Bitcoin

BlackRock’s Bitcoin fund hits $70B faster than any ETF in history

Credit : ambcrypto.com

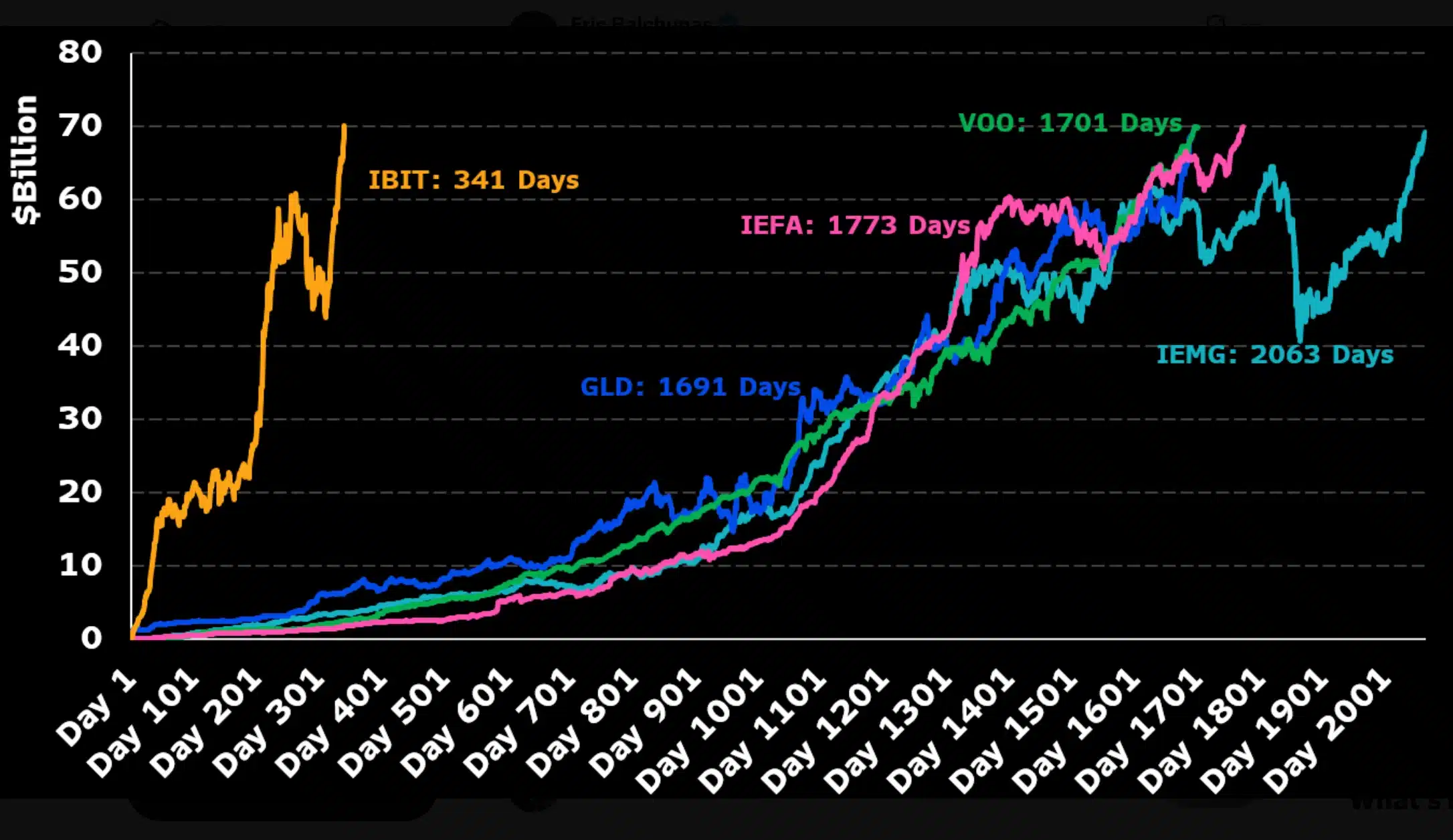

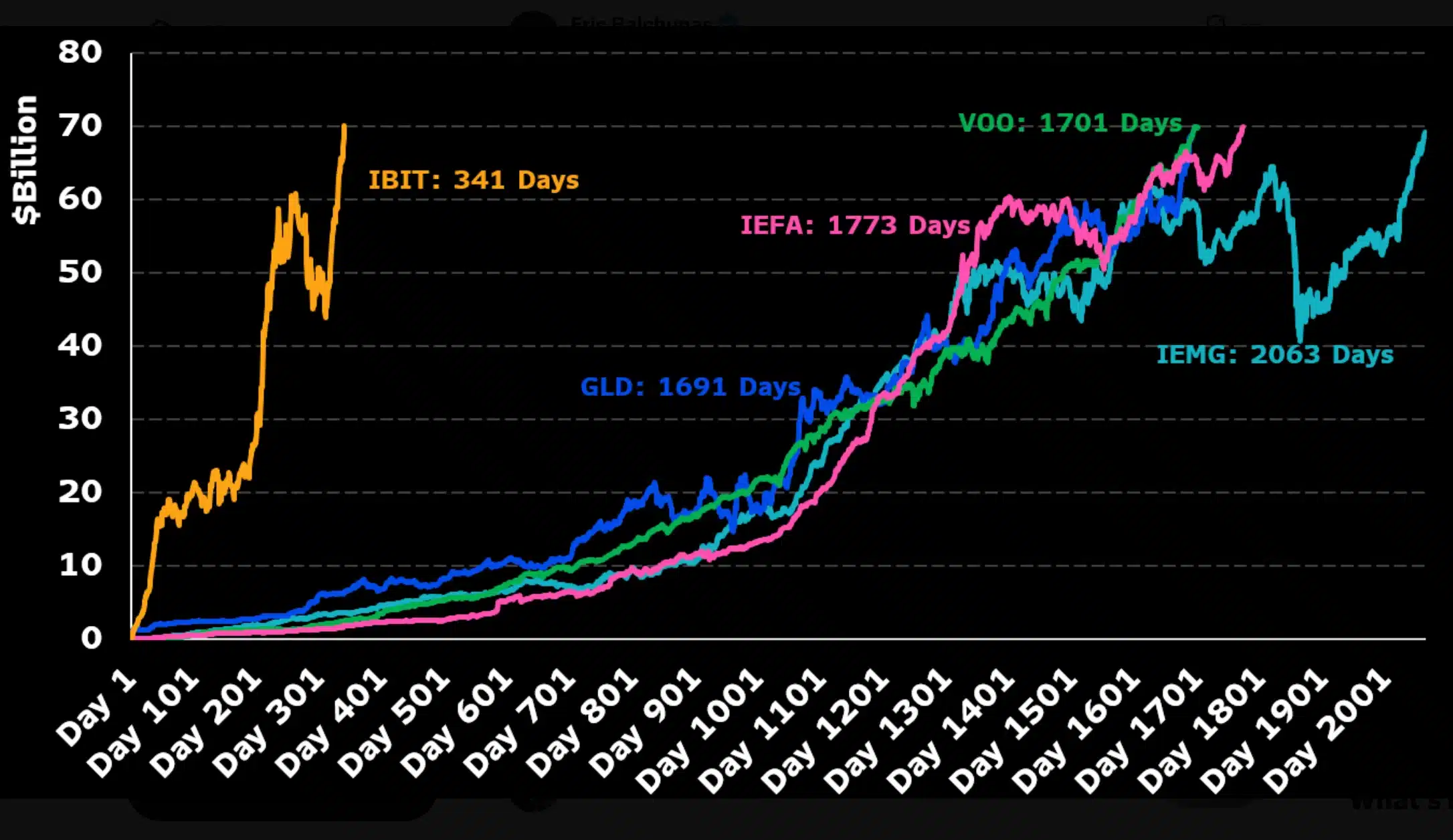

- The IBIT of BlackRock turned the quickest ETF to exceed $ 70 billion AUM in simply 341 days.

- IBIT held 661,000+ BTC, making it the biggest institutional Bitcoin holder worldwide.

Blackrock’s place Bitcoin [BTC] ETF has written historical past by turning into the quickest fund with trade that exceeds greater than $ 70 billion in property.

The milestone displays broader market confidence and positions BlackRock’s supply as a possible recreation changer within the evolution of crypto funding merchandise.

Analyst appreciates the IBIT progress of BlackRock

Be aware about the identical, Eric Balchunas taken to X (previously Twitter) and seen,

“Ibit simply blew via $ 70 billion and is now the quickest ETF ever in simply 341 days that determine has hit.”

Balchunas additionally emphasised that the IBIT of BlackRock exceeds expectations and reaches nearly 5 instances sooner $ 70 billion in property than SPDR Gold shares (Gld) -the earlier file holder.

Eric Balchunas in Ibit

Whereas GLD took over greater than 1600 buying and selling days to achieve the milestone, BlackRock’s Ibit has achieved it in a fraction of time, which strengthens the explosive market enter.

That mentioned, because the debut in 2024, ETF has secure In 2025 alone, greater than $ 9 billion in influx and earns a spot within the high 5 of the American ETFs.

This coincided with BlackRock lately 2,704 bitcoins value round $ 283.9 million, along with 28,239 Ethereum [ETH] Tokens value an estimated $ 73.2 million.

Settings soar in IBIT

This enhance within the familiarity of BlackRock can also be mirrored within the variety of settings that participated within the record of Ibit embracing.

For instance, the Moscow Inventory Trade has listed Bitcoin Futures linked to IBIT.

Furthermore, JPMorgan can also be planning to roll out Loans supported by ETF, beginning with the flagship Crypto Fund of BlackRock, which signifies rising belief and usefulness in Bitcoin-oriented funding merchandise.

That’s the reason BlackRock’s IBIT has grow to be the biggest institutional holder of Bitcoin with greater than 661,000 BTC -underwearing, which exceeds each the technique of Binance and Michael Saylor.

What’s extra?

Presently appreciated at $ 71.9 billion, the meteorical enhance within the ETF has additionally positioned it in potential to overtake Even the estimated corporations of Satoshi Nakamoto in opposition to the next summer season, in line with Eric Balchunas from Bloomberg.

Subsequently, since IBIT shares commerce near $ 62 and Bitcoin crosses the $ 110,000, the ETF continues to dominate its colleagues, so that just about $ 49 billion in internet entry is obtained because the 2024 debut.

As anticipated, this route paints IBIT as essentially the most influential participant underneath Spot Bitcoin ETFs on the American market.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024