Blockchain

BlackRock, Securitize Reduce BUIDL’s Market Cap on Ethereum by 60%

Credit : cryptonews.net

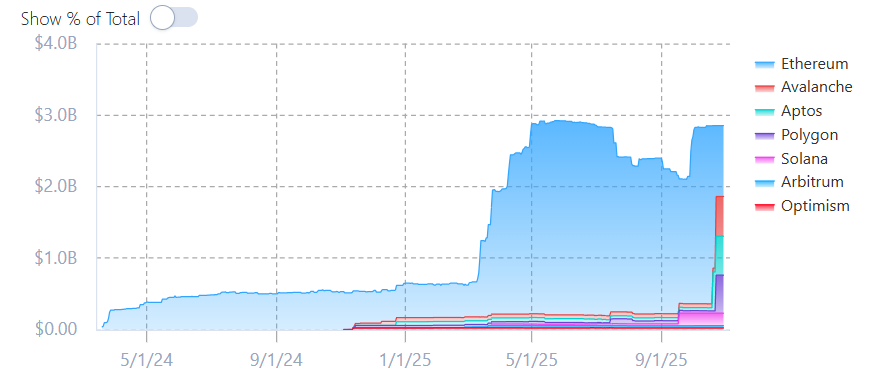

BlackRock and its tokenization companion Securitize have reallocated a big portion of the asset supervisor’s tokenized fund BUIDL throughout a number of blockchains, quietly decreasing the market capitalization on Ethereum by round 60%.

RWAxyz information exhibits the fund’s investments rose from $2.8 billion in Avalanche, Aptos and Polygon to roughly $554.7 million, $544.1 million and $530.9 million as of Oct. 30, up from $54.3 million, $43.4 million and $30.7 million, respectively, on Oct. 19. the Ethereum community dropped to round $990 million.

BUIDL initially launched on Ethereum solely in March 2024, earlier than starting its enlargement to different blockchains just below a yr in the past, with the overwhelming majority of the fund remaining on Ethereum till this month. Each BlackRock and Securitize didn’t instantly reply to The Defiant’s request for touch upon the measure.

BUIDL market cap for blockchains. Supply: RWAxyz

BlackRock is the world’s largest asset supervisor with greater than $13.4 trillion in belongings underneath administration within the third quarter. BUIDL stays the biggest tokenized real-world asset (RWA) product, with greater than $2.85 billion in belongings.

Complete RWA worth. Supply: RWAxyz

BUIDL’s community diversification comes as the overall worth of tokenized RWAs continues to rise this yr, at present at greater than $35.6 billion, up about 8.8% previously 30 days, in accordance with RWAxyz.

Ethereum stays the most well-liked blockchain for RWAs, with almost $12 billion in tokenized RWA worth, or roughly 53% of the business.

Launched by BlackRock in partnership with Securitize, BUIDL provides certified traders the chance to carry and earn dividends on blockchain-based tokens backed by US Treasury bonds, money and repurchase agreements.

Earlier this week, Securitize introduced plans to develop into a publicly traded firm by a enterprise mixture with Cantor Fairness Companions II, Inc., a SPAC backed by Cantor Fitzgerald, an organization beforehand led by Howard Lutnick earlier than he turned U.S. Secretary of Commerce.

The deal values the corporate at roughly $1.25 billion, and the mixed entity is anticipated to commerce on Nasdaq underneath the ticker SECZ.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now