Altcoin

Bofa CEO teases dollar-pegged stablecoin-is a banking revolution on the horizon?

Credit : ambcrypto.com

- Whereas the US authorities is switching to pro-Crypto coverage, conventional funds are getting ready for change.

- CEO of Financial institution of America has proposed a possible stablecoin as quickly as there’s a authorized readability.

In the course of the previous yr, the adoption of crypto in all states, governments and conventional funds elevated. With a pro-Crypto authorities within the US, numerous conventional corporations centered on finance are dedicated to coming into the crypto race.

The most recent firm to point such a motion is Financial institution of America, the place the CEO reveals plans to launch a stablecoin.

Financial institution of America launching Stablecoin

Based on CEO of Financial institution of America Brian MoynihanThe financial institution is getting ready to launch its stablecoin as quickly as there are rules that make it potential.

Throughout his speech on the Washington DC financial membership, Moynihan revealed that the financial institution is occupied with collaborating within the fast-growing crypto room. Nonetheless, he observed that the corporate is ready for authorized and regulatory readability.

He observed that

“It’s clear that there shall be a stablecoin whether it is authorized.”

Moynihan additionally famous {that a} Greenback-Pegged-Stablecoin issued by the financial institution can have totally different functions and applicability for each day actions.

The financial institution desires to make use of the identical framework that it used when it turned the primary to launch a cellular financial institution app, which was a hit with greater than forty million customers.

Nonetheless, Moynihan famous that the precise position that the Stablecoin can play in funds stays unclear. Because of this the financial institution nonetheless has to find out the right way to use Stablecoins in his conventional monetary angle.

Regardless of this lack of readability, the announcement by the Financial institution of America, with greater than $ 3.3 trillion in belongings, is a crucial growth within the crypto business. If the Financial institution adopts Stablecoins, different banks can observe, resulting in a banking revolution.

This revolution also can create more room for the adoption and development of crypto.

Professional Crypto coverage and Stablecoins rules

With Moynihan who reveals his plans for the doorway to the financial institution, the ball is now solely left to legislators. Authorized readability is required for banks to enter the area.

Numerous accounts have been thought-about by the American congress, together with the ‘Genius Act’ and the ‘Secure Act’. These rules will draw up Greenback-Pegged crypto belongings similar to USDT and USDC.

Nonetheless, there’s nonetheless an extended solution to go earlier than these accounts are authorised and are set for signature by the president.

What it means for the cryptomarket

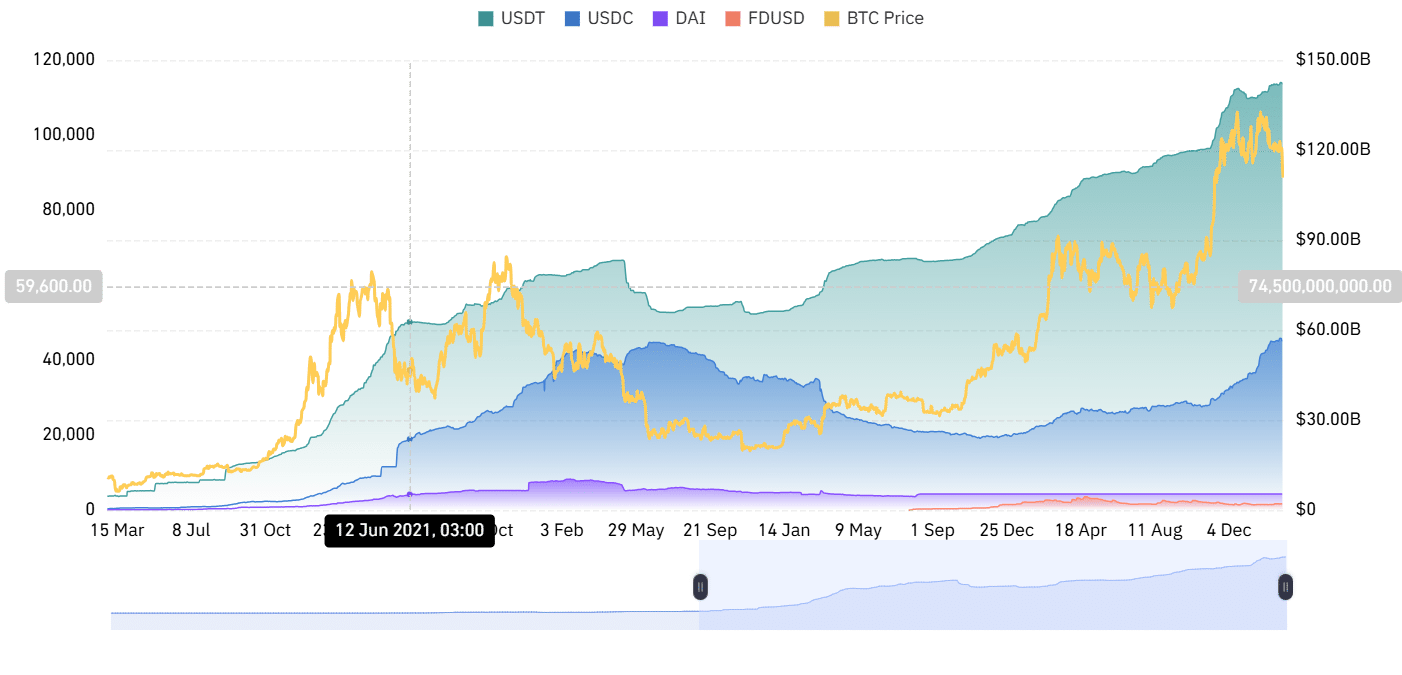

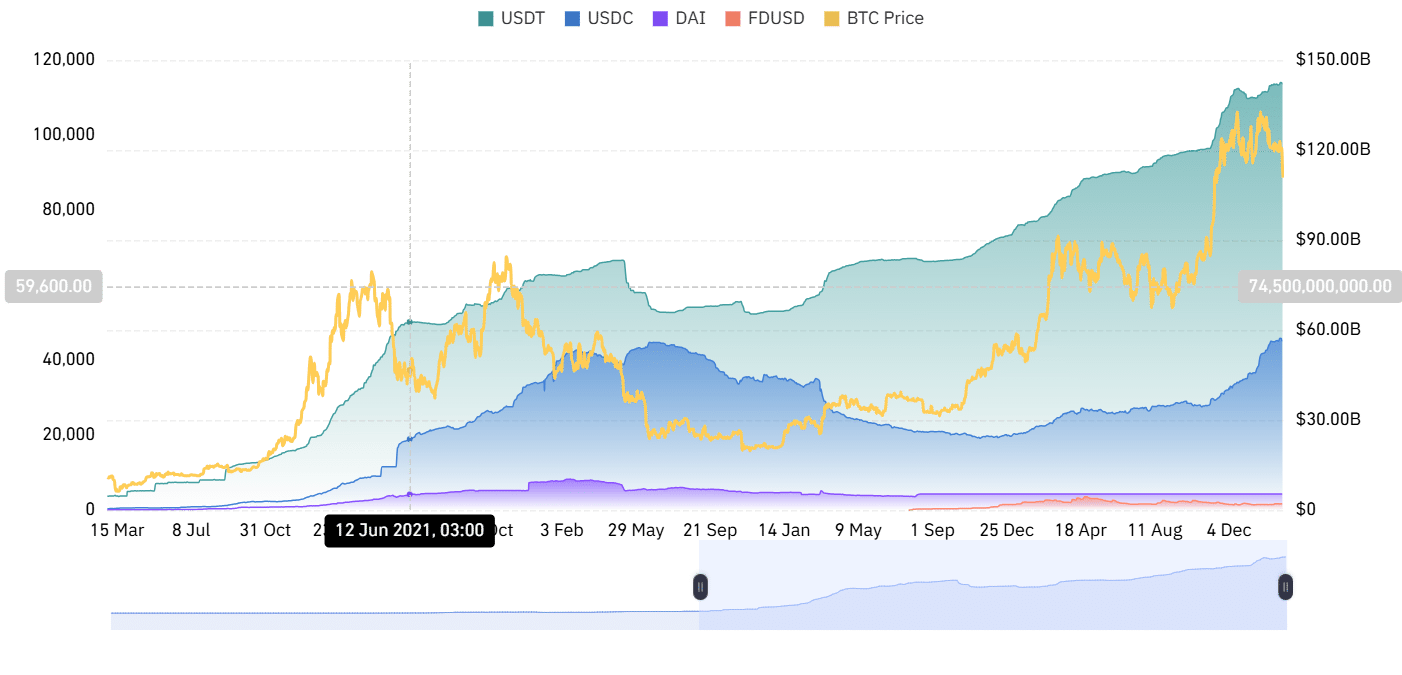

Supply: Coinglass

A potential entrance to the Financial institution of America can have a big impact on the cryptomarket. Firstly, it’ll stimulate the Stablecoin market, which has undergone regular development lately and has hit $ 231.7 billion.

This development has reached Stablecoins similar to USDT a market capitalization of $ 142.1 billion and USDC reaches $ 52.9 billion.

With the Stablecoin market capitalization, the doorway to a different massive participant will push the market development even additional.

And this development will even translate right into a broader development for the cryptocurrency market, as a result of Stablecoins have grow to be central to crypto transactions.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now