Web 3

BitMart Research—WLFI Ecosystem and Tokenomics: From USD1 Stablecoin Expansion to Strategic Public Company Integration

Credit : web3wire.org

Bitmart Analysis, the military of analysis Bitmart Exchangehas printed an intensive report about World Liberty Monetary (WLFI)Analyzing the evolving defi-ecosystem of the venture, Tokenomics and the unprecedented integration of $ 1.5 billion in Nasdaq-Genten Alt5 Sigma. With the USD1 Stablecoin within the core of its growth technique, WLFI shortly has the loans, commerce and cross-chain utilities in Ethereum, BNB chain and Solana, whereas they enter fast-growing verticals resembling memefi, AI and LSD protocols. The collaboration with Alt5 Sigma, which displays the Bitcoin Treasury mannequin from MicroStrategy, marks a milestone in bridging crypto property with conventional monetary infrastructure. As WLFI will get a grip in launch plates, RWA integrations and the preparation of ecosystems, this report investigates how the stablecoin-driven structure and strategic share offers can once more outline what institutional crypto-acceptance seems to be like within the following cycle.

I. Undertaking updates

Prior to now yr, World Liberty Monetary (WLFI) has constructed up an intensive Defi -eco system that’s aimed on the USD1 Stablecoin, broaden to loans, commerce, funds, meme, LSD, AI and even its personal blockchain. The technique might be summarized in three phases:

-

Arrange the elemental query of USD1 by utilizing loans and commerce eventualities in giant block chains resembling BSC, Ethereum and Solana.

-

Combine USD1 in rising sectors, together with Meme, Stablecoins and AI by way of investments and partnerships, which will increase the consumer’s use frequency and the stickiness of the consumer.

-

Lengthy -term safety by strategically investing in and incubating tasks at an early stage, acquiring token rights and stimulating the additional acceptance of the USD1.

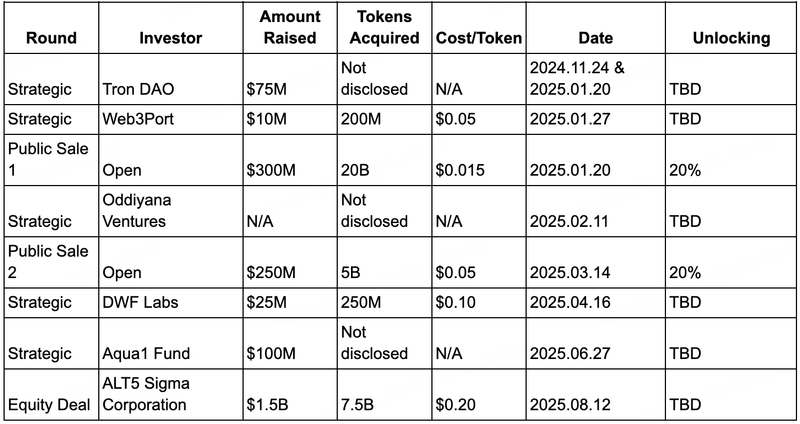

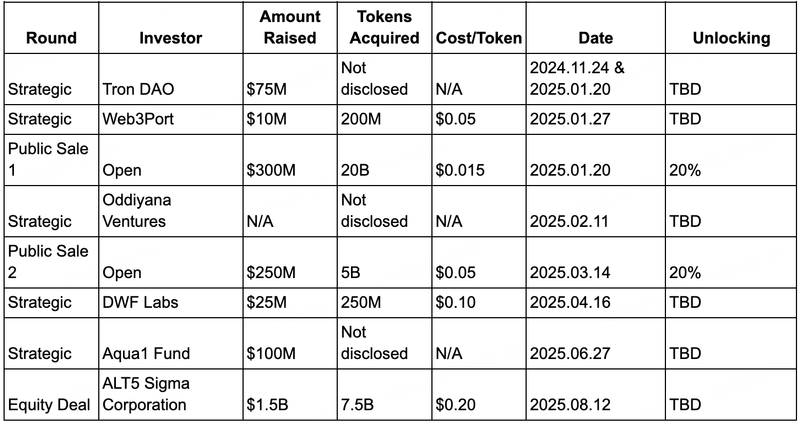

Thus far, WLFI has accomplished 4 main fundraising rounds, with public gross sales priced at $ 0.015 and $ 0.05 per token. Strategic rounds attracted market leaders resembling Justin Solar (Tron Dao), DWF Labs, Aqua1 Fund and Web3port.

An important milestone was the partnership of WLFI with Nasdaq-raised Alt5 Sigma. In his final S1 software, Alt5 Sigma introduced a purchase order of $ 1.5 billion from WLFI Governance -Tokens, which acquires roughly 7.5% of the whole supply and was acquired for $ 750 million in tokens. This step is broadly in comparison with the Bitcoin Treasury technique of MicroSstrategy – which embeds digital property within the stability sheet of a public firm, rising the monetary and regulatory legitimacy of WLFI. The combination is additional underlined by Eric Trump who turns into a member of the board of Alt5 Sigma and WLFI CEO Zach Witkoff turns into chairman of the corporate.

WLFI Funding Rounds Overview

Ii. Tokenomics and market efficiency

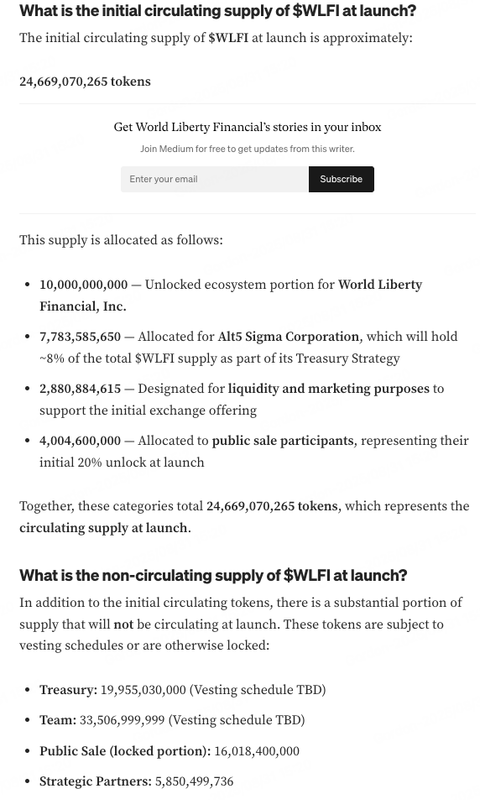

Based on WLFI’s official weblog, 24.67 billion tokens (24.6% of the whole supply) had been unlocked at TGE, distributed as follows:

Specifically, the allocation of Alt5 Sigma is taken into account a part of its strategic reserves and isn’t anticipated to flow into in TGE. Ecosystemtokens are additionally reportedly linked to the USD1 Rewards program and they don’t seem to be instantly tradable. That’s the reason the true circulating vary is estimated at 20% of public gross sales + liquidity/advertising and marketing.

Market efficiency

WLFI was launched on 1 September with a restricted preliminary momentum resulting from uncertainty about circulating supply. The token reached a peak at $ 0.32 earlier than it corrected to $ 0.225 earlier than 2 September. This quantities to an preliminary circulating market capitalization of $ 5.71 billion and a completely diluted appreciation (FDV) of $ 23.1 billion.

-

Public Sale 1 Traders ($ 0.015 entry) noticed paper revenue as much as 20x.

-

Public Sale 2 individuals ($ 0.05 enter) achieved totally different multiples at TGE.

-

Strategic traders resembling Web3port and DWF Labs have additionally established a robust return.

-

Alt5 Sigma, which is available in at $ 0.20, is closest to the present market worth and due to this fact represents a psychological assist zone. Historic pre-market transactions recommend that WLFI finds a robust buy curiosity round $ 0.20, however a decisive break under this degree may cause a wider market panic.

The value dynamics of WLFI presently depend upon two important elements:

-

Unlocked gross sales strain of traders of public sale.

-

Potential token influx of the ecosystem allocation or Alt5 Sigma’s strategic reserves.

If ecosystemtokens are locked beneath the USD1 launch plan, the gross sales strain should stay manageable within the brief time period. Nevertheless, if Alt5 Sigma or associated funds resolve to discharge holdings, the worth stability of WLFI can get appreciable challenges.

III. Ecosystem improvement

Defi

-

Dolomite – A decentralized credit score and margin commerce protocol on Ethereum. USD1 is built-in, with Dolo/USD1 as the first market pair. Dolomite is sweet for ~ 90% of the USD1 -Leen Liquidity on Ethereum. His co-founder Corey Caplan Additionally serves as WLFIs CTO.

-

Lista Dao -A BSC-based loans and stablecoin platform. USD1 has been added as collateral, with Lisusd pair reside on Pancakeswap.

-

Stakestone -A Cross-chain LSD Liquidity Protocol. Companions with WLFI to allow USD1-based in adjusting yields and cross-chain liquidity.

Launch pads

-

Lets.bonk – Official Solana Launchpad from USD1, which use Meme tradition to incubate new tasks.

-

Buildon -Ame venture on BSC that develops a USD1-exclusive launchpad.

-

Blockstreet -Wlfi’s official launch path, partly based by Matthew MorganThat can be CIO from Alt5 Sigma.

-

Aol – Meme Token launched by WLFI -advisor @Cryptogle, with plans for America.Enjoyable Launchpad.

RWA & Stablecoins

-

USD1 – WLFI’s USD Stablecoin was launched in March. Market capitalization surpassed $ 2.4 billion By September 1, with> 88.5% circulation on the BNB chain.

-

Chainlink (hyperlink) -Wlfi makes use of Chainlink CCIP for interoperability of the USD1 cross-chain.

-

Ethena (Ena) – Labored collectively in December to combine with Susde.

-

ONDO Finance (ONDO) – USDY and OUSG added to USD1 – Reserves.

-

Falcon Finance – WLFI invested $ 10 million; USD1 can be utilized to mine artificial stablecoins.

-

Plume community – WLFI built-in USD1 as a spare collateral for PUSD.

Different tasks

-

Vaulta (previously EOS) – Rebranded as Web3 Banking Infra; WLFI invested $ 6 million, USD1 built-in as settlement energetic.

-

EGL1 – MEME PROJECT WIN A WLFI buying and selling competitors.

-

Freedom -UUSD1-driven charity stips on BNB chain.

-

YOU – Meme venture with WLFI’s public pockets – possession> 45% of the supply.

-

Tagger – Decentralized AI -data platform utilizing USD1 for firm funds and rewards.

Iv. Conclusion

The present circulating vary of WLFI is topic to 2 competing interpretations:

-

Optimistic state of affairs: solely ~ 6.88B tokens are circulating successfully, as a result of the reserves of ALT5 and ecosystem allocations are strategically locked. At ~ $ 0.23 this is the same as a circulating market capitalization of ~ $ 1.58 billion.

-

Threat State of affairs: Each Alt5’s possession and ecosystem allocations can finally enter blood circulation, which represents mass overhang and potential gross sales strain.

Trying forward, the event of WLFI will proceed to run round its USD1 ecosystem. Partnerships and new utilities – resembling plotting and borrowing – are anticipated to stimulate the adoption and appreciation of token. Within the meantime, Alt5 Sigma’s $ 1.5 billion funding and governance integration robust WLFI within the regulated monetary story. If WLFI efficiently replicates the Bitcoin Treasury mannequin of MicroSstratey, it could possibly get a substantial traction in conventional funds and enhance the long-term financialization potential.

About Bitmart

Bitmart is a outstanding worldwide digital property buying and selling platform with greater than 12 million customers worldwide. Bitmart is constantly organized beneath the perfect crypto gala’s on Coingecko and affords greater than 1,700 buying and selling {couples} with aggressive prices. Bitmart has dedicated itself to steady innovation and monetary inclusion and permits customers worldwide to behave seamlessly. Extra details about Bitmart at WebsiteObserve their X (Twitter)Or be a part of them Telegram For updates, information and promotions. Obtain Bitmart -app To behave anytime and wherever.

Threat -warning:

The data supplied is just for reference and shouldn’t be thought of as a advice to purchase, promote or hold a financially energetic. All info is supplied in good religion. Nevertheless, we don’t present statements or ensures, explicitly or implicitly, with regard to accuracy, adequacy, validity, reliability, availability or completeness of such info.

All cryptocurrency investments (together with effectivity) are very speculative in nature and have a substantial threat of loss. Hypothetical or simulated efficiency from the previous isn’t essentially a sign for future outcomes. The worth of digital currencies can rise or fall, and there might be important dangers when shopping for, promoting, holding digital currencies. You will need to rigorously contemplate whether or not commerce or digital foreign money is appropriate for you based mostly in your private funding goals, monetary state of affairs and threat tolerance. Bitmart doesn’t present funding, authorized or tax recommendation.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now