Ethereum

Bitmine Buys 44,036 Ethereum Worth $166M During Market Dip – Details

Credit : www.newsbtc.com

Ethereum (ETH) stays beneath stress and buying and selling beneath the $4,000 mark as bulls attempt to regain management after weeks of post-crash uncertainty. The sharp sell-off on October 10 not solely worn out leveraged positions out there, but additionally disrupted the uptrend that ETH had constructed over the summer time.

Since then, worth motion has weakened and momentum has shifted to the draw back, elevating considerations amongst analysts {that a} deeper correction might happen if consumers fail to defend key demand ranges within the coming days.

Associated studying

Regardless of these technical challenges, on-chain and institutional stream information inform a special story beneath the floor. Giant-scale traders – together with funds, company entities and crypto-native establishments – proceed to build up ETH throughout the pullback.

The distinction between worth weak point and institutional accumulation creates a vital setup for Ethereum. If ETH can stabilize and regain the $4,000 threshold, it might spark new bullish momentum. However the lack of help might open the door to additional downturn earlier than a sustainable restoration happens.

Bitmine provides ETH as institutional accumulation rises

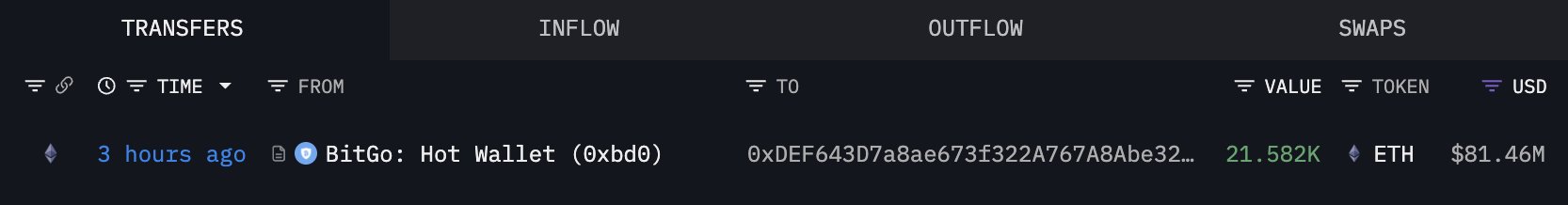

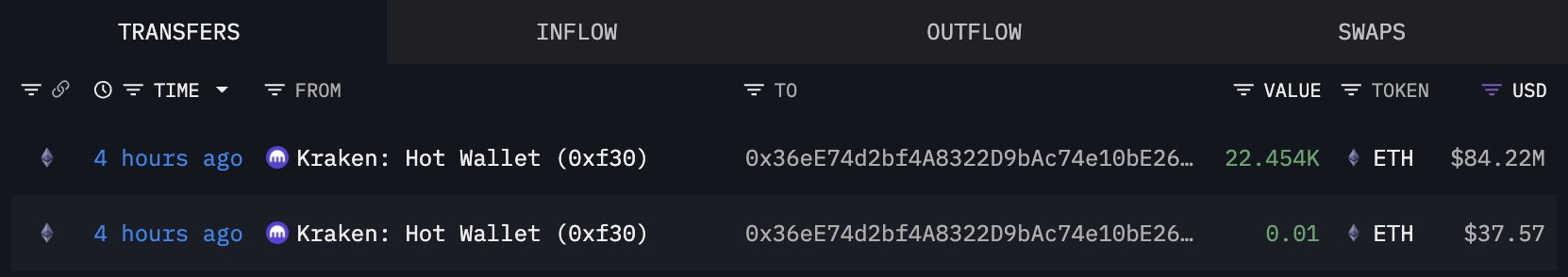

In response to facts adopted by Lookonchain, institutional participant Bitmine has continued its aggressive accumulation technique. Buy of 44,036 ETH – value roughly $166 million – throughout the current market pullback.

This buy will increase Bitmine’s whole holdings to roughly 3.16 million ETH, valued at roughly $12.15 billion, strengthening the corporate’s place as one of many largest Ethereum holders on the planet. Such intensive shopping for exercise in periods of worth weak point highlights a notable disconnect between institutional habits and short-term market sentiment.

Whereas retail merchants and leveraged members could also be shocked by Ethereum’s incapacity to reclaim the $4,000 stage, long-horizon consumers seem unfazed. For them, worth falls signify an accumulation of alternatives quite than causes for concern.

This duality is turning into more and more obvious out there: spot inflows, foreign money outflows and whale accumulation numbers all level to rising long-term conviction, even because the chart displays hesitation and downward stress.

This divergence underlines a well known sample within the crypto market construction. Value motion usually lags behind underlying fundamentals, particularly throughout transition phases when macro catalysts and liquidity shifts are nonetheless being processed. Ethereum stays structurally supported by growing institutional participation, rising demand for staking, and the enlargement of Layer-2 ecosystems – all of which strengthen its long-term funding thesis.

Associated studying

Ethereum checks main help

Ethereum (ETH) is buying and selling round $3,847 and testing a important help zone after failing to carry above $4,000 and rejecting the $4,200 resistance space earlier this week.

The every day chart exhibits ETH breaking beneath each the 50-day (blue) and 100-day (inexperienced) transferring averages, indicating weakening momentum and a shift towards a extra defensive market stance. This collapse places extra stress on bulls to defend the $3,800 area – a stage that has served as a pivot level repeatedly over the previous two months.

If ETH loses this help, the subsequent significant demand zone is close to $3,500, adopted by the 200-day transferring common round $3,200, which might function a deeper structural retest throughout the longer-term uptrend. For now, nonetheless, ETH stays above its long-term trendline, which means the broader bullish construction is unbroken regardless of the short-term weak point.

Associated studying

On the upside, bulls must reclaim $4,000 after which $4,150-$4,200 to revive bullish momentum and break the streak of decrease highs since September. Till that occurs, worth motion promotes consolidation and warning. With macro shifts underway and institutional accumulation on the rise, Ethereum’s chart signifies a wait-and-see part, the place holding help turns into essential earlier than making one other upward try.

Featured picture of ChatGPT, chart from TradingView.com

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now