Altcoin

Bitstamp Just ‘Pulled’ the XRP Community: CEO of XPMarket

Credit : www.newsbtc.com

This text is offered in Spanish.

Dr. Artur Kirjakulov, CEO and founding father of XPMarket, has mentioned this publicly accused Bitstamp performing a “again pull” towards the XRP group. This critical accusation has sparked a controversial debate amongst trade stakeholders, elevating questions concerning the stability and reliability of Bitstamp’s involvement in XRPL-based monetary devices.

Has Bitstamp Rug Pulled Out of the XRP Neighborhood?

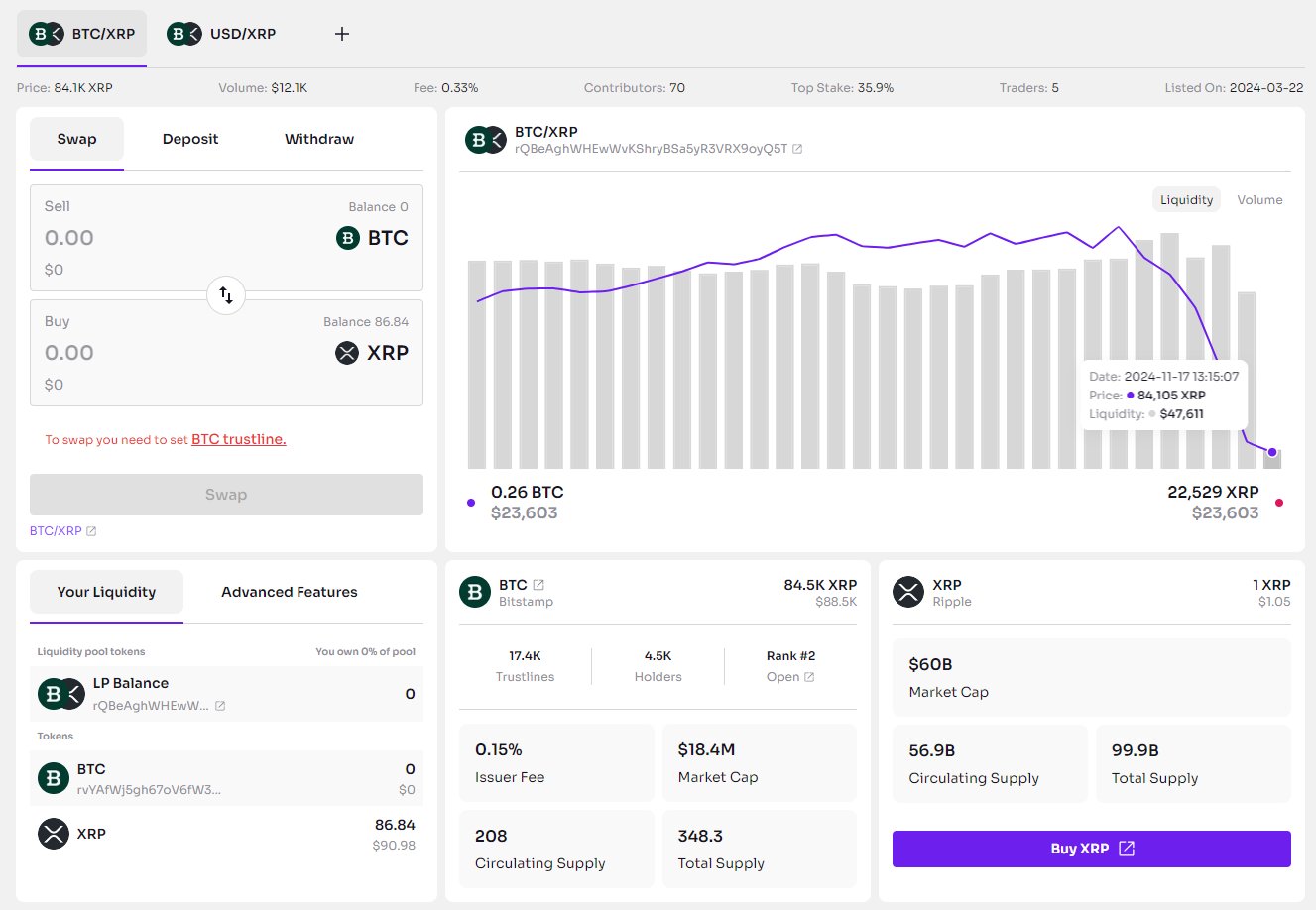

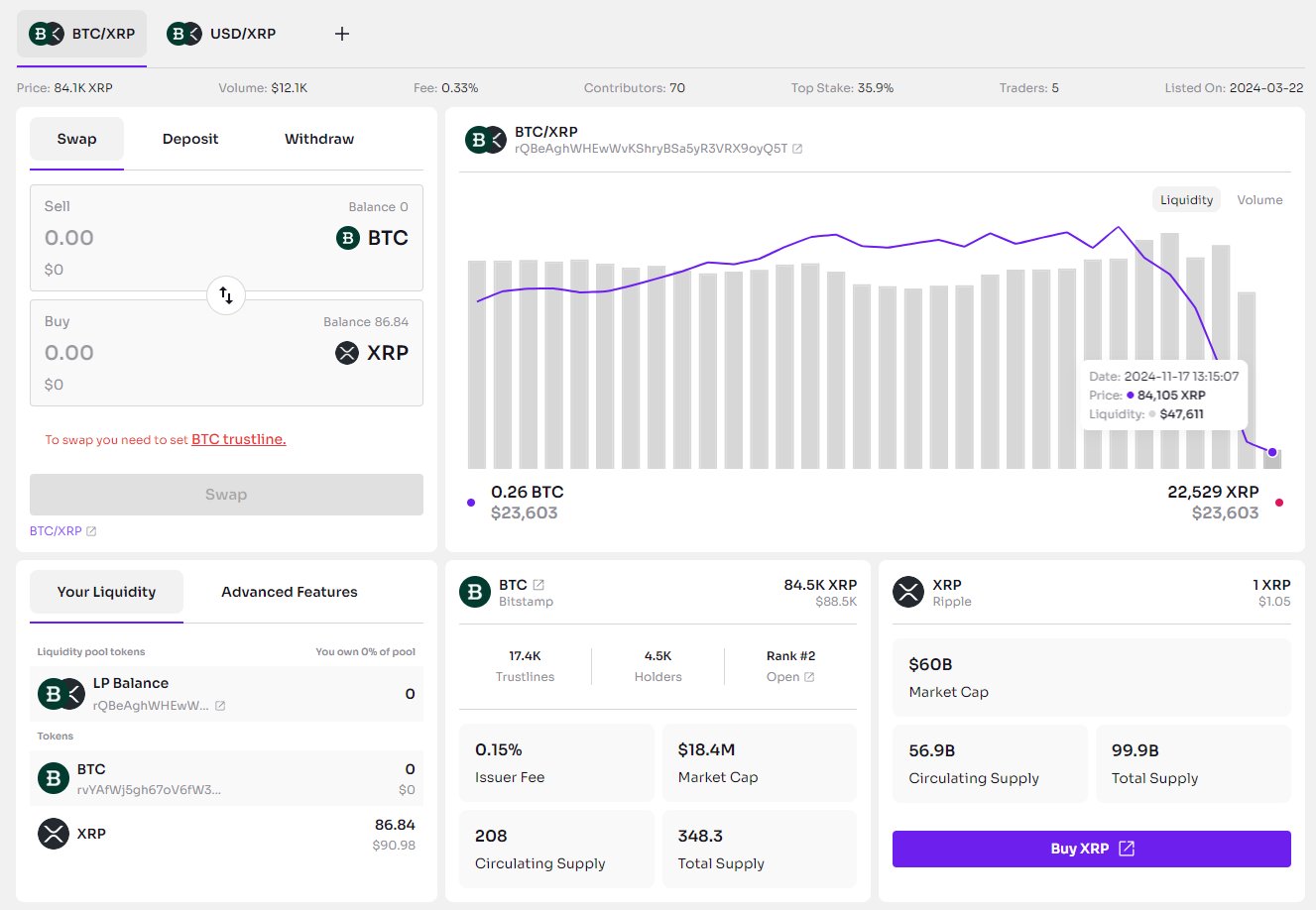

On Sunday, November 17, Dr. Kirjakulov to X to specific his considerations about Bitstamp’s latest actions. “Bitstamp actually simply pulled out of the and unannounced maneuver. leaving the XRPL group in a precarious place.

In accordance with Kirjakulov, the dearth of a proper assertion from Bitstamp or RippleX will increase the uncertainty surrounding this liquidity drain, probably resulting in “extraordinarily risky” buying and selling circumstances and important value impacts for these asset pairs.

Dr. Kirjakulov additional highlighted the difficult relationship between Ripple and Bitstamp, noting that “Ripple owns an fairness stake in Bitstamp.” This connection means that Ripple’s stake in Bitstamp may affect the change’s strategic choices inside the XRPL house. XPMarket’s CEO expressed deep considerations concerning the assurance of a 1:1 conversion price for packaged property issued by Bitstamp, drawing a parallel to the Stably incident the place such ensures weren’t honored. He emphasised: “How can anybody belief DeFi on XRPL if official companions are taking such steps? Optics are horrible.”

Associated studying

The accusations didn’t go unnoticed inside the XRPL group. Daniel Keller, CTO at Eminence and ambassador of XRPL, was skeptical concerning the authenticity of Kirjakulov’s claims. Keller questioned the legitimacy of the accounts linked to the liquidity swimming pools, saying, “Do we all know that is an official Bitstamp account? Wanting again on the activation sequence, it was activated by way of Binance, which is bizarre if Bitstamp runs it.”

In response, Dr. claimed Kirjakulov that the accounts in query have been certainly related to Bitstamp. He clarified: “In case you undergo the accounts, it’s seen that they’re clearly related to Bitstamp as in addition they market these tokens. There may be actually nobody else right here interested by creating these tokens in the marketplace as a result of they’re area of interest and unpopular.”

He additional defined that liquidity had been withdrawn to a market making (MM) account, reinforcing his declare of Bitstamp’s direct involvement. Kirjakulov additionally dismissed the significance of activation accounts, noting: “Activation accounts imply nothing. I activate my account from a number of exchanges particularly to make it much less traceable.”

Associated studying

Keller pushed for extra concrete proof to assist the claims. He requested, “Are you able to share a few of these connecting trades as a result of in case you’ve already regarded them up it will be cool to share. An activation account is essential if you’re an change supporting an LP since you need folks to know it’s your firm.

Dr. Kirjakulov responded by emphasizing the power of the circumstantial proof pointing in the direction of Bitstamp, saying: “Circumstantial proof? Sure. However this proof factors fairly clearly to Bitstamp as nobody else has such numerous these property issued by them besides somebody affiliated with them. And circumstantial proof isn’t any excuse to disregard them.”

The discourse prolonged to the subject of Bitstamp’s IOU providers. Michael Nardolillo, a person on He argued: “There isn’t a assure that Bitstamp will honor their IOUs?! That is like saying there isn’t any assure you’ll withdraw your cryptocurrency from an change. Bitstamp is very regulated, IOUs are all the time redeemable. It’s no completely different than holding property on an change.”

This protection was met with skepticism from Kirjakulov, who drew consideration to earlier failures within the sector. He replied, “Someplace, FTX’s collectors did just a few facepalms. Once more, Stably didn’t honor the 1:1 conversion. And there may be nothing on Bitstamp and even GateHub sources that claims there will probably be a 1:1 conversion and completely nothing of any proof of funding.”

In an try to bolster his protection, Nardolillo shared a screenshot of Bitstamp’s web site detailing their IOU service. The screenshot exhibits that customers can switch worth on the XRP Ledger through IOUs issued by Bitstamp in change for actual property equivalent to BTC, USD, EUR or ETH.

Dr. Kirjakulov highlighted a crucial flaw on this association. He mentioned, “And that is the issue. That is the one manner you may make this commerce. It additionally says completely nothing about 1:1 conversion. What if it deviates by 50%? Will they change 1 bUSD (which is price 50 cents) for 1 USDT (which is price 1 USD)?”

On the time of writing, the XRP group is awaiting an official response from Bitstamp. XRP was buying and selling at $1.15.

Featured picture created with DALL.E, chart from TradingView.com

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now