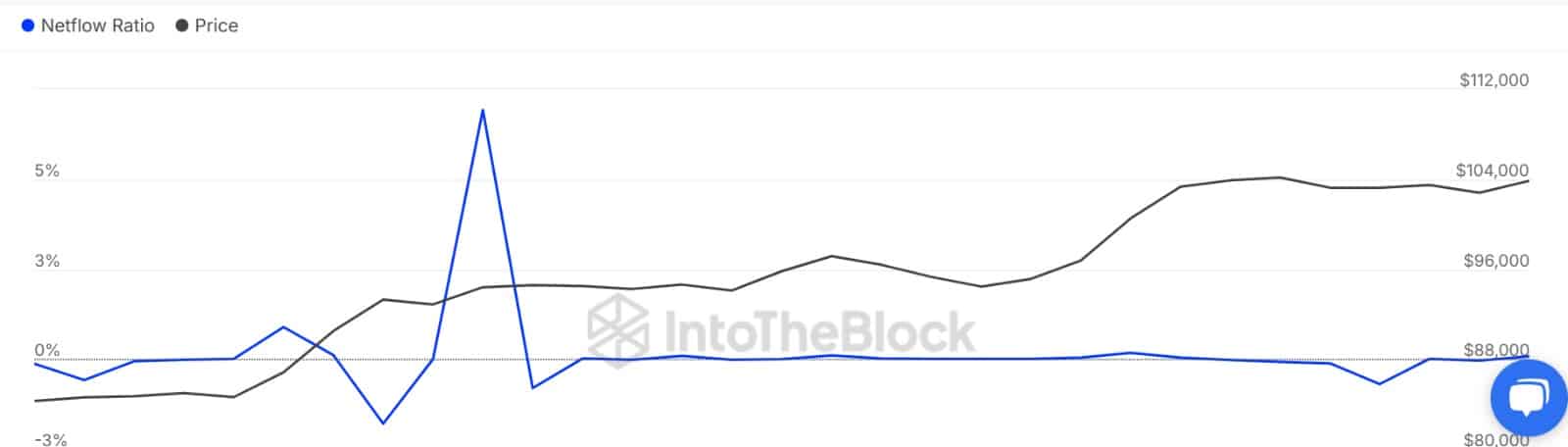

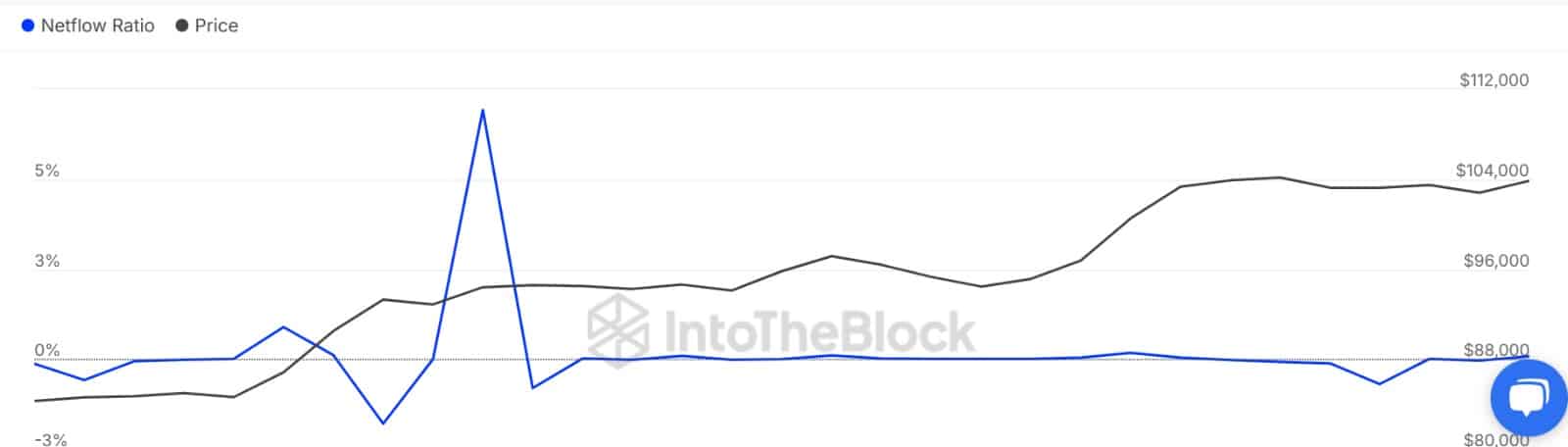

Whale accumulate if Netflows stay adverse

Supply: Coinglass

We will see this query between market individuals of each retail merchants and whales.

To start with, Bitcoin’s Spot Netflow has held within the adverse territory for the previous 5 days. It was on -$ 48.9 million on the time of the press, which displays a powerful accumulation development.

Wanting additional, this query at Bitcoin is much more aggressive amongst massive holders. Whales have collected BTC for the previous 30 days.

Thus, whale change previously months have fallen significantly. On Binance, for instance, the stain stream refused to the touch a low level of 6 months.

Supply: Checkonchain

Furthermore, altering whale change change -49.7k BTC within the final 30 days -btc, whereas massive whales (1k -10k BTC) confirmed a steadiness shift of -26k.

Merely put, whales don’t ship cash to change – they maintain.

Furthermore, the massive holders of Bitcoin to vary the Netflow ratio has fallen from 6.93% to 0.08% within the final 30 days.

This additional confirms the diminished inflow of the change of whales, as a result of they promote much less whereas they accumulate extra.

Supply: Intotheblock

What’s the subsequent step: outbreak or rejection?

With on -call choices that dominate the Futures market, this implies that buyers are bullish and count on costs to rise even additional. Merchants due to this fact not solely think about BTC, however speculators guess aggressively.

The demand for Bitcoin stays robust amongst whales and retail buyers, and positions it for doable revenue. If developments maintain, BTC can break from consolidation and attain $ 107,225.

Nevertheless, if holders make a revenue within the brief time period, this may come again to round $ 101,530.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024