Altcoin

Bonk Price forecast – where will this new buy signal take the Memecoin?

Credit : ambcrypto.com

- Bonk’s outbreak of the falling trendline hinted to a possible bullish reversal

- Constructive market indicators and rising open rates of interest identified that the upward momentum on the charts

Bonk [BONK] Not too long ago a shopping for sign flashed on the TD sequential indicator, which signifies the potential for a value fame. It’s recognized that this technical sign factors to a shift in market sentiment, one that always follows a protracted -term downward development. What it implies is that market Momentum may change into bullish and set the stage for upward value motion within the charts.

On the time of writing, Bonk traded at $ 0.00001234, after a rise of 5.06% within the final 24 hours.

That’s the reason the query is that this – will the TD sequential sign trigger a persistent rally or will resistance ranges stop additional revenue?

What does Memecoin’s technical evaluation say in regards to the development elimination?

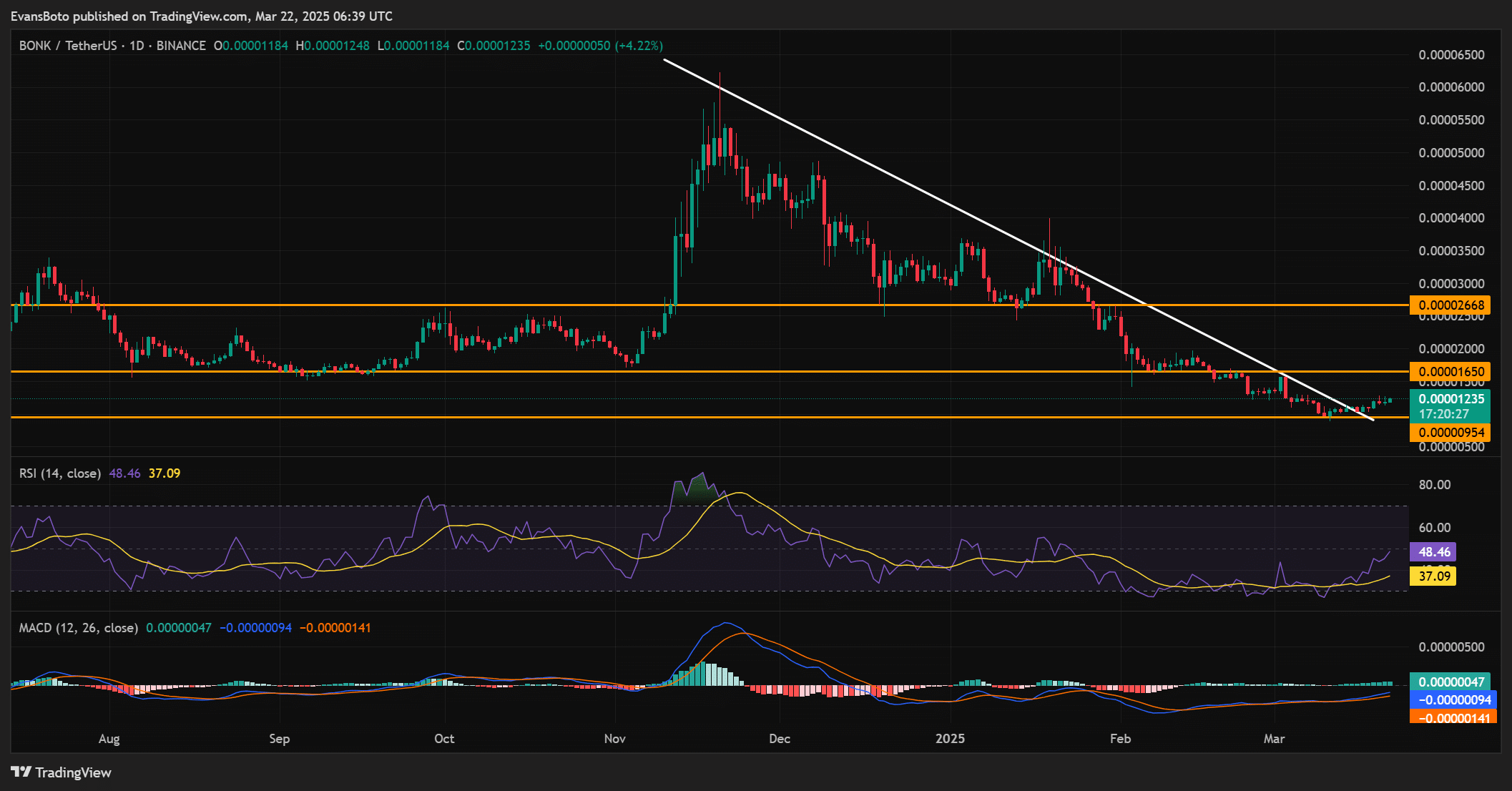

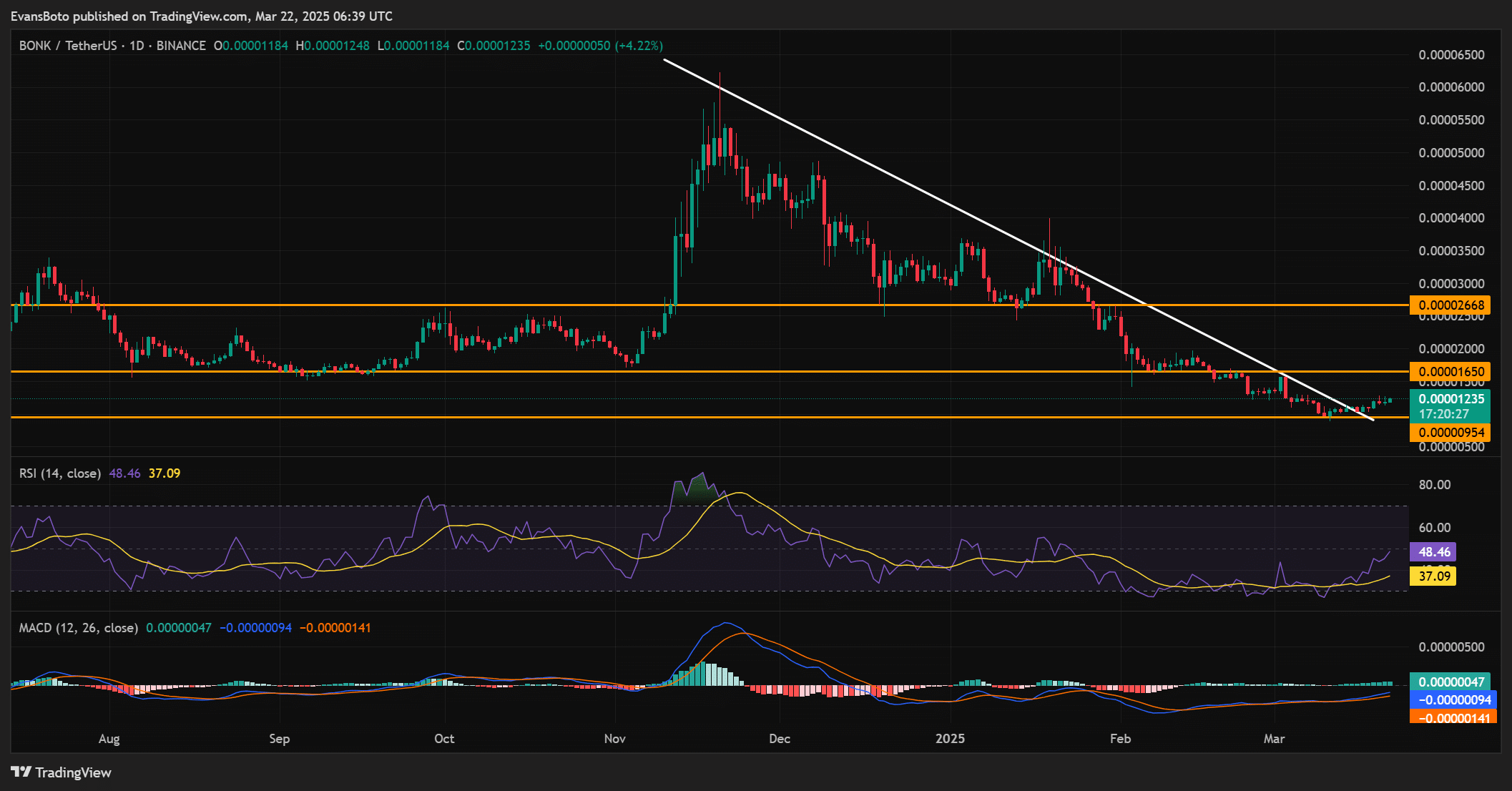

The most recent outbreak of Bonk from a falling trendline has marked an important second for the memecoin. This technical improvement hinted that Bonk was prepared for a bounce. In truth, the press stage of the press was positioned at $ 0.00000954, whereas the resistance was at $ 0.00001235.

These ranges are essential to find out whether or not the value can keep north or bear additional resistance. Furthermore, the place of the RSI implied at 48.46 that Bonk was neither overbought nor offered.

Merely put, the memecoin nonetheless has sufficient room for value motion. The MACD -Histogram additionally turned inexperienced, referring to a shift to Bullish Momentum, which strengthens the case for a possible upward development.

Supply: TradingView

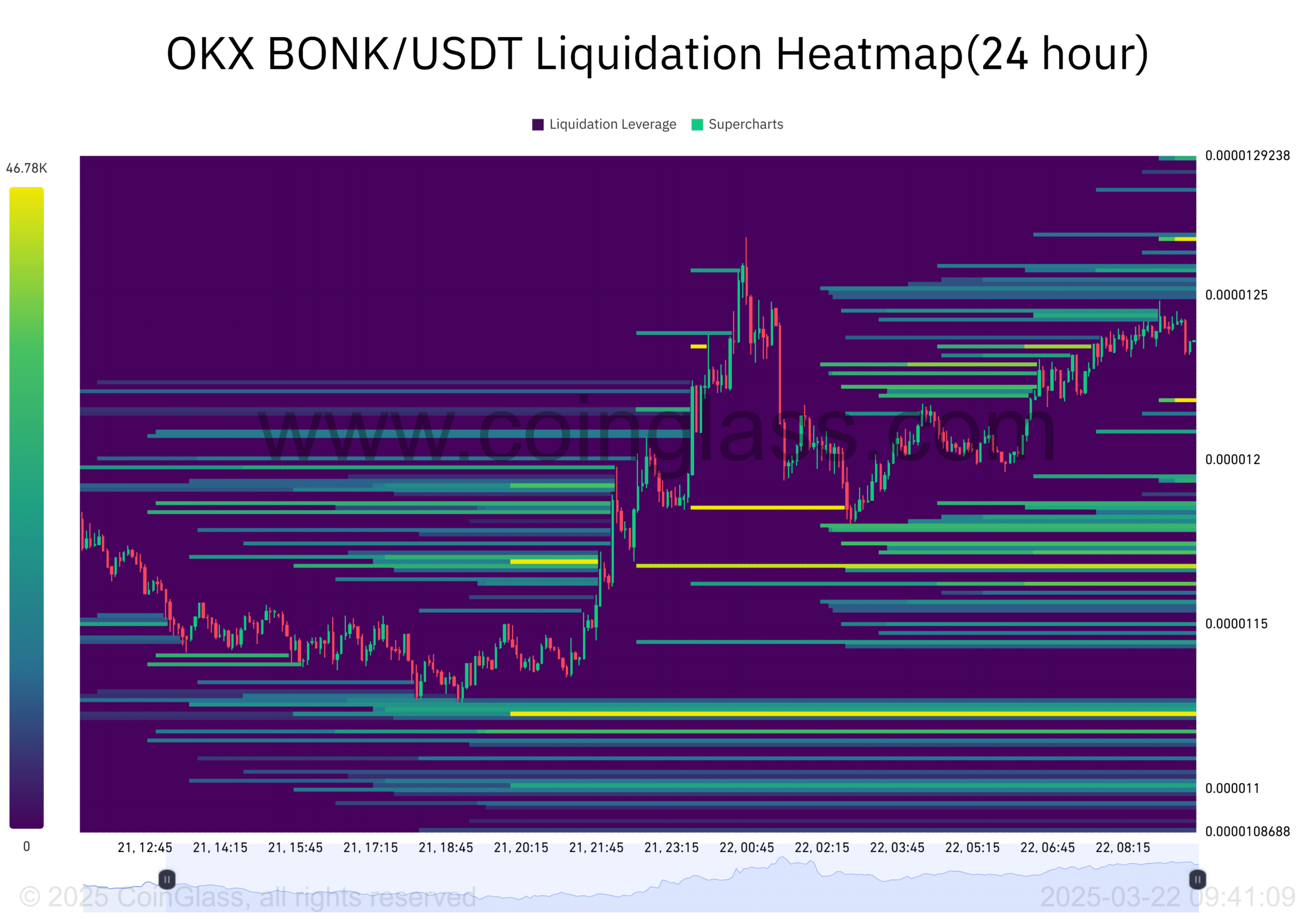

How does the liquidation heat replicate the present market sentiment?

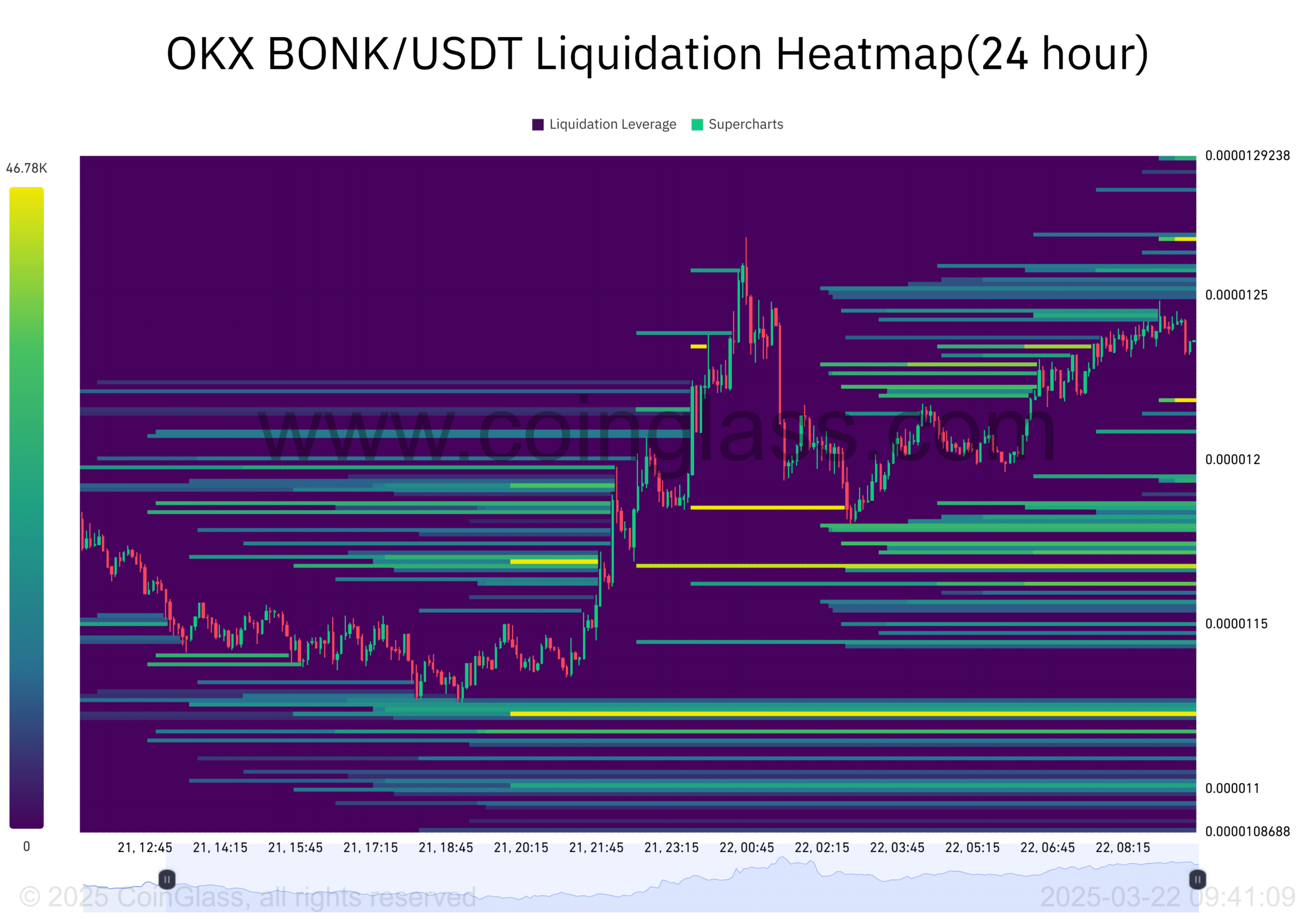

The liquidation warmth folder for Bonk revealed a big buying and selling exercise round $ 0.00001200-mark. This zone is particular of essential significance as a result of it underlines excessive liquidation factors. If the value continues to rise and this resistance touches, brief positions could be pressed, which additional contributes to the upward value stress.

Furthermore, the focus of liquidity at this stage emphasised that merchants actively place themselves for potential value motion. This sort of market habits typically contributes to volatility, which may favor bulls within the brief time period.

Supply: Coinglass

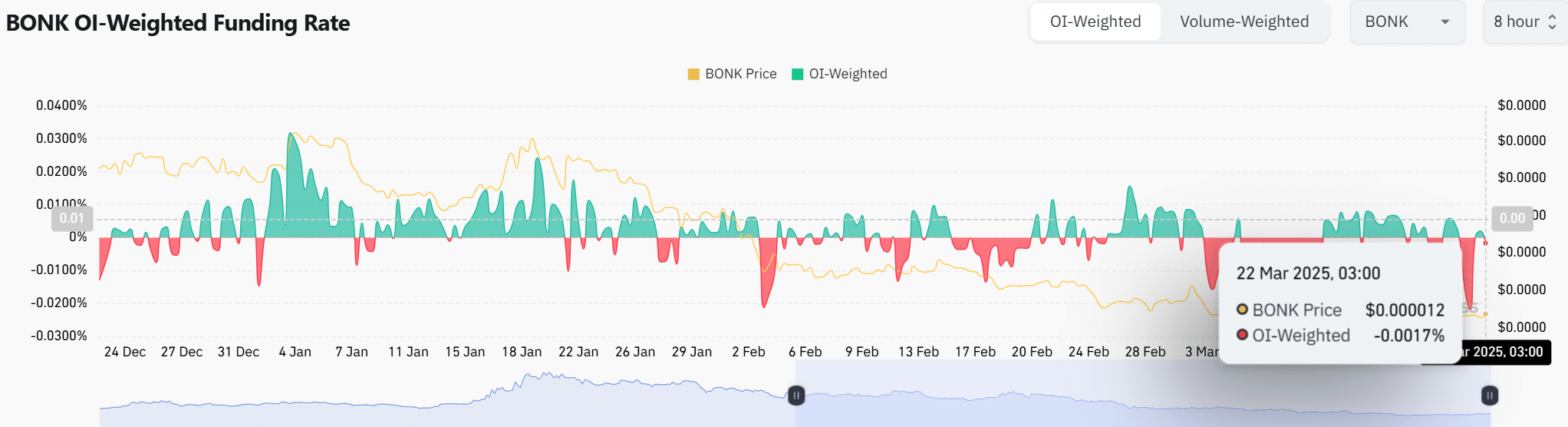

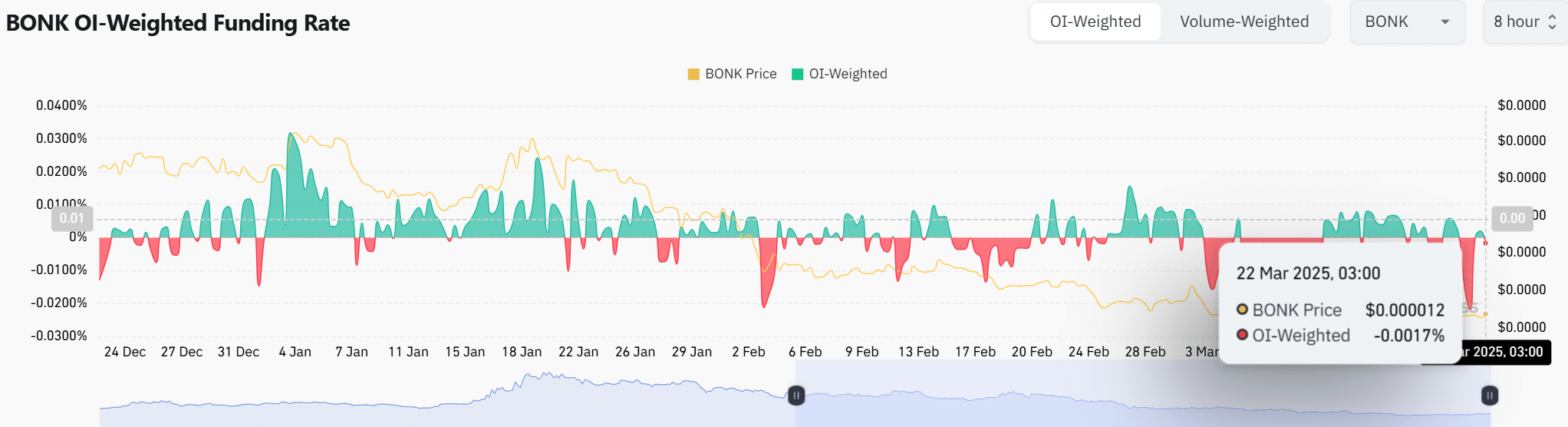

An evaluation of open curiosity

Bonk’s open curiosity rose With 12.20%, with the identical $ 12.79 million in whole on the time of writing. This wave hinted to bigger market participation, which means that extra merchants guess on the long run value path of the cryptocurrency.

Increased open curiosity often implies that the rising belief within the asset, which helps the potential for persistent bullish motion. Nevertheless, it additionally introduces the potential for larger volatility. That’s the reason merchants should stay cautious for aggressive value fluctuations.

Furthermore, the OI -weighted financing proportion for Bonk had a worth of -0.0017%, indicating that brief positions might be considerably most popular.

Though this isn’t nice concern, it pointed to a slight imbalance available in the market. And but it appeared like basic sentiment bullish, supported by constructive technical indicators and rising open curiosity.

Supply: Coinglass

Conclusion

What’s now clear is that Bonk has proven clear indicators of developments. The outbreak of the falling trendline, together with the TD sequential buy sign, urged {that a} long-term rally might be underway.

Nevertheless, resistance ranges and brief positions will proceed to play an important function in figuring out the sustainability of this motion.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024