Bitcoin

Bitcoin’s retail demand remains flat – Here’s how it can affect BTC’s bull run!

Credit : ambcrypto.com

- Trade working climbed whereas the reserves fell

- Massive transactions have been dominant, however the retail quantity and tackle exercise appeared weak

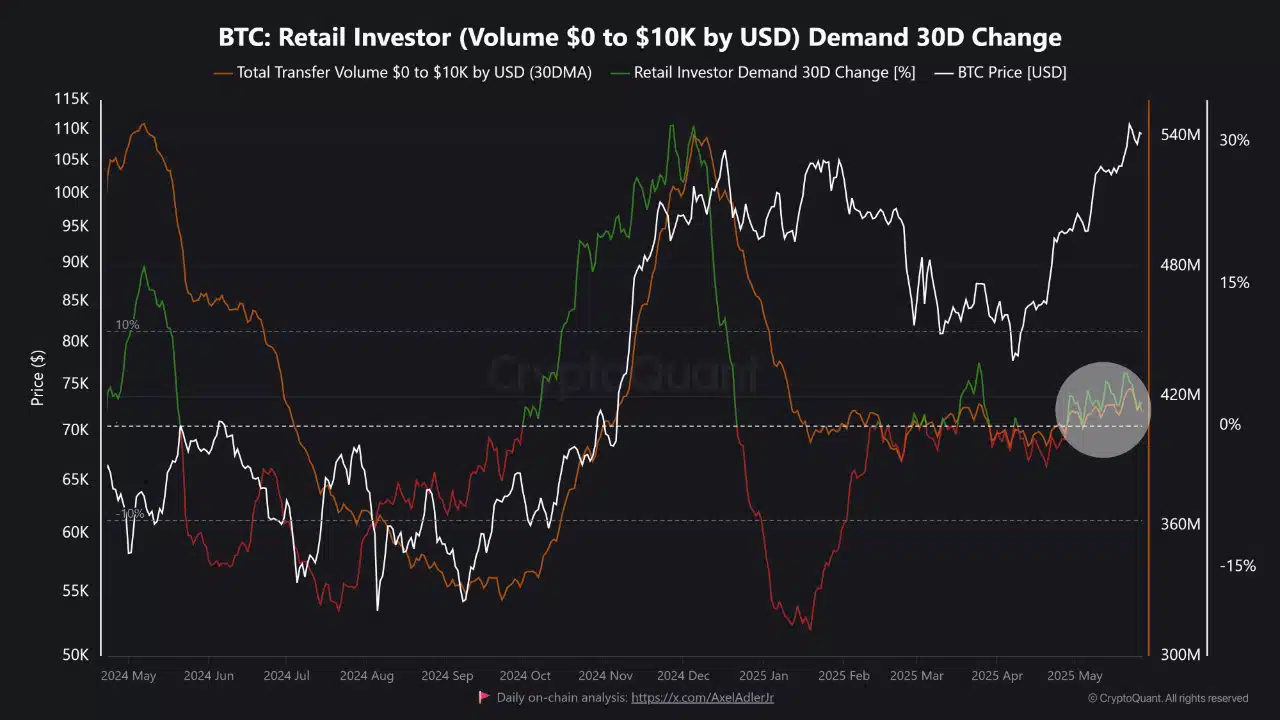

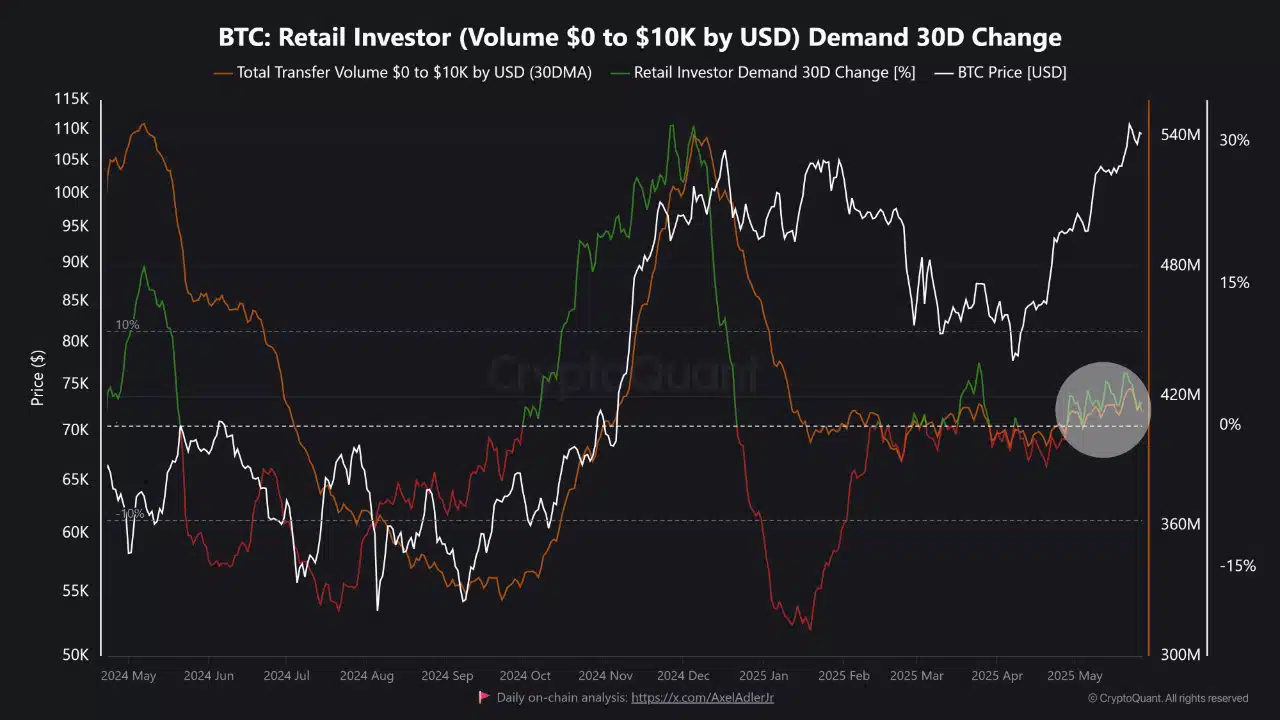

Bitcoin [BTC]S 30-day proportion change in small investor exercise has remained flat, regardless of a extremely upward value momentum within the charts.

This divergence is usually a signal that settings or whales lead the rally. Traditionally, persistent bull markets are depending on broader participation, whereby retail traders feed the gears from the cycle from center to late.

With out this demand layer, the prevailing momentum can miss the depth that’s wanted for lengthy -term enlargement. Regardless of the value that has been raised above $ 100k.

Supply: Cryptuquant

Valuation statistics level to overload

Spot trade flows on Might 28 mirrored sturdy outsourcing of $ 721.44 million in opposition to the influx of $ 616.51 million.

As well as, the trade reserves fell by 0.96%, with the identical assembly at $ 266.49 billion on the time of the press. This prompt that traders have withdrawn BTC from inventory markets, typically a precursor of lengthy -term property or institutional detention.

Such a sample has historically preceded sturdy value tendencies, as a result of a decreased liquid provide can tighten the order books.

Supply: Coinglass

Valuation indicators Appeared to indicate clear early indicators of cooling, regardless of the sturdy value course of from Bitcoin. The NVT Golden Cross-used to evaluate the value in opposition to transaction quantity on the Dreef chain by 26.06% to 1,075.

Within the meantime, the Puell A number of, which evaluates the earnings of the miner in opposition to historic requirements, fell by 11.22% to 1,297.

These findings implied that value development might surpass each community worth and miners -based valuation anchors.

The presence of the retail commerce fades as a community exercise, whales take management of

Regardless of the value improve, Bitcoin’s community development has considerably caught. Within the final 7 days, new addresses fell by 5.93%, lively addresses fell by 6.46percentand nil steadiness sheets fell by 9.79%.

These statistics mirrored the falling on onboarding and transactional exercise. These figures often rise in a strong bullrun, which signifies elevated demand and speculative significance.

Such a decoupling is usually a signal that the present rally shouldn’t be organically supported by a wider person base.

Supply: Intotheblock

The transaction profile of Bitcoin additionally revealed important imbalances. Transactions beneath $ 100 fell sharply, with $ 0 – $ 1 bracket with 66.38% and the $ 10 – $ 100 bracket with 6.90%.

Conversely, transactions above $ 10 million rise by 59.26%, whereas between $ 1 million and $ 10 million climbed by 13.26%.

This hinted at a gathering led by excessive neat-worthy traders or institutional members whereas the retail commerce remained largely on the sidelines.

Though massive gamers can transfer the costs rapidly, sustainable rallies often require quantity and assist in all transaction sizes.

Supply: Intotheblock

Will the BTC outbreak be sustainable with out the participation of the retail commerce?

The current value improve of Bitcoin is clearly powered by institutional streams and lengthy -term possession sentiment, as evidenced by the shrinking trade reserves and robust outflows.

Cooling valuation -indicators, lowering tackle exercise and shrinking store transaction volumes, nevertheless, prompt that the rally is lacking a broad foundation. With out renewed retail stake, the momentum can weaken or grow to be more and more susceptible.

For Bitcoin to interrupt decisive in a sustainable bull cycle, retail members should return with belief, liquidity and quantity.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024