Altcoin

Bleeding shares; Bitcoin holds – how this divergence BTC could send to $ 100k

Credit : ambcrypto.com

- Bitcoin’s pullback of $ 90 billion remained small within the gentle of the macro delay cycle.

- The following leg can arrive sooner than the market anticipated.

In contrast to the consensus of the marketBitcoin’s path to $ 100k appears more and more possible within the aftermath of the ‘commerce dump’.

Since February 19, the US inventory market has paid $ 11 trillion in market capitalization, with 54.55% of that drawing that accelerates the day after ‘liberation.’

But this may solely be the start. Gold (XAU) marked a Q2 peak at $ 3,143 per ounce earlier than a retracement of just about 3%, with $ 520 billion in market capitalization erased since 2 April. Bitcoin [BTC]Within the meantime, 5.17% have corrected of the ranking of $ 1.74 trillion.

A dip of $ 90 billion is small in comparison with the broader market flushing. Consequently, the rising divergence of Bitcoin towards danger belongings and macro swings has been strengthened.

Correct holders accumulate, strengthen conviction

The supply of holders in the short term (<155 days) has fallen to a lowest level in two months of three.7 million BTC, which displays round 3 million BTC in realized losses within the midst of Bitcoin's retracement of his $ 109k of all time.

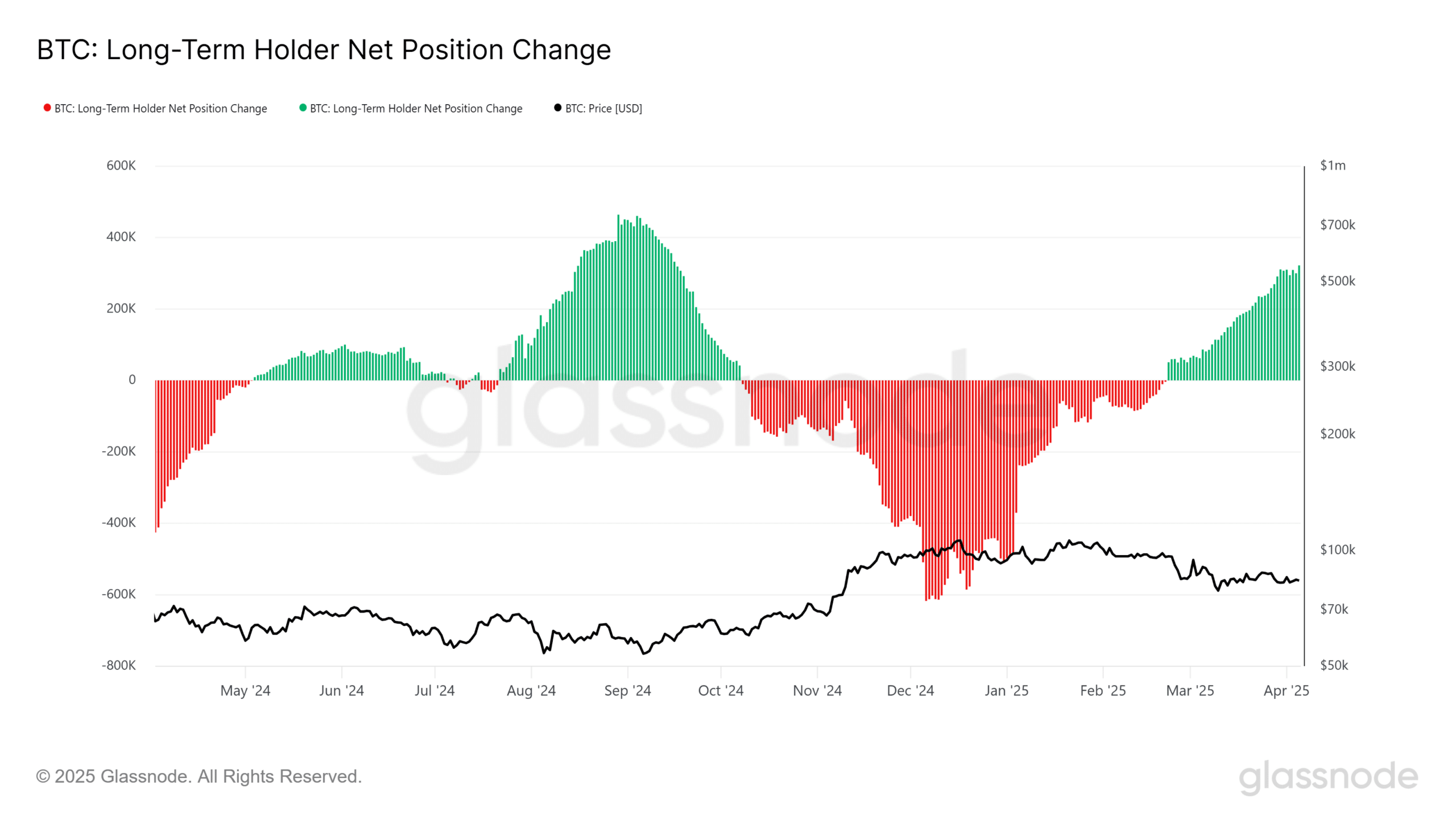

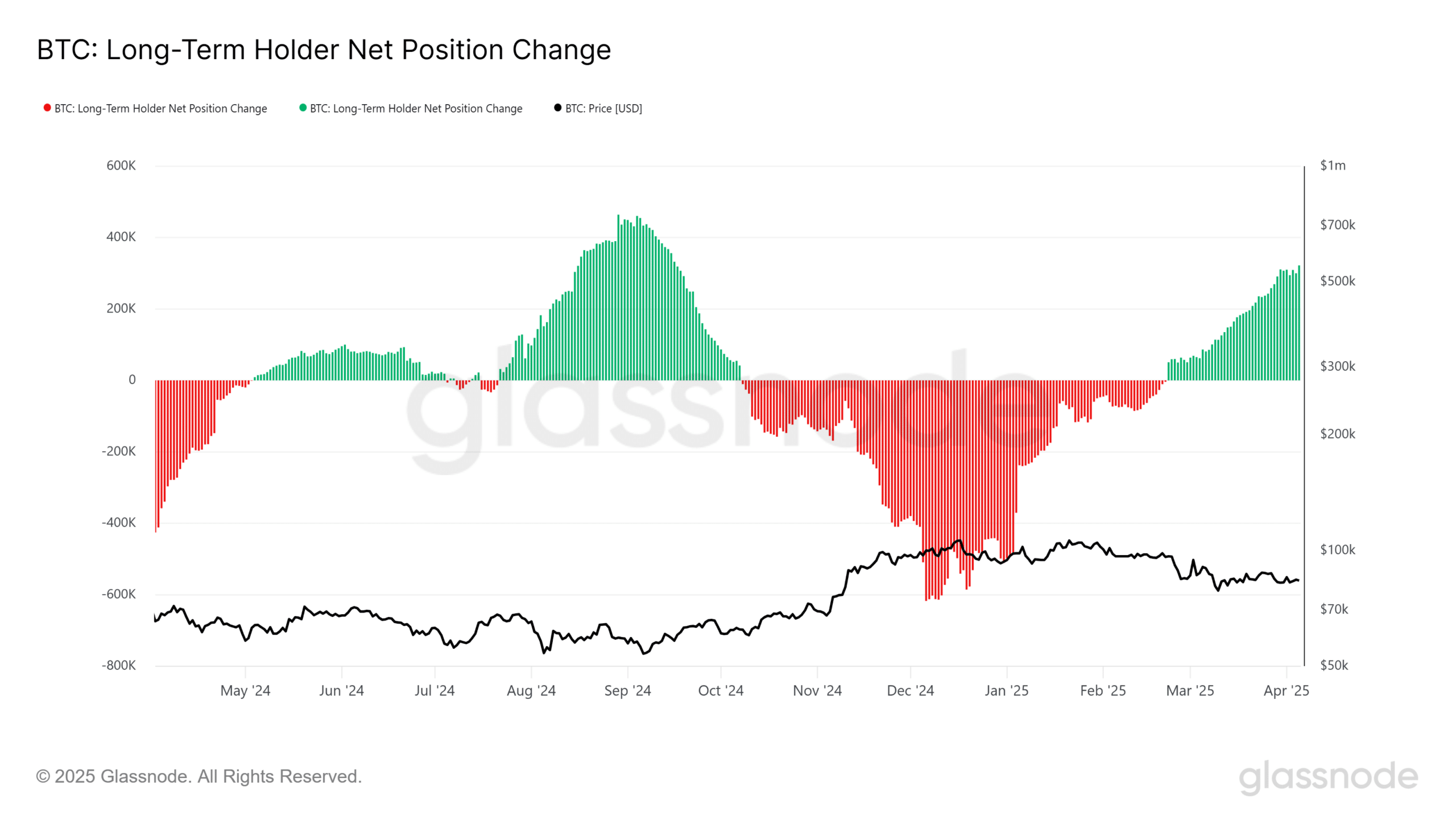

Conversely, the lengthy -term holder (LTH) inventory has been expanded in the identical interval.

The web place change statistics alerts aggressive accumulation at a median price foundation of $ 84k per BTC, which underlined a powerful conviction.

Supply: Glassnode

On the time of the press, Bitcoin remained underneath $ 85k, a important break life threshold for weak fingers.

Persistent LTH accumulation and the rising decoupling of BTC of US shares, nonetheless, point out a important bending level That may very well be the scene for BTC to reclaim $ 100k.

Crucial driver? Capital flows from danger activa – and even protected ports – in BTC.

Germany Recently initiated A pullback of 1200 tons of gold price $ 124 billion from the New York reserves. If extra nations comply with, this might weaken the position of Gold as a worldwide port.

With Bitcoin that’s sturdy, whereas the S&P500 $ 4 trillion throws the most important drop because the COVID-19-Crash and Gold that loses steam, BTC is in a wonderful place to draw capital of governments, establishments and retail buyers.

Bitcoin’s Haven standing again in Focus

Within the quick time period, to activate FOMO, Bitcoin has to interrupt resistance to $ 85k $ 87k, a key zone the place taking a revenue goes then. It was a month since these ranges have been final examined.

That’s the reason the creation of a powerful bidding wall inside this attain is essential for bullish continuation. But a breakdown beneath $ 80k stays an occasion with little chance.

Since March 12, Walviscohorten (> 1K BTC) have collected aggressively, in order that corporations have been dropped at a 3 -month excessive. With deep pocket entities that take in the vary, a retest of help of $ 77k appears more and more unlikely.

Supply: Glassnode

The flexibility of BTC to maintain sturdy regardless of the macro uncertainty continues to feed its case as a canopy towards the market turbulence.

So long as the query stays agency, the trail from Bitcoin to the invention of six digits stays nicely positioned. Capital influx might decide up much more, particularly with US shares which are confronted with a higher danger of rising fee strain.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now