Policy & Regulation

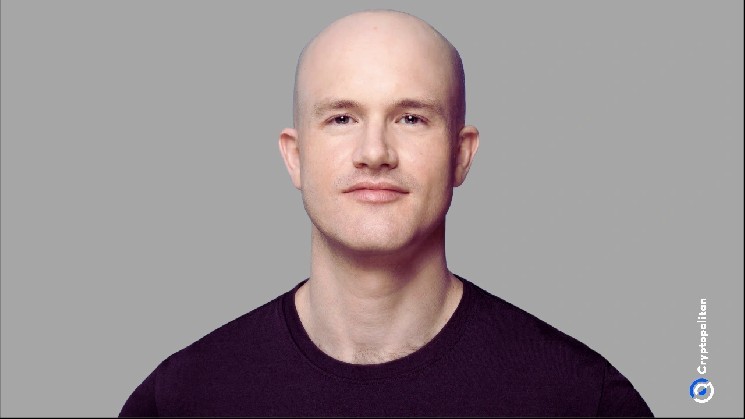

Brian Armstrong clashes with banks on Capitol Hill over Coinbase’s right to offer crypto rewards

Credit : cryptonews.net

COINBASE CEO Brian Armstrong stormed in Capitol Hill this week with a message that made zero room for interpretation.

Sitting in the direction of legislators in Washington DC, he and a bunch of crypto leaders made it clear that they had been there to defend what they regard as a primary proper to compete.

In accordance with CNBC, the dispute concentrates on whether or not crypto exchanges resembling Coinbase must be permitted to develop and provide rewards that operate as curiosity funds provided by banks, and the recoil of the banking world is quick and loud.

Brian didn’t keep away from the assaults. “I am unsure why the banks would need to deliver that once more,” he mentioned throughout an interview on Wednesday. “However they need to compete on a degree enjoying discipline in Crypto.”

That line pulled a pointy distinction between how Coinbase sees itself and the way banks deal with the scenario. Coinbase at present provides customers 4.1% rewards for retaining USDC, whereas Kraken gives the next 5.5% on the identical stablecoin.

In accordance with the brand new Genius Act, the curiosity on Stablecoins is off the desk, however rewards are nonetheless authorized. That authorized distinction is strictly what banks need to shut.

Banks lobbying to kill crypto rewards because the concern of capital outflow grows

Financial institution buying and selling teams actively put the congress beneath stress to ban these crypto statements. They declare that providing charges resembling 4.1% of Coinbase will lure clients away from small banks.

John Courtroom, who acts as Govt Vice President on the Financial institution Coverage Institute, warned The legal guidelines that these remuneration applications are a menace to the broader financial stability of the nation.

“If folks take away their deposits from their financial institution accounts and switch them to Stablecoin investments,” mentioned the court docket, “you might be successfully neutring, to a sure extent the power of the banks to proceed to borrow in the actual financial system and to assist and assist financial development.”

The warning didn’t come out of nowhere. A report from the Treasury Leense Advisory Committee estimated in April that at least $ 6.6 trillion to buyer deposits from conventional banks to Stablecoins may transfer as a reward programs proceed.

The banks say that that form of change would break their credit score fashions. Brian does not purchase that. He known as your entire argument a “boogeyman” and accused massive benches of staggering behind faux tales.

“The actual purpose that they elevate this as an issue,” mentioned Brian, “is that they’re making an attempt to guard the $ 180 billion they’ve made of their fee firm. That is one thing that giant banks behind the scenes finance. These are in no way small banks.”

Within the meantime, simply earlier than, JPMorgan met Chase CEO Jamie Dimon Senate Republicans. Dimon later mentioned that the difficulty of Stablecoin Rewards was not talked about within the assembly, however nonetheless advised reporters that supervisors must be cautious. “We aren’t in opposition to Crypto,” Jamie mentioned, rigorously select his phrases. However the banking sector that he represents is fast paced to encourage legislators to behave.

The legislators break up as crypto teams and banks trade letters

Each events are submitting letters to the congress. On 12 August, the American Bankers Affiliation and varied associations at state degree requested legislators to “shut this Maas within the legislation and to guard the monetary system.” The expression “closes this Maas to the legislation” is a number of the banks. Their aim is to re -classify reward programs, in order that they fall beneath the identical limitations as curiosity.

Crypto teams instantly shot again with a warning that forbidding rewards at gala’s resembling Coinbase and Kraken “would tilt the enjoying discipline in favor of legacy establishments, specifically bigger banks, which routinely don’t produce aggressive returns and take away customers of significant selection.”

Throughout the Senate there’s nonetheless no definitive settlement on methods to take care of it. The market construction account, which incorporates crypto platform directions, has accomplished varied ideas. Nothing is accomplished. However some legislators assume that the struggle for deportation and rewards has already been accomplished.

Senator Cynthia Lummis, a Republican from Wyoming who collaborates with financial institution chairman Tim Scott from South Carolina, mentioned the case has already been resolved. “The problem was closely addressed within the genius legislation,” mentioned Cynthia, “and I’m in favor of the compromise that the banks and the digital belongings trade have reached. I do not assume this subject must be reopened.”

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024