Analysis

Breakdown Below $110K or Recovery Toward $115K?

Credit : coinpedia.org

Bitcoin is at the moment floating round an important worth zone, trapped between Beerarish print and Bullish Resilience. After testing help close to the $ 110K stage, BTC Worth now stands for a decisive second that would set the tone for the subsequent main motion. A breakdown below $ 110k might be activated to promote accelerated, open the door for a deeper correction, whereas a rebound to $ 115k might restore the bullish momentum and appeal to new buy curiosity. The market volatility stays elevated as a result of merchants maintain an in depth eye on liquidity zones, institutional flows and macro -economic alerts. The approaching periods can determine whether or not Bitcoin stabilizes or enter a broader correction part.

Giant holders contribute to the sale of the market

The beginning of the week attracted a substantial gross sales stress that drove the Bitcoin worth of the consolidated vary above $ 115k to the native lows decrease than $ 112,000. The amount rose from round $ 20 billion to greater than $ 66 billion, which hinted to extreme sale of buyers. Nonetheless, the information on the chains recommend that it was the massive holders or the whales that made the win.

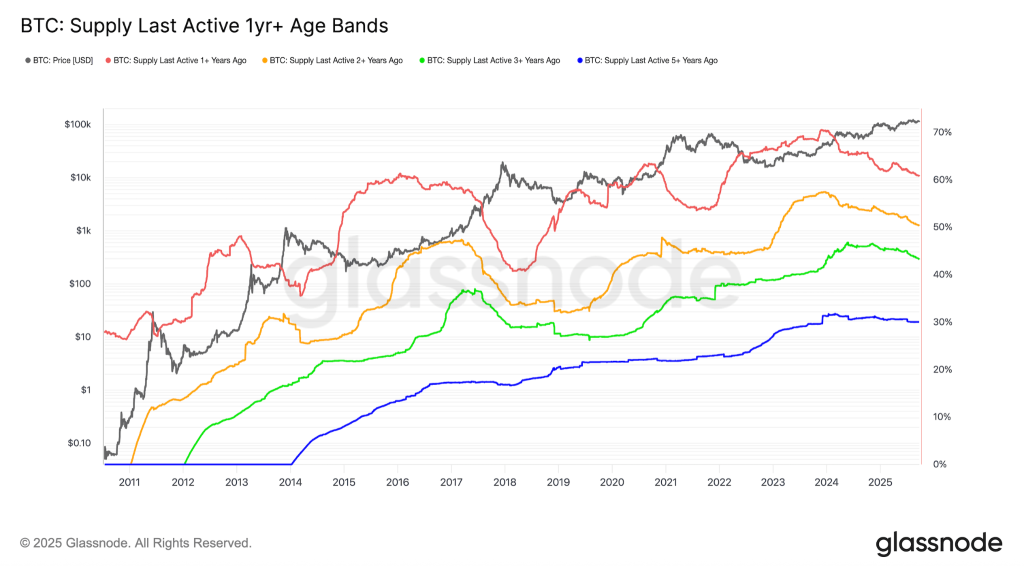

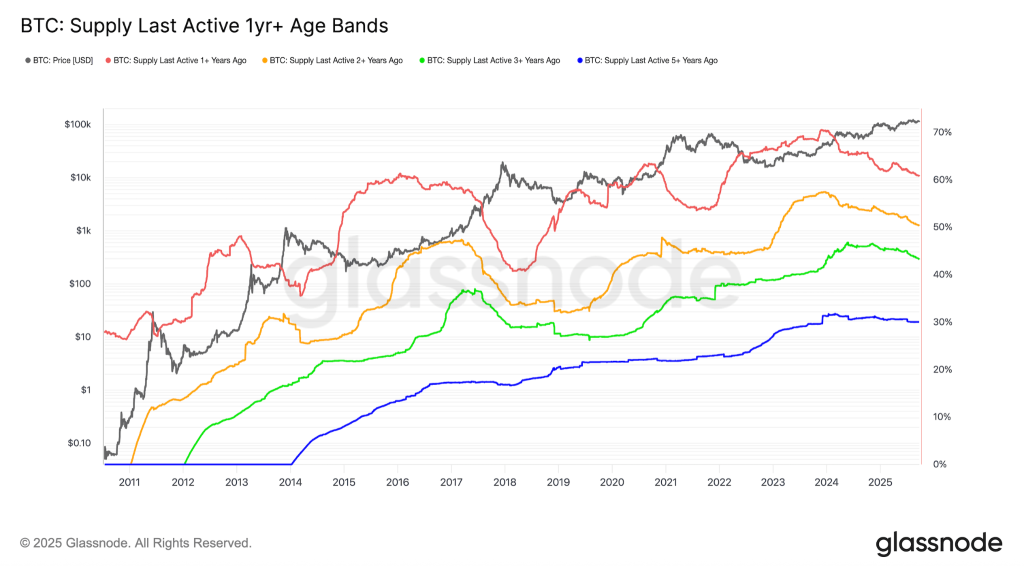

The info from Glassnode point out that the gross sales stress has been collected as a result of whales have bought extensively. Every pockets cohort, which holds greater than 10,000 BTC, is situated within the distribution part because the lengthy -term holder decreases. In latest months, the supply has fallen from 70% to 60% and the supply for greater than two years has fallen to 52% of 57%. The above metric measures the relative accumulation based mostly on the scale and quantity of tokens which were obtained over the previous 15 days.

- Additionally learn:

- XRP – Worth forecast for September 2025 – What could be a bit tigger a rebound to $ 3.60 tigers

- “

What’s the following? Will the BTC worth dive below $ 110k?

Because the worth was confronted with a rejection of $ 120K, the rally has largely remained Beerarish. The star smoking fell greater than 13%, however the bulls shortly began a restoration. Regardless of the restoration, the value stays throughout the consolidated vary. Consequently, the Bearish -influence on the rally continues to exist, in order that the Bearish objectives stay energetic.

The HTF graph of Bitcoin means that the value has maintained a steep rising pattern inside a rising parallel channel. The weekly Bollinger tires are compressing, which suggests a lower in volatility as a result of the amount exhausts. Alternatively, the Chainkin Cash Stream (CMF) goes again to 0, to the rise in gross sales stress. The merchants appear to get cash from Bitcoin, which may weigh the value. That’s the reason the long-term worth promotion from Bitcoin refers to an intensive Bearish promotion, in order that the degrees are led to the decrease bulb Bollinger within the brief time period.

Pack!

Particular gross sales has been an vital motive behind the newest pullback and exhausting volatility. Nonetheless, the star smoking has been maintained inside a bullish vary and after the upward stress fades, the Bitcoin (BTC) worth will endure a small withdrawal, adopted by a powerful rebound to the preliminary ranges.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, skilled evaluation and actual -time updates on the newest developments in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

The present lower is basically powered by taking a revenue from massive holders, or ‘whales’, who bought their participations after the latest assembly, growing the gross sales stress available on the market.

Regardless of the brief -term volatility, the general construction of Bullish stays inside a rising channel. A brief pullback is feasible, however many analysts then count on a powerful rebound.

The market volatility is excessive. Though the costs are decrease, the pattern is unsure. At all times assess vital help ranges and market sentiment and take into account your individual funding technique earlier than you determine.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Solana6 months ago

Solana6 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?