Bitcoin

BlackRock Bitcoin ETF sees first inflow in weeks: Investors favor BTC again?

Credit : ambcrypto.com

- Bitcoin ETFs noticed renewed inflows, with BlackRock’s IBIT registering $15.8 million on September 16.

- The massive ETF inflows positively impacted Bitcoin’s value, pushing it above $60,000 whereas confidence elevated.

The Bitcoin [BTC] The ETF market has just lately shifted from a constant streak of outflows to days of renewed inflows, a development that started on September 12.

Blackrock’s IBIT makes headlines

iShares Bitcoin Belief from BlackRock [IBIT] attracted a variety of consideration after experiencing no exercise for weeks.

On September 16, IBIT recorded inflows of $15.8 million. This was the primary every day internet influx in three weeks.

In keeping with Farside Traders, this has contributed to a mixed internet influx of $12.8 million for US spot BTC ETFs.

Nevertheless, this improve was short-lived as IBIT returned to zero inflows the following day.

Different Bitcoin ETFs Analyzed

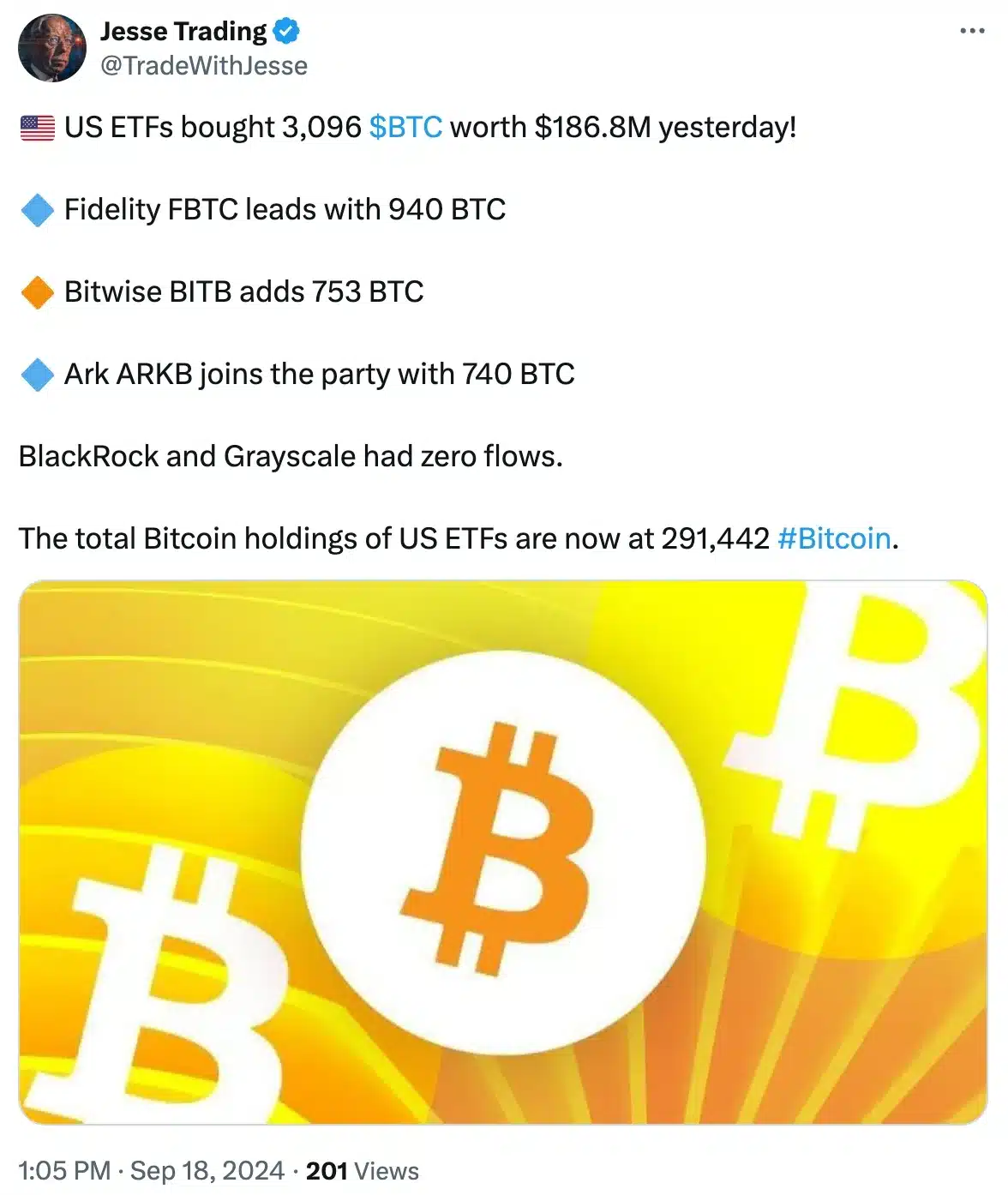

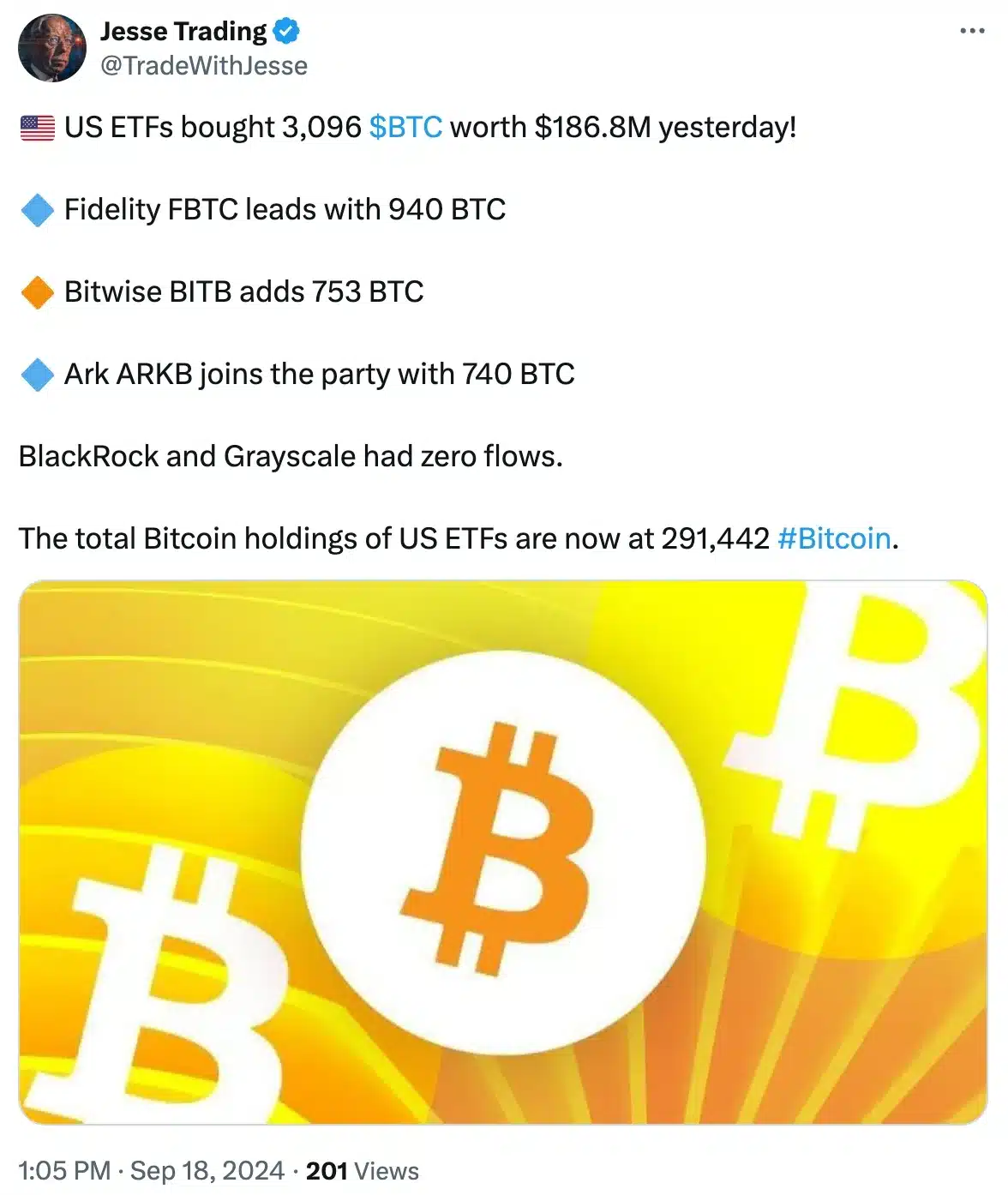

On September 17, a number of main Bitcoin ETFs skilled notable inflows, signaling renewed investor curiosity.

Constancy’s FBTC led the pack with a formidable influx of $56.6 million, adopted by Bitwise’s BITB with $45.4 million and Ark’s ARKB with $42.2 million.

VanEck’s HODL noticed extra modest inflows of $20.5 million, whereas Invesco’s BTCO recorded $10.2 million, Franklin’s EZBC $8.7 million, and Wtree’s BTCW grossed $3.2 million.

In the meantime, Grayscale’s GBTC remained stagnant, recording zero flows over the identical interval.

Supply: Jesse Buying and selling/X

Neighborhood response

Word on the identical, X consumer Puppeteer stated,

“That could be a vital improve in Bitcoin holdings by US ETFs, indicating sturdy institutional confidence.”

Dealer and investor joined the fray Mark the monkeywho stated,

“BlackRock and Grayscale could maintain off for some time, however the demand is there and they’re making ready for what could possibly be a significant catalyst within the coming months.”

This underlines the neighborhood’s continued confidence in BTC ETFs, even regardless of zero flows from distinguished gamers like BlackRock and Grayscale.

Trying again on the previous, BlackRock’s entry into the rising crypto ETF area created a variety of pleasure amongst traders.

With $9 trillion in belongings beneath administration, BlackRock’s entry into the market offered a lift in institutional confidence and a elegant perspective, driving the adoption of cryptocurrency ETFs.

Influence on the value of Bitcoin

That stated, whereas Bitcoin ETFs noticed notable inflows, BTC itself confronted challenges breaking the $60,000 threshold on September 17.

Nevertheless, with the most recent improve of two.96%, BTC was buying and selling at $60,432 on the time of writing. CoinMarketCap.

This upward momentum underlines the optimistic affect that ETF inflows have had on Bitcoin’s value trajectory, reflecting a possible bullish development.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024