Bitcoin

Bitcoin’s rough day: Over 44K BTC pulled amid controversy – What now?

Credit : ambcrypto.com

- Binance faces a large Bitcoin pullback amid a backlash.

- Liquidations are rising as Bitcoin EFTs expertise adverse web flows.

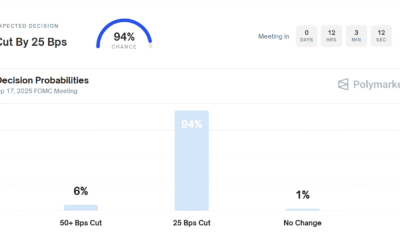

Bitcoin [BTC] Yesterday, August 28, noticed a dismal day, with the main cryptocurrency dealing with declines in a number of markets, together with spot buying and selling and Bitcoin ETFs common within the US markets.

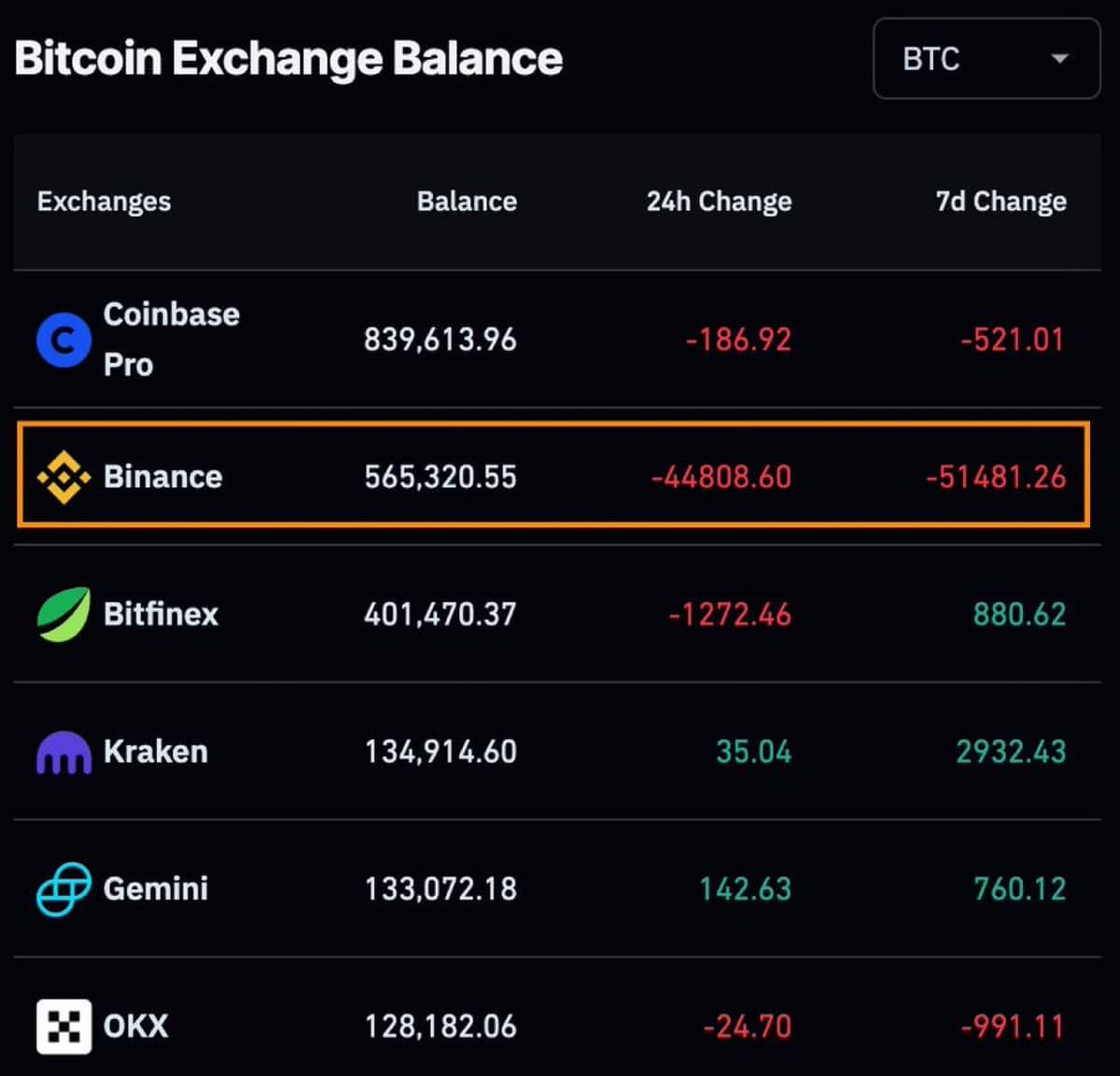

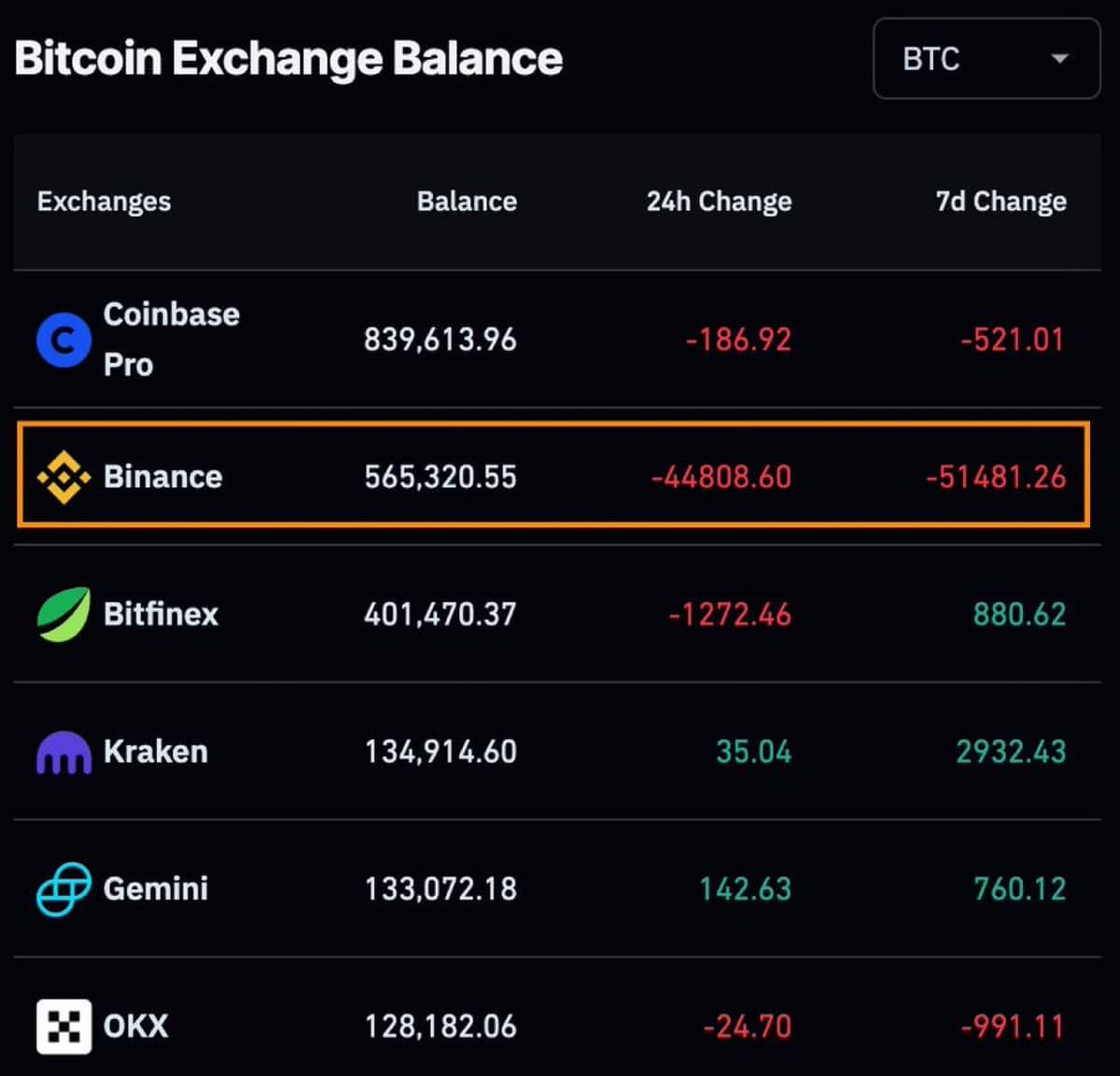

The market drop coincided with a large outflow of 44,808 BTC, value over $2.6 billion, withdrawn from Binance up to now 24 hours.

This important withdrawal from Bitcoin adopted allegations that Binance had seized Palestinian belongings on the request of Israeli authorities. Amid the backlash, Binance shortly unblocked the accounts.

Supply:

These huge Bitcoin outflows will doubtless have an effect on the worth of BTC, with potential results in each instructions.

First, Bitcoin might be held for long-term acquire, doubtlessly driving up its value. Alternatively, a serious sell-off may result in a value drop, given the numerous amount of cash concerned, the Bitcoin market may very well be shaken.

Huge liquidations

Along with Binance’s withdrawal, 66,423 merchants have been liquidated within the final 24 hours, amounting to $161.12 million.

The most important liquidation occurred on Bybit’s BTC/USD pair for $3.52 million, adopted by a $12.67 million liquidation on Binance’s ETH/BTC pair the day earlier than.

Supply: Coinglass

These occasions contributed to greater than $4.8 billion in liquidations in August 2024, the best since 2021, with two days to go.

Because the market matures and turns into heavier, contributors turn into extra leveraged, resulting in larger losses throughout sturdy market actions.

Supply: Coinglass

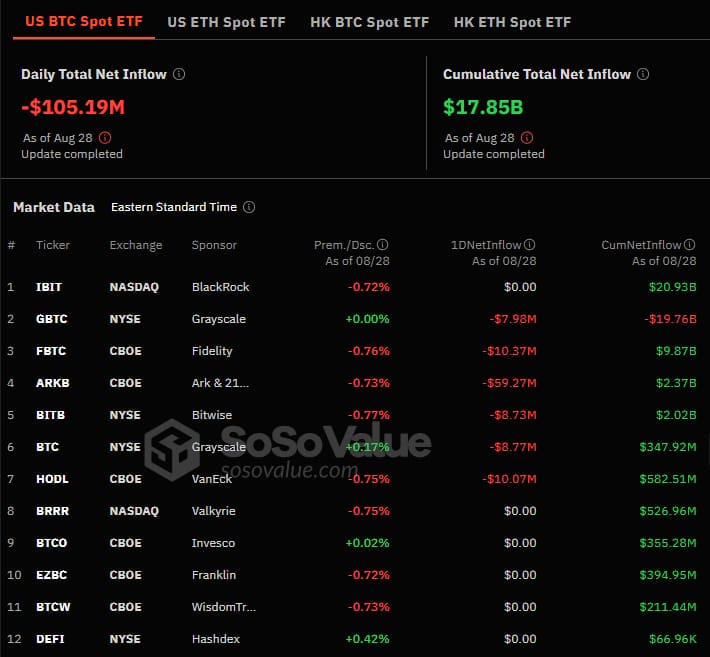

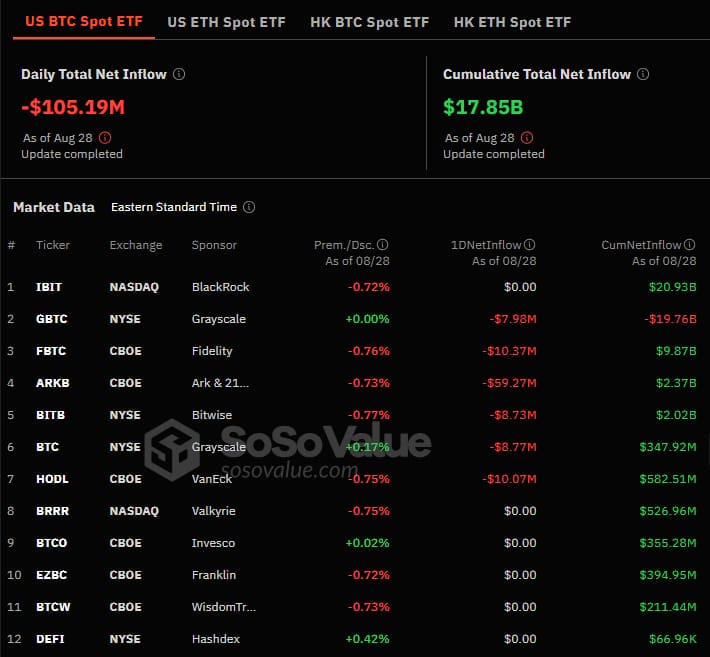

Bitcoin ETFs are dealing with adverse NetFlow

The huge withdrawal of BTC from Binance additionally affected ETFs, which noticed a web outflow of $105.19 million on August 28, the identical day because the Binance BTC withdrawal.

Ark & 21Shares’ $ARKB led the outflows with $59.27 million, adopted by Constancy’s $FBTC, VanEck’s $HODL and Grayscale’s $GBTC with $10.37 million, $10.07 million and $7.98 million, respectively.

Supply: Sosowaarde

These continued adverse occasions elevate considerations about BTC’s potential to recuperate as value motion hovers round $60,000.

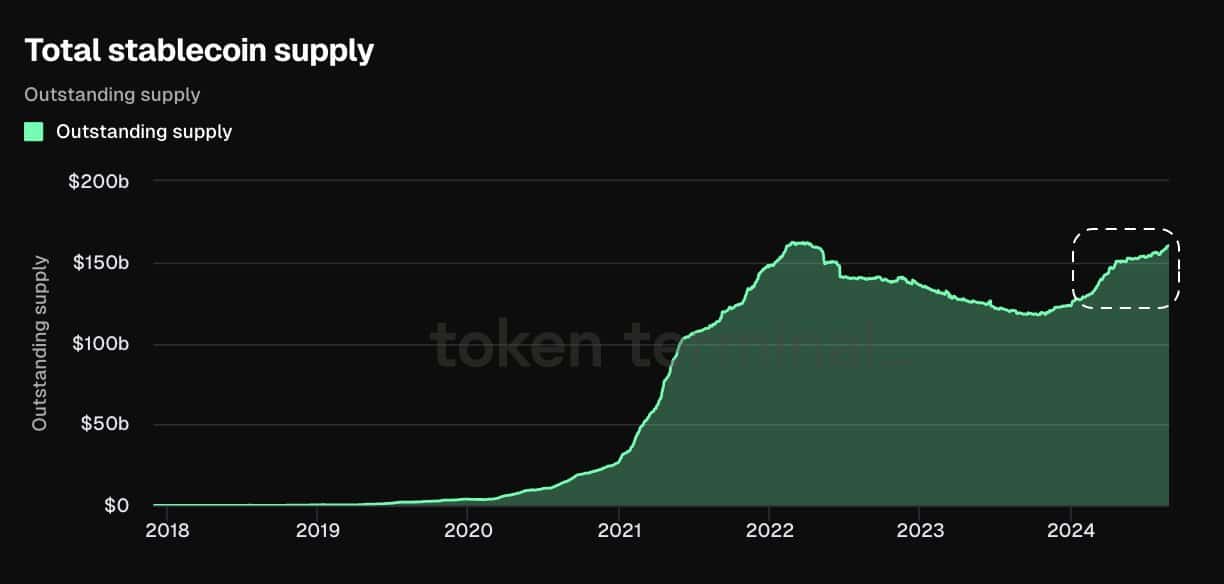

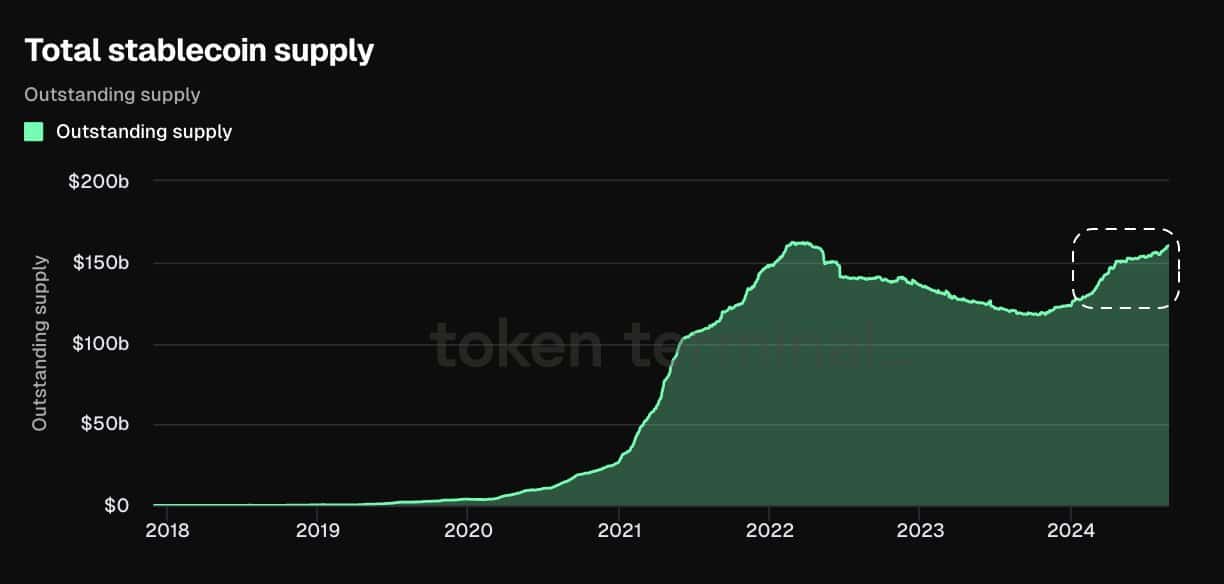

Will the availability of stablecoins assist Bitcoin recuperate?

Regardless of BTC’s huge withdrawal from Binance, widespread liquidations, and adverse ETF outflows, there may be hope that Bitcoin’s adverse correlation with stablecoins may result in a turnaround.

Learn Bitcoin’s [BTC] Value forecast 2024-25

Over the previous 24 hours, greater than $67 million in USDC has been minted, $70 million in USDC transferred to an unknown pockets, and one other $100 million USDT transferred to Bitfinex.

Supply: Token terminal

This inflow of stablecoins into the market may push up costs and doubtlessly push Bitcoin greater. With stablecoin charts close to all-time highs, a turnaround for Bitcoin and different cryptocurrencies may very well be within the offing.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024