Ethereum

Breaking down Ethereum’s price slump: Temporary setback for ETH?

Credit : ambcrypto.com

- The current drop in ETH’s value appeared like a retracement.

- Market sentiment pointed to a possible pullback, pushed by waning shopping for strain.

Over the previous 24 hours, Ethereum [ETH] has entered a so-called retracement – a brief dip that usually precedes a renewed rally in bullish markets – leading to a decline of two.70% throughout this era.

AMBCrypto studies that the downturn might proceed, probably reversing the 1.62% acquire ETH has remodeled the previous week.

ETH faces continued weak spot

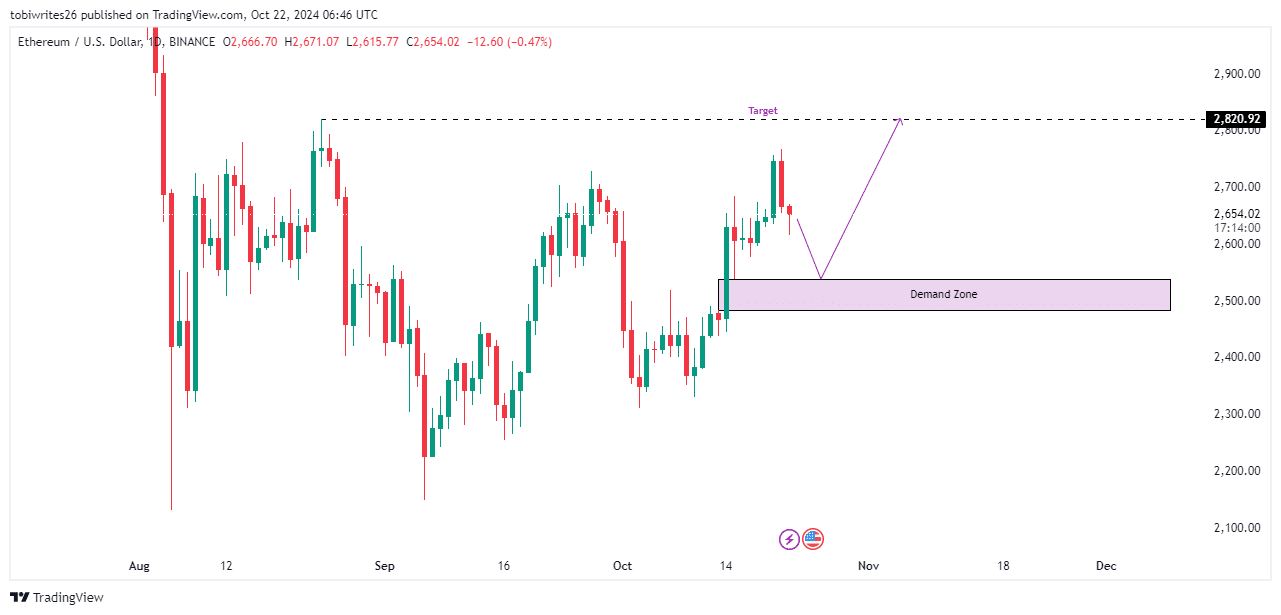

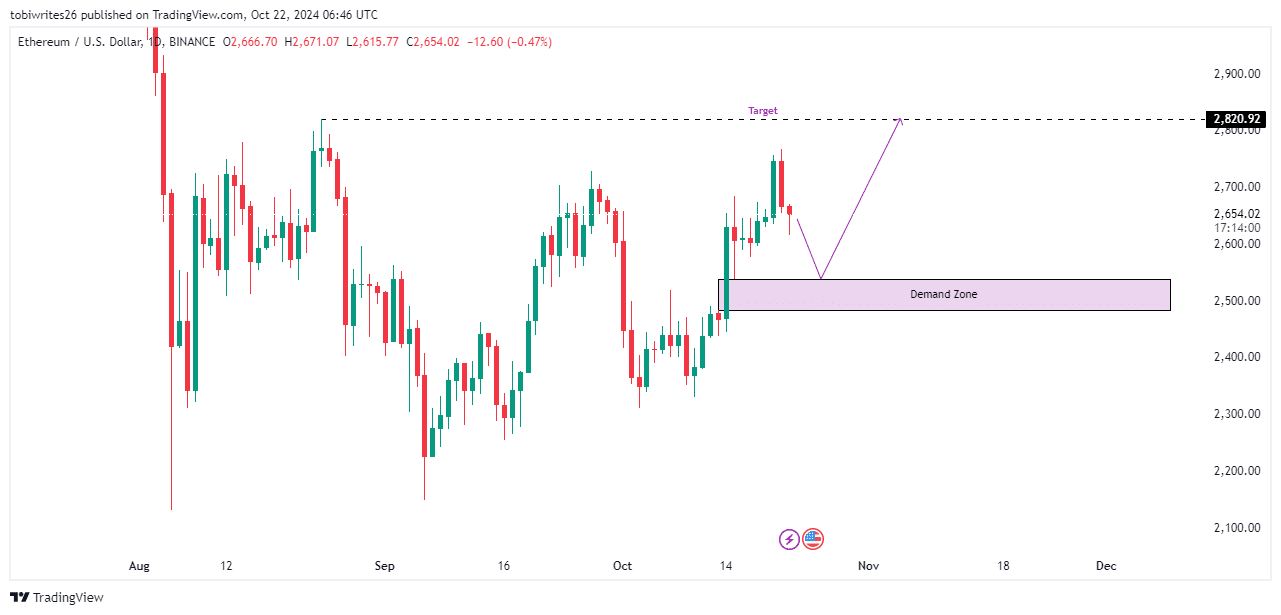

The ETH chart is at present lacking bullish indicators, indicating a potential additional decline whereas looking for an optimum liquidity degree to assist a value enhance.

Proper now, the closest liquidity zone is the demand space that extends between $2,536.47 and $2,484.44. If the worth enters this area, ETH might get well to $2,820.92, which serves as a key goal.

Supply: TradingView

Nonetheless, if ETH falls beneath this demand zone, it might set off a cease hunt – a tactic the place merchants search for further liquidity earlier than making a closing upward thrust.

A protracted downward transfer might point out that ETH has entered a bearish pattern.

Merchants are in search of momentum within the ETH market

Current buying and selling exercise signifies that the market is in search of momentum, pointing to a potential decline from the present value of $2,654.02.

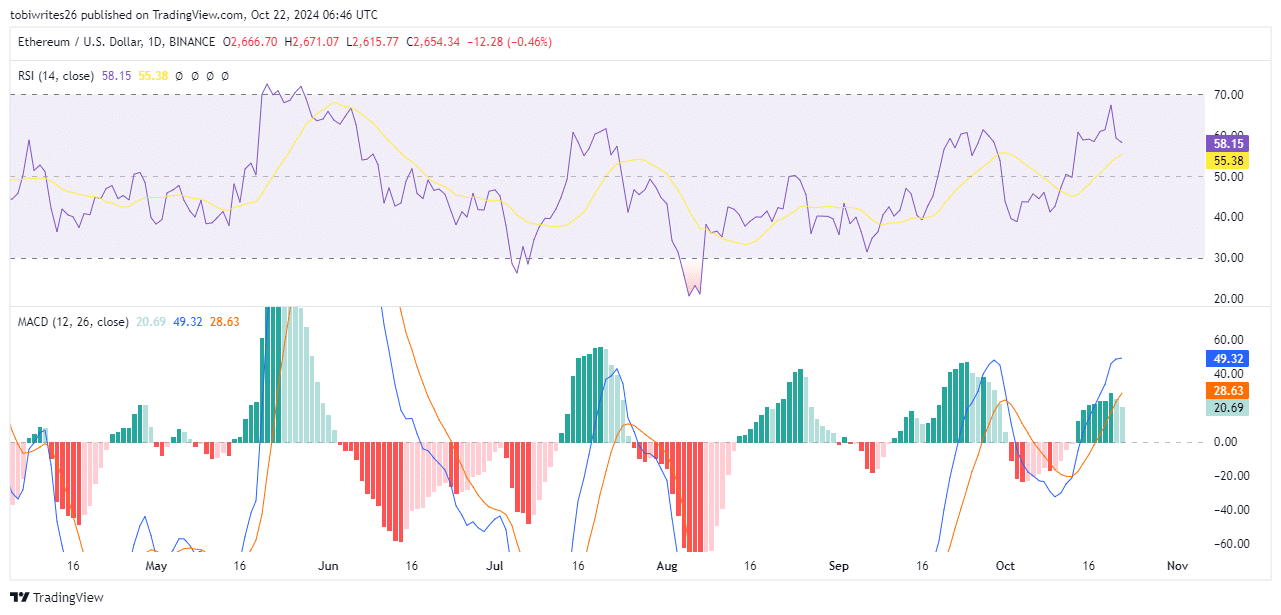

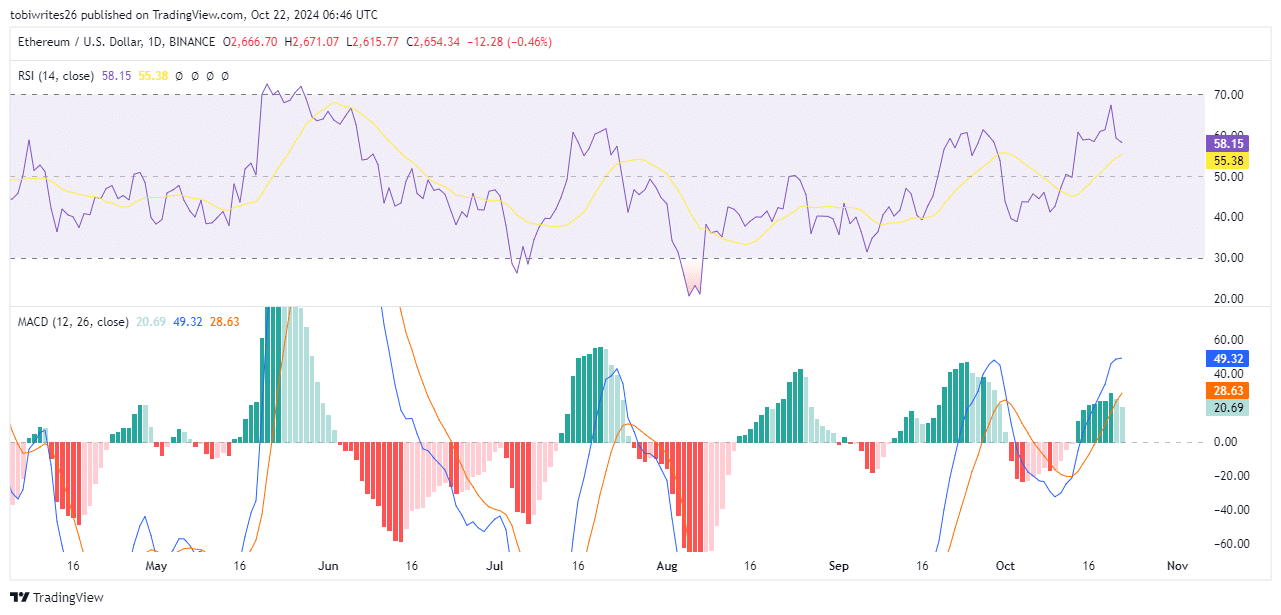

The Relative Power Index (RSI) works on a scale of 0 to 100, with 50 representing the impartial level. Values above 50 point out optimistic momentum, whereas values between 50 and 60 point out average shopping for strain.

Conversely, values beneath 50 mirror promoting strain, with a spread of 30 to 50 indicating average promoting. Values above 70 point out overbought circumstances, whereas values beneath 30 counsel oversold circumstances.

Presently, ETH has an RSI worth of 58.15, however it’s trending down, indicating that the worth might fall because it seeks a requirement zone, even when it stays actively bullish.

Supply: buying and selling view

Likewise, the MACD, which remains to be optimistic, has additionally proven a notable drop in momentum, as indicated by the fading inexperienced bars on the chart.

This means that whereas total market well being is sweet, shopping for strain is progressively waning.

Non permanent withdrawal from sellers

Open Curiosity, an indicator used to evaluate merchants’ sentiment within the present market, exhibits that merchants are primarily positioning themselves to brief belongings.

Learn Ethereum’s [ETH] Value forecast 2024–2025

In response to Mint glassOpen Curiosity fell to $13.56 billion, reflecting a decline of two.89%.

If this pattern continues, it signifies that promoting strain could also be driving the asset decrease, though a bullish pattern should still exist.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September