Analysis

BONK Price Defies Bears with 4% Gain, 30% Upsurge Coming?

Credit : coinpedia.org

Bonk (BONK), the favored Solana-based meme coin, is defying the market pattern and poised for a large value enhance regardless of bearish sentiment. With a powerful 4% value enhance, it has obtained vital consideration from the crypto neighborhood, resulting in open curiosity rising 16% within the final 24 hours.

BONK outperforms main cryptos

With robust bullish intent, BONK has outperformed main cryptocurrencies together with Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and BNB (BNB). On the time of writing, it’s buying and selling close to the $0.0000162 stage and has skilled a value enhance of over 4% within the final 24 hours. In the meantime, BONK’s buying and selling quantity has elevated by 72% over the identical interval, indicating larger dealer participation in the course of the latest market crash.

BONK value prediction

In response to skilled technical evaluation, BONK is close to a vital assist stage at $0.000015 and is at the moment going through robust resistance from a descending trendline and a horizontal stage at $0.0000164. If BONK’s value momentum continues and breaks by each hurdles, it may rise 30% to the $0.0000213 stage within the coming days.

In the meantime, the Relative Energy Index (RSI) is in oversold territory, indicating a doable bullish reversal within the coming days.

Bullish statistics within the chain

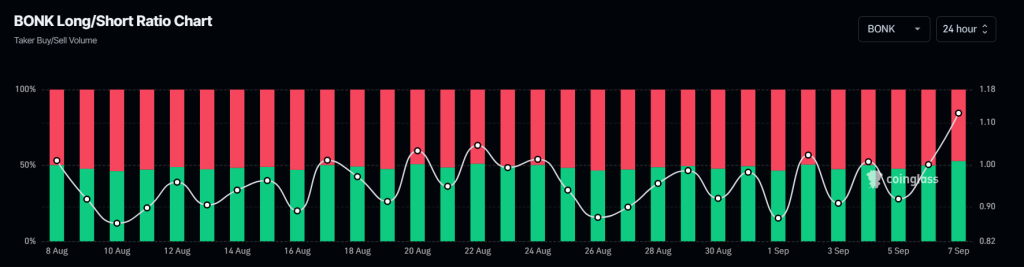

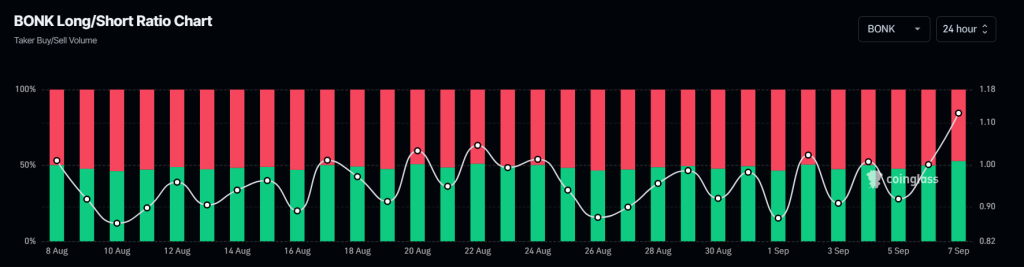

Along with the technical evaluation, key on-chain metrics additionally assist BONK’s bullish outlook. CoinGlass’s BONK Lengthy/Quick ratio, a sentiment indicator that highlights merchants’ views and market sentiment, at the moment stands at 1.112, the very best stage since August, indicating robust bullish sentiment.

Moreover, the info reveals that 53% of prime merchants maintain lengthy positions, whereas 47% maintain quick positions, which additionally helps this bullish outlook.

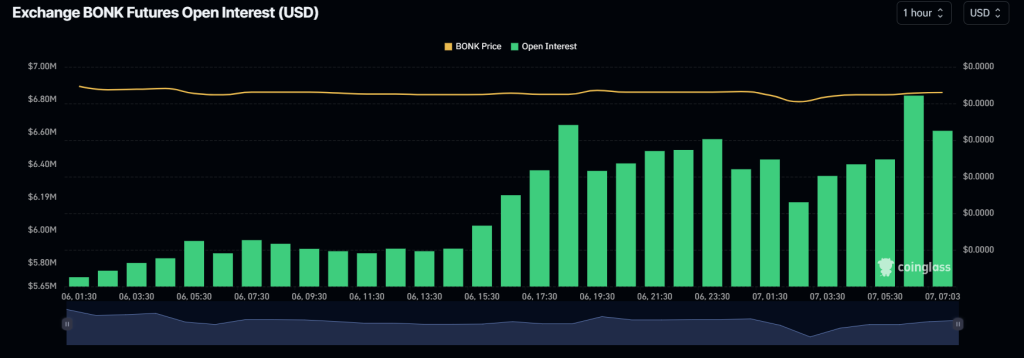

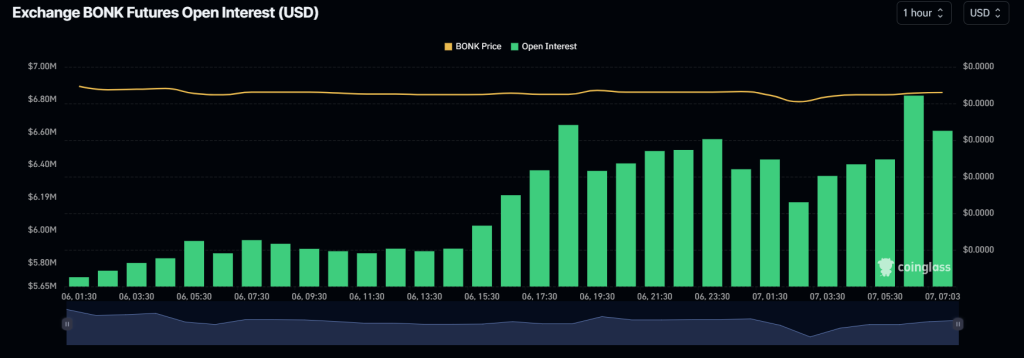

Then again, BONK’s open interest can also be up 16% up to now 24 hours, indicating rising curiosity from merchants amid the continued value momentum.

The mixture of rising open curiosity with a Lengthy/Quick ratio above 1 is a robust bullish signal. Merchants typically use this mixture to bid on either side of their trades.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024