Ethereum

BlackRock: Bitcoin is ‘gold alternative,’ Ethereum a ‘technology bet’ – Why?

Credit : ambcrypto.com

- BTC is sound cash and a risk-off asset, in accordance with BlackRock.

- However ETH is a speculative wager on the adoption of blockchain know-how.

BlackRock, the world’s largest asset supervisor, not too long ago introduced distinctive but numerous pitch decks for Bitcoin [BTC] And Ethereum [ETH].

The twin pitch deck was introduced throughout a digital belongings convention in Brazil. BlackRock’s Robbie Mitchnick introduced BTC as a ‘risk-off’ asset, placing it on par with or higher than gold.

However, ETH was promoted as a ‘risk-on’ asset, much like US shares.

BTC as cash; ETH as a wager

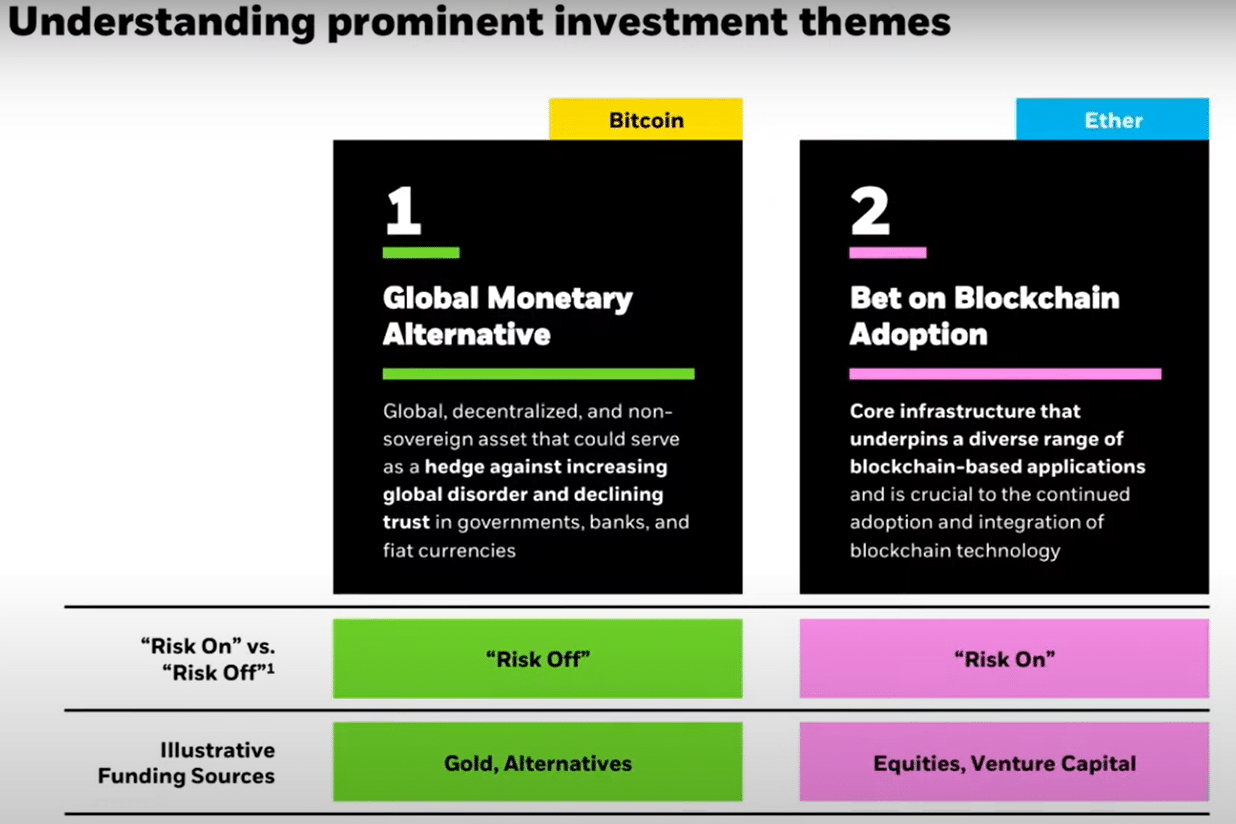

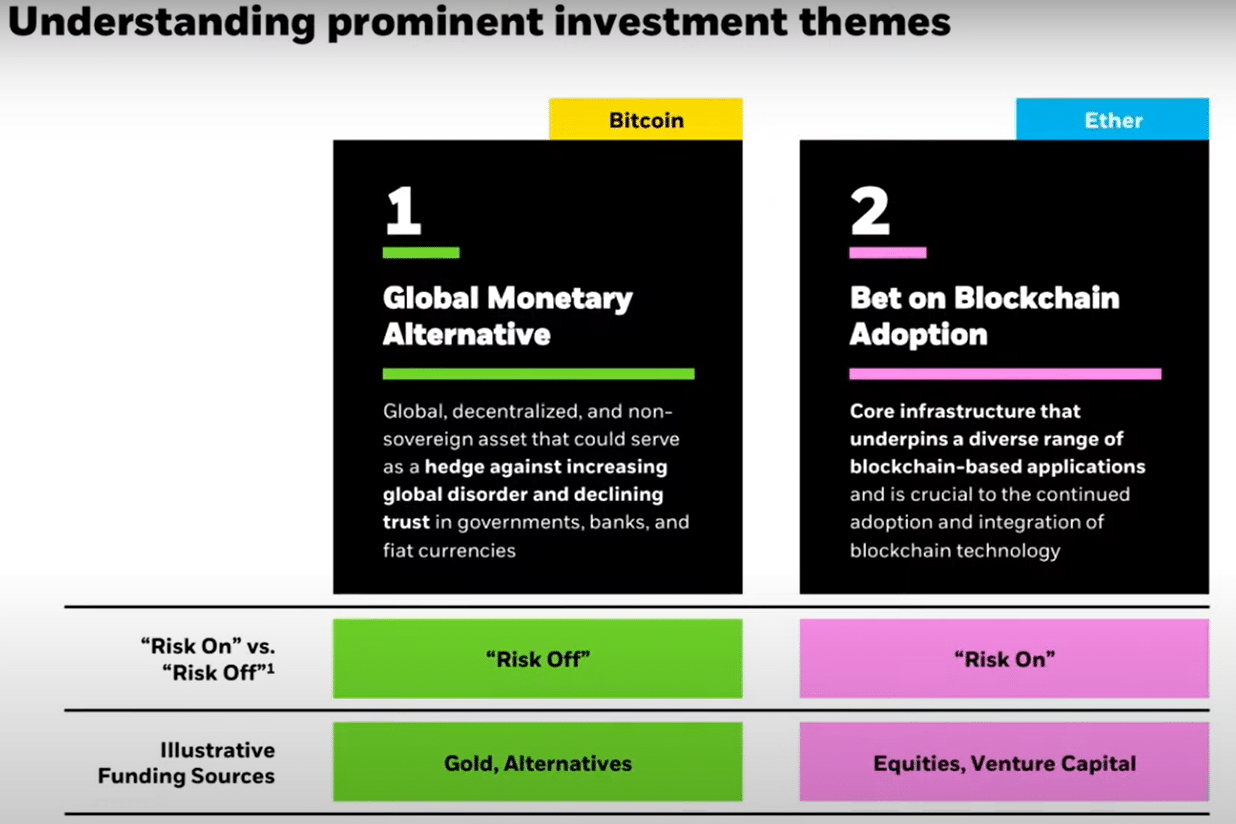

The asset supervisor touted BTC as a world financial various and a very good hedge in opposition to declining belief in governments and the ruthless devaluation of the fiat forex.

Supply: BlackRock

Relatively, ETH was introduced as a speculative wager on the adoption of blockchain know-how, an funding that Mitchnick equated to US shares.

He noted,

“On the one hand you’ve got BTC, a commodity like gold and a substitute for shares and bonds. Ethereum, extra of a long-term know-how, is betting that this blockchain will convey extra use instances and extra worth to the economic system sooner or later.”

A part of the crypto group echoed Mitchnick’s shows, highlighting that BTC is ‘cash’ with much less inflationary stress than fiat currencies, which lose worth yearly.

However it additionally settled the raging debate that has been happening for a while: ETH isn’t cash. Because the introduction of Blobs earlier this yr, ETH’s inflation fee has truly elevated, making it much less of an “ultra-sound forex.”

If forecasts maintain, BTC might rise extra sharply throughout future geopolitical tensions, whereas ETH might fall in such eventualities.

BlackRock’s perspective is essential as a result of it’s a trendsetter and is widely known. Along with Grayscale, the asset managers are seen as chargeable for the US shift and last approval of US spot BTC ETFs.

Because the ETF’s inception, BlacRock’s ETFs have outperformed all various choices and exceeded key milestones.

On the time of writing it’s BTC ETF, iShares Bitcoin Belief [IBIT]had cumulative web flows of $21.5 billion with almost $23 billion in web belongings.

That mentioned, BlacRock’s ETH ETF, ETHA, has netted complete inflows of $1.1 billion since buying and selling started in July.

Ergo, the world’s largest asset supervisor, might affect the way in which different buyers view the sector. Based on some market observers, the message appears clear: Bitcoin is cash, whereas the remainder of crypto is speculative.

In the meantime, BTC was valued at $62,000, down 5% from the weekly charts. However, ETH was valued at $2.4K, down 8.5% over the identical interval.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now