Bitcoin

Bitcoin’s next move: Why corrective dip before new highs is likely

Credit : ambcrypto.com

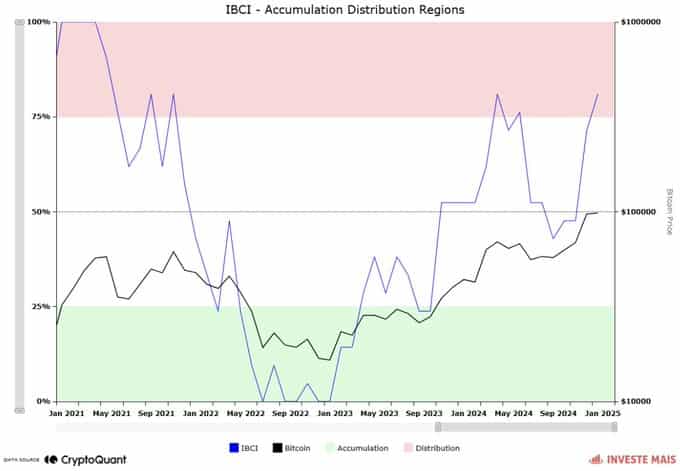

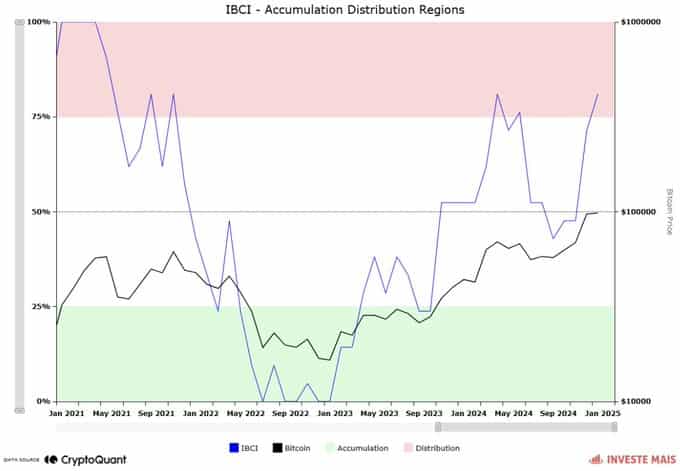

- Bitcoin cycle inducators (IBCI) have crossed a essential level on the graph, which suggests {that a} fall might be on the horizon.

- BTC has developed sturdy assist ranges that may affect a worth leap if a worth correction takes place.

Bitcoin [BTC]Within the final 24 hours, a slight lower has seen, with only one.08%. Nonetheless, it nonetheless acts above the $ 100,000 area.

Regardless of the bullish market sentiment, corrective phases are inevitable and are a part of the broader market cycle.

The evaluation of Ambcrypto confirmed {that a} corrective part may strategy and recognized vital areas that may assist a price-back in worth.

Distribution part threatens BTC

The Index of Bitcoin cycle indicators (IBCI) on Cryptoquant confirmed that it was actively launched a distribution zone, a degree that was final reached eight months in the past, in Might 2024.

IBCI is a mixture of various market indicators – in complete – together with Puell A number of, MVRV, NUPL and Sopr.

A distribution is indicated when the IBCI inserts the pink area into the graph, beginning at 75%, which implies that there’s nonetheless development potential for BTC; Nonetheless, gross sales actions have began.

Supply: Cryptuquant

As quickly as IBCI touches the 100% zone – which happens when all seven indicators begin their distribution part – BTC would attain a market prime, with its worth, decrease highlights and lows.

IBCI above 50%, the place BTC is at present positioned, suggests {that a} corrective part is anticipated earlier than BTC resumes its upward course of.

Additional evaluation of Ambcrypto recognized a probably bounced-back degree if a correction takes place earlier than the market prime is reached.

A drop to mid-$ 90k for rally

With the assistance of the in/out of cash across the worth, an on-chain statistics to find out potential assist and resistance zones on the graph, sure Ambcrypto the place a possible BTC decline could be paid by the demand for a steady motion.

This demand zone is between $ 94,800 and $ 97,000, with a central vary of $ 96,500. About 1.36 million BTC Purchase orders of 1.4 million addresses assist this attain.

Supply: Intotheblock

A corrective part on this area could be adopted by a worth die again to the $ 100,000 area, with the likelihood that BTC will set a brand new excessive from there.

Different noticed market actions may additionally play in favor of BTC for a transfer, one is to create a inventory together with BTC.

US Stockpile may stimulate BTC

The institution of an American digital belongings inventory, as introduced within the latest govt order on January 23 by President Donald Trump, may promote BTC.

Learn Bitcoin’s [BTC] Value forecast 2025–2026

A digital inventory together with BTC implies that the US authorities can preserve the cryptocurrency as a part of its reserves.

In line with Arkham, the US authorities already has round 198,000 BTC, with a worth of $ 20.71 billion. If the federal government will increase its participations, it may stimulate query and positively affect the BTC’s worth course of.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024