Bitcoin

Bitcoin’s turning point ahead? – THIS metric could predict BTC’s future

Credit : ambcrypto.com

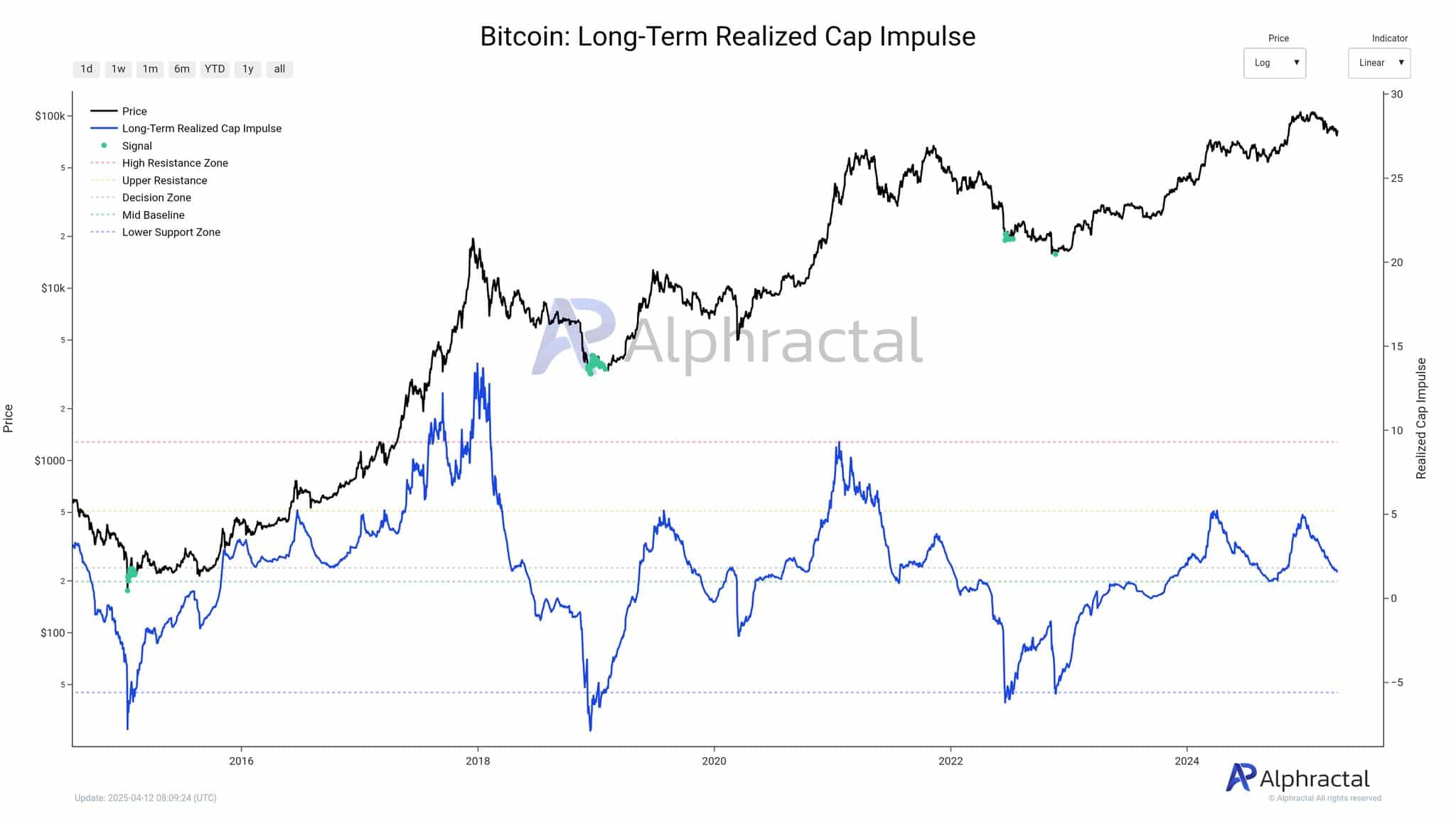

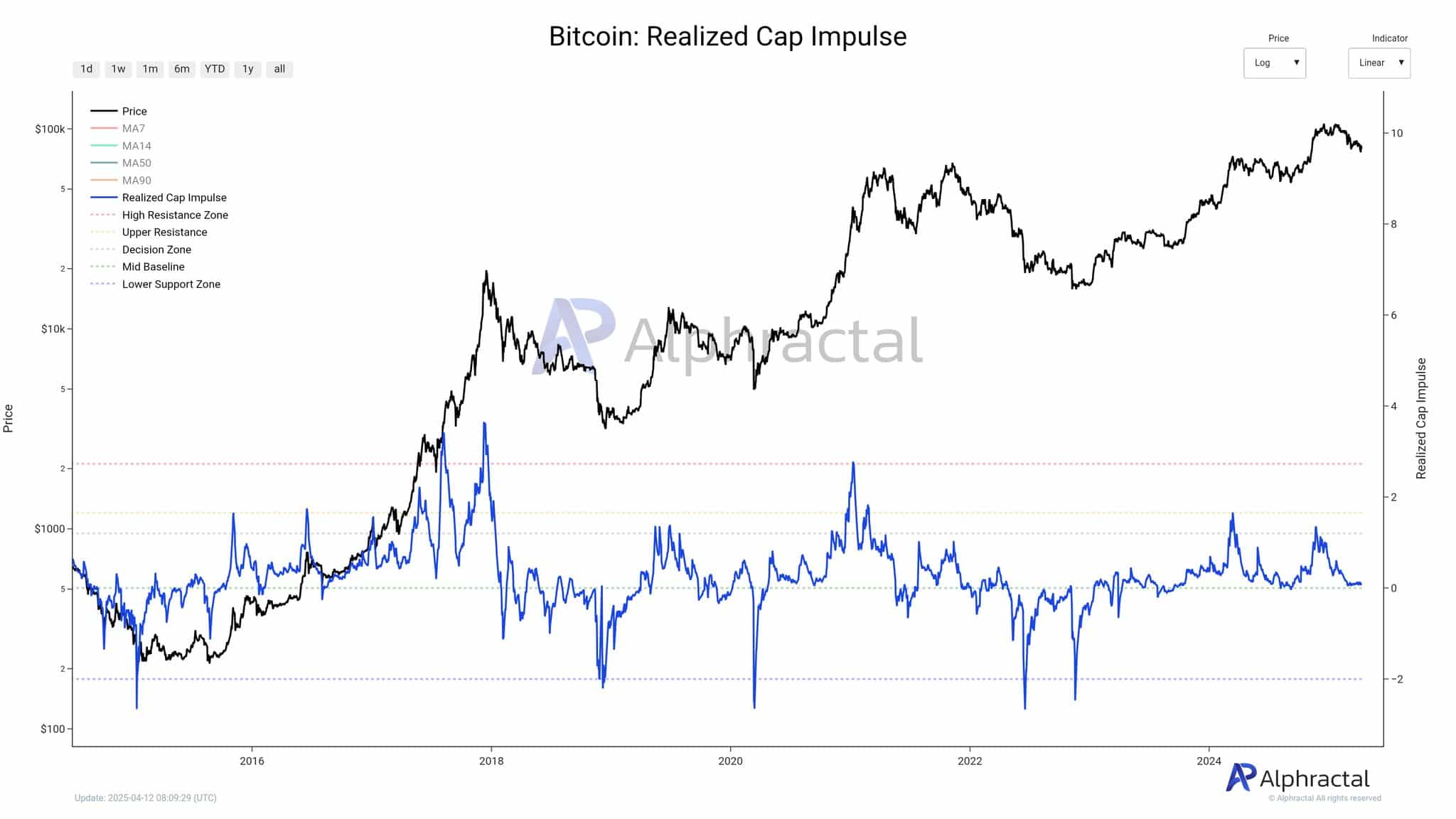

- Bitcoin’s long-term realized CAP-Impuls approached historic help, indicating a possible massive market villains.

- Sentiment remained impartial as a result of holders in the long run expertise an necessary choice that would outline the path of Q2.

Bitcoin [BTC] Is at an important second. Since some of the significant lengthy -term statistics is approaching a traditionally necessary stage, the market is maintained.

Within the coming days, the tone can set for what’s coming – whether or not it’s the foundation of a brand new rally or the sting of a deeper slide.

What do the information say?

The Dopimpuls realized in the long term is a crucial statistics for measuring the conviction of long-term Bitcoin holders.

This metric evaluates the momentum of realized capitalization, which displays the motion of cash primarily based on their most up-to-date transaction worth and has been tailored for lengthy -term traits.

Traditionally, when this impulse reaches its decrease help zone, it has tailor-made to appreciable turning factors within the worth of Bitcoin.

Supply: Alfractaal

On the time of the press, the impulse is at a stage that preceded appreciable market restoration earlier in 2019 and on the finish of 2022. This sample means that holders will enter a criticism choice window in the long run.

Or they continue to be agency or the broader market story can begin to shift.

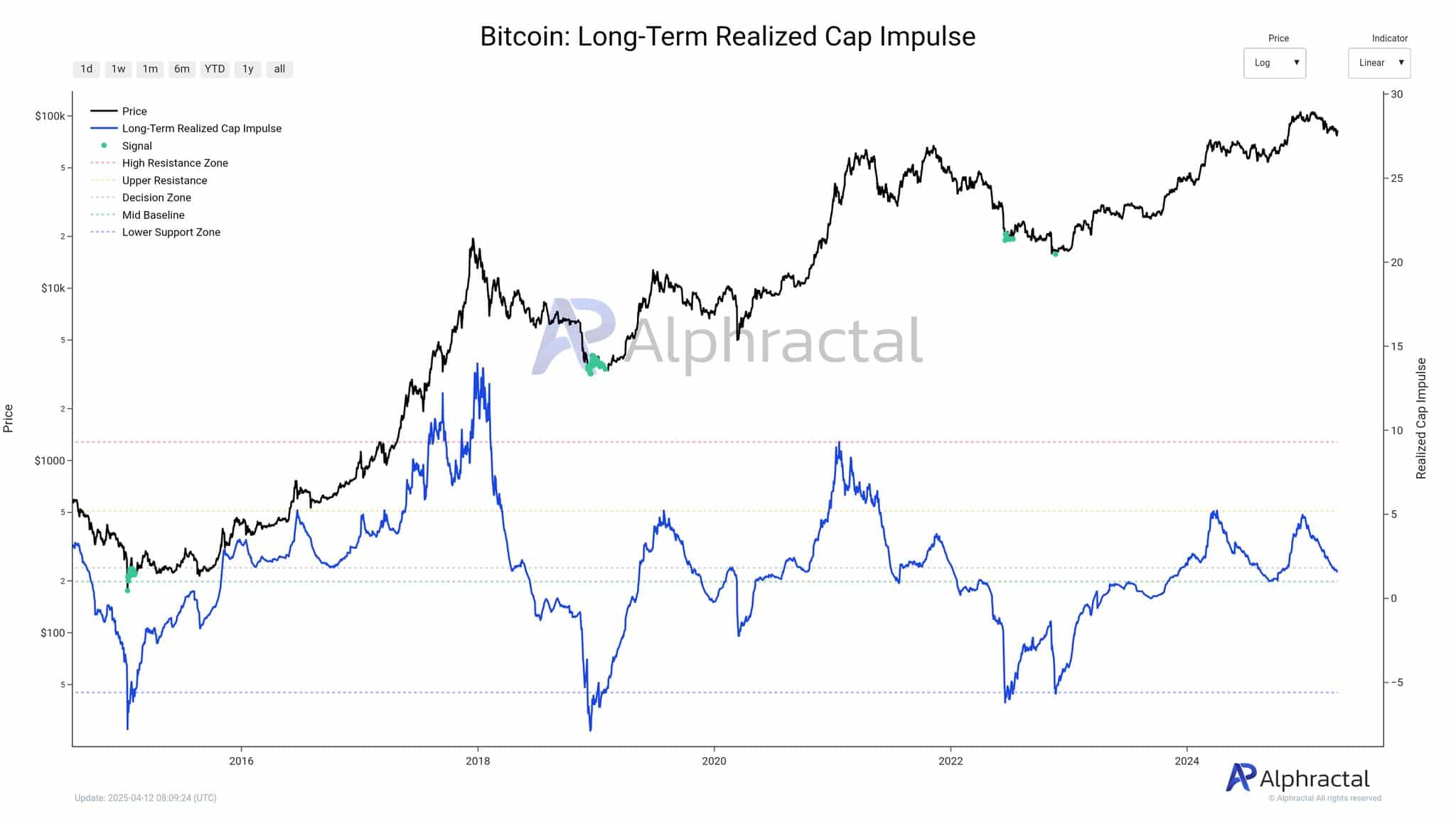

Assist bounce or structural demolition?

The present setup affords a binary consequence. If Bitcoin manages a constructive strout of this help zone, this may point out that lengthy -term holders keep their positions, which lays the inspiration for renewed accumulation and upward momentum.

Supply: Alfractaal

Nonetheless, A breakdown at this stage can imply a lack of belief among the many most resilient individuals out there – those that normally take in gross sales stress as an alternative of including it. Such a shift may cause a extra pronounced correction.

Given the observe document of the lengthy -term impulse of anticipation of macroming, his subsequent motion may outline the method for the approaching quarter.

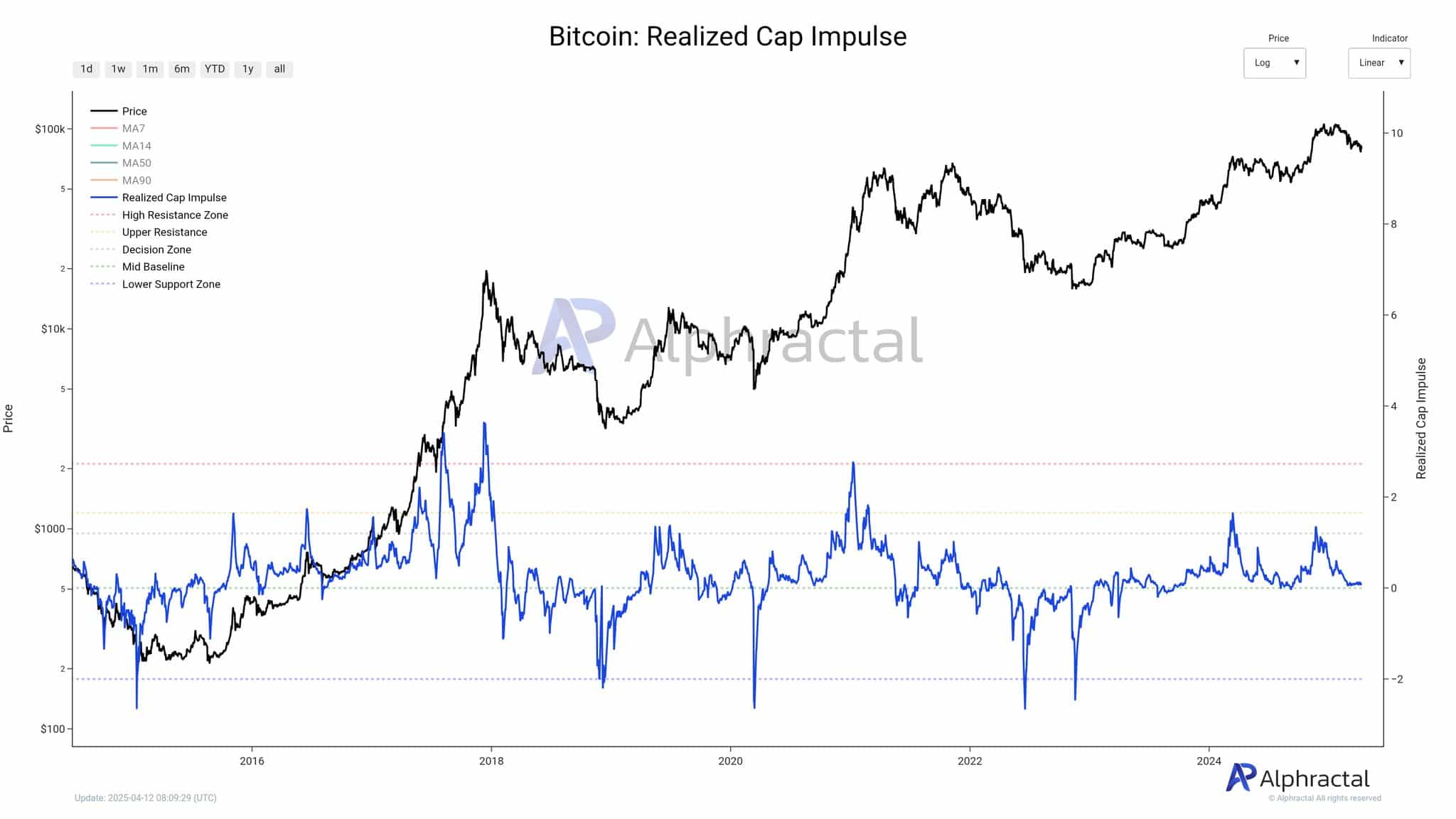

Bitcoin: sentiment on the sting

On the time of the press, the worry and greed index stood at 45, which signifies a cautious impartial sentiment – on the path of worry however stops capitulation. This displays a market that’s characterised by uncertainty and continues to answer potential catalysts.

Studying sentiment displays the indecision that’s seen on the lengthy -term impulse and underlines that Bitcoin is approaching a vital choice level.

Traditionally, sentiment usually follows structural statistics, which means that the present calmness can precede an necessary directional shift. Whether or not this shift will probably be bullish or bearish will largely depend upon the habits of lengthy -term holders throughout this important second.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024