Altcoin

BNB targets $604, but technical indicators suggest…

Credit : ambcrypto.com

- The momentum on the day by day chart was about to shift bullishly.

- Sentiment amongst short-term speculators was bearish.

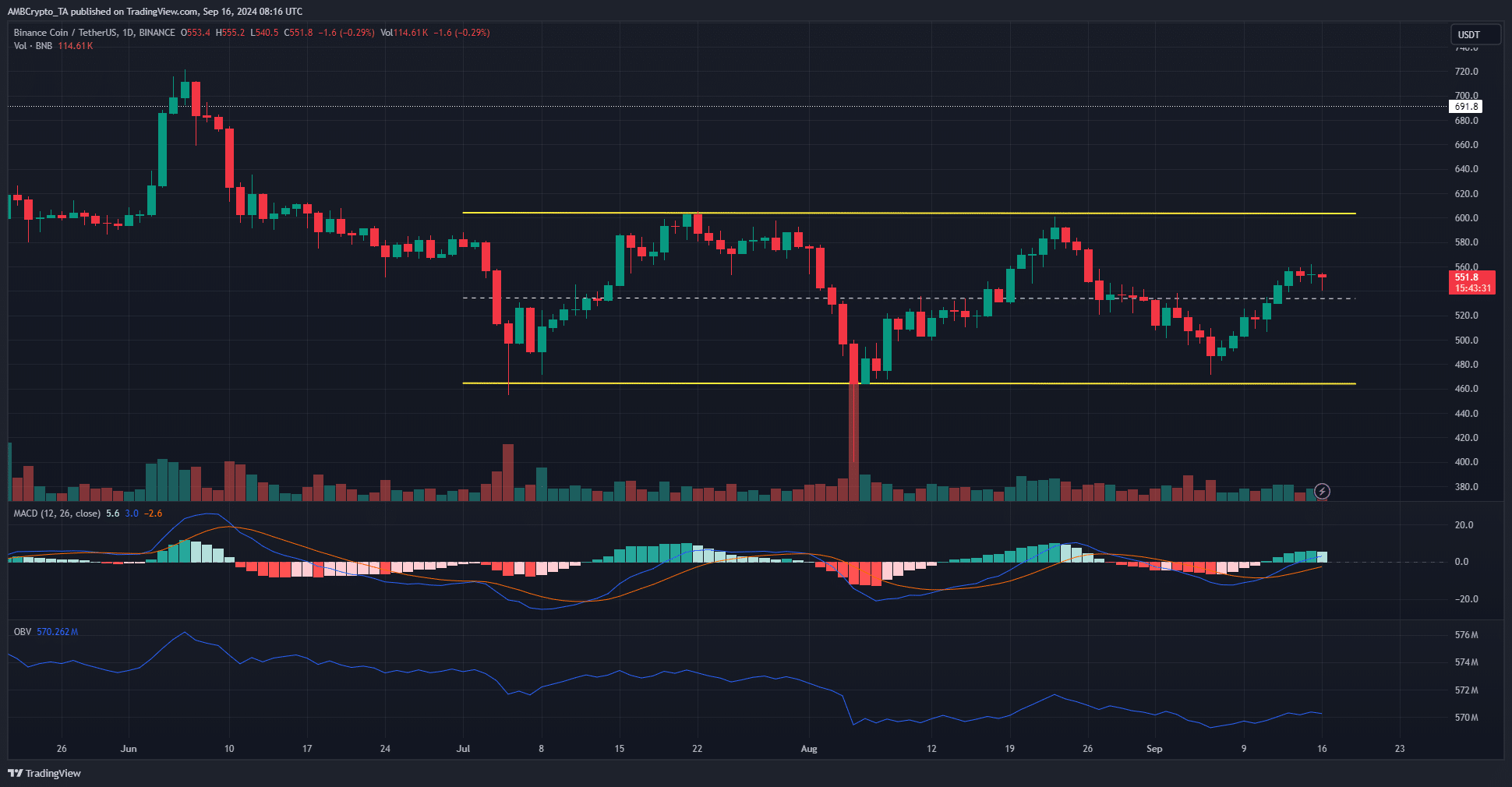

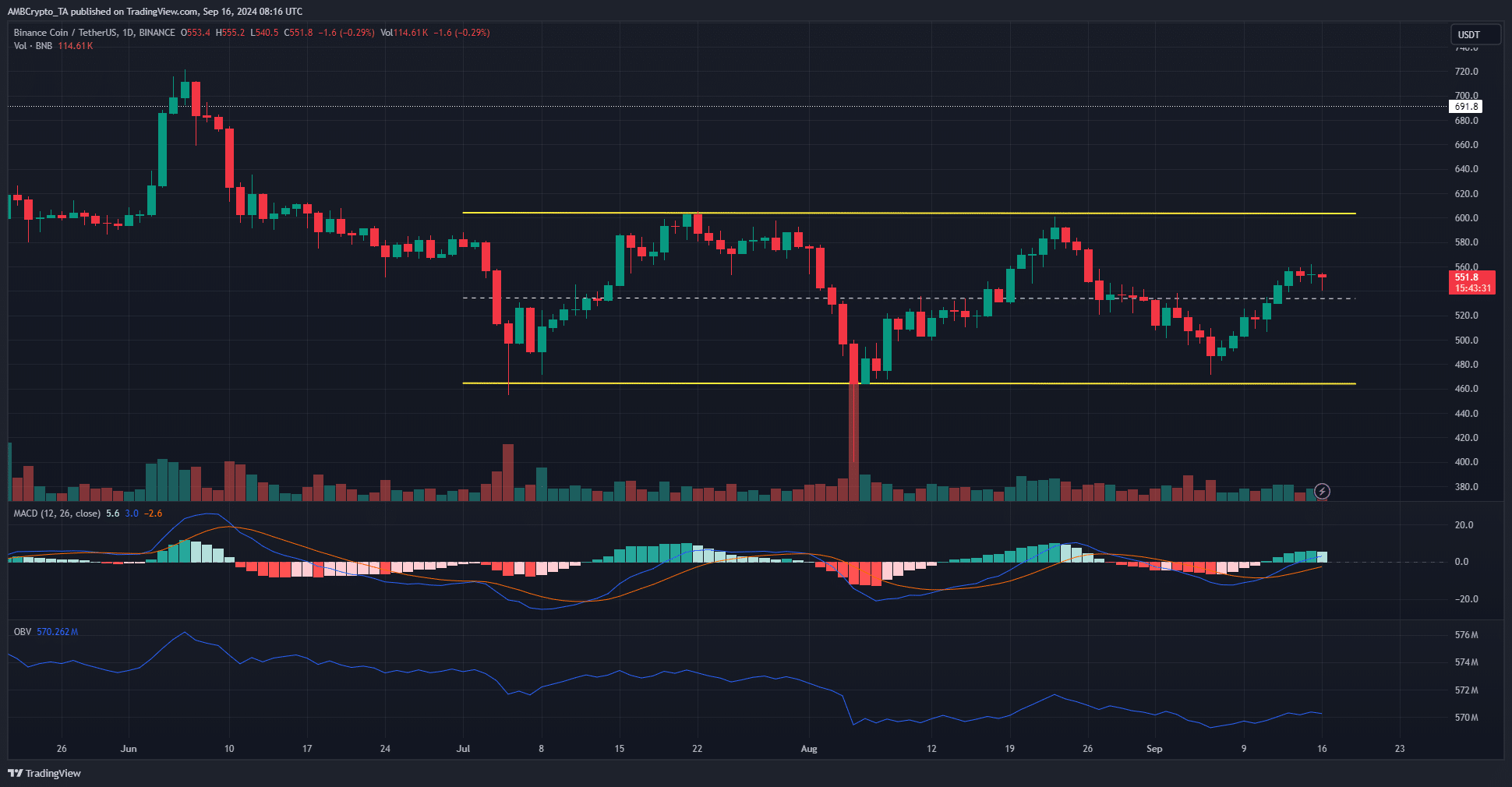

Binance coin [BNB] Bulls have been focusing on a transfer in the direction of a excessive within the $604 vary after falling to $471 within the first week of September. Patrons have proven resolve in defending the demand zone on the native low.

The technical indicators gave combined indicators, however some beneficial properties will be anticipated within the coming days. Shopping for strain was not but steady sufficient to vow a breakout.

The psychological $550 was in a bullish maintain

Supply: BNB/USDT on TradingView

The shorter timeframe market construction, such because the 4-hour market, favored consumers. The vary formation noticed its low at $464, which was virtually retested in early September. The worth rally since then has taken BNB above the mid-range resistance at $535.

On the day by day chart, the MACD shaped a bullish crossover, indicating that upward momentum was gaining power. The indicator was additionally about to cross the impartial zero line, reflecting a attainable development shift.

Nonetheless, the OBV didn’t erase native highlights. Furthermore, buying and selling quantity was additionally muted. Subsequently, the prospect of a powerful BNB rally was low, however it might slowly rise to $604, which is a excessive vary.

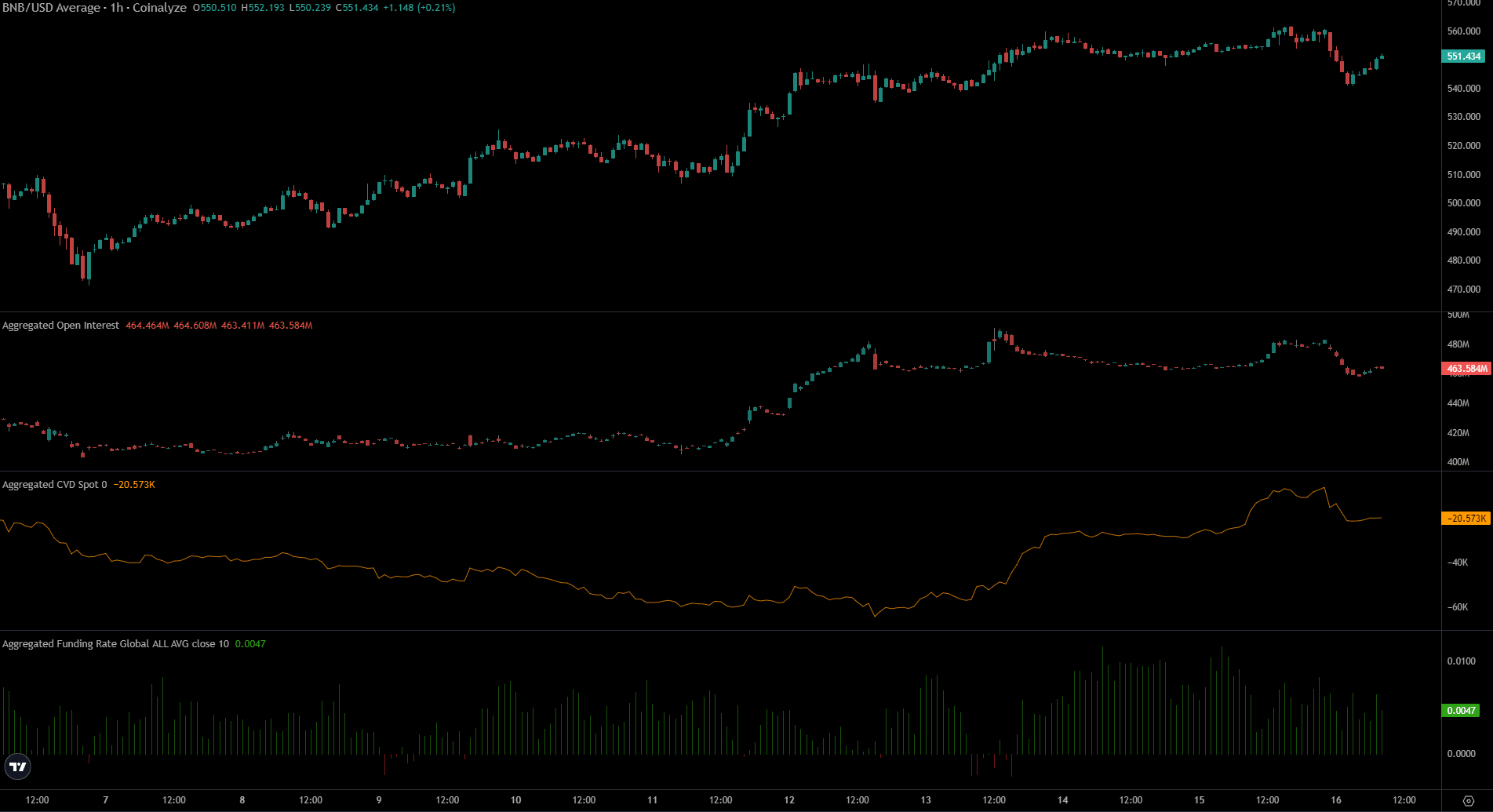

The futures confirmed that the bullish sentiment was short-term

Since September 12, the protection ratio has been predominantly optimistic. The Open Curiosity additionally recorded some improve on the eleventh and twelfth, however has stagnated since then. Throughout this time, the worth has moved between $540 and $560.

Learn Binance Coin’s [BNB] Value forecast 2024-25

This meant that the bullish sentiment of the previous week has light and been changed by uncertainty. The current drop in OI means that short-term sentiment has been bearish. Spot CVD has moved considerably larger in current days, indicating demand has been sturdy.

Though the indicators have been contradictory, the excessive CVD and restoration of mid-range resistance have been encouraging indicators of a transfer in the direction of the highs within the vary.

Disclaimer: The data offered doesn’t represent monetary recommendation, funding recommendation, buying and selling recommendation or every other type of recommendation and is solely the opinion of the author

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024