Bitcoin

Bitcoin’s Uptober: Can BTC recover after slipping from September highs?

Credit : ambcrypto.com

- Bitcoin is exhibiting a number of indicators that point out that it’s again on a bearish leg, a minimum of within the brief time period.

- Can Bitcoin adapt to market expectations even if October has began with some revenue taking?

Bitcoin [BTC] Buyers have proven lots of optimism about BTC in October, to the purpose that Uptober is trending. This could possibly be on account of a number of elements, similar to decrease rates of interest, historic efficiency in October, and BTC’s newest bullish efficiency.

Whereas bullish expectations for Bitcoin are excessive in October, there are indicators that issues might end up otherwise. For instance, a recent CryptoQuant analysis means that BTC’s newest highs noticed in late September might mark the ultimate native excessive.

The evaluation was primarily based on BTC’s NVT golden cross and its latest rise above 2.2. One other evaluation means that Bitcoin will possible wrestle to take care of bullish momentum in October, primarily based on historic efficiency.

In accordance with the analysisBitcoin rose for 2 weeks after a significant price lower in 2019, adopted by two months of bearish efficiency.

These observations counsel that Bitcoin should be topic to promoting strain regardless of the prevailing strain. That is already evident from BTC’s newest efficiency.

The cryptocurrency has already given up a few of its September features, indicating that some buyers have taken income.

Bitcoin’s promoting strain is accelerating

Bitcoin lately threatened to dip under $60,000 on October 1. It exchanged palms for $61,430 on the time of writing. The value has fallen 7.8% 12 months to this point from the best worth in September.

This implies it’s on monitor to say no in the direction of the $59,580 and $57,940 worth ranges based on the Fibbonacci retracement.

Supply: TradingView

The decline is enough indication that the hype after the rate of interest lower announcement is over. Nevertheless, this raises extra questions than solutions. Will demand resume as worth retests the Fibonnacci stage?

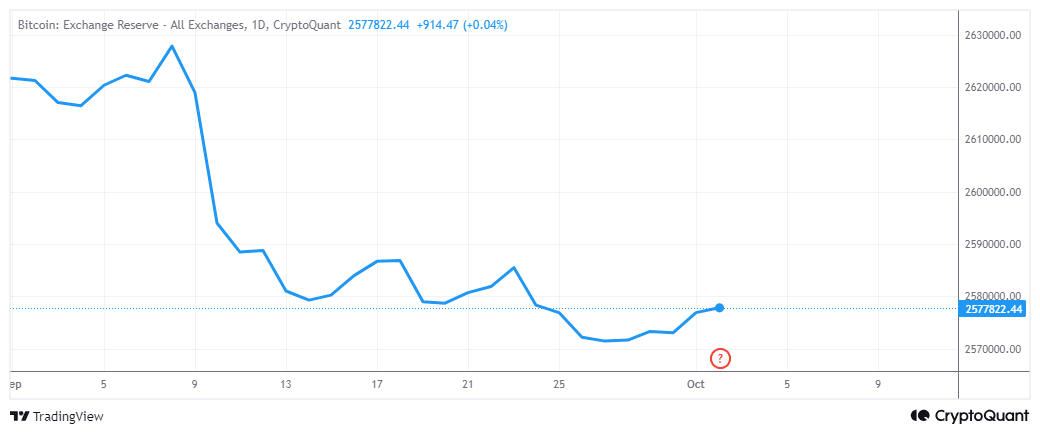

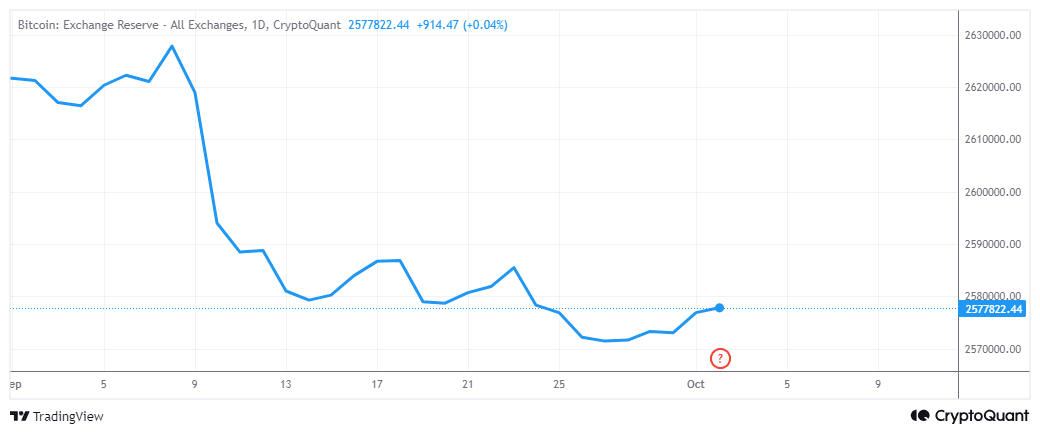

On-chain knowledge introduced data in line with the bearish final result. For instance, Bitcoin alternate reserves have maintained a basic downward development in latest months, with slight will increase right here and there.

Bitcoin alternate reserves ended September with a slight improve. This confirms that some cash have moved from personal wallets to exchanges. Normally, this corresponds to a resurgence of promoting strain seen in latest days.

Supply: CryptoQuant

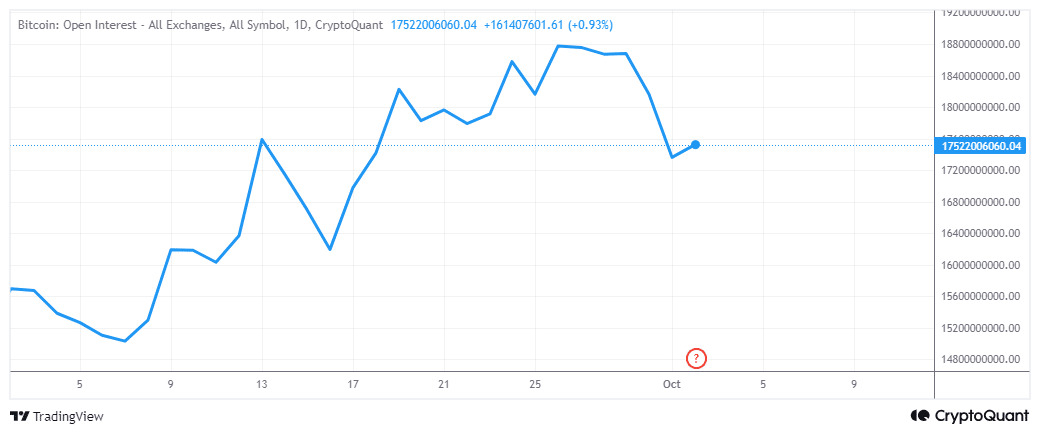

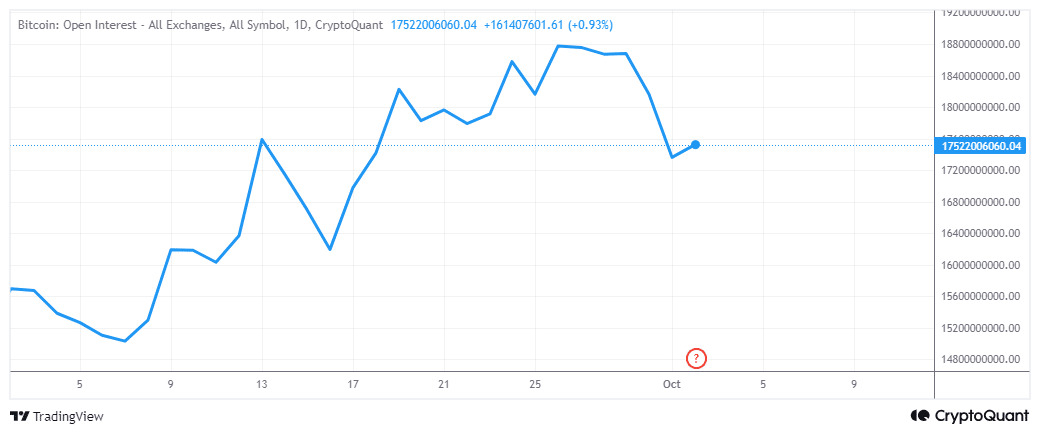

The rise in international alternate reserves additionally corresponded with a dip in Bitcoin open curiosity since September 26. This confirms that Bitcoin demand within the derivatives section additionally slowed.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth forecast 2024-25

The findings counsel a major chance that BTC will face elevated promoting strain within the close to time period. As is at the moment the state of affairs, however this doesn’t essentially present a transparent timetable.

It could possibly be a brief relapse or last more relying on how issues will unfold.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now