Blockchain

BNB Chain overtakes TRON with over 190M stablecoin users, captures 47% of DEX market: ARK Invest

Credit : cryptonews.net

BNB Chain has overtaken TRON to grow to be probably the most lively community for stablecoin transactions, fueled by rising DEX quantity and spillovers from Binance’s buying and selling incentives. However analysts at ARK Make investments famous that the house has grow to be extra fragmented.

Abstract

- BNB Chain has overtaken TRON because the busiest community for stablecoin exercise, pushed by growing on-chain buying and selling and Binance-backed incentives.

- Whereas Ethereum and its Layer 2 techniques nonetheless dominate institutional settlement, BNB Chain is now main in person engagement and decentralized change quantity.

- In keeping with the report, the market is turning into more and more fragmented, with liquidity unfold throughout a number of chains fairly than targeting a single community.

BNB Chain has quietly dethroned TRON as the most important community in stablecoin exercise.

In keeping with ARK Make investments’s “The DeFi Quarterly” report, roughly 192 million addresses have interacted with them for the reason that first stablecoin hit the market. Tether’s (USDT) dominates with about 115 million of these, whereas the now-defunct Binance USD (BUSD) nonetheless accounts for 35 million, and USD Coin (USDC) is shut behind with 31 million.

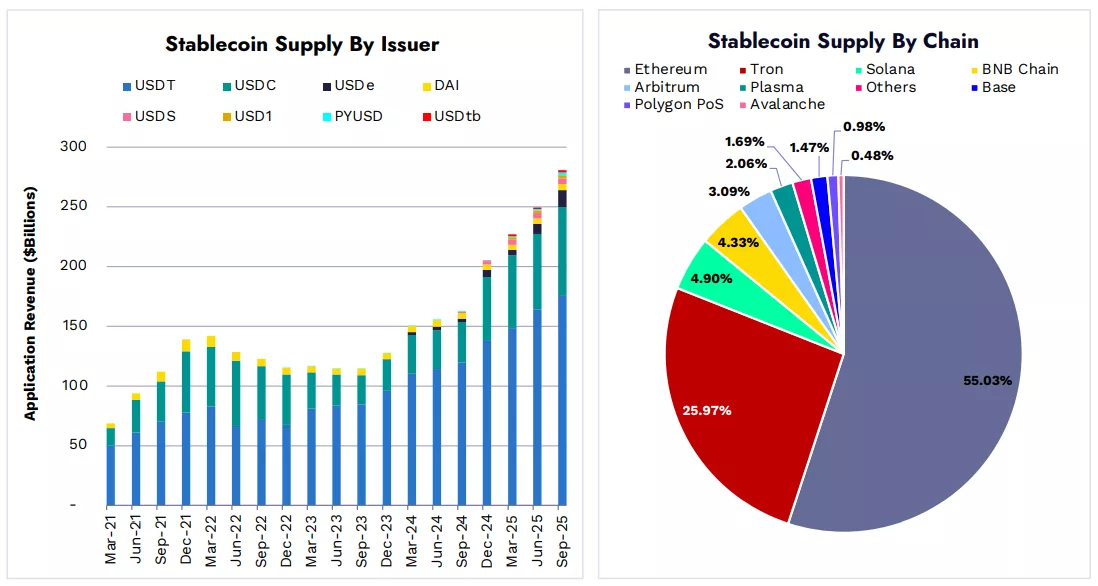

Stablecoins by issuer and chains | Supply: ARK Make investments

As ARK analysts put it, quarterly adjusted transaction quantity for stablecoins “has since grown 43%, reaching almost $9 trillion within the third quarter of 2025,” implying that stablecoins are circulating sooner and throughout extra networks than ever earlier than.

Community shares

Ethereum continues to be the largest elephant within the room. Particularly for those who embody the Layer 2s like Base and Arbitrum, which collectively deal with round 48% of whole stablecoin transactions. In the meantime, TRON constructed its footprint by transporting USDT flows into rising markets, a dynamic that saved it related lengthy after newer gamers entered the scene.

However community shares have shifted, because the report reveals that Ethereum’s share of the stablecoin provide has elevated from 51% to 55%, whereas TRON’s has fallen from 32% to 26%. And someplace in that realignment, BNB Chain stepped in and picked up the slack as Solana misplaced floor and its buying and selling operations migrated elsewhere.

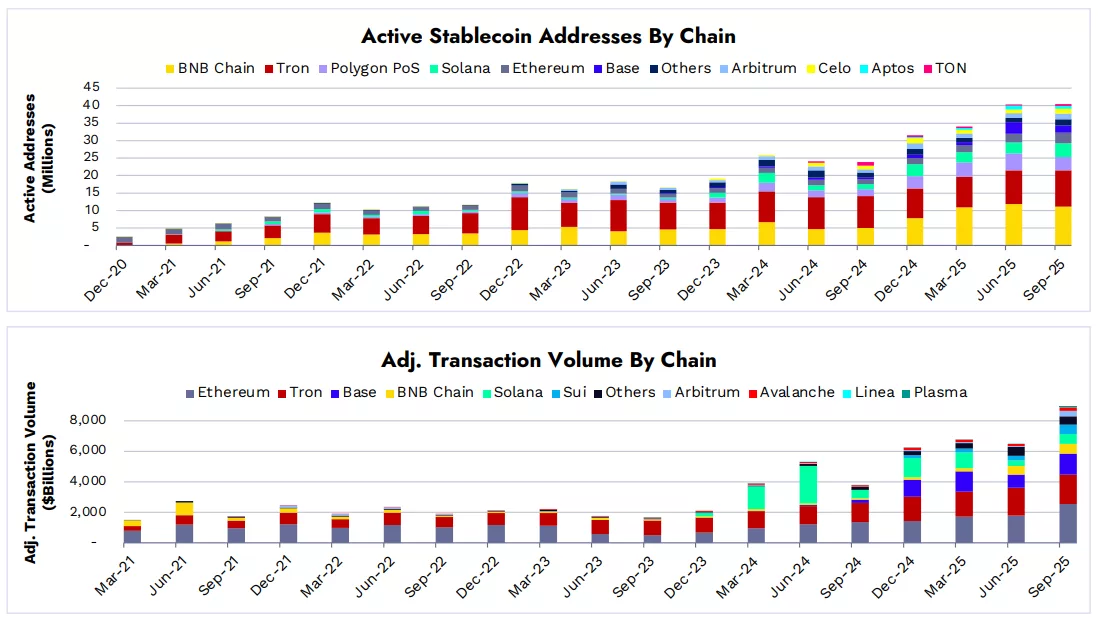

Lively stablecoin addresses per chain | Supply: ARK Make investments

This line from the report reveals the change in provide allocation throughout chains. BNB Chain’s good points got here as Solana misplaced floor and spot DEX exercise shifted.

DEX quantity tells the identical story. For the reason that finish of 2024, decentralized buying and selling has elevated by about 61%, from about $1 trillion to $1.7 trillion. In the meantime, Solana’s share fell from 47% to 19%, whereas BNB Chain’s soared from 11% to 47%.

Tree of TVL

As ARK Make investments defined, the change adopted Binance’s zero-fee buying and selling program, noting that this system “induced a surge in PancakeSwap quantity and redirected memecoin buying and selling from Solana to BNB Chain.”

This system additionally made sure buying and selling flows extra engaging on BNB Chain, as merchants shifted memecoin and retail liquidity to the chain that was intently tied to Binance, the report stated.

You may also like: BNB Chain unveils $45 million airdrop reward for merchants who ‘suffered losses’ from memecoin crash

Furthermore, BNB Chain additionally distinguishes itself by buying and selling effectivity. As of Q3 2025, the chain had probably the most spot DEX quantity relative to whole worth locked (TVL). In keeping with the report, the community’s quarterly quantity rose 94.7x that of TVL, a ratio nicely above Ethereum’s roughly 3.83x.

Whereas Ethereum nonetheless attracts a number of long-term capital that strikes much less continuously, BNB Chain concentrates larger turnover and extra speculative flows.

Rising competitors in a fragmented house

Tendencies in stablecoin choices are additionally altering. Collectively, USDT and USDC market share fell barely this yr from 93% to 89% as newer entrants gained floor. Ethena Labs’ USDe rose about 68% to just about $14 billion, whereas PayPal’s PYUSD rose 135% to about $2.4 billion, with most of that on Ethereum, ARK notes.

Furthermore, the DEX-CEX ratio has additionally modified. As on-chain buying and selling has gained over centralized platforms, the ratio will enhance by roughly 192% by 2024.

Whereas BNB Chain might not change Ethereum as the first community for the custody of institutional stablecoins or as the primary settlement node, with Ethereum and its Layer 2 networks nonetheless dealing with the majority of dollar-denominated transactions, it has nonetheless taken the cake when it comes to lively person engagement and DEX-led buying and selling, the report stated.

As ARK’s report suggests, the broader result’s a fragmented market. One by which stablecoins transfer throughout extra chains and places than ever. That fragmentation brings new challenges when it comes to liquidity and routing, but additionally leaves room for every community to specialise in what it’s good at.

Learn extra: Ondo World Markets Pushes RWA Adoption to BNB Chain

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now