Bitcoin

Bitcoin’s uneasy calm: Is demand slowing, or is BTC taking a pause?

Credit : ambcrypto.com

- Bitcoin’s CDD, Utxo Losses, and Community Progress Counsel Bitcoin is in A Holding Sample Amid Combined sentiment.

- Gentle Purchase-Aspect Dominance and Persistent Volatility Replicate Cautious Optimism With out Sturdy Momentum.

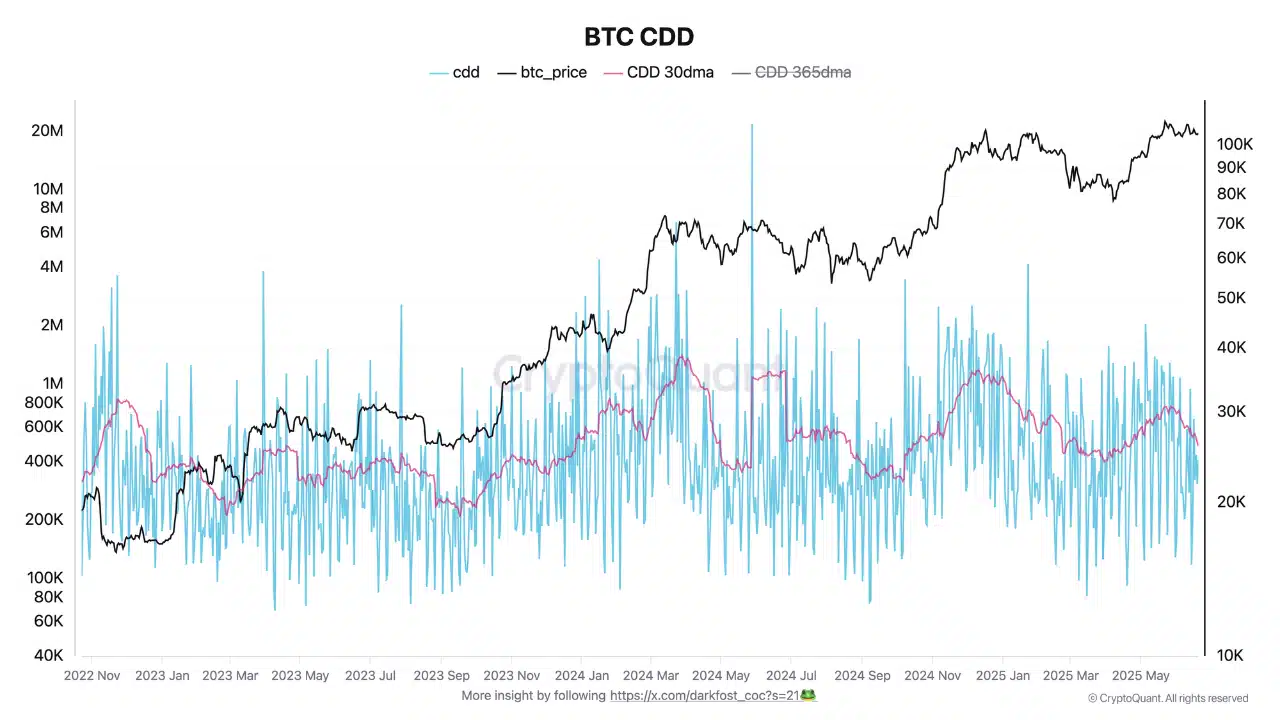

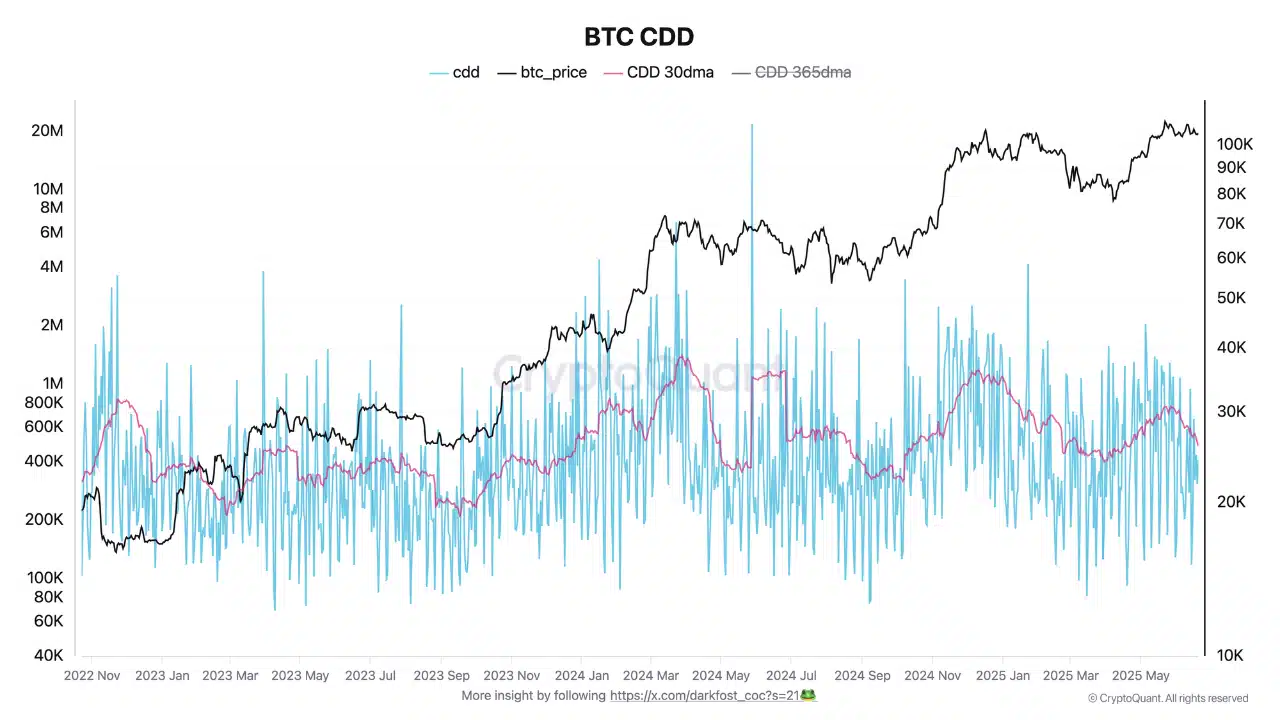

Bitcoin’s [BTC] Coin Days Destroyed Metric declined to 500k, down from peaks above 1 million. This steered long-term holders confirmed Restraint Regardless of BTCs Strategy to all-time highs.

In FACT, The CDD 30-Day Transferring Common Confirmed This Cool-Off, Hinting at A Clear Shift From Aggressive Revenue-Taking To Quiet Accumulation.

Naturally, IT Helps the Thought That Diamond Palms Nonetheless Aren’t Accomplished Enjoying the Lengthy Recreation.

Supply: cryptoquant

Bitcoin’s Utxos in Loss Surged 42.81% to 12.23 Million, Whereas Utxos in revenue Slipped 1.2% to 305.15 Million.

This means {that a} notable portion of not too long ago consumers entered at highher costs and at the moment are holding underwater positions. So the stress is localized, not Market-Large, at Least for Now.

Supply: cryptoquant

Are consumers nonetheless right here?

The BTC Taker Purchase/Promote Ratio Ticked As much as 1,28, A 1.04% Acquire That Put Purchase-Aspect Takers Barely Forward.

This Degree, Simply Above the Impartial Line, Implies That Perpetual Market Members Stay CautiOUSly Optimistic. Nonetheless, The Modest Energy in Purchase Quantity Does Not Sign A Full-Blown Bullish Breakout.

This delicate shopping for curiosity hints at conviction however with out the noise.

Supply: cryptoquant

BTC Volatility Stays Elevated, But Managed.

The newest studying of 0.011 reveals Sharp Spikes However No Comply with-By means of. These Bursts Have Been Frequent Since Mid-April However Have not Breed the Total Development.

This tells us one thing easy: merchants are alert, not alarmed. Volatility May Look Wild On The Chart, However It is Not Tipping the Market Into Chaos.

Supply: Santiment

What does the crash in Community Progress Imply for Bitcoin Demand?

Bitcoin’s Community Progress NOSDIVED FROM over 500k to 76.5k, a Steep Drop That May Sign Weavening Consumer Curiosity.

This contraction reveals a big decline in New Addresses Interacting with the Community, Indicating a Slowing of Natural Demand.

The spike in June Possible resulted from short-term pleasure that might not be sustained.

Supply: Santiment

Put it All Collectively, Feer Lengthy-Time period Sellers, Rising Unrealized Losses, Modest Purchase Strain, and Cooling Community Progress, and You Get A Market in Limbo.

Bitcoin is not signaling a prime, nevertheless it’s not charging forward both. Till on-chain indicators Like Community Progress or Taker Exercise Strengthen, BTC Might Keep Caught in Consolidation, Quietly Coiling for its Subsequent Transfer.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024